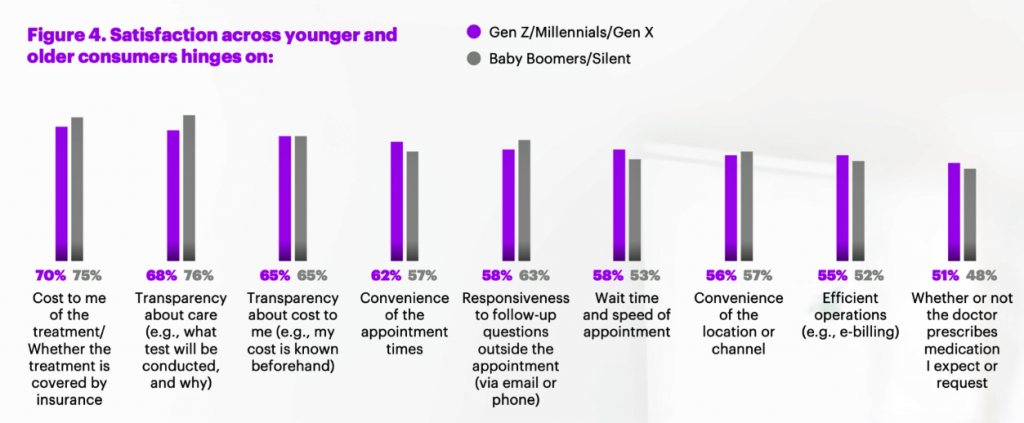

Across generations, from younger to older patients, cost, transparency and convenience drive consumer satisfaction, Accenture’s latest health consumer survey found.

Across generations, from younger to older patients, cost, transparency and convenience drive consumer satisfaction, Accenture’s latest health consumer survey found.

I had the opportunity to brainstorm the study’s findings in real-time on the day of survey launch, 12 February, with Dr. Kaveh Safavi, Brian Kalis, and Jenn Francis at HIMSS19. Our starting point was the tipping-point statistic that over 50% of people in the U.S. have chosen to use a non-traditional health care setting. Those non-traditional sites of care include walk-in and retail clinics, outpatient surgery centers, virtual health (whether on the phone, on video or via mobile apps), on-demand services, and digital therapeutics.

We weren’t surprised to note that younger patients took advantage of retail clinics and other on-demand channels for health care, older people, too, have been willing to use sites other than doctor’s offices and hospital clinics to receive health care services.

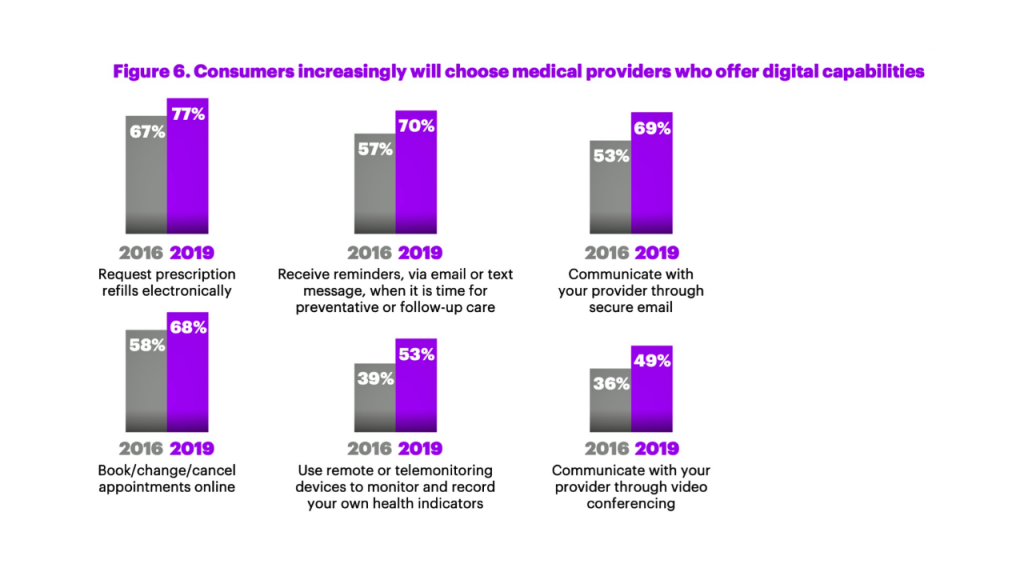

Accenture has conducted research among health consumers for several years, so we could compare 2016 to 2019. In 2016, one-half of people said they would choose a doctor based on digital capabilities. In 2019, that digital health preference reached three-fourths of consumers, “a step function increase,” Kaveh noted. “Expectations for digital enablement is moving into the mainstream,” he observed.

Accenture has conducted research among health consumers for several years, so we could compare 2016 to 2019. In 2016, one-half of people said they would choose a doctor based on digital capabilities. In 2019, that digital health preference reached three-fourths of consumers, “a step function increase,” Kaveh noted. “Expectations for digital enablement is moving into the mainstream,” he observed.

People in middle-age tend to behave more like their kids than older parents. This is driving choice when patients select which health care system to work with, Brian explained. There’s a higher preference for systems with richer digital capabilities.

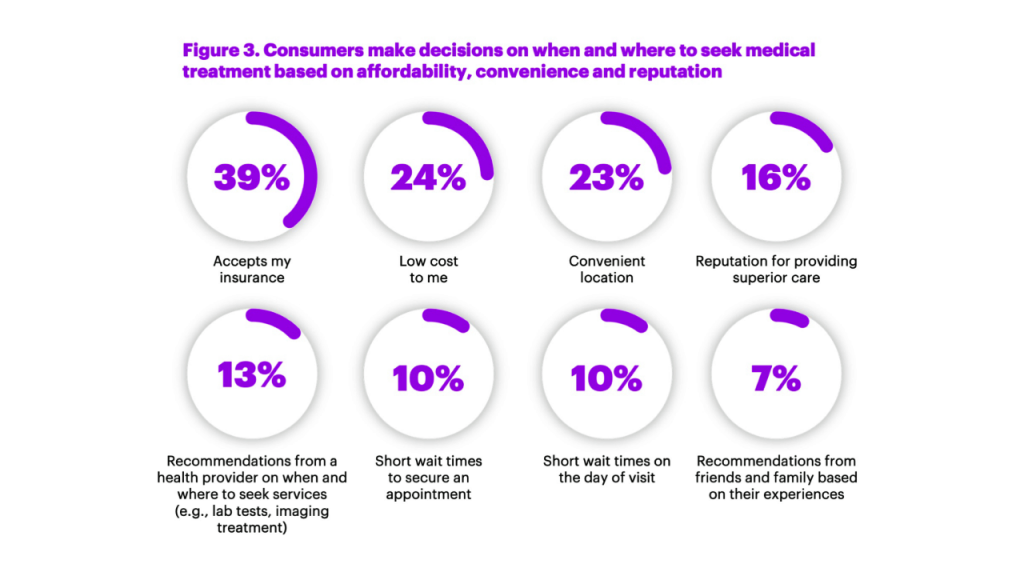

Beyond the digital convenience and life-flow streamlining, consumers are willing to go to alternative settings based on cost — where the alternative health provider site accepts “my” insurance, thus lowering my out-of-pocket cost — and convenient location, which was three-times more important than recommendations from friends and family.

In past studies, such word-of-mouth from “people like me” has been a top driver of consumer health care decision-making.

Understanding “my” personal costs in advance of treatment, and greater price transparency, are part of this thinking and expectation.

Understanding “my” personal costs in advance of treatment, and greater price transparency, are part of this thinking and expectation.

When consumers select a non-traditional site for health services, they are generally seeking care for respiratory conditions, physical injury, aches and sprains, and pediatric care for their children.

We’ve also begun to see specialization in non-traditional settings, such as orthopedic urgent care and allergy centers emerging to address niche needs.

Health systems are re-imagining care beyond the bricks-and-mortar institution, Brian commented. In local communities, health care providers recognize the need to meet consumers closer to home, work and play, to reach and engage patients digitally and physically redefining the “front door” to health care.

This led us to a discussion of how the electronic health record could reach into these more retail health locations, especially challenging if not directly owned by the health system. The big announcement from CMS via Seema Verma during HIMSS19 addressed open data and standards that would help make data more liquid and interoperable, highly relevant to this situation of care in the community in places that may or may not be owned by a patient’s health system. Collaboration for health care in the community, for services and for social determinants of health factors, is a growing feature in U.S. health care — and desirable. But collaboration with added fragmentation is not a success factor for quality patient care, outcomes, and cost-effectiveness.

“Digital is not a discrete thing on the side,” Brian asserted. “The entire mindset [in health care] is changing the way you do all your business, not ‘in addition.'”

For this study, Accenture polled 2,338 U.S. healthcare consumers 18 and over in November and December 2018.

Health Populi’s Hot Points: Patients, now consumers and ultimately payors managing up to their deductible and out-of-pocket health care costs, are clearly seeking health care services on their terms — based on value and personal values. That’s the demand side. On the supply side, we see CVS and Walgreens both announcing new concepts in retail health morphing what our idea of a “pharmacy” is well beyond dispensing prescription drugs.

Health Populi’s Hot Points: Patients, now consumers and ultimately payors managing up to their deductible and out-of-pocket health care costs, are clearly seeking health care services on their terms — based on value and personal values. That’s the demand side. On the supply side, we see CVS and Walgreens both announcing new concepts in retail health morphing what our idea of a “pharmacy” is well beyond dispensing prescription drugs.

Whether the CVS “HealthHUB” or Walgreens addition of dental, telehealth and vision services, the new health consumer-payor will increasingly find services closer to home for both non-acute medical needs and chronic condition management. Walmart, another key channel in the expanding retail health landscape, just announced that they will extend telehealth visits to employees for the low-low cost of $4 (yes, you read that correctly).

To get this right, it can’t just be about new locations for lower-cost services, even at a high degree of consumer confidence and supplier quality. The person’s/patient’s data from these encounters experienced quite apart (physically) from a patient’s health care system must find their way to a person’s health record. This is the promise of the CMS announcement, which is seeking input from interested health care stakeholders. Here’s the link: let’s opine and ensure we add no more fragmentation to our all-too-fragmented health services landscape.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...