In the past few weeks, two announcements from Amazon point to a strategy, whether intended or my dot-connecting, that the ecommerce leader has the health of its customers in its sights.

In the past few weeks, two announcements from Amazon point to a strategy, whether intended or my dot-connecting, that the ecommerce leader has the health of its customers in its sights.

In late May, CNBC first published the news that Amazon was seeking out a candidate to be a general manager for a pharmacy business. Here’s the video telling the story.

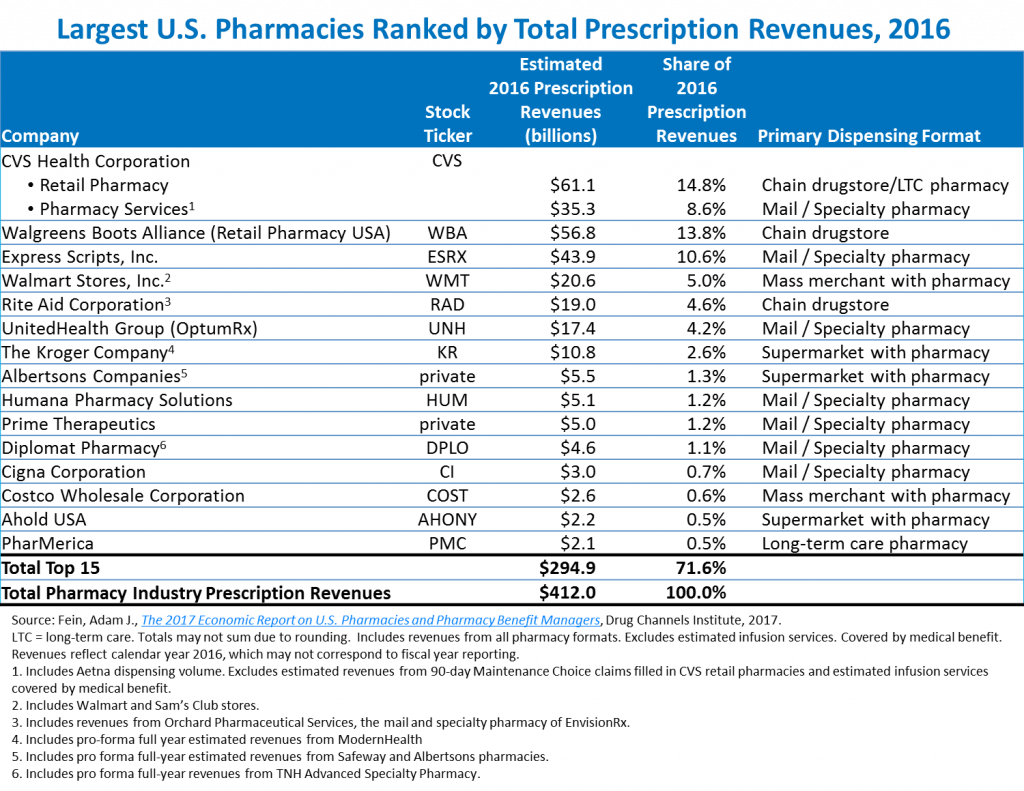

Getting into the retail pharmacy channel is in itself a huge message to this health industry segment, which is very competitive between chain pharmacies (led by CVS, Walgreens, and Rite-Aid), grocery pharmacies (the largest of which are Kroger and Albertsons), Big Box stores (topped by Walmart), mail order Rx businesses and pharmacy benefit managers (PBMs). The 2016 league table for the largest US pharmacies by Rx revenues appears in the table, courtesy of Adam Fein’s Drug Channels Institute.

Getting into the retail pharmacy channel is in itself a huge message to this health industry segment, which is very competitive between chain pharmacies (led by CVS, Walgreens, and Rite-Aid), grocery pharmacies (the largest of which are Kroger and Albertsons), Big Box stores (topped by Walmart), mail order Rx businesses and pharmacy benefit managers (PBMs). The 2016 league table for the largest US pharmacies by Rx revenues appears in the table, courtesy of Adam Fein’s Drug Channels Institute.

Thus when it comes to retail pharmacy, Amazon is entering an already-crowded space. Not every analyst is bullish on this prospect, as this Barron’s article explains.

This week, Amazon began to offer a Prime membership discount to people enrolled with a U.S. government Electronic Benefits Transfer card for benefits such as SNAP (the Supplemental Nutrition Assistance Program, aka food stamps). Eligible customers can sign up for a 30-day free trial, then receive Prime benefits for $5.99 a month and can cancel anytime. Prime benefits include free two-day shipping (particularly useful for food purchases), unlimited Prime video, music, photo storage, reading free e-books and magazines, 20% discount on diaper subscriptions, and other features. This move is seen by industry analysts as a direct competitive challenge to Walmart, whose customer base tends to be people with lower incomes. Amazon began testing out food stamps out of stealth mode in January 2017, discussed in this USA Today column.

A third Amazon-aspect that can underpin consumer health is the company’s very popular Alexa connected home device, which was the company’s biggest-selling product in Amazon’s electronics store during the 2016 holiday season. Alexa has already begun to support consumers’ home health needs, beyond stress-reducing via our favorite music (which in itself is an important contributor to wellness and overall health). Developers are already creating services that embed in Alexa to help people manage healthcare at home. One such company is Orbita, which I profiled here in Health Populi. Here’s the key paragraph from that post:

Alexa’s base technology can be used for health care at home, which was demonstrated by Orbita at the recent Connected Health Conference in December 2016. The company showed voice-activated home health capabilities such as medication adherence, pain management, patient monitoring, and caregiver coordination. This is an early example of home health through home tech assistants, of which Amazon’s Jeff Bezos waxed, “I think health care is going to be one of those industries that is elevated and made better by machine learning and artificial intelligence. And I actually think Echo and Elena do have a role to play in that.” Boston Children’s Hospital is a pioneering healthcare provider, implementing Alexa in KidsMD, which uses the device to support parents’ caregiving for their kids’ healthcare.

Health Populi’s Hot Points: Consider the fact that 71% of US households earning over $112,000 a year were Amazon Prime subscribers in 2016, according to Piper Jaffray. The company has room to grow among lower-income American shoppers,as the chart shows, although by the spring of 2016, Amazon Prime had over 40% of lower-income families subscribing to the program.

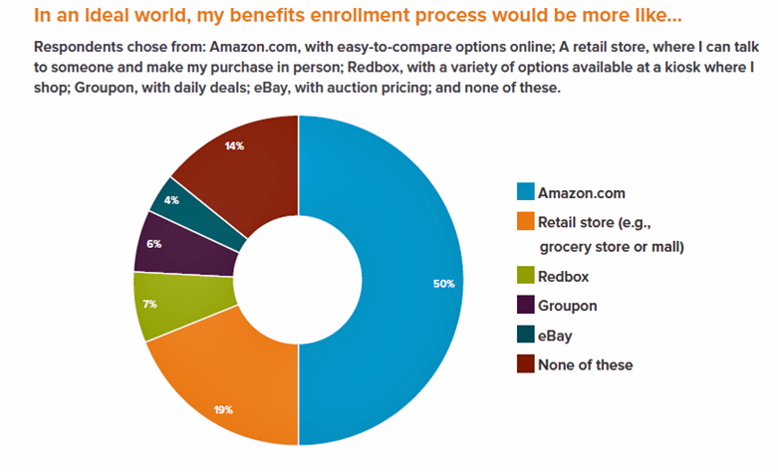

Now consider that one-half of consumers are looking for simplified, convenient, accessible healthcare journeys. Note the third graphic, illustrating that people want an Amazon-type experience when enrolling for health insurance, Aflac found in a 2016 consumer study.

Now consider that one-half of consumers are looking for simplified, convenient, accessible healthcare journeys. Note the third graphic, illustrating that people want an Amazon-type experience when enrolling for health insurance, Aflac found in a 2016 consumer study.

Note that as many consumers trust retail and digital companies to help them manage personal health as trust health care providers, a Strategy& survey found. Why would this be the case? ask those historically-trusted doctors and hospitals. It has to do with value propositions delivered in a transparent, understandable, streamlined fashion. The legacy healthcare industry hasn’t delivered that kind of customer experience the way other industries have — and most especially, Amazon, which has “Primed” a plurality of consumers for just-in-time gratification and respect as I wrote here in Health Populi earlier this year.

If the company successfully develops a pharmacy business, Amazon can leverage Big and small D(d)ata to personalize healthcare to the individual based on what it knows about our medications, food and personal care purchases, lifestyle behaviors, and other data that the traditional healthcare system doesn’t know about our everyday life. These are many of the social determinants of health that can help keep us well, reduce health disparities (especially as the Prime program can grow among SNAP food beneficiaries), and boost public health through Amazon’s scale.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...