In the future, a hospital won’t be a hospital at all, according to 9 in 10 hospital executives who occupy the c-suite polled in Premier’s Spring 2016 Economic Outlook.

In the future, a hospital won’t be a hospital at all, according to 9 in 10 hospital executives who occupy the c-suite polled in Premier’s Spring 2016 Economic Outlook.

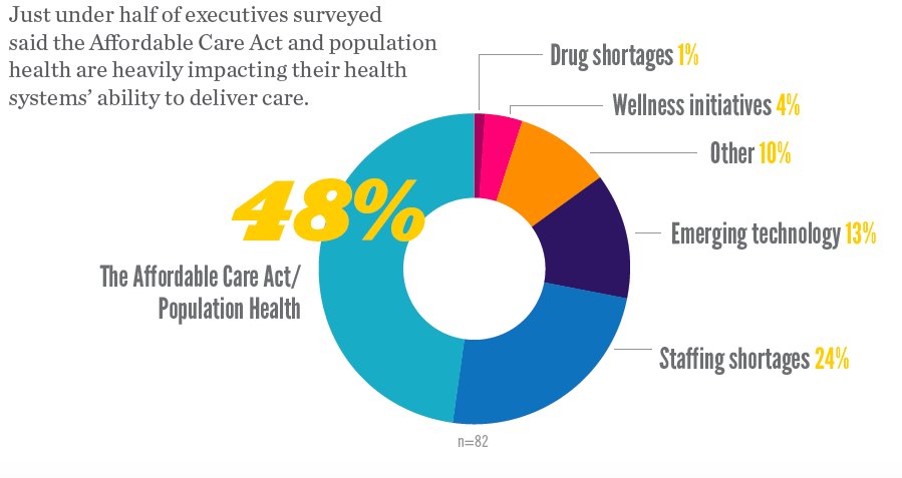

Among factors impacting their ability to deliver health care, population health and the ACA were the top concerns among one-half of hospital executives. 1 in 4 hospital CxOs think that staffing shortages have the biggest impact on care delivery, and 13% see emerging tech heavily impacting care delivery.

Technology is the top area of capital investment planned over the next 12 months, noted by 84% of hospital execs in the survey. Other areas of planned capital investment include facility renovation (for 56% of c-suite respondents) and construction (for 46%), imaging equipment (45%), surgical equipment (42%), and other clinical equipment (23%).

Health IT has been a major capital investment line item over the past five years, Premier has found. Since population health is top-of-mind for nearly 50% of the c-suites, Premier’s press release on the study noted that, “Having interoperable data across the entire continuum of care – including employed and affiliated physician networks – is critical for providers to seamlessly manage population health.” But only 38% of hospital providers feel they’re successfully accessing data from affiliated or non-employed physician networks, Premier cautioned.

Premier polled c-suite respondents on trends impacting providers and the healthcare industry in winter 2016.

Health Populi’s Hot Points: The hospital execs polled by Premier are in the midst of moving from a volume-based payment regime to value-based, in the forms of accountable care, bundled payments (such as those for orthopedic joint replacement implemented earlier this month among 800 pioneering hospitals), pay-for-performance. Getting paid less for doing more is the M.O. here, which is what prompts the CxOs’ focus on population health, 94% of whom told Premier that creating high-value post-acute networks will be greatest challenge over the next few years.

Enter the retail health opportunity, to extend care closer to where people live, work, and play. One lower-hanging-fruit area in retail health is pharmacy: 66% of the CxOs believe their organization will own or operate a retail pharmacy in the next 3 years.

Morphing toward retail health channels will be an important bridge to population health. Beyond that objective is the longer-term vision of the re-imagining the nature of a hospital-that’s-not-a-hospital, which 92% of the hospital executives believe will be their future.

One scenario I’ve been working on with clients is the home-as-hospital, or home-as-medical-home. NPR covered the idea that the future of hospital care could look a lot like home earlier this month, forecasting that, “the hospitals that thrive won’t be the ones with the free parking and fancy lobbies. They’ll be the ones that can get to your house faster than the pizza guy.”

A pioneering cohort of hospital executives have begun to think-the-unthinkable about this new identity beyond Pill Hill. They’re starting to adopt remote health monitoring, building the evidence for care outside of the hospital walls using medical grade products that are artfully designed for consumer and caregiver use. The emerging era of the Internet of Medical Things has begun.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...