There’s more evidence of shopping behavior among patients: there’s new data showing that patients-as-consumers switch healthcare providers not due to quality of care or costs, but because of lack of service.

There’s more evidence of shopping behavior among patients: there’s new data showing that patients-as-consumers switch healthcare providers not due to quality of care or costs, but because of lack of service.

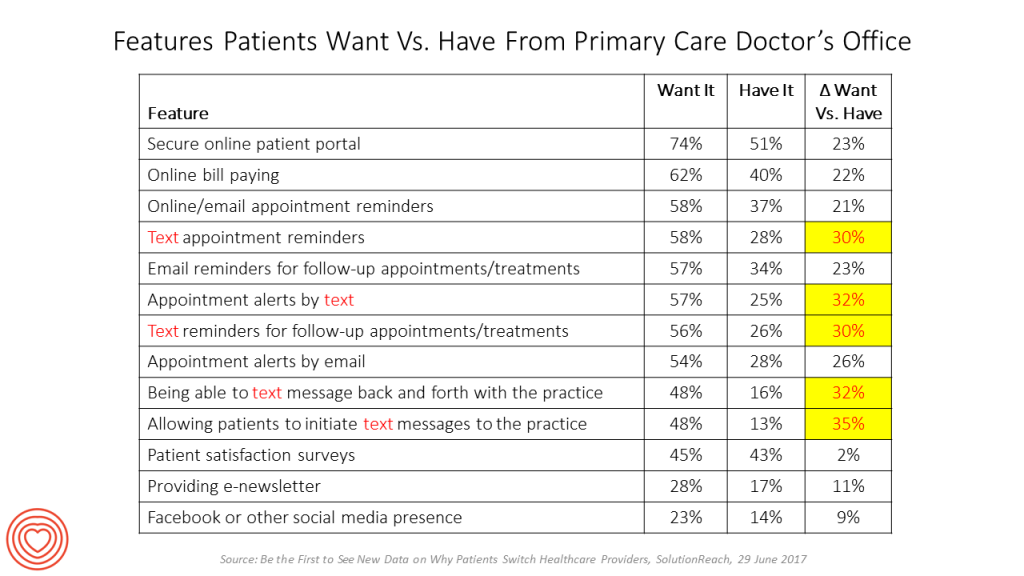

I discovered one key verb and feature patient-consumers expect from doctors: it’s the ability to text, for appointment reminders, alerts, treatments, and communicating with the practice.

SolutionReach, in the business of patient engagement, conducted a survey among 500 consumers asking about primary care providers, communication experience and satisfaction levels. The company presented the research results in a webinar on 29 June 2017. The research was also written up in a report, The Patient=Provider Relationship Study, which mines the data for generational differences across patient cohorts by age.

The first table orders the features patients told SolutionReach they want versus those they have. The highlighted areas show the greatest gaps in service, all related to texting.

Here are some other key findings:

- Over all patients, only 32% are completely satisfied with their medical provider

- Due to dissatisfaction, 12% of patients say they have left their doctor’s practice, and 34% are considering leaving

- Generationally, 42% of Millennials are likely to switch doctors in the next couple of years; 44% of Gen X patients; and 20% of Boomers

- Dissatisfaction with practice logistics is driven mainly by convenient location, ease of making an appointment online or by phone, receiving reminders about upcoming appointments, and ease in getting that appointment.

“Patients are not leaving because of poor quality care,” SolutionReach concluded. Poor experience is driving at least one-third of patients to seek a new provider practice.

Health Populi’s Hot Points: The findings here are part of a larger growing market for retail health and healthcare, where patients, flexing consumer muscles, are feeling empowered to make more decisions on their own behalf. While cost continues to be a major factor in healthcare decision making, service levels are highly tied to communication, access, convenience and transparency.

My recent take on West’s research into patient experience in healthcare reinforced this consumer demand.

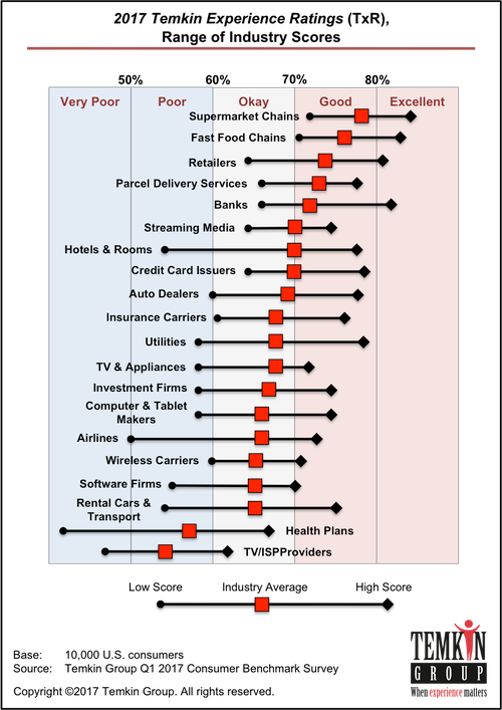

Note the last chart, which features data from the 2017 Temkin Experience Ratings which I’ve written about here in Health Populi. Health plans rank at the bottom, and retail, fast food, and financial services at the top. The latter create the high benchmark for customer service that legacy healthcare stakeholders — hospitals, physicians, pharma, and health insurance — are expected to meet.

Remember: the last-best consumer experience people have is the benchmark against which they compare future experiences across all industries, whether banking, food, hospitality, or package delivery. If patients are paying more for healthcare, they expect that higher benchmarked experience.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.