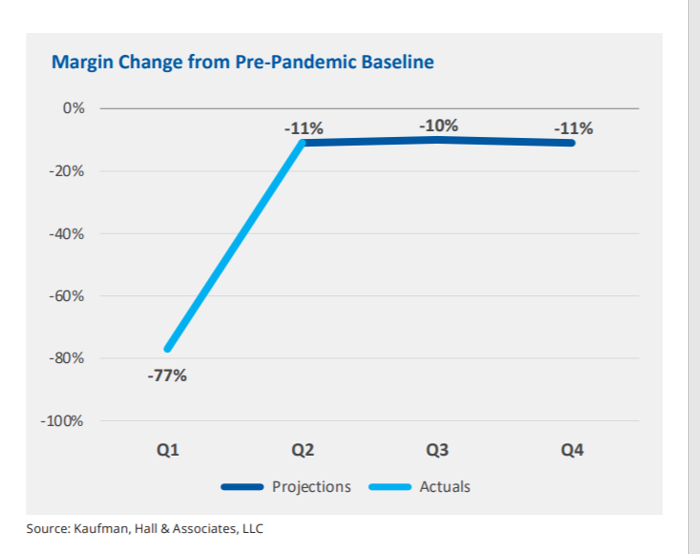

In the fourth quarter of 2021, U.S. hospital margins will still be lower than before the COVID-19 pandemic, Kaufman, Hall & Associates project in their latest read on hospital finances.

Kaufman Hall has been monitoring hospitals’ financial health in the coronavirus era since March 2020, month-by-month. This new report looks into the Financial Effects of COVID-19: Hospital Outlook for the Remainder of 2021.

Kaufman Hall has been monitoring hospitals’ financial health in the coronavirus era since March 2020, month-by-month. This new report looks into the Financial Effects of COVID-19: Hospital Outlook for the Remainder of 2021.

This report was conducted on behalf of the American Hospital Association (AHA), who succinctly summarized the forecast saying, “COVID-19 [is] expected to drive continued hospital losses throughout 2021.”

That projection is further couched in the concern that it did not factor in recent growth in coronavirus cases due to the Delta variant — which, Kaufman Hall warns, could erode margins even lower in the second half of 2021.

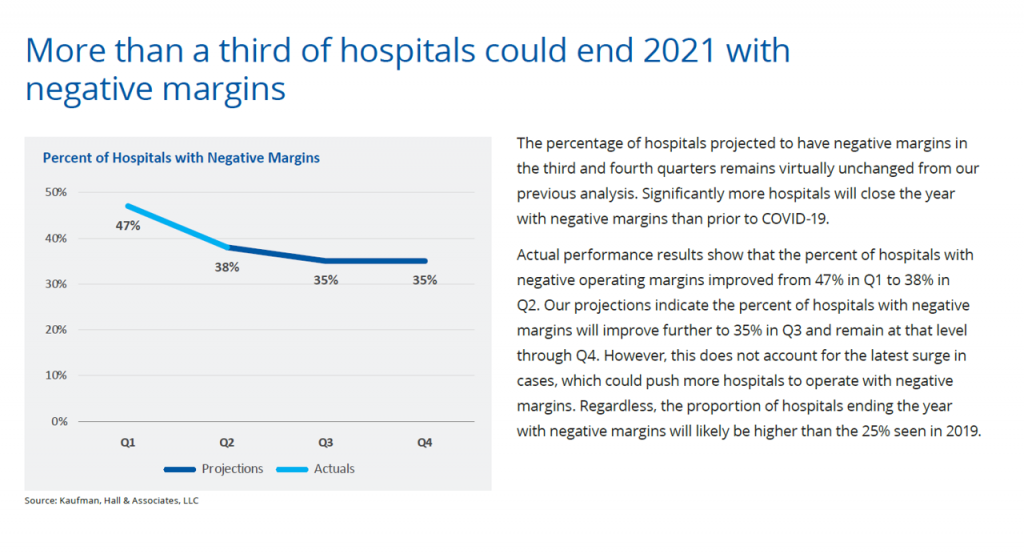

Bottom-line for the industry is that over 1 in 3 U.S. hospitals could end 2021 with negative margins. This is a less-negative forecast than Kaufman Hall’s previous report which expected that nearly one-half of hospitals would end the year in negative territory.

Even so, more hospitals will end 2021 with negative margins than before the emergence of COVID-19 in 2019 which was 25%

Even so, more hospitals will end 2021 with negative margins than before the emergence of COVID-19 in 2019 which was 25%

Higher-acuity patients and less outpatient revenue combine to depress margins. Even with CARES Act funding, hospitals’ annualized income loss from pre-pandemic levels is $54 billion; without the CARES Relief, that loss would be $92 billion.

Outpatient revenues have typically buoyed U.S. hospitals’ finances. Kaufman Hall intuits that some patients are delaying ambulatory care due to their concerns about the pandemic.

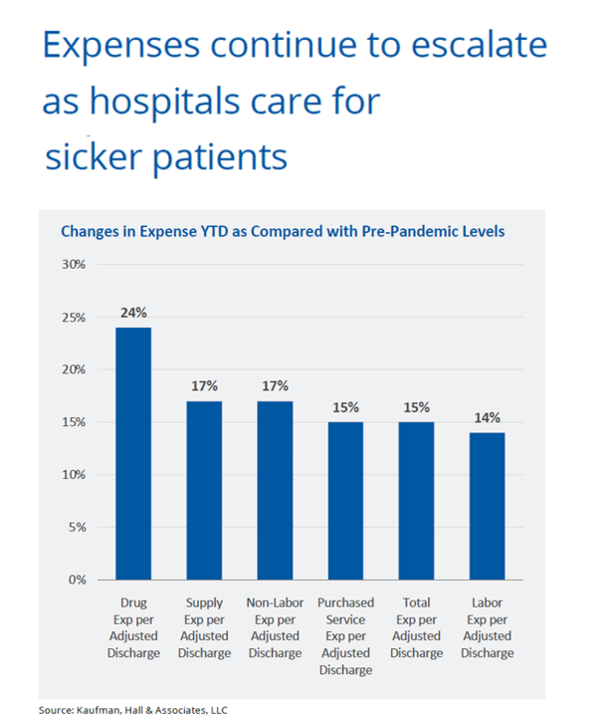

Expenses rise with the rising acuity of patients, shown by the second bar chart. Note the changes in expenses year-to-date versus pre-pandemic levels range from 14% growth in labor costs per discharge to 24% for drug cost growth. Double-digit expense increases impact supply costs, purchased services, among other line-items.

Supply expenses per discharge rose 17% with the continued purchase of PPE, equipment, and supplies associated with sicker patients’ care.

Kaufman Hall concludes that U.S. hospitals’ financial recovery is unlikely due to the effects of sicker patients admitted to hospitals, with the required cost-increasing resources to care for them.

It’s the Delta variant that changed the trajectory for American hospitals’ collective recovery expected in mid-year 2021 just before the spike in new COVID cases in Florida and Texas, then spreading to other geographies.

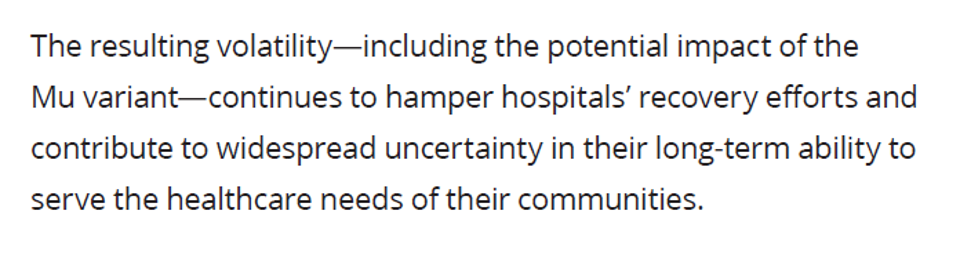

Health Populi’s Hot Points: This last graphic captures the last paragraph of Kaufman Hall’s sobering report on the financial un-wellness of U.S. hospitals.

Health Populi’s Hot Points: This last graphic captures the last paragraph of Kaufman Hall’s sobering report on the financial un-wellness of U.S. hospitals.

The potential for a Mu variant to emerge could hamper hospitals’ recovery. At a minimum, that not-so-wild card for planning compels us to expect a rocky road to the American hospital sector’s financial re-set for 2022.

Delta has wreaked havoc on U.S. public and individual health. This week, as many people in the U.S. died due to complications of the coronavirus as passed away in the 1918 Spanish flu pandemic. National Geographic called COVID-19 the deadliest pandemic in American history.

The loss of personal lives is a tragedy. And we must add to that loss the negative impacts on the U.S. health system — both facilities and especially our precious human capital who work in health systems — our physicians, nurses, allied health professionals — on the frontline of coronavirus care. The burnout, anxiety, and depression experienced now by hospital staff lies underneath these difficult hospital finance statistics.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...