Two news items published in the past week point to the yin/yang of cancer survivorship and the high prices of cancer drugs.

The good news: a record number of people in the US are surviving cancer, according to the American Cancer Society. That number is 15.5 million Americans, according to a study in the cancer journal CA.

The good news: a record number of people in the US are surviving cancer, according to the American Cancer Society. That number is 15.5 million Americans, according to a study in the cancer journal CA.

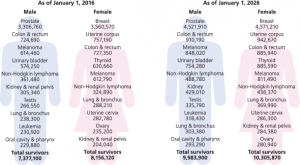

Note the demographics of cancer survivors:

- One-half are 70 years of age and older

- 56% were diagnosed in the past ten years, and one-third in the past 5 years

- Women were more likely to have had breast cancer (3.5 mm), uterine cancer (757,000), and colon or rectal cancer (727,000)

- Men were more likely to survive prostate cancer (3.3 mm), colon or rectal cancer (725,000), or melanoma (614,000).

- Over 65,000 cancer survivors are 14 and younger, and 47,000 are 15-19 years of age.

With long-term cancer survivorship comes a host of issues beyond the clinical: they’re economic, social, psychological.

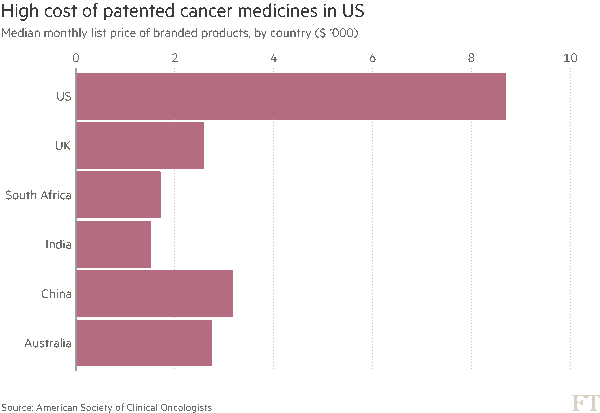

The drug cost news: in the U.S., the price of cancer drugs is much higher than in other nations, shown in the chart published by the Financial Times on 7 June. The median monthly price of branded cancer drugs was about $8,700 in the U.S., versus $2,600 in the UK, $2,700 in Australia, and $3,200 in China. The research on these prices was presented this week at the annual meeting of ASCO, the American Society of Clinical oncologists.

The drug cost news: in the U.S., the price of cancer drugs is much higher than in other nations, shown in the chart published by the Financial Times on 7 June. The median monthly price of branded cancer drugs was about $8,700 in the U.S., versus $2,600 in the UK, $2,700 in Australia, and $3,200 in China. The research on these prices was presented this week at the annual meeting of ASCO, the American Society of Clinical oncologists.

The US has about 5% of the world’s population but represents one-third of drug revenue — and 50-70% of drug companies’ profits, according to the Chief Medical Office of Express Scripts, Dr. Steve Miller.

Health Populi’s Hot Points: The high prices for oncology products have a side effect that Dr. Leonard Saltz of Memorial Sloan Kettering Cancer Center characterized as “financial toxicity” in this interview on 60 Minutes. I had the pleasure of participating on a panel with Dr. Saltz last month at the MM&M Transforming Healthcare meeting discussing what’s transforming healthcare in and beyond 2016: the emergence of value-based care which essentially asked the question: “is [the drug, procedure, visit, technology, bed-day] ‘worth it?'”

Value is in the eye of the beholder, and that beholder is the payor: the employer; the health plan sponsor like the VA or Medicare or Medicaid; and, increasingly, the patient, now starring as the health care consumer.

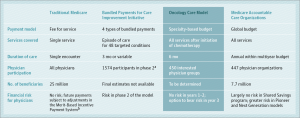

Two novel approaches are being discussed to manage the high costs of cancer drugs and care. Specialty-Based Global Payment is discussed in JAMA this week (issue dated 7 June 2016). Drs. Song and Colla present the Oncology Care Model (OCM) which incorporates global payment, medical homes, pay-for-performance, and aligned incentives across payors. The OCM functions like a Medicare bundled payment for an episode of care and covers spending across the continuum of care. As of the writing of this article, over 450 practices are participating in the OCM. Oncologists are the coordinators of care in this model, akin to primary care doctors’ role in ACOs.

Two novel approaches are being discussed to manage the high costs of cancer drugs and care. Specialty-Based Global Payment is discussed in JAMA this week (issue dated 7 June 2016). Drs. Song and Colla present the Oncology Care Model (OCM) which incorporates global payment, medical homes, pay-for-performance, and aligned incentives across payors. The OCM functions like a Medicare bundled payment for an episode of care and covers spending across the continuum of care. As of the writing of this article, over 450 practices are participating in the OCM. Oncologists are the coordinators of care in this model, akin to primary care doctors’ role in ACOs.

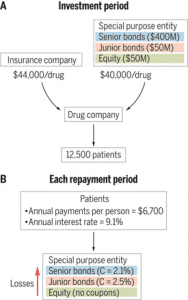

A second approach with the lens on the patient-as-payor is presented in

A second approach with the lens on the patient-as-payor is presented in

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...