Retail clinics are a growing source of primary care for more U.S. health consumers, discussed  in a review of retail clinics published by Drug Store News in July 2016.

in a review of retail clinics published by Drug Store News in July 2016.

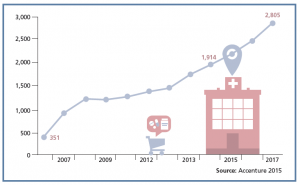

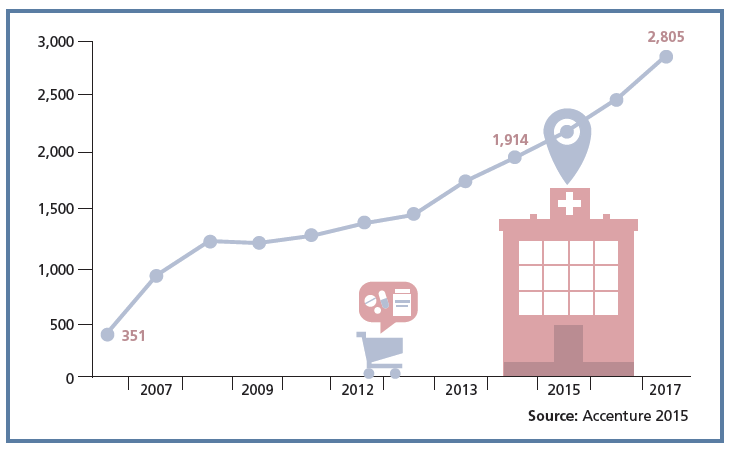

There will be more than 2,800 retail clinics by 2018, according to Accenture’s tea leaves. Two key drivers will bolster retail clinics’ relevance and quality in local health delivery systems:

- Retail clinics’ ability to forge relationships with legacy health care providers (physicians, hospitals); and,

- Clinics’ adoption and effective use of information technology that enables data sharing (e.g., to the healthcare provider’s electronic health records system) and data liquidity (that is, securely moving data from the retail clinic digital records system to the provider’s information system, based on information standards and sound business and data security practices).

Clinics are growing in both number and in the roster of services offered, going beyond urgent care toward more population health and chronic disease management services. The Robert Wood Johnson Foundation noted that, “Some delivery systems seeking to improve primary care access and manage total cost of care are using retail clinics to reduce unnecessary emergency department (ED) visits,” given that retail clinics’ costs are lower than EDs and some hospital-based ambulatory departments.

Drug Store News pointed out several clinic innovations in this special issue:

CVS Health’s MinuteClinics number over 1,100 clinics (including 79 in Target stores). They are growing clinical affiliations with medical schools and teaching hospitals such as the Cleveland Clinic, University of Chicago Medical Center, and the University of Michigan Health System, among others. CVS Health’s clinics use an electronic health records system that can share information with health providers and collaborate between the retail health setting and health providers.

Walgreens operates over Healthcare Clinics and 50 other clinics in stores run by other providers. The company is moving toward more coordinated care models beyond urgent care services, and has invested in an Epic EHR to build that communications/IT infrastructure for a vision of seamless care delivered in the community.

The Little Clinic operates in Kroger grocery stores, which is a leader in grocery chains delivering healthcare services. The company makes the connection between health and healthy food, and engages dietitians in their care model in the Little Clinics. THINK: weight management, diabetes care, food allergies, and other consumer-facing health issues that can be self-managed.

Clinics are also emerging in smaller, regional store chains that seek to partner with healthcare providers in local markets.

Health Populi’c Hot Points: “Retail health” used to mean “the pharmacy.” But today, “the pharmacy” isn’t just a prescription drug dispensary: CVS Health launched a healthy food kiosk in June 2016, and some Wegman’s grocery store pharmacies feature Withings and Higi kiosks for channeling wearable tech and supporting self-checks for blood pressure, pulse, weight, and BMI. (This is my personal photo taken in my local Wegman’s store in Malvern, PA).

Health Populi’c Hot Points: “Retail health” used to mean “the pharmacy.” But today, “the pharmacy” isn’t just a prescription drug dispensary: CVS Health launched a healthy food kiosk in June 2016, and some Wegman’s grocery store pharmacies feature Withings and Higi kiosks for channeling wearable tech and supporting self-checks for blood pressure, pulse, weight, and BMI. (This is my personal photo taken in my local Wegman’s store in Malvern, PA).

As grocers engage nutritionists and dietitians, retail clinics conduct full physical exams (for $40, in the case of Walmart’s new clinic model), and pharmacists take on the role of medication therapy management, consumers can readily access primary care in their close-by community. That convenience, accessibility and “close-by” neighborhood feeling can help bolster medication adherence, continuity of care, and more effective self-care if health care providers (hospitals, clinicians) — especially those taking on more value-based payment in all forms — are willing to collaborate. The new entrants are willing, ready, and able to do so.

And as patients, now health care consumers, are learning to manage high-deductible health plans and health savings accounts, a $40 visit to a PCP is a high-value healthcare proposition.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...