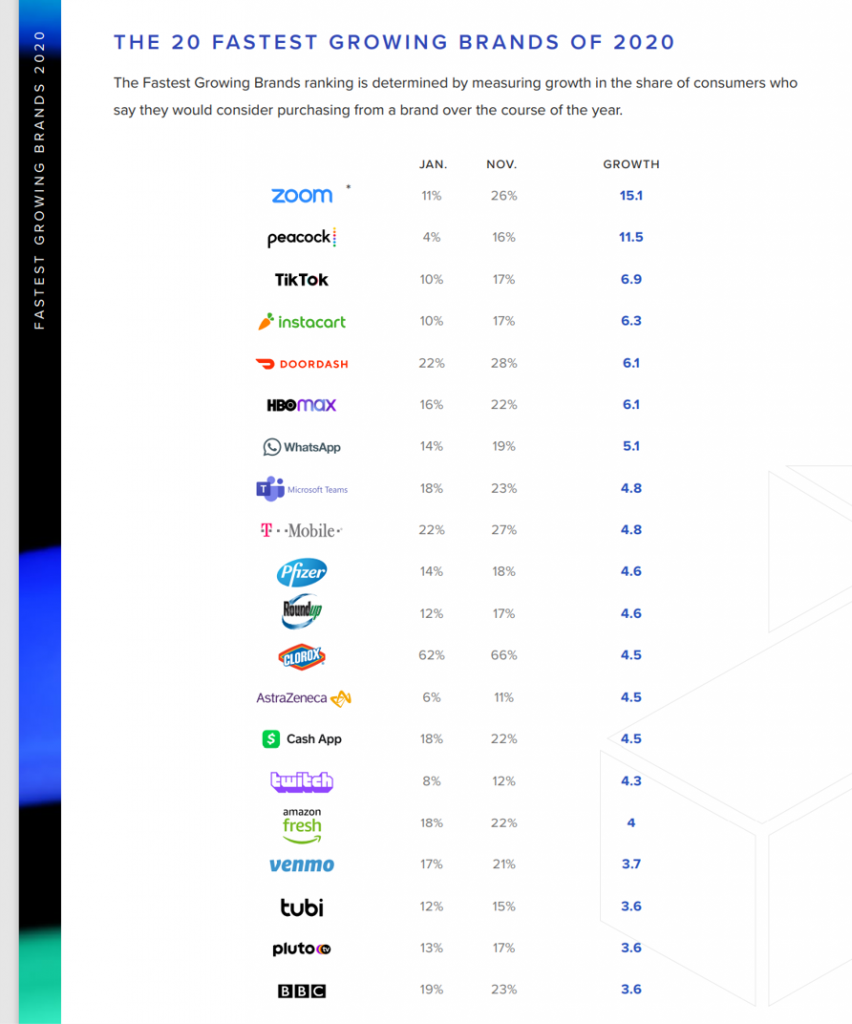

Staying home, being clean, staying entertained, eating well, and self-caring for healthcare….these are the major factors underpinning the twenty fastest-growing brands of 2020, based on Morning Consult’s annual look at the topic.

Let’s look into these categories by brand, and connect the dots for health, medical care, and well-being…

Let’s look into these categories by brand, and connect the dots for health, medical care, and well-being…

Connectivity as a social determinant of health. Zoom was the fastest-growing brand of the year, with 26% of U.S. consumers saying they would consider purchasing the service in November compared with 11% in January. Zoom morphed from a business meeting platform to a consumer and family-connecting service spiking on holidays like Easter and Passover in March 2020, and over Thanksgiving weekend in November. The other top-20 brand of virtual connecting companies was Microsoft Teams, ranked 8th fastest-growing brand overall. Other communications companies making the top 20 brand list included WhatsApp and T-Mobile.

Hygiene for health and well-being. We noted that earlier in the COVID-19 pandemic, U.S. consumers ranked Clorox as the #1 brand for reputation based on the Harris-Ipsos poll for 2020. Clorox ranks 12th on the Morning Consult fastest-growing brand roster for 2020, illustrating the importance of “clean” and hygiene this year.

The home as cineplex, gaming salon, and sports arena. The home has not only emerged as the health hub — it’s the center for entertainment and gaming, too, now that going out to the cinema and arenas for live shows and sports is hazardous to our public and individual health. Eight in the top twenty fastest-growing brands have to do with home entertainment: in order of rank, Peacock (the NBC streaming service), TikTok, HBOMax, Twitch (for gaming), Tubi, Pluto, and the BBC.

Food-as-medicine and staying out of grocery stores. Instacart, DoorDash, and Amazon Fresh were the 3 food-related brands ranking in the top 20 growth list. Instacart during the pandemic has partnered closely with consumers’ grocery stores to deliver food, hygiene and paper products heroically to peoples’ homes, allowing people to quarantine safely at-home to avoid physical exposure to the coronavirus in retail places. The pandemic has been a financial goldmine for these businesses: DoorDash launched its IPO worth over $60 bn in its debut, and InstaCart has been planning a $30 billion IPO.

Spending virtual money. In our increasingly gig economy and in the #StayHome journey, consumers look to virtual financial services and contactless wallets. On the fast-growing brand list, the Cash App and Venmo rank as the two top brands in this category.

Healthcare and self-care are the new black. The pandemic has accelerated trends for self-care and health care self-awareness. In this top 20 list, the fastest-growing health care brands include Pfizer, made famous for being the first approved vaccine in the U.S. market and frequently discussed in the “Warp Speed” project of vaccine development; and, AstraZeneca, partnering with the Oxford University vaccine project.

To conduct this study, Morning Consult gathered consumer perception data for thousands of brands, comparing data between January 1-31 2020 and October 16-November 16 2020, with an average of 11,470 survey points per brand.

Health Populi’s Hot Points: The home has emerged as our personal and family health hubs, I recently wrote in my book, Health Citizenship: How a virus opened hearts and minds.

Health Populi’s Hot Points: The home has emerged as our personal and family health hubs, I recently wrote in my book, Health Citizenship: How a virus opened hearts and minds.

Consumers who could connect to the online world underwent digital transformation during the COVID-19 pandemic – working from home, schooling from home, exercising at home opting out of going to the gym, praying at home, cooking and baking in kitchens sometimes rarely used before, and finally, using virtual care platforms for telemedicine and psychotherapy/counseling.

The top-20 fastest-growing brands tell us a lot about “who we are” in America in the pandemic era. These also set the table for who we will continue to be and how we will live in and beyond 2021.

A couple of key learnings, so far, in the coronavirus pandemic for health care…

First, that connectivity has revealed itself as a social determinant of health — including physical, mental, and financial health. For physical health, connection enabled meeting up with clinicians for diagnosis and consultation. For mental health, people who needed access to psychotherapy and counseling could access services via virtual platforms, which should persist well past the crushing of the virus. For financial wellness, people who could tele-work have done so, with millions of jobs pivoting to Microsoft Teams, Zoom, BlueJeans and other virtual platforms. But for people who either lacked connectivity or whose jobs could not be done from home, they are being left behind and less well-off economically than people who could work-from-home during the public health crisis. This may result in a structural shift of jobs and unemployment for people who will need training to move into the knowledge and digital economy.

Second, there is the question of how telehealth and virtual care services will become “just” part of health care delivery along a continuum of care options. I’m thinking about this as omni-channel health care, the way we’ve seen retailers evolve toward omni-channel options for consumers seeking goods and services in brick-and-mortar stores, from home via apps and websites, and other on-ramps to purchase.

Health is made at home, in our communities, in schools, in faith-based institutions – where we live, work, play, pray, learn….and shop. For telehealth to persist, it will take an alignment of reimbursement/payment, licensure and regulatory forces, and work-flows and cultures in provider settings and in consumers’ own life-flows to adopt and adapt.

Consumers have made major behavioral changes in 2020, for health, wellness, living and working from home. People have undergone digital transformation, and millions of people have mastered the art of baking sourdough bread (and posting their yeasty results on Instagram), reading to grandchildren living in other towns, and doing productive work with teams distributed across time zones and geographies.

CPG brands — not typically associated with health and medical care — are also enabling patients’ DIY healthcare efforts at home. Expect more of this development in and beyond 2021, and certainly past the pandemic.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...