One in two people in the U.S. say their financial health has been negatively impacted by the COVID-19 pandemic, through job loss, income disruption, or reduced work hours.

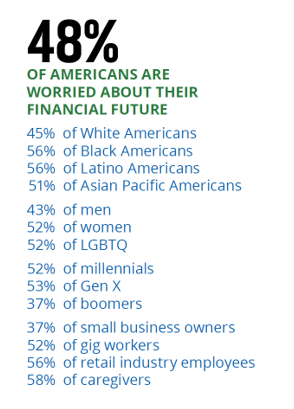

The 2020 Financial Wellness Census, from Prudential found that one-half of U.S. adults are anxious about their financial future as of May 2020, an increase from 38% in late 2019.

The 2020 Financial Wellness Census, from Prudential found that one-half of U.S. adults are anxious about their financial future as of May 2020, an increase from 38% in late 2019.

Prudential surveyed 3,000 U.S. adults across three generational cohorts: Millennials, Gen X, and Baby Boomers.

The economic hit from the pandemic has disproportionately impacted people of color, younger people, women, small business owners, gig workers, and people working in retailer harder than other folks, the study learned.

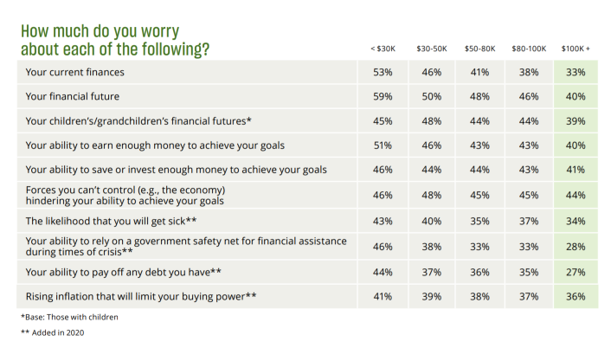

Concerns about finance and health vary by age, the first table shows. Unsurprisingly, people with lower incomes and fewer assets are significantly more worried than those who “make and have more,” Prudential notes.

There is one challenge where even the most wealthy people earning at least $100,000 a year are worried: wealthier Americans index fairly close to people earning lower incomes for feeling forces are beyond one’s control which hinder the ability to meet goals. Those uncontrollable forces would include the coronavirus itself and the length of the pandemic, and the economic fallout from the pandemic, among other external factors shaping our lives.

Using data from the consumer survey, Prudential has identified three segments of people based on their perceived financial challenges in the pandemic: Confidents, who are doing well and believe they are doing well; Pessimists, with a high level of financial health but pessimistic about their finances; and the Discouraged, who have a low level of financial health based on objective measures — and they recognize that.

Using data from the consumer survey, Prudential has identified three segments of people based on their perceived financial challenges in the pandemic: Confidents, who are doing well and believe they are doing well; Pessimists, with a high level of financial health but pessimistic about their finances; and the Discouraged, who have a low level of financial health based on objective measures — and they recognize that.

About the same percentage of people felt confident, discouraged, or pessimistic as of May 2020 as they did three years ago. This illustrates Prudential’s finding that Americans largely perceive their financial mobility is fixed. There was a bounce in “Confident” group in 2019, which fell by 10% just months later to nearly the 2017 level.

Underneath the discouraged statistic is that fact that 17% of U.S. households saw their income fall by half or more. These householders were more likely to be:

- Small business owners (32%)

- 31% of gig workers

- 24% of retail employees

- 23% of caregivers

- 25% of LGBTQ people

- 22% of Black Americans

- 21% of White Americans,

compared with 15% of White Americans.

Prudential’s survey covered many other issues, learning that 32% of Americans see the Federal government as a source of financial assistance in times of crisis, followed by 28% looking to family and friends, and 27% looking to state governments.

Post-pandemic, people are looking for more affordable health care, more flexible work options, and government programs to better support small business. For people earning lower incomes, income security and health care benefits are top of mind, looking to the government to strengthen safety nets and wage supports.

In particular, more women than men seek affordable health care, more flex work options, better government programs, and an increase in the minimum wage.

Health Populi’s Hot Points: Clearly, lower-income Americans have been harder hurt in the economic fallout of the pandemic than people earning higher incomes. Even before the pandemic, the 2019 Prudential Census found that women, Black Americans, Latino Americans, American Indians, and Alaska Natives were in households with much lower incomes than the overall population, along with caregivers, the disabled, and LGBTQ people.

Health Populi’s Hot Points: Clearly, lower-income Americans have been harder hurt in the economic fallout of the pandemic than people earning higher incomes. Even before the pandemic, the 2019 Prudential Census found that women, Black Americans, Latino Americans, American Indians, and Alaska Natives were in households with much lower incomes than the overall population, along with caregivers, the disabled, and LGBTQ people.

More people of color, more women, more LGBTQ, and more caregivers are worried about their financial futures in the wake of the pandemic.

Among Prudential’s “path forward” recommendations, three cover the biggest challenges COVID-19 has presented U.S. health citizens: they are,

- Ensure fair access to capital, financial advice, and products, especially in communities of color. Make our national economy more inclusive.

- Make affordable, accessible health insurance coverage available to more Americans.

- ss

The tagline explaining #2 here especially resonates int his moment:

“The huge job losses brought about by COVID-19 were a vivid illustration of how public health can impact the nation’s economic progress.”

In this teachable moment, living daily in the whirlpool that is the coronavirus pandemic, we know that public health directly impacts individual health and home economies. Patients in America are envisioning a more resilient health and social fabric in a next-normal for the U.S., with this trial-by-fire forging us as health citizens.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...