Four in ten U.S. patients said the state of the economy changes how often they seek health care, according to a new study from TransUnion, the credit agency that operates in the health care finance space.

Four in ten U.S. patients said the state of the economy changes how often they seek health care, according to a new study from TransUnion, the credit agency that operates in the health care finance space.

Nearly two-thirds of patients said that knowing their out-of-pocket expenses in advance of receiving health care services influenced the likelihood of their seeking care.

Given reports from mass media, business press and regional Federal Reserve press releases, the short-to-midterm economic outlook may be softening, which is the signal that TransUnion is receiving in this health consumer poll.

The other side of this personal health financing coin is that one in four patients said reports of a weakening economy compels them to seek care based on their current insurance coverage for care they may have postponed.

This latter point suggests that for these people, there may be concern that their current health insurance coverage could be limited or otherwise “shrink” based on next year’s potentially slimmed-down health plan. Smaller companies, in particular, are already fiscally-stressed in providing health insurance to employees which can eat into profit margins. Smaller companies are less likely to provide health insurance coverage to workers, we’ve seen year-after-year in the Kaiser Family Foundation studies on employer-sponsored health care.

This latter point suggests that for these people, there may be concern that their current health insurance coverage could be limited or otherwise “shrink” based on next year’s potentially slimmed-down health plan. Smaller companies, in particular, are already fiscally-stressed in providing health insurance to employees which can eat into profit margins. Smaller companies are less likely to provide health insurance coverage to workers, we’ve seen year-after-year in the Kaiser Family Foundation studies on employer-sponsored health care.

Providers that serve up cost transparency to patients fare better in this scenario, TransUnion explains. Health care providers, physicians and hospitals both, face a growing challenge of patient payables piling up, or not being paid at all. In this study, TransUnion found that one-half of patients didn’t understand how much they owed providers. When provided a clear picture of that amount at the time of the health care service, two-thirds of patients were willing to make at least a partial payment, TransUnion learned.

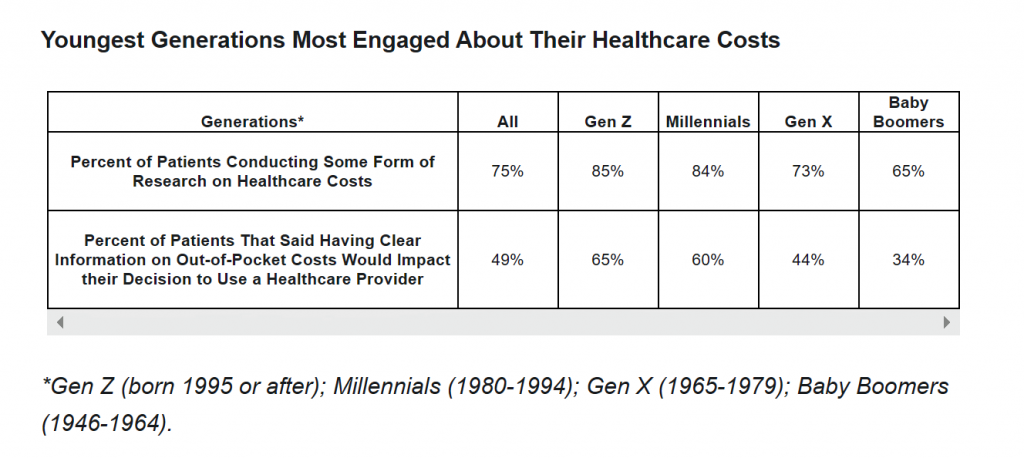

The likelihood of engaging with health care costs varies by age, as the third chart shows from the TransUnion data. While most people across age groups do some kind of research on medical costs, a greater percentage of the younger GenZ and Millennial cohorts do research — noting that two-thirds of Baby Boomers do, too. But older people, the Boomers, would be less likely to change their health care provider based on cost versus younger people, the chart clearly shows.

Health Populi’s Hot Points: Patients are payors, I’ve adopted as a mantra these past few years in the growing era of the great financial risk-shift of the high-deductible, along with growing specialty drug costs. This is the underpinning theme of my book, HealthConsuming.

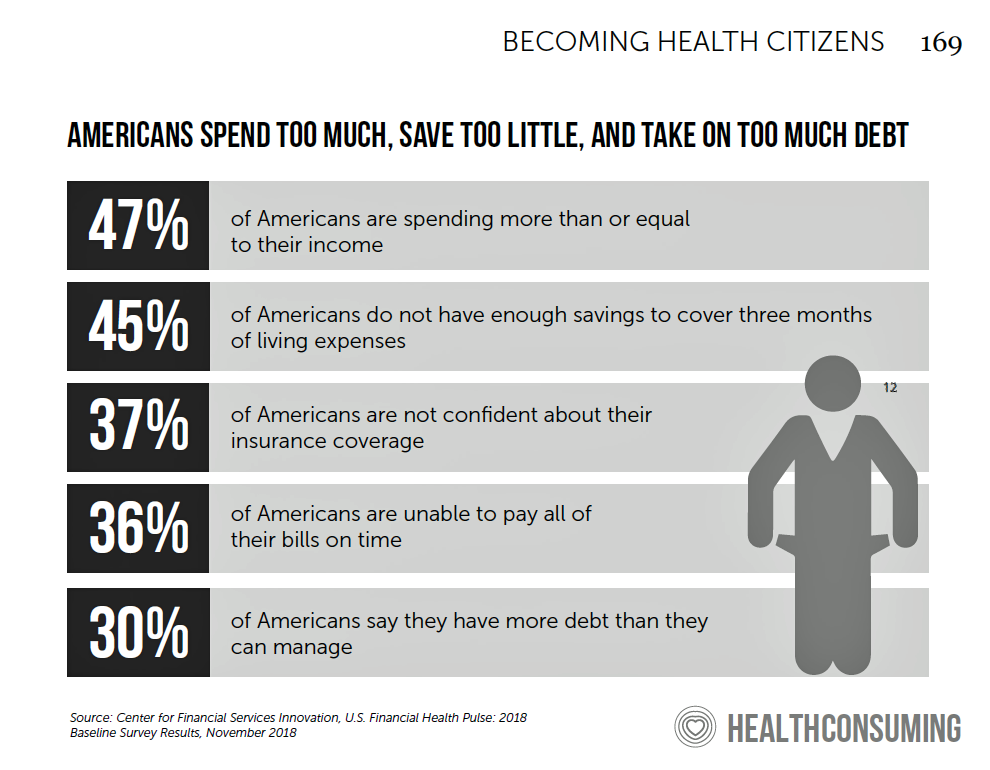

TransUnion found that the percent of patients with out-of-pocket costs between $501 to $1,000 grew from 39% in 2017 to 59% in 2018. This is a household financial challenge for American families, who save too little and take on too much debt as the chart from my book illustrates.

Health care costs are a pocketbook issue for families at all income levels in the U.S. We’re witnessing growing consumerism in health care, we riffed on our consumer health panel at Health 2.0 yesterday, across different consumer and patient groups: some parents are dealing with the price of EpiPens for their kids; people managing diabetes have insulin sticker-shock and some are dangerously self-rationing or bio-hacking solutions as part of the #WeAreNotWaiting movement. All of these engaged health consumers will place votes in the 2020 Elections with health care on their minds. My bet is on people taking on their mantle as health citizens.

Thank you,

Thank you,  As a proud Big Ten alum, I'm thrilled to be invited to

As a proud Big Ten alum, I'm thrilled to be invited to  I was invited to be a Judge for the upcoming CES 2025 Innovation Awards in the category of digital health and connected fitness. So grateful to be part of this annual effort to identify the best in consumer-facing health solutions for self-care, condition management, and family well-being. Thank you, CTA!

I was invited to be a Judge for the upcoming CES 2025 Innovation Awards in the category of digital health and connected fitness. So grateful to be part of this annual effort to identify the best in consumer-facing health solutions for self-care, condition management, and family well-being. Thank you, CTA!