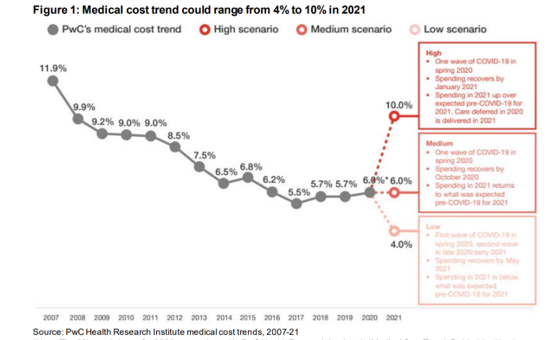

Whether healthcare spending in 2021 increases by double-digits or falls by one-third directly depends on how the coronavirus pandemic will play out over the rest of 2020, based on PwC’s annual report on medical cost trends for 2021.

Whether healthcare spending in 2021 increases by double-digits or falls by one-third directly depends on how the coronavirus pandemic will play out over the rest of 2020, based on PwC’s annual report on medical cost trends for 2021.

The three cost scenarios are based on assumptions shown in the fine print on the first chart:

The medium scenario, a sort of “return to normal” where medical trend could stay even at 6.0%, equal to the 2020 trend. This assumes that healthcare spending recovers by October 2020 as patients return to hospitals and doctors’ offices for regular care patterns. In 2021, spending would return to pre-COVID projections.

A low scenario envisions medical trend growth of 4.0%, based on a second wave of COVID-19 emerging in late 2020 extending into 2021. This slows down overall healthcare spending until May 2021. The headline might be, “U.S. Patients Forgo Care Until 2021.”

A high scenario of medical trend calculates a 10.0% medical cost trend, assuming one wave of COVID-19 resolving as regular healthcare spending resolves by January 2021. Care that patients postponed during the 2020 pandemic is delivered in 2021, PwC projects, raising volumes and spending and resulting in a double-digit increase.

“Medical trend” is the expected increase in a health plan’s per capita health care costs. Several factors influence those costs upward or downward: among them, utilization (volume), the cost of services, and technology.

“Medical trend” is the expected increase in a health plan’s per capita health care costs. Several factors influence those costs upward or downward: among them, utilization (volume), the cost of services, and technology.

The pandemic itself is re-shaping these three forces, which feed into the ultimate forecasts of what next year’s healthcare cost increase will be.

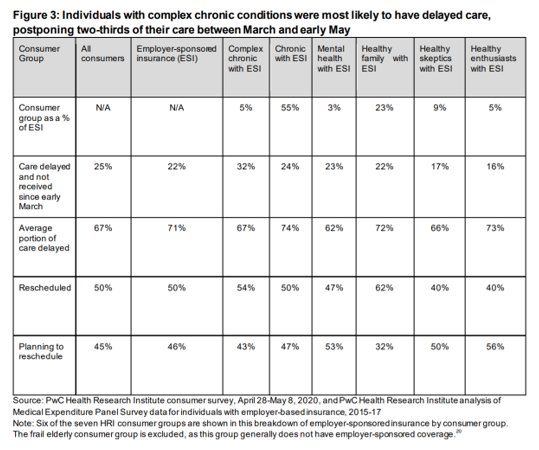

Utilization during the pandemic has actually fallen in terms of patients postponing/forgoing care as well as hospitals’ cancelling elective or non-emergent procedures due to infection control and/or capacity. The second table from the PwC report details patients delaying care by consumer segment, health, and insurance status.

In the first months of the pandemic, patients postponed many forms of care, including prevention, primary care, and even cancer care. The table indicates that people managing complex chronic conditions delayed significant portions of care.

PwC’s Health Research Institute found that one-fifth of people with employer-sponsored health insurance delayed over 70% of the care they should have received beginning in March until at least early May.

The cost of services is another key driver of medical trend. In the pandemic, patients and clinicians adopted telehealth and virtual care platforms to conduct encounters, which has the potential to lower costs overall. Cost, it turns out, has been a factor in some health consumers avoiding care even when experiencing symptoms of COVID, according to Commonwealth Fund research.

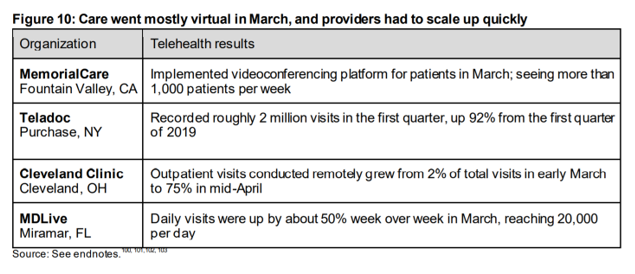

Technology, too, is a factor in medical trend. Technology underpins telehealth, one of the big stories of the coronavirus pandemic in terms of how care carried on. PwC included this table documenting that care went mostly virtual in March 2020, as providers quickly scaled up. Health systems and physician practices quickly pivoted to virtual care, whether via commercial systems enabling private labeling of telehealth (such as Teladoc or Amwell), or Cleveland Clinic’s outpatient visits growing from 2% of all visits in early march to three-fourths of visits within several weeks. “Telehealth was slowly gaining traction before COVID-19,” the PwC report recognized, “Overnight, the pandemic transformed it into the preferred way to deliver and receive care when possible – a preference that should have long-lasting impacts.”

Technology, too, is a factor in medical trend. Technology underpins telehealth, one of the big stories of the coronavirus pandemic in terms of how care carried on. PwC included this table documenting that care went mostly virtual in March 2020, as providers quickly scaled up. Health systems and physician practices quickly pivoted to virtual care, whether via commercial systems enabling private labeling of telehealth (such as Teladoc or Amwell), or Cleveland Clinic’s outpatient visits growing from 2% of all visits in early march to three-fourths of visits within several weeks. “Telehealth was slowly gaining traction before COVID-19,” the PwC report recognized, “Overnight, the pandemic transformed it into the preferred way to deliver and receive care when possible – a preference that should have long-lasting impacts.”

Another COVID-19 impact that both bolstered demand and revealed unmet patient needs has been mental health – which I’ve characterized as the pandemic after the pandemic here in Health Populi.

Another COVID-19 impact that both bolstered demand and revealed unmet patient needs has been mental health – which I’ve characterized as the pandemic after the pandemic here in Health Populi.

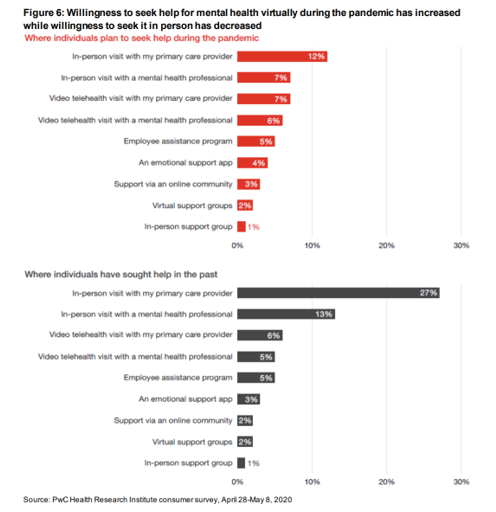

This bar chart from the PwC study shows that U.S. adults were more likely to seek help for mental health via virtual channels than in-person in face-to-face therapeutic encounters.

Before the pandemic, 27% of consumers sought mental health support through an in-person visit with their primary care provider; during the crisis, this fell by over half to 12%. Demand for video telehealth visits grew during the COVID-crisis. Telemental health has also received substantial support from employers, whose investments in behavioral health will increase as a result of the pandemic, beyond levels that had already grown in the opioid epidemic.

Looking at the 3 medical trend scenarios, it is likely that mental health services will continue the uptake in demand, and growth on the supply side especially for virtual platforms that can scale behavioral health services to people whether in rural or urban areas, or feeling stigma about seeking in-person care.

PwC also rightly calls out the fact that employers spend 12x more per year on people dealing with a complex chronic disease coupled with mental illness, compared with spending on healthy individuals.

“Healthcare will look different after the pandemic,” PwC concludes. We can’t know every feature of what that post-COVID U.S. health system will look like, but virtual care, more care to the home as health hub, and growing need for mental health supports as a mainstream service will be certain components in the healthcare-system-to-come.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.