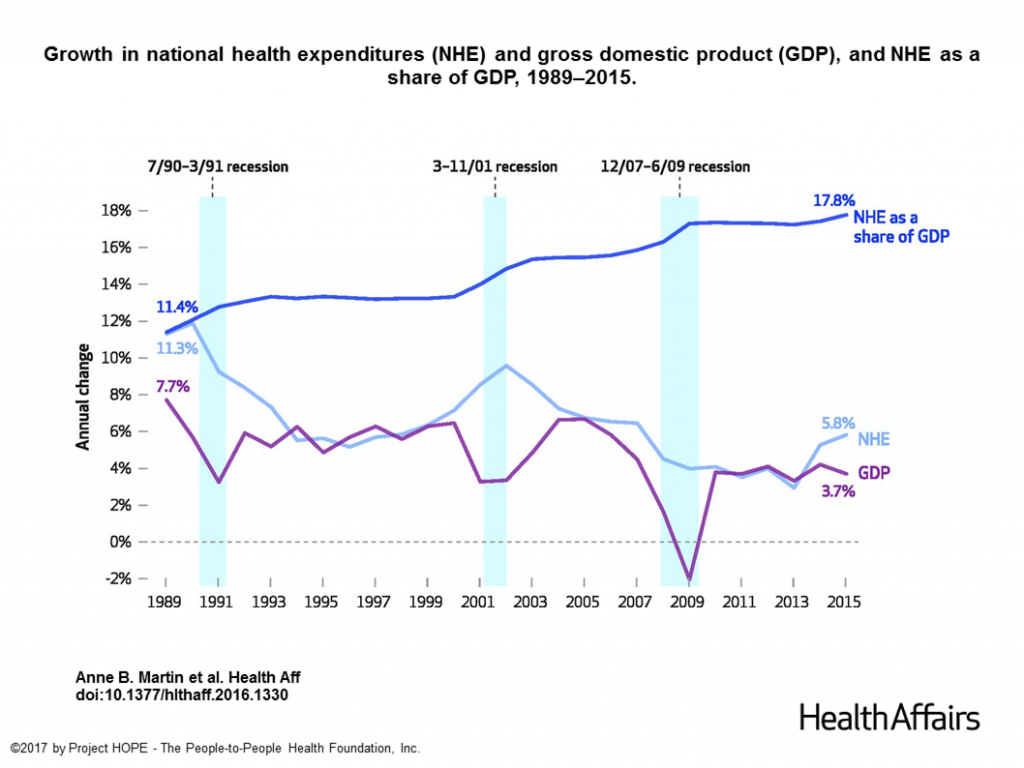

Spending on health care in the U.S. hit $3.2 trillion in 2015, increasing 5.8% from 2014. This works out to $9,990 per person in the U.S., and nearly 18% of the nation’s gross domestic product (GDP).

Factors that drove such significant spending growth included increases in private health insurance coverage owing to the Affordable Care Act (ACA) coverage (7.2%), and spending on physician services (7.2%) and hospital care (5.6%). Prescription drug spending grew by 9% between 2014 and 2015 (a topic which I’ll cover in tomorrow’s Health Populi discussing IMS Institute’s latest report into global medicines spending).

The topic of increasing healthcare costs as a component of the U.S. national economy is covered in the January 2017 Health Affairs “web first” article, National Health Spending: Faster Growth In 2015 As Coverage Expends and Utilization Increases.” That title communicates the bottom line of research by a team from the Office of the Actuary at the Centers for Medicare and Medicaid Services (CMS).

That expanding coverage is due in large part to new enrollees in health insurance plans supported by Obamacare — the ACA — since the law’s implementation began in 2013. When the ACA took effect, 86% of Americans were covered by health insurance. By 2015, the covered population was nearly 91% of the U.S. population.

That expanding coverage is due in large part to new enrollees in health insurance plans supported by Obamacare — the ACA — since the law’s implementation began in 2013. When the ACA took effect, 86% of Americans were covered by health insurance. By 2015, the covered population was nearly 91% of the U.S. population.

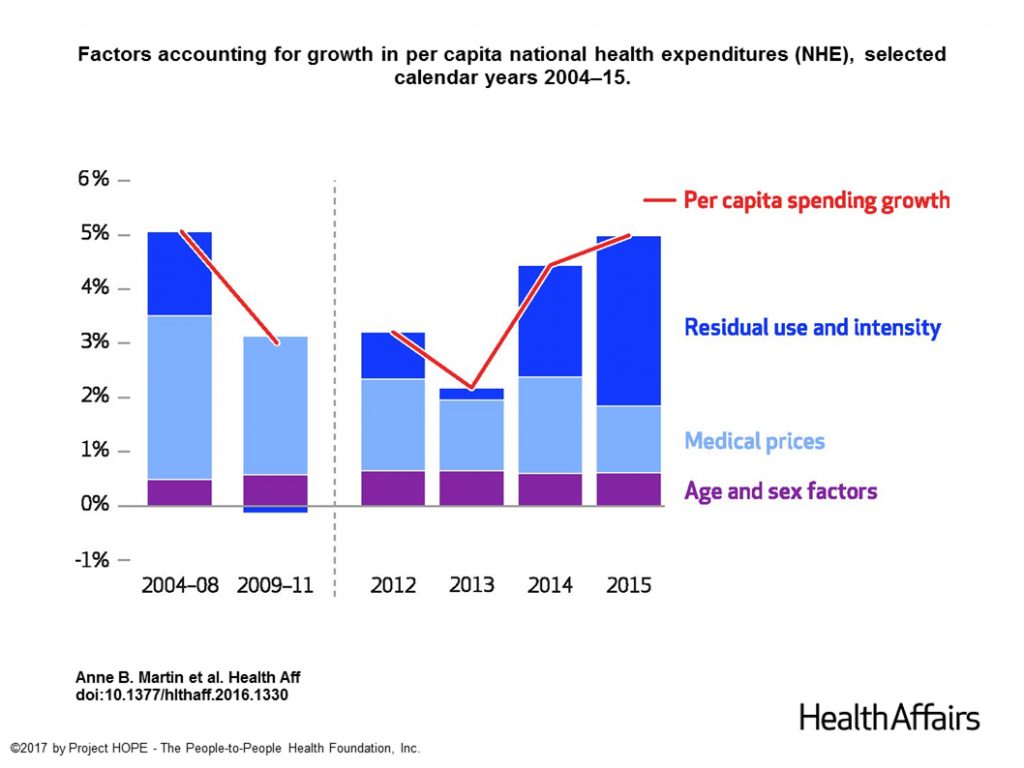

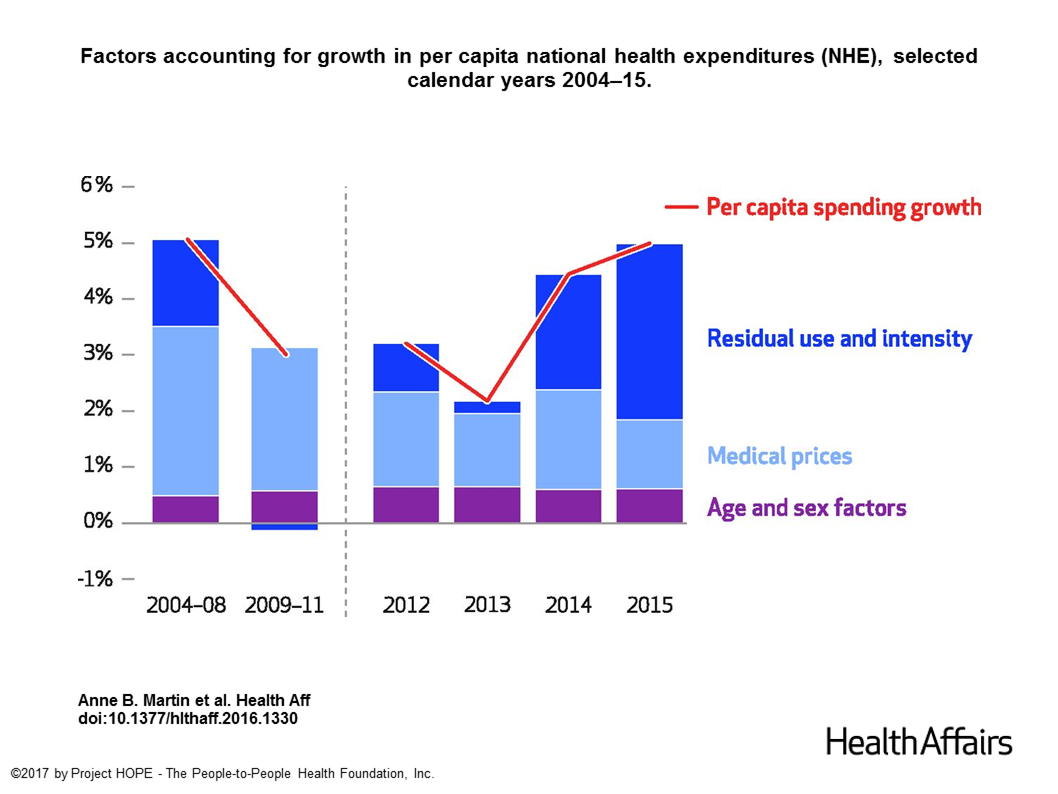

The growth in spending between 2014-2015 is due more to utilization (that is, consumers’ use of services) than to price inflation of services. In fact, medical price growth slowed to the point of “deceleration,” with prices actually declining for physician and clinical services, durable medical equipment, and other non-durable medical products.

Spending growth was therefore driven upward by use and intensity of services, which “accelerated” for most personal health care services including hospital care, physician and clinical services. See the first chart’s dark blue bars, which in 2015 are the largest for “residual use and intensity.”

The growth in health spending by households (consumers) increased by 4.7%, nearly double the rate of 2014 (which was 2.6% over the previous year). This included out-of-pocket costs, contributions to health insurance premiums, and contributions to Medicare through payroll deductions. Consumers’ contributions to employer-sponsored health insurance plans grew by 6.9% in 2015.

Prescription drug spending grew faster than any other health category, by 9% in 2015. The growth was driven by price growth for existing brand name drugs, high prices on new medicines (namely, specialty drugs like Harvoni and Sovaldi for Hepatitis C), and growing spending on generics, and a decline in the number of branded medicines going off-patent to generic Rx status. This study found that price growth for existing brand-name drugs reached double-digit rate for the fourth year in a row.

Looking forward to the next decade, health care costs are expected to grow as a proportion of the overall U.S. economy, spurred on by the aging of America, slow-growth economy, and accelerating medical price growth.

Health Populi’s Hot Points: This study was published at the same time President-Elect Donald Trump nominated Tom Price to lead the Department of Health and Human Services, which has responsibility for the Centers for Medicare and Medicaid (where the researchers of this paper work) as well as the Food & Drug Administration (FDA), the National Institutes of Health, and the Centers for Disease Control, among other health stakeholder agencies. Tom Price is an orthopedic surgeon from Georgia, one of the original members of the Tea Party caucus, and has chaired the House of Representatives Budget Committee since 2015. From the start of the ACA, he has been outspoken about repealing the law.

There is no doubt that the “Affordable” adjective in the law’s name has been elusive since its implementation in 2013. It is also a fact that many millions of Americans are now covered by health insurance, which has afforded people access to health care services for which they had pent-up demand — resulting in the acceleration of health care utilization shown in the first chart’s dark blue vertical bars for 2014 and 2015 — a direct impact of Obamacare’s coverage, which opened up services to patients in need of care.

It’s scenario planning time here at THINK-Health among our clients who span the health/care ecosystem. A scenario of Health Savings Accounts-In-Every-Pot is one of the clearer healthcare reforms espoused by Donald Trump and Tom Price. HSAs place patients in the explicit role of health care consumer, having to shop for the various line-items that make up a healthcare market basket: health insurance plans, health care services at hospitals and physicians’ offices, emergency care, prescription drugs, among other line items. Due to the complexity of building that market basket, consumers often turn to the easy-to-understand-and-access solution: the closest emergency room. That’s an expensive alternative that too many people who choose by default…leading to potentially greater health care costs in the National Health Spending accounts. We’re currently working out this, and other, health reform scenarios for 2017 and beyond. One thing is certain: costs will certainly increase, and consumers, hospitals and physicians will be bearing more of them.

For a preliminary look at how a President Trump health agenda could play out, see Kaiser Family Foundation’s Drew Altman’s post here in the Wall Street Journal.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...