“Overall, Council members express pessimism about the health are landscape in the wake of the Trump administration’s proposed plans, citing no clear winners, only losers: patients, clinicians, and provider organizations.”

“Overall, Council members express pessimism about the health are landscape in the wake of the Trump administration’s proposed plans, citing no clear winners, only losers: patients, clinicians, and provider organizations.”

This is the summary of the Leadership Survey report, Anticipating the Trump Administration’s Impact on Health Care, developed by the New England Journal of Medicine‘s NEJM Group.

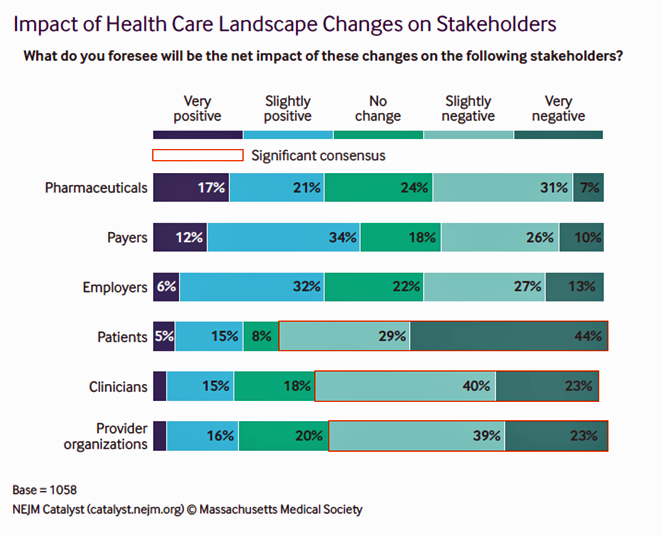

The first chart illustrates the “biggest healthcare losers” finding, detailed on the bottom three bars of patients, clinicians, and provider organizations. The stakeholders that will fare best under a President Trump healthcare agenda would be drug companies, payers, and employers.

The biggest loser in this survey are patients: 73% of the NEJM Council forecast that patients will be negatively impacted by Trump administration health care policies versus 63% for clinicians and 62% for providers.

NEJM surveyed the Council members on several health care policies making up the Trump health care policy spectrum. The most significant consensus was seen for insurance premium prices, which 69% of Council members believe will increase; insurance coverage benefits, which 70% of respondents believe will decrease; the number of citizens covered, which 74% of the Council think will decrease, and research funding, which 67% of the respondents foresee will fall.

The online survey was conducted in February 2017 among 1,058 members of the NEJM Catalyst Insights Council, which is comprised of U.S. executives, clinician leaders, and clinicians directly involved in health care delivery.

Health Populi’s Hot Points: “For a lot of people, a $10,000 deductible is the same as being uninsured,” an NEJM Council member is quoted in the report. New research was published in the past couple of weeks that speak to the impact of high-deductibles and greater out-of-pocket costs on U.S. health citizens. Crowe Horwath’s report, Revenue Recognition and High-Deductible Plans, has the subtitle, “The Greater the Patient Portion, the Lower the Collections.”

The executive summary explains: “The increase in high-deductible health plans (HDHPs) has been dramatic, and the self-pay collections on these plans also have been dramatically….lower. The percentage of collections on patients with balances greater than $5,000 are four times lower than collections on low-deductible plan patients.”

The NEJM Council, which includes healthcare executives and clinicians, are most concerned about a Trump administration’s negative impact on (1) patients and (2) health insurance. They have already connected the financial un-wellness dots that the Crowe Horvath report calls out. Patients’ financial exposures to health care bills impact providers’ financial health, as well.

The NEJM Council, which includes healthcare executives and clinicians, are most concerned about a Trump administration’s negative impact on (1) patients and (2) health insurance. They have already connected the financial un-wellness dots that the Crowe Horvath report calls out. Patients’ financial exposures to health care bills impact providers’ financial health, as well.

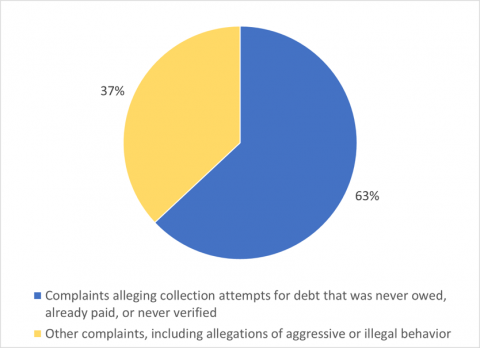

A second report is worth mentioning on the patient-as-payor side of the healthcare financial ledger. Medical Debt Malpractice discusses consumer complaints about medical debt collectors and the role of the Consumer Financial Protection Bureau (CFPB). The report, from the U.S. PIRG Education Fund and the Frontier Group, examines 17,701 medical debt collection complaints to the CFPB and finds widespread problems — in particular, two-thirds of complaints that allege collection attempts for debt that was never owed, already paid, or never verified, illustrated in the pie chart. Geography is also destiny as some states have worse records than others: Nevada has the most medical debt collection complaints at 11.4 complaints per 100,000 residents, followed by Florida, Delaware, Georgia, and New Jersey.

The CFPB has played an important role in protecting Americans’ rights with respect to banking behavior. The latest egregious examples have been consumers’ risk exposure to Wells Fargo’s sales practices along with student loan scams perpetrated by Navient.

As U.S. health citizens’ access to health insurance is potentially threatened, pay attention to the future of the CFPB, as well.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...