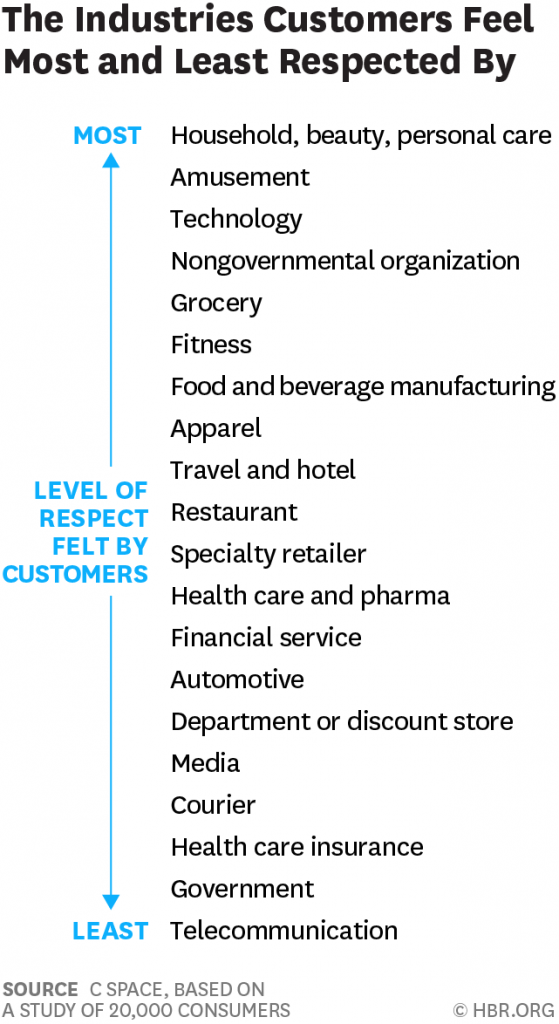

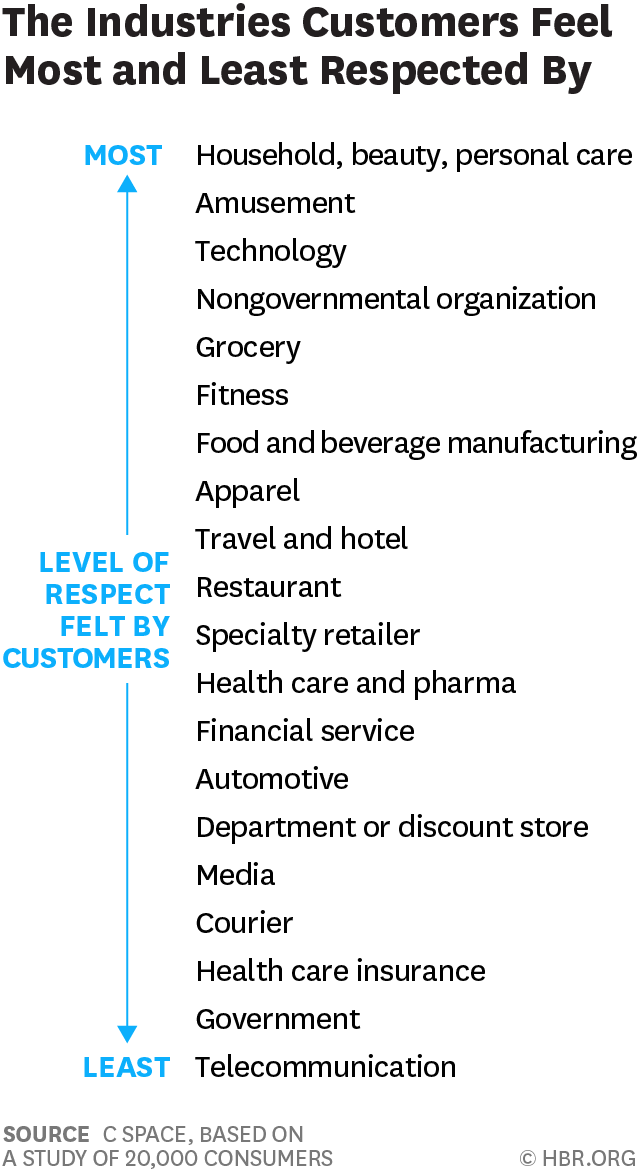

People feel like get-no-respect Rodney Dangerfield when they deal with health insurance, government agencies, or pharma companies. Consumers feel much more love from personal care and beauty companies, grocery and fitness, according to a brand equity study by a team from C Space, published in Harvard Businss Review.

As consumer-directed health care (high deductibles, first-dollar payments out-of-pocket) continues to grow, bridging consumer trust and values will be a critical factor for building consumer market share in the expanding retail health landscape.

Nine of the top 10 companies C Space identified with the greatest “customer quotient” are adjacent in some way to health: they are grocers, personal care and beauty companies, hospitality/travel, fitness — and one healthcare organization, St. Jude. In the following ten (numbers 11 through 20), there is more personal care, travel, fitness and financial (which in personal health values can bolster financial wellness).

Among the top 20 CQ scores, I would call out the following as high-value brands that represent health engagement opportunities for consumers @retail:

- REI (fitness, wellness, social health, healthy workplace)

- Publix (nutrition, health at the pharmacy)

- Wegmans (nutrition, health at the pharmacy, healthy workplace)

- Dove (beauty, wellness, healthy aging)

- Olay (beauty, wellness, healthy aging)

- St. Jude (healthcare, social responsibility)

- Trader Joe’s (nutrition, financial wellness)

- Marriott (healthy travel, nutrition, fitness, medical tourism)

- HEB (nutrition, health at the pharmacy)

- Schwab (financial wellness)

- Disney (wellness, fitness, medical tourism)

- Under Armour (fitness, health)

- LL Bean (wellness, fitness)

- Ben & Jerry’s (emotional wellbeing, corporate responsibility)

- Hyatt (healthy travel, nutrition, fitness, medical tourism)

- L’Oreal (beauty, wellness, healthy aging)

- Fidelity (financial wellness).

The CQ methodology polls consumers open-ended asking people what companies “get them” and which people feel respects them, among other perceptions consumers have about businesses they patronize.

Health Populi’s Hot Points: Consumers look to engage for health well beyond the “healthcare” system — with personal care brands, food purveyors, travel companies, and even financial services companies. When consumers have choice between one brand and experience versus another, people vote with their feet and wallets. The companies noted by C Space are some of those with whom consumers would rather spend their dollars than others who are not perceived as empathetic or sharing personal values.

No legacy health care organization — whether health plan, hospital system, or pharmaceutical company — has a monopoly on empathy and person-centeredness. But hospitals have a workforce that’s rich with the top three professions that are most-respected in the U.S.: nurses, pharmacists, and doctors. These folks work at the frontline point-of-care with patients, caregivers, and consumers. They have the grassroots opportunity to build trust, empathy, and brand equity with people. For health plans and suppliers to the industry, service design-thinking with deep empathy for patients and caregivers is a required competency for dealing with the new health consumer.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...