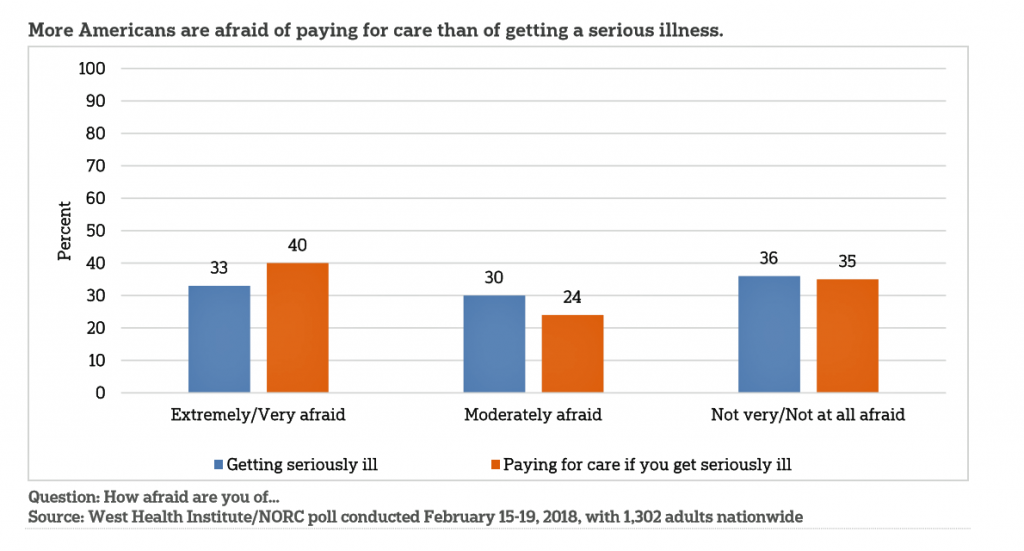

Health care in America is such a scary experience that more people are afraid of paying for care than the actually getting sick part of the scenario.

The patient is the payor, and she is afraid…more afraid of the paying than of the illness, according to a survey conducted among U.S. health consumers from WestHealth Institute and NORC, Americans’ Views of Healthcare Costs, Coverage, and Policy from WestHealth and NORC.

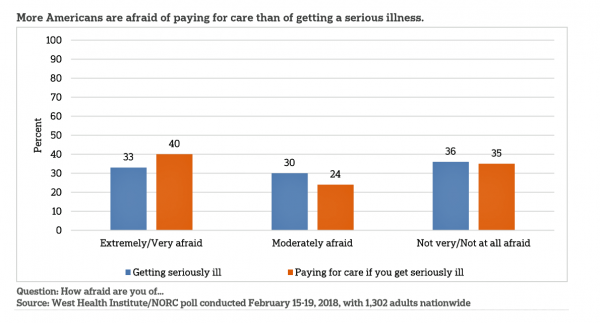

See the orange bar on the left: 40% of Americans are “extremely or very afraid” about paying for care if they get seriously ill, and 33% are that afraid if they get very sick.

Shifting to the middle of the graph, 24% of consumers are “moderately” afraid of the paying versus 30% about getting sick.

If you add the “afraid” proportions together, it’s a tie between roughly two-thirds of consumers afraid of getting seriously ill or having to pay for that care in view of being ill.

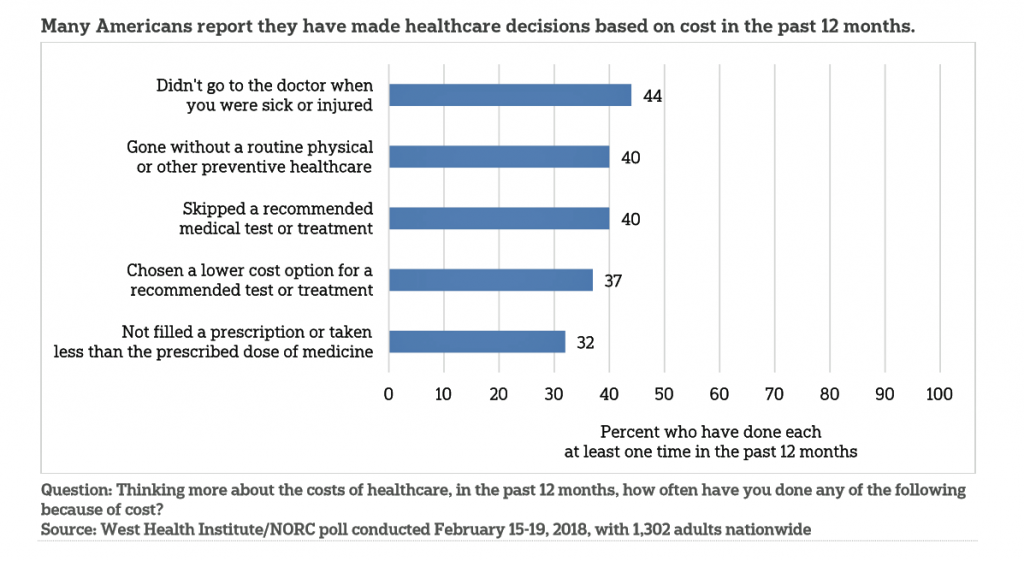

Consumers come to that ethos through experience with health care costs: the second chart from the report illustrates the reality of patient self-rationing due to cost: 44% didn’t go to the doctor when they were sick because of cost, and 40% went without a routine physical or preventive care due to cost as well as skipping a recommended test or treatment.

While one-third of U.S. consumers didn’t fill a prescription or stick to a medication as directed due to cost, one-third shopped around for lower-cost care for that recommended treatment.

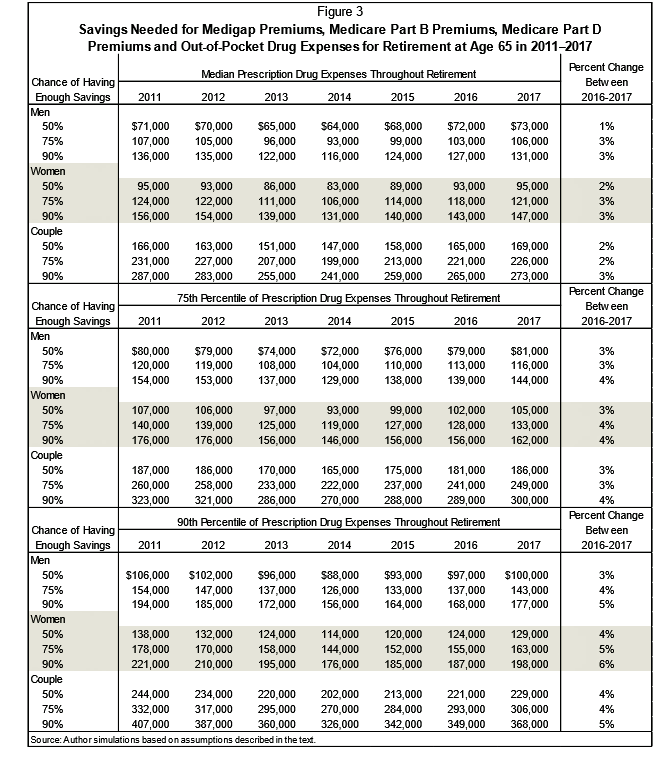

Health Populi’s Hot Points: Health care cost sticker shock gets worse with age. The latest data on health care costs in retirement was published by EBRI earlier this year in their report, Savings Medicare Beneficiaries Need for Health Expenses: Some Couples Could Need as Much as $370,000, Up from $350,000 in 2016.

It’s a good thing that report has a long title, because when I got to the “$370,000,” I was taken aback and needed to catch my breath a bit. In one year, EBRI’s forecast for needed monies for medical care in retirement rose by $20K, which equates to a 5.7% increase in one year. That’s the top-line number for a couple in retirement, including Medigap premiums, Medicare Part B Premiums, Medicare Park D Premiums, and out-of-pocket drug expenses at age 65 in 2017.

Here’s EBRI’s big table with the big number.

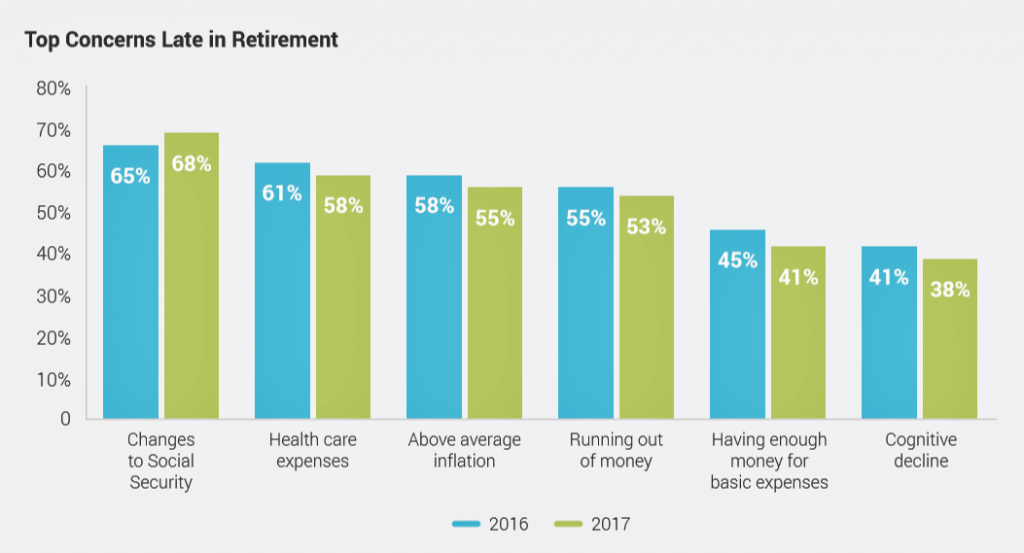

With that sober number in mind, the next chart, from the Insured Retirement Institute report on Boomers’ expectations for retirement, illustrates that American workers have gotten the 9-1-1 emergency news about health care costs: that most U.S. consumers say health care expenses are their top concern late in retirement. #1 is changes to Social Security, which Americans realize is their first go-to source for income in retirement years. If Social Security is threatened, so goes the older American’s ability to pay for health care as she ages.

Thank you,

Thank you,  As a proud Big Ten alum, I'm thrilled to be invited to

As a proud Big Ten alum, I'm thrilled to be invited to  I was invited to be a Judge for the upcoming CES 2025 Innovation Awards in the category of digital health and connected fitness. So grateful to be part of this annual effort to identify the best in consumer-facing health solutions for self-care, condition management, and family well-being. Thank you, CTA!

I was invited to be a Judge for the upcoming CES 2025 Innovation Awards in the category of digital health and connected fitness. So grateful to be part of this annual effort to identify the best in consumer-facing health solutions for self-care, condition management, and family well-being. Thank you, CTA!