The business and mission of pharmacies are being re-shaped by several major market forces, most impactful being uncertain health reform prospects at the Federal level — especially for Medicaid, which is a major payor for prescription drugs. Medicaid covered 14% of retail prescriptions dispensed in 2016, according to QuintilesIMS; Medicare accounted for 27% of retail prescriptions.

“But if affordability, accessibility, quality, innovation, responsiveness and choices are among the standards that will be applied to any future changes, pharmacy has strong legs to stand on,” Steve Anderson, president and CEO of the National Association of Chain Drug Stores, said in the PoweRx Top 50 report from Drug Store News (DSN).

The pharmacy has always been a healthcare destination by the nature of what happens in the proverbial “back-of-the-store:” dispensing prescription drugs, typically written by physicians. 50% of people in America take at least one prescription drug. 1 in two people in America have taken at least one prescription drug in the past 30 days, and 4.4 billion prescriptions were written in the U.S. in 2016.

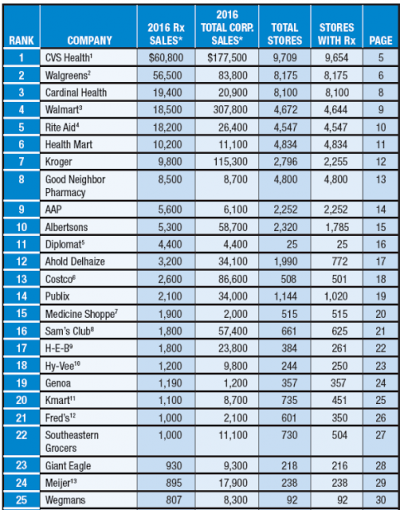

The table organizes DSN’s roster of the leading pharmacy retailers by 2016 Rx sales.

The opportunities in the so-called “front of the store” (including the aisles in the fast-growing number of pharmacies situated in grocery stores) hold promise for boosting health consumers’ overall health and wellness.

Consider these example from DSN’s report, which fit into Health Populi’s mantra that Health/care is Everywhere:

CVS, #1, quitting tobacco in 2014, is moving onto healthier food offerings, removing products that contain partially hydrogenated oils from its private-label products. The chain is also baking health into its beauty offerings, which is a trend we can see happening in the all-beauty chains, Sephora and Ulta, as well. CVS gets learnings from a Digital Innovation Lab located in South Boston to test new ideas, including the newly-rolled out CVS Curbside and CVS Pay services that boost the store brand’s customer service and convenience.

Walgreens, #2, is part of the Boots Alliance, based in Europe. In the U.S., Walgreens partners with UnitedHealthcare for a Medicare Advantage and Part D prescription plan, and serves 4.8 million seniors through its Medicare plans. Walgreens works in specialty care on cancer, designating several dozen locations as “Community, a Walgreens Pharmacy,” to deliver oncology meds closer to where patients live, and to help with medication therapy management. Walgreens has also been a leader in digital health app development, as well.

Walmart, #4, is already a primary care destination for many of its millions of daily customers, providing pharmacy services along with urgent care, primary care clinics, and huge allocation to over-the-counter floor space. In addition, Walmart is changing messaging around healthier foods, and adding wearable health devices to its electronics department. Walmart also performs medical screenings at its event, “America’s Biggest Health Fair,” for blood pressure, glucose, and vision.

Kroger, #7, is investing in health and wellness for a long-term strategy, acquiring the ModernHEALTH specialty pharmacy in 2016. Specialty pharmacy is fast-growing as Health Populi has discussed, and Kroger sees this add to its health-wellness portfolio as a growth driver for the grocery chain. Kroger also operates The Little Clinic brand of retail clinics. “Health and wellness can be food; it could be mind, body and spirit,” Philecia Avery, Kroger’s VP of Pharmacy, told DSN. One of her missions is to ensure Kroger engages in collaborations that support health and wellness.

Hy-Vee, #18, has grown immunization and in-store clinics through its 8-state Midwestern footprint, and collaborates with local healthcare providers. The chain has invested in expanding nutritionists to bolster nutrition, weight loss, and disease management (e.g., diabetes) in the stores. To make healthy food purchasing easier, the chain operates 179 HealthMarket departments with organic, natural, gluten-free, and allergy-friendly foods, and publishes an in-store magazine called Hy-Vee Balance. Hy-Vee has an exclusive deal with Mark Wahlberg to market his sports nutrition line, Performance Inspired. Hy-Vee announced today its entry into the meal-kit business; imagine this purposed for food prescriptions, for example, to support people living with diabetes.

Raley’s, #34, opened in 1971 as the first “food-and-drug combo” superstore, DSN reports. The chain operates 121 supermarkets in Northern California and Nevada. Their program, “Let’s Begin,” leads shoppers through steps for leading healthy lifestyles based on personal goals, preferences, and budgets. There are “Better for You” checkout lanes that have replaced artificially sweetened sodas from fridges and added protein bars to the snack selections. “We want to make it easier for our customers to make better choices for their life,” said Raley’s Director of Pharmacy Operations, Dave Fluitt.

The PoweRx 50 report highlights many other examples of pharmacies and grocers building out health-and-wellness strategies, which include growing primary care services beyond immunizations.

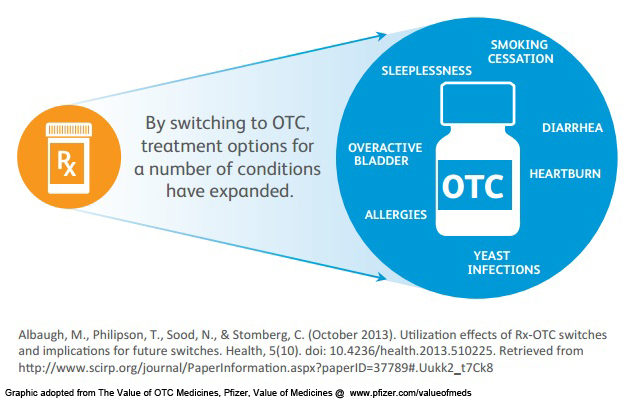

Health Populi’s Hot Points: The pharmacy that dispenses prescription drugs is complemented by goods in front of the counter: over-the-counter products that drive 2.9 billion trips annually to purchase OTCs, according to the Consumer Healthcare Products Association (CHPA).

Health Populi’s Hot Points: The pharmacy that dispenses prescription drugs is complemented by goods in front of the counter: over-the-counter products that drive 2.9 billion trips annually to purchase OTCs, according to the Consumer Healthcare Products Association (CHPA).

CHPA found that without the availability of OTCs in the U.S., 60 million Americans would not seek treatment for their conditions. 81% of people in the U.S. Use OTC medicines as a first response to medical ailments. Picture worried parents in the middle of the night: nearly 7 in 10 parents have given their child an OTC medicine late at night to treat a sudden medical symptom.

While OTCs are very useful for children, they’re also convenient and inexpensive for mainstream adults who can access a growing range of OTCs for various conditions shown in the graphic: from sleep to smoking cessation, allergies to yeast infections, OTCs are a tool of health consumer self-care when used appropriately.

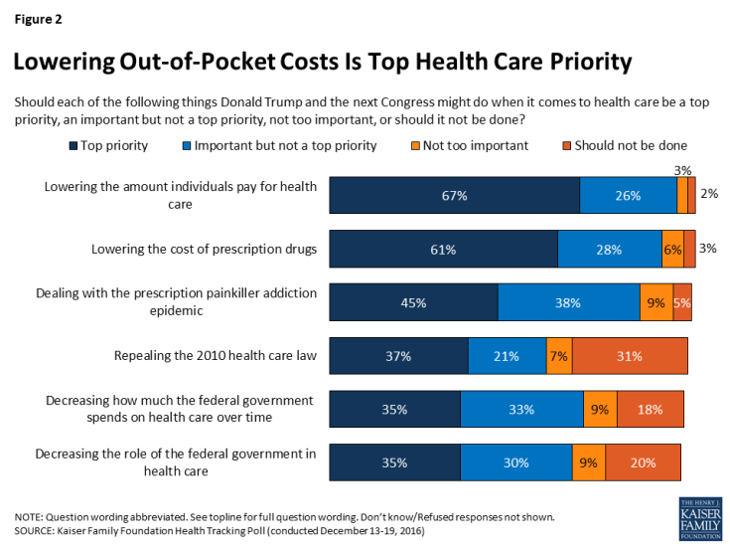

Facing growing out-of-pocket costs and first-dollar spending for high deductibles, retail health at the pharmacy for self-care and primary care is a huge opportunity on both the supply side (of pharmacies and grocers with pharmacies) and on the demand side for fiscally-mindful health consumers.

Lowering out-of-pocket costs were top-of-mind for Americans as the new year 2017 began, the Kaiser Family Foundation Health Tracking Poll results found.

Lowering out-of-pocket costs were top-of-mind for Americans as the new year 2017 began, the Kaiser Family Foundation Health Tracking Poll results found.

Couple that with accessible and attractive spaces and parking, value-based pricing, and healthcare services that people need and demand in their local communities, and pharmacies and grocers can fill the need for greater primary care where people live, work, play, learn, and shop.

“To shop” becomes an operative verb in retail-facing, consumer-driven health care in the new era of the “Amazon Primed” health consumer. I’ve been evolving the concept here on Health Populi and with THINK-Health’s clients across the health/care ecosystem. Amazon continues to grow its healthcare team — now adding veteran health-tech pro Missy Krasner to the company’s expertise announced here via CNBC.

With the possibility of expanding health services to pharmacy, legacy pharmacies can add Amazon-the-disruptor as a wild card along with health care reform. One certainty that strategists can count on: the centrality of the health care consumer, who faces increasing out-of-pocket costs which helps to set the tactical table for retail health opportunities.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...