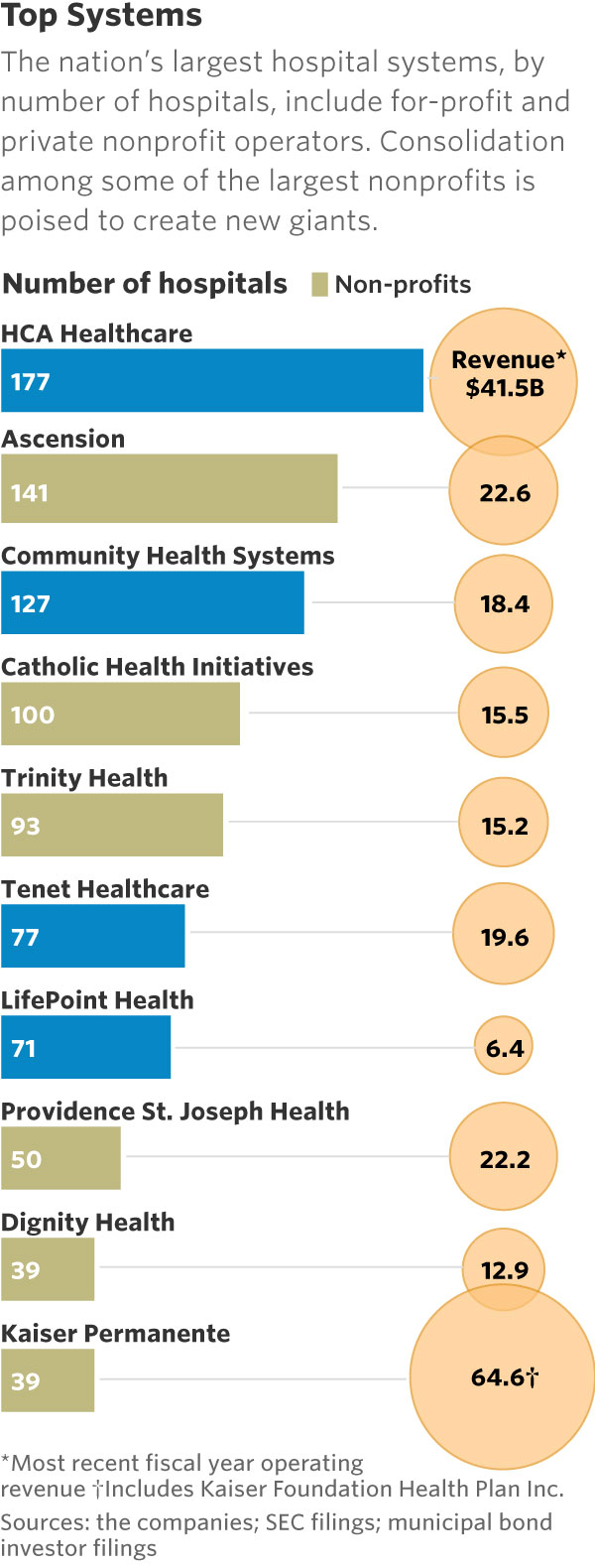

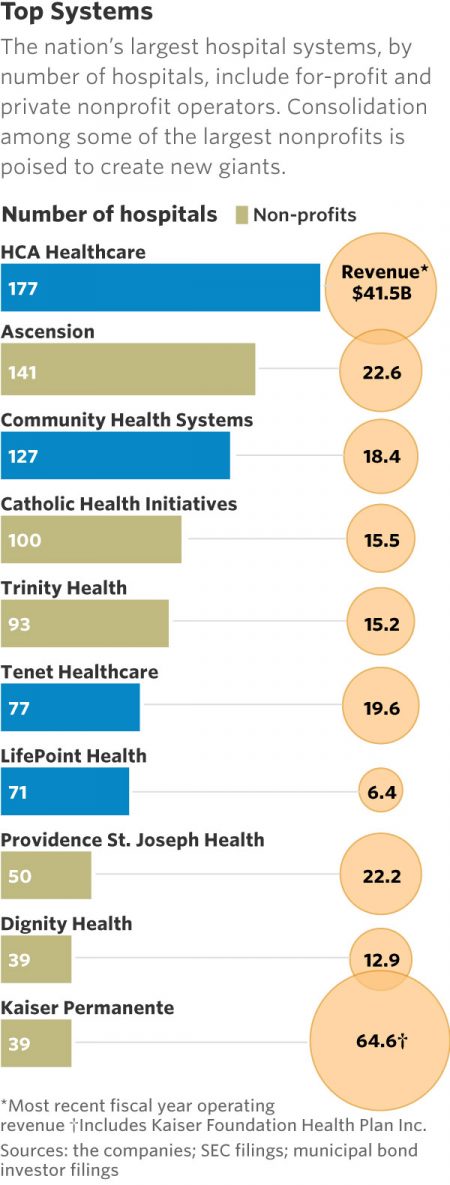

This month, two hospital mega-mergers were announced between Ascension and Providence, two of the nation’s largest hospital groups; and, between CHI and Dignity Health.

This month, two hospital mega-mergers were announced between Ascension and Providence, two of the nation’s largest hospital groups; and, between CHI and Dignity Health.

In terms of size, the CHI and Dignity combination would create a larger company than McDonald’s or Macy’s in terms of projected $28 bn of revenue. (Use the chart of America’s top systems to do the math).

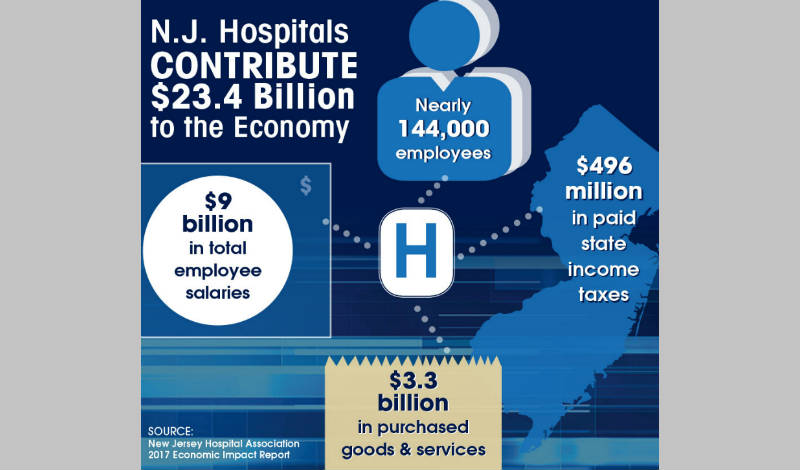

For context, other hospital stories this week discuss in southern New Jersey. And this week, the New Jersey Hospital Association annual report called the hospital industry the “$23.4 billion economic bedrock” of the state.

Add a third important item to paint the state-of-the-U.S. hospital-industry picture: Moody’s negative ratings outlook for non-profit hospital finances for 2018.

So will getting bigger through merger and consolidation make the hospital business better?

In the wake of the CVS-Aetna plan to join together, the rationale to go big seems rational. Scale matters when it comes to contracting with health insurance plans at the front-end of pricing and financial planning for the CFO’s office, and to managing population health by controlling more of provider elements of care from several lenses: influencing physician care; crafting inpatient hospital care; doing smarter, cheaper supply purchasing; and leaning out overhead budgets for things like marketing and general management.

But the Wall Street Journal warned today the “serious condition” of U.S. hospitals, despite these big system mergers.

Health Populi’s Hot Points: In the past two years, I’ve had the amazing opportunity of speaking about new consumers and patients growing into healthcare payors with leadership from hospitals in over 20 states, some more rural, some more urban, and all in some level of financial crisis mode.

After describing the state of this consumer in health and healthcare, and how she/he got here, I have challenged hospital leadership to think more like marketers with a fierce lens on consumer experience and values. That equal proportions of U.S. consumers trust large retail and digital companies to help them manage their health is a jarring statistic to these hospital executives. The tie-up between CVS and Aetna marries the retail health/healthcare segments and responds to this consumer trust issue.

But then, I remind them that nurses, pharmacists, and doctors are the three most-trusted professions in America.

These three professional clinicians are the human capital that comprise the heart of a hospital in a community.

Hospitals should be mindful that trust is necessary for patient/health engagement. And the trust is with hospitals if the organization chooses to leverage that goodwill for a value-exchange. Hospitals are economic engines in their local communities — often, the largest employer in town. “Everyone” in most communities knows someone who works in a hospital.

Hospitals should be mindful that trust is necessary for patient/health engagement. And the trust is with hospitals if the organization chooses to leverage that goodwill for a value-exchange. Hospitals are economic engines in their local communities — often, the largest employer in town. “Everyone” in most communities knows someone who works in a hospital.

And hospital employees spend money in communities, bolstering local employment and tax bases.

Partnering with patients means empathizing with them as both clinical subjects and consumers. For the latter, refer to the sage column from JAMA which recommends that Value-Based Healthcare Means Valuing What Matters to Patients. This means thinking about the value-chain of the patient journey, from keeping people well in their communities through to managing sticker-shock in the financial office. The financial toxicity of healthcare is one risk factor threatening the hospital-patient relationship with the patient-as-payor.

As Mufasa told Simba in The Lion King, “You are more than what you have become. Remember who you are.”

As Mufasa told Simba in The Lion King, “You are more than what you have become. Remember who you are.”

Dignity Health remembered who they were based on core values of human kindness in their rebranding, from Catholic Healthcare West to the Dignity Health brand, #HelloHumankindness. Here’s more on that good business case here in Health Populi.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...