Cost is the number one driver among consumers declining satisfaction with pharmacies, J.D. Power found in its 2017 U.S. Pharmacy Study.

Cost is the number one driver among consumers declining satisfaction with pharmacies, J.D. Power found in its 2017 U.S. Pharmacy Study.

Historically in J.D. Power’s studies into consumer perceptions of pharmacy, the retail segment has performed very well, However, in 2017, peoples’ concerns about drug prices negatively impact their views of the pharmacy — the front-line at the point-of-purchase for prescription drugs.

In the past year, dissatisfaction with brick-and-mortar pharmacies related to the cost of drugs and the in-store experience. For mail-order drugs, consumer dissatisfaction was driven by cost and the prescription ordering process.

Among all pharmacy channels, supermarket drugstores received the highest overall satisfaction, followed by mail order, hospital or clinic, chain drug stores, specialty pharmacy, and mass merchants at the bottom.

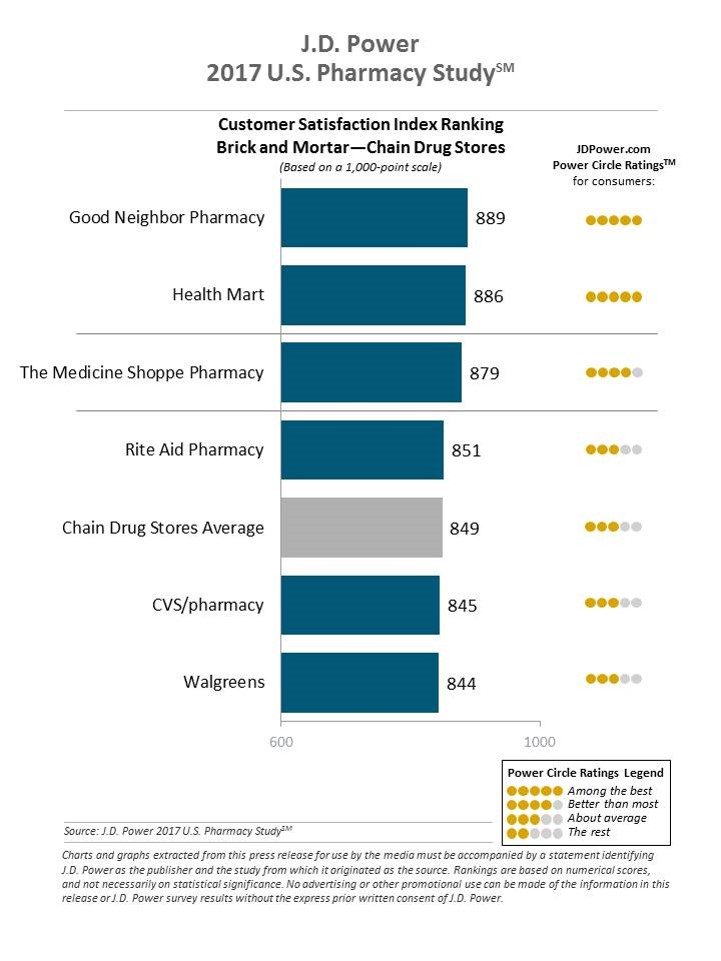

Among brick-and-mortar chain drug stores, Good Neighbor Pharmacy garnered the highest overall satisfaction, as shown in the first chart. Health Mart and The Medicine Shoppe Pharmacy followed in second and third places. The largest two pharmacy chains, CVS/health and Walgreens, fell to the bottom of this group, below the chain drug store average.

Among mass merchandisers, consumers ranked Sam’s Club and Fred’s at the top. In the middle were Costco, Meijer, CVS/pharmacy in Target, and Kmart. Walmart drew the bottom slot this year for mass merchandisers.

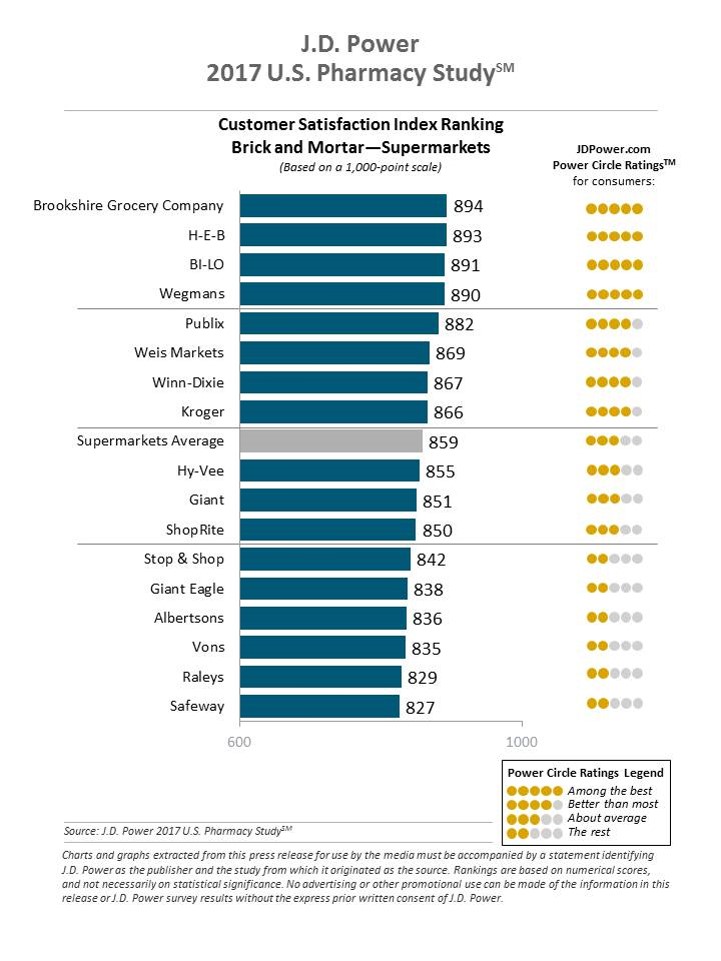

Supermarkets, the top-performing retail pharmacy channel, are led by Brookshire Grocery Company, H-E-B, BI-LO, and Wegmans. The second tier of grocery pharmacy favorites included Publix, Weis Markets, Winn-Dixie and Kroger. At the bottom? Safeway and Raleys.

Supermarkets, the top-performing retail pharmacy channel, are led by Brookshire Grocery Company, H-E-B, BI-LO, and Wegmans. The second tier of grocery pharmacy favorites included Publix, Weis Markets, Winn-Dixie and Kroger. At the bottom? Safeway and Raleys.

For mail order, the VA (Department of Veterans Affairs mail order service) took top place by a large margin. After the VA, consumers favor Kaiser Permanente’s Pharmacy, then Humana, Walmart, and OptumRx. Least favored mail order pharmacies included CIGNA home delivery, Aetna, and Prime Therapeutics.

Drug prices have been receiving greater scrutiny in both the marketplace and in Washington, DC. Last summer, consumers of the EpiPen expressed outrage over the pricing of the live-or-die drug. In the two years before that, both patients and legislators became more focused on the growing costs of specialty drugs, the poster child of which were therapies to deal with Hepatitis C. Throw into the mix Martin Shkreli’s 5,000% price increase for Daraprim, a life-saving drug, and the issue of prescription drug pricing grew important as a 2016 Presidential campaign issue.

In fact, in Donald Trump’s interview as TIME Magazine Man of the Year in December 2016, he told TIME: “I’m going to bring down drug prices. I don’t like what’s happened with drug prices.”

This ninth year of the J.D. Power U.S. Pharmacy Study was based on surveys completed by 17,326 pharmacy customers who filled or refilled a prescription during the three months prior to the May-June 2017 fielding of the poll.

Health Populi’s Hot Points: Poor pharmacies: they’re really the messenger of the pharma and life science industry’s pricing strategies, translated at the point-of-purchase.

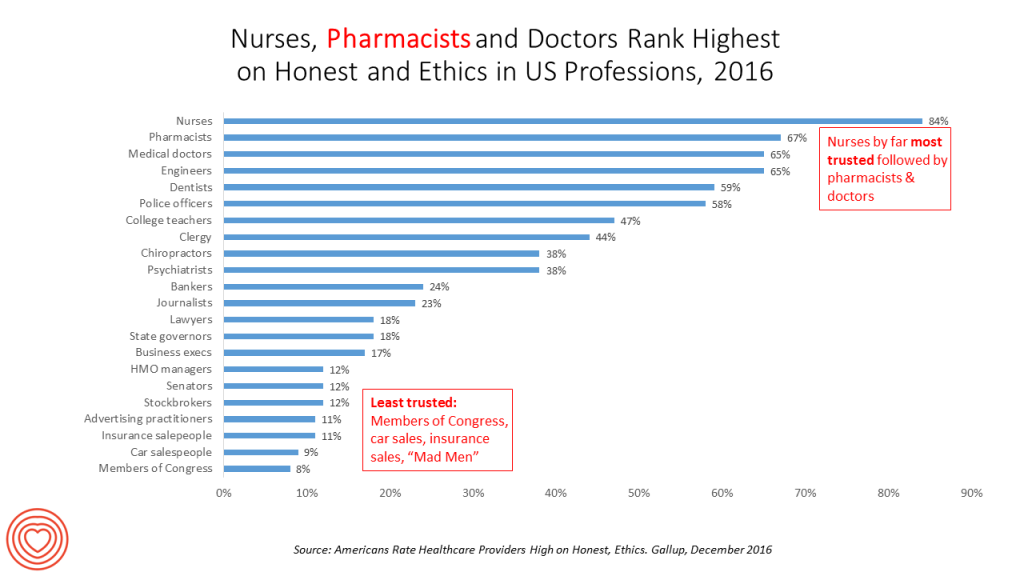

It’s noteworthy that pharmacists sit among the top-three most ethical and honest job types in America, according to the Gallup Poll conducted in December 2016 [illustrated by the last graphic]. Pharmacists are historically trusted in this Poll among the top three professions, with nurses and then doctors rounding out the trio.

This positive relationship is an important one to preserve as the U.S. (and pharma companies) wrestle with the challenge of medication adherence, from filling a new prescription to following through with ingesting a prescribed drug. That pharmacist is a key, trusted partner for patients in the retail health setting for bolstering patients’ self-care outside of the doctor’s office.

Consumers now have several choices of digital apps and tools to help people find lower prices for prescription drugs. Blink Health raised another $90 mm in a Series B round to grow its consumer-facing app in April 2017. GoodRx has been expanding its platform and began to partner with PBM ExpressScripts in May. These new entrants into the pharmaceutical/pharmacy space represent the sort of innovative disruption that health consumers seek. The pharma company and retail pharmacy segments will need to respond to this disintermediation between patient and supplier. Greater transparency, financial assistance, and services “beyond the pill” will be part of that solution.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...