Before the coronavirus pandemic, patients had been transforming into health care payors, bearing high deductibles, greater out of pocket costs, and financial risk shifting to them for medical spending.

In the wake of COVID-19, we see health consumers-as-payors impacted by the pandemic, as well as for existing diagnoses and chronic care management.

In the wake of COVID-19, we see health consumers-as-payors impacted by the pandemic, as well as for existing diagnoses and chronic care management.

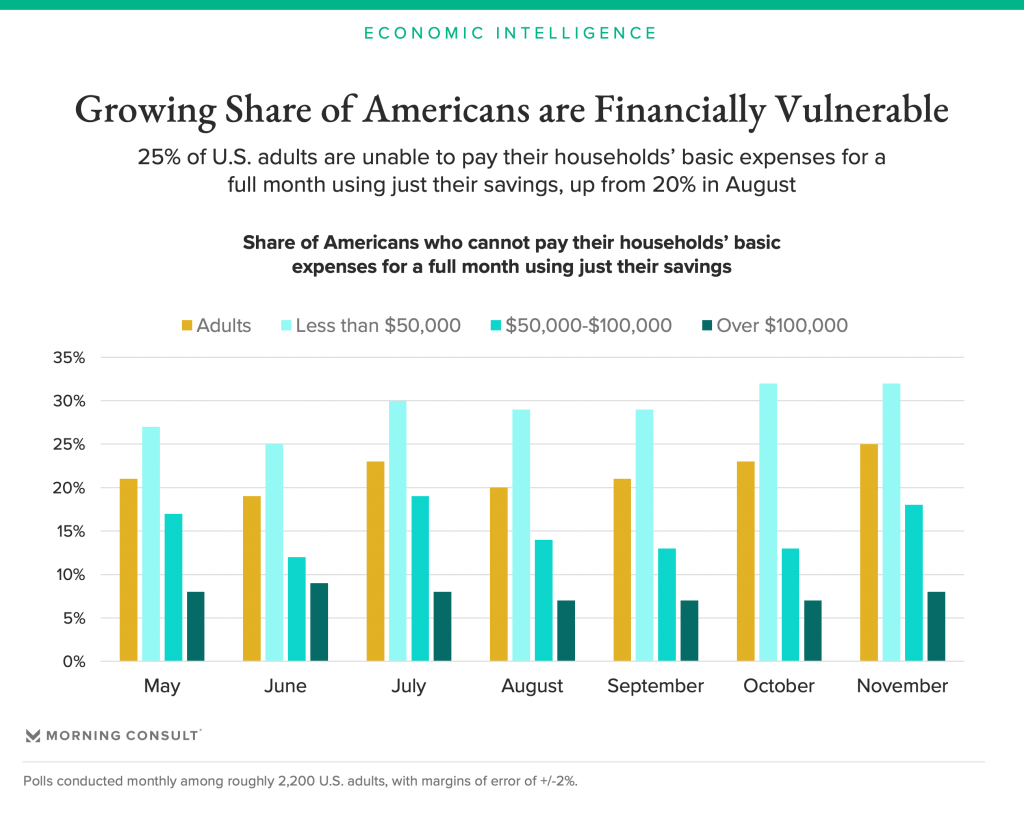

There is weakening in U.S. consumers’ overall household finances, the latest report from the U.S. Bureau of Economic Analysis (BEA) asserted (published 25 November 2020). In John Leer’s look into the BEA report in Morning Consult, he wrote,

“Decreases in income, the expiration of unemployment benefits and increased anxieties regarding future income losses all act as headwinds to consumer spending in the near term. Even if a coronavirus vaccine is imminent, people are losing money now, and they’re worried about losing more of it in the future. A growing share of Americans live paycheck to paycheck, with an increasing share of households unable to pay their basic expenses for a full month if they strictly rely on their savings. These emerging weaknesses in households’ balance sheets pose risks to the broader economy via consumer defaults and bankruptcies.”

This is directly impacting Americans’ views on health care and costs…from the coronavirus to cancer care.

I had the opportunity to chat with John Nosta of NOSTALab this week on the topic of cancer and costs, wearing my health economics hat. We briefly brainstormed the topic which will be featured on a future CEN broadcast. But it got me thinking about financial health among U.S. patients-as-payors, from cancer to COVID.

I had the opportunity to chat with John Nosta of NOSTALab this week on the topic of cancer and costs, wearing my health economics hat. We briefly brainstormed the topic which will be featured on a future CEN broadcast. But it got me thinking about financial health among U.S. patients-as-payors, from cancer to COVID.

In this post, I’ll connect dots between the latest TransUnion survey wave (#15, collected the week of 30th November 2020) and a study out from this week’s annual meeting of the American Society of Hematology (ASH), held virtually.

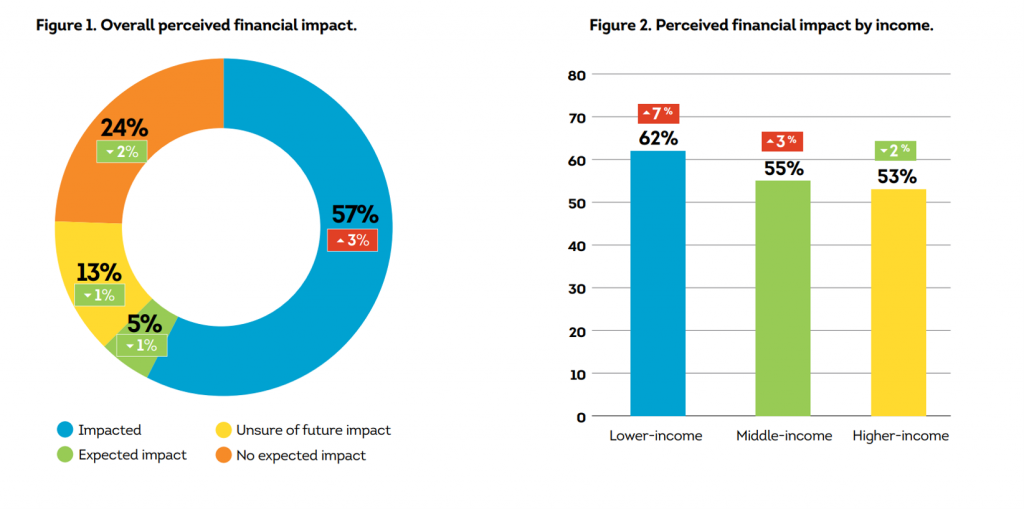

Start with TransUnion’s newest poll into U.S> consumers’ financial responses to the COVID-19 pandemic. TransUnion has been studying consumers since the start of the public health crisis, and this round of research looked at 3,100 online U.S. adults 18 years of age and older.

Top-line, with the growing prevalence of the coronavirus across America, financial impact of COVID-19 is increasing (again) after a bit of improvement a couple of months ago, TransUnion observes. The first chart illustrates consumers’ overall perceived financial impact due to COVID-19, with details broken out by income segment. While more lower-income people feel an acute financial hurt due to the pandemic, middle- and higher-income people do, too.

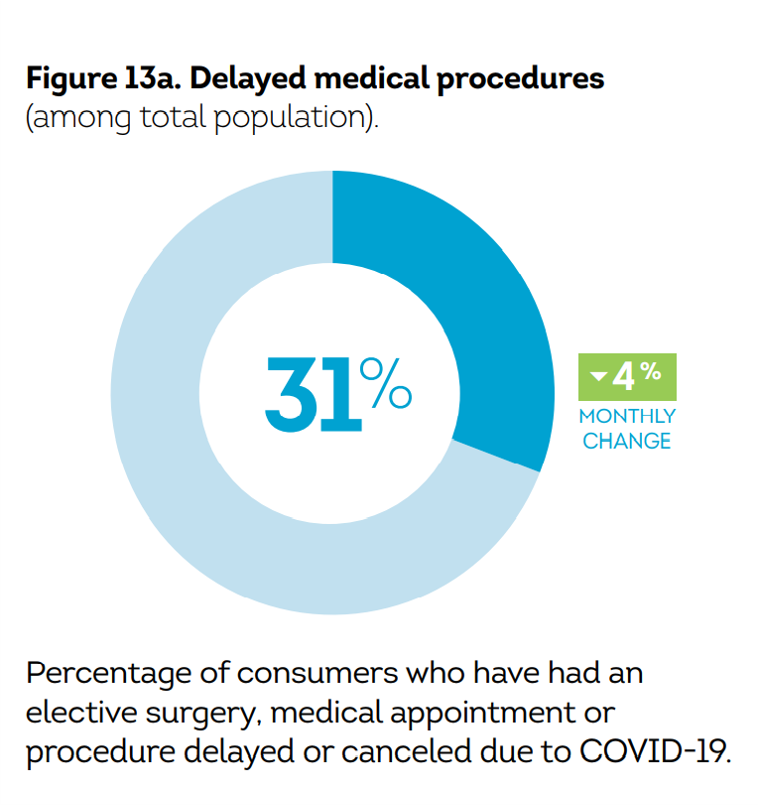

TransUnion has also been tracking consumers “taking care of yourself” in this survey through the pandemic. A key metric here is patients delaying medical procedures due to COVID-19, seen here as about one-third of Americans doing so. [The detailed question was where you delayed or cancelled an elective surgery, medical appointment or procedure due to COVID-19.]

TransUnion has also been tracking consumers “taking care of yourself” in this survey through the pandemic. A key metric here is patients delaying medical procedures due to COVID-19, seen here as about one-third of Americans doing so. [The detailed question was where you delayed or cancelled an elective surgery, medical appointment or procedure due to COVID-19.]

When do these postponers plan to reschedule their medical encounters?

- 34% plan to reschedule as soon as their health care providers allow them to do so

- 29% plan to reschedule once they no longer believe there is a high risk of COVID-19 infection in doing so

- 16% plan to reschedule once guidelines advise it is safe to do so

- 9% will not reschedule but will seek alternative treatment options.

High-income consumers were more likely to have delayed or cancelled a procedure compared with middle- or lower-income patients.

In light of pandemic financial pressures, it’s important to check in with consumers’ intent to pay their medical bills in the context of their overall ability to manage household finances during the public health crisis. One-third of all consumers told TransUnion they would be unable to pay their rent, especially challenging for lower-income consumers who also find difficulty covering utilities.

Overall, 26% of consumers said they would not be able to pay their medical bills: this compares with 38% unable to pay credit card bills, 34% mobile phone bills, 24% insurance and/or car payment, and 19% student loans.

Importantly, 34% of Boomers would have trouble covering their medical bills — a higher percent than the average 26% of overall consumers who could not cover healthcare expenses in this study.

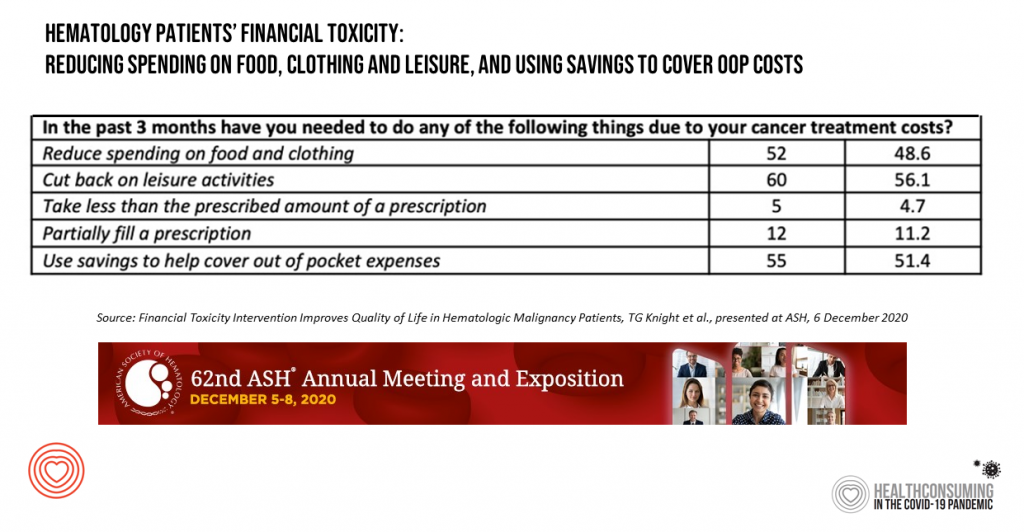

Now, shift into cancer care and costs. This week, the American Society of Hematology annual meeting convened virtually as researchers shared their latest innovations and learnings on cures, care protocols, and key issues facing the cancer ecosystem. Last Sunday on 6th December, a team of researchers from Atrium Health presented their paper on how an intervention helped hematology patients manage the financial toxicity of the cost of their treatment.

Now, shift into cancer care and costs. This week, the American Society of Hematology annual meeting convened virtually as researchers shared their latest innovations and learnings on cures, care protocols, and key issues facing the cancer ecosystem. Last Sunday on 6th December, a team of researchers from Atrium Health presented their paper on how an intervention helped hematology patients manage the financial toxicity of the cost of their treatment.

The table presents data from the study, finding that hematology patients were faced with various forms of financially toxic “side effects” due to cost of cancer treatment: one in two of these patients reduced their spending on food and clothing, spent less on leisure activities, and used savings to cover out-of-pocket expenses of their cancer treatment.

The Atrium Health team developed an intervention to help cancer patients risk-manage this financial impact; there were three pillars to this approach:

- Patients at-risk for financial challenges due to cancer treatment cost were scheduled to meet with a nurse navigator to identify sources for financial assistance

- Patients were seen by a clinical pharmacist to review their health insurance co-pay responsibilities and opportunities for financial assistance

- Patients could meet with a community pro-bono financial planner to assist with medical cost financial planning.

As a result of this intervention, qualified patients were able to receive free or reduced-cost therapies at a median retail value of nearly $200,000, along with gas cards, food pantry and transportation assistance. One-half of the patients also scheduled appointments with financial planners.

This resulted in higher quality of life for both physical and mental health.

The financial impacts of both COVID-19 and cancer care sharpened U.S. patients’ collective keen eye on personal health care costs and medical expense exposure felt before the public health crisis.

Health Populi’s Hot Points: The key learning from the Atrium Health team’s financial toxicity research was that an intervention could be crafted to help patients manage their financial exposure to cancer treatment, resulting in improvement in both physical and mental health.

That intervention brought together nurses as navigators, pharmacists as clinical-financial consultants, and financial planners as household money coaches.

The journal Nature published an essay on the impact of the COVID-19 pandemic on cancer care in June 2020 from a team of US- and UK-based clinicians exploring implications for diagnosis, surgery, radiotherapy, systemic treatment, ongoing care, and clinical trials. Their conclusion for the cancer ecosystem: that, “negative outcomes can be minimized through the concerted efforts of healthcare providers and regulatory bodies, individual clinicians and patients.”

That’s excellent advice, too, for addressing the challenge of financial wellness among U.S patients. This is an ecosystem that goes beyond the price of a treatment in one area of health care. The fragmented nature of care and financing in the U.S. require streamlining to address this problem in a holistic way that addresses a patient-as-payor and member of a household.

The KaufmanHall report on The State of Consumerism 2020 found that hospital discharges were down 12% year to date as of October 2020, accelerating shifts in how consumers are accessing health care services. The financial risks for care and costs faced by consumers are motivating people to seek care in lower-cost settings that are also more convenient and enchanting. This pressure from the grassroots of health consumers will be expressed upward to clinicians, hospitals and health systems, pharma and life science companies, and health plans as the pandemic continues through late 2021.

The financial health of the patient, in COVID, cancer, or primary care, is everyone’s business in the larger health care ecosystem. As the Nature research noted in their look at the future of reimagining cancer care beyond the COVID era, it will take the concerted efforts of all stakeholders to move forward, together.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...