From appointment scheduling to checking in, payment and clinical encounter follow-up, patients now expect digital experiences across the health care continuum….and really great ones, like they get from Amazon and other platforms that earn high net promoter scores.

That is the big message from the 2020 Healthcare Consumer Experience Study published by Cedar, based on the input of 1,502 U.S. adults who paid a medical bill between October 2019 and October 2020.

That is the big message from the 2020 Healthcare Consumer Experience Study published by Cedar, based on the input of 1,502 U.S. adults who paid a medical bill between October 2019 and October 2020.

The timing of this study coincided with the start of the COVID-19 pandemic in the U.S. through at least seven months of American patients’ experiences in 2020.

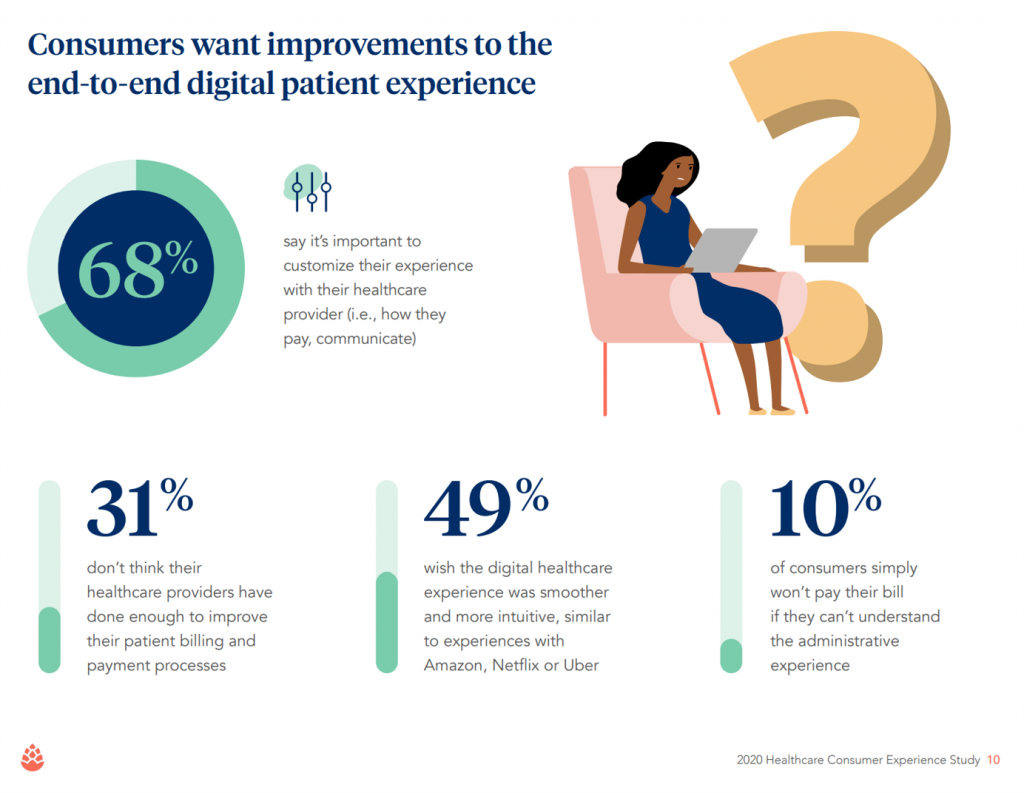

Two-thirds of patients look for customized experiences with their health care providers, addressing personalized communications and payment options, for example. One-half want those experiences to look and feel intuitive and streamlined akin to those they encounter via Amazon, Netflix, or Uber.

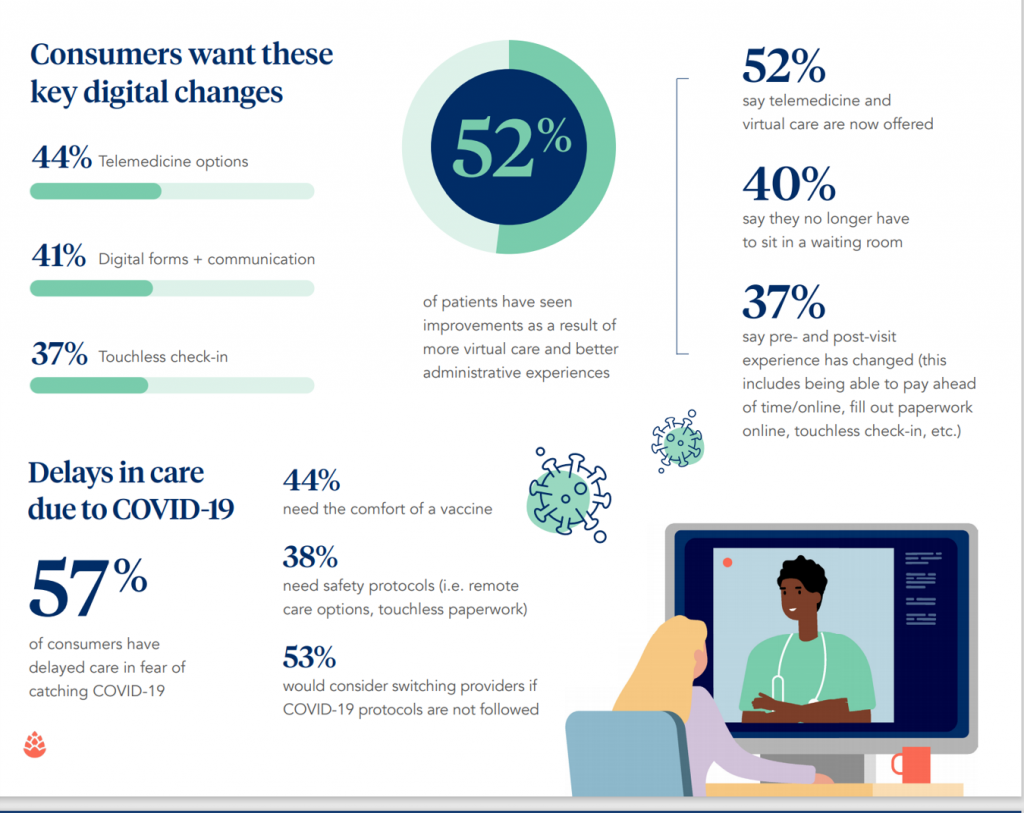

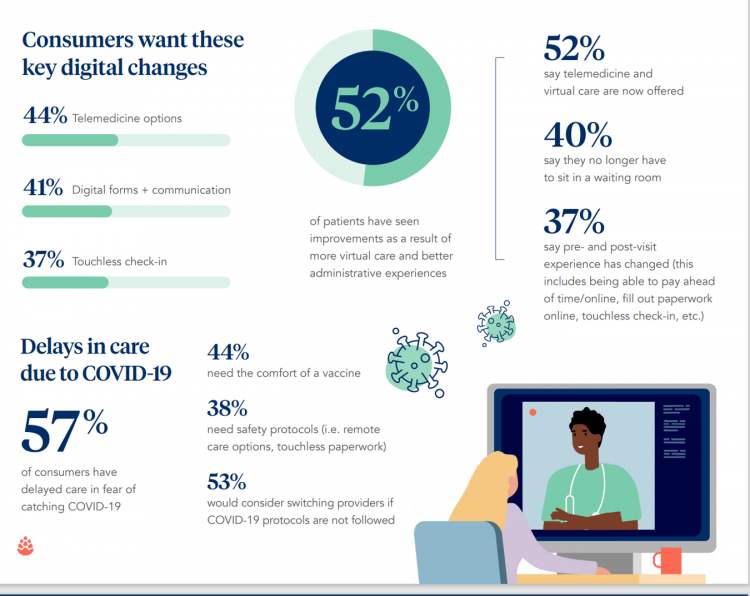

Nearly one-half of patients expect telemedicine and other virtual care services to be offered, Cedar’s study found.

One aspect of digital health transformation for the patient encounter is moving toward “contactless” experience: that starts with touchless check-in, desired by 37% of patients, and digital forms and communications cited by 41% of consumers.

Touchless also means consumers are keen to avoid spending time in waiting rooms. This leads to the expectation for pre- and post-visit payment (ahead of the encounter or immediately following it), completion of paperwork outside of the clinical site, and contactless check-ins).

Touchless also means consumers are keen to avoid spending time in waiting rooms. This leads to the expectation for pre- and post-visit payment (ahead of the encounter or immediately following it), completion of paperwork outside of the clinical site, and contactless check-ins).

What’s driving the contactless/touchless health consumer demand is avoiding exposure to the coronavirus.

Some 57% of patients delayed their health care due to COVID-19, they told Cedar. To return to their health care providers, 44% of consumers said they would need the “comfort of a vaccine.” In the post-pandemic health care environment, patients also seek safety protocols.

Without the feeling of hygiene, safety and comfort in place, over one-half of patients in the Cedar study said they would consider switching health care providers.

Another major pain-point for patients has been determining their expected cost-sharing amounts pre-visit.

During this year of the pandemic, more Americans have adopted contactless payment apps like Venmo and the Cash App to pay for goods and services without having to touch cash, a credit card, or a checkbook. So more health consumers want digital payment options: 60% would like to make a digital payment via a portal, for example. Two-thirds would take advantage of “creative payment plans” or financing options for big medical bills were they made available.

Health Populi’s Hot Points: Digital experiences have become table stakes in health care, Cedar’s report observes in its conclusion.

Health Populi’s Hot Points: Digital experiences have become table stakes in health care, Cedar’s report observes in its conclusion.

And more consumers are going online to comment to compliment or criticize their health care experience.

That use of social media to diss or support a health care provider goes beyond patients’ clinical experience. It crosses over into financial experiences as well.

One in four patients have provided a negative review due to unexpected costs or a frustrating billing experience.

A new Gallup Poll, published yesterday, found that Americans’ satisfaction with health care costs reached a new high this month. The green line chart comes from Gallup’s study.

Before you think this is the feeling of most U.S. health consumers, it is not: it’s a “high” of 30%, compared with 26% last year, and 17% in 2007 — the year before Barack Obama won the 2008 election, eventually leading to the passage of the Affordable Care Act under his leadership.

While the Gallup Poll found fewer Americans felt health care cost pain as of late 2020, surprise medical bills continue to be a major driver of financial anxiety for U.S. families, “already straining under the weight of an ongoing pandemic,” the president of the American Heart Association (AHA). AHA launched an advocacy campaign to gather patients’ experiences with surprise medical bills using the hashtag #IWasBilled.

One in two consumers told AHA that worrying about unexpected medical costs prevents them from seeking care — resulting in self-rationing health care due to costs, AHA’s survey of 2,045 U.S. adults conducted in October 2020 found. Nearly one-half of people also would not have the cash to pay for a $1,000 medical bill.

Most Americans, across political party ID, support Congress passing a law to ban surprise medical bills (82% of Democrats and 70% of Republicans).

What’s important to take away from the Cedar, AHA and Gallup consumer studies is that U.S. patients have been re-shaped in the COVID-19 pandemic — seeking hygiene, digitally-enabled services, and transparency of costs across their health care experiences.

As a scenario planning/2021 forecasting data point, pay attention, too, to consumers’ health care cost sentiment. Many Americans stayed away from health care settings in 2020 due to COVID-19, lowering utilization among many patients and, therefore, health care bills. The Kaiser Family Foundation points out that this has not necessarily been a good thing, potentially resulting in exponentially higher spending in 2021.

Patients will be playing catch-up for many health care services in 2021. I anticipate this will lead to more direct financial exposure to health care costs, and we could see the Gallup Poll satisfaction “high” of 30% fall back into the 20s as people seek more medical care in health care settings by the third quarter of 2021.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.