Too many dollars, stimulated by an influx of COVID-19 government stimulus, are chasing too few goods in economies around the world. Couple this will labor, material shortages, and disrupted supply chains, the exogenous shock of the Ukraine crisis amplifying cost increases and shortage driving higher prices for food and commodities, and global consumers are faced with strains in household budgets.

This is impacting grocery stores and. through my lens, will impact health consumers’ spending, as well.

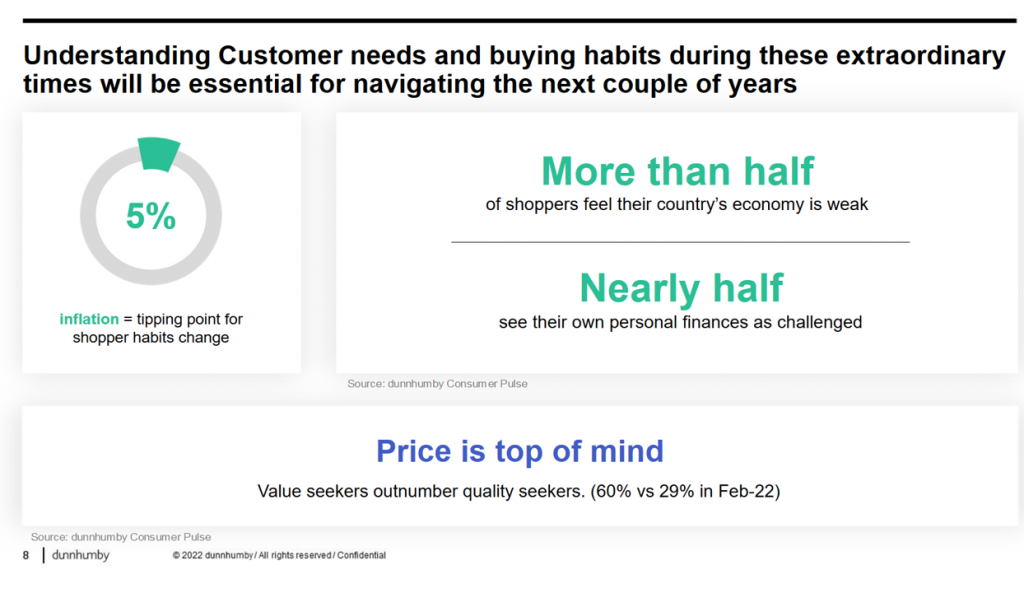

In their discussion of Customer First Retailer Responses to Inflationary Times, dunnhumby, retail industry strategists, covered an update on inflation with the top-line that global consumers generally perceive inflation to be greater than it actually is, statistically.

The dunnhumby team presented new data on consumers’ shopping habits in grocery, discount, and Big Box stores. The firm’s Retailer Preference Index (RPI) assesses consumers’ behavior in terms of preferences: in the pre-COVID era, consumers’ price + quality perceptions outweighed their value for digital, convenience, and speed.

The dunnhumby team presented new data on consumers’ shopping habits in grocery, discount, and Big Box stores. The firm’s Retailer Preference Index (RPI) assesses consumers’ behavior in terms of preferences: in the pre-COVID era, consumers’ price + quality perceptions outweighed their value for digital, convenience, and speed.

In the COVID era, consumers’ “value amplifiers” of convenience, speed, and safer shopping experiences inspired peoples’ willingness-to-pay higher prices.

By February 2022, given inflationary pressures on households, people are shifting to lower-priced alternatives, with price top of mind versus quality. Dunnhumby quantified that grocery store value seekers outnumbered quality seekers by 60% to 28% in February.

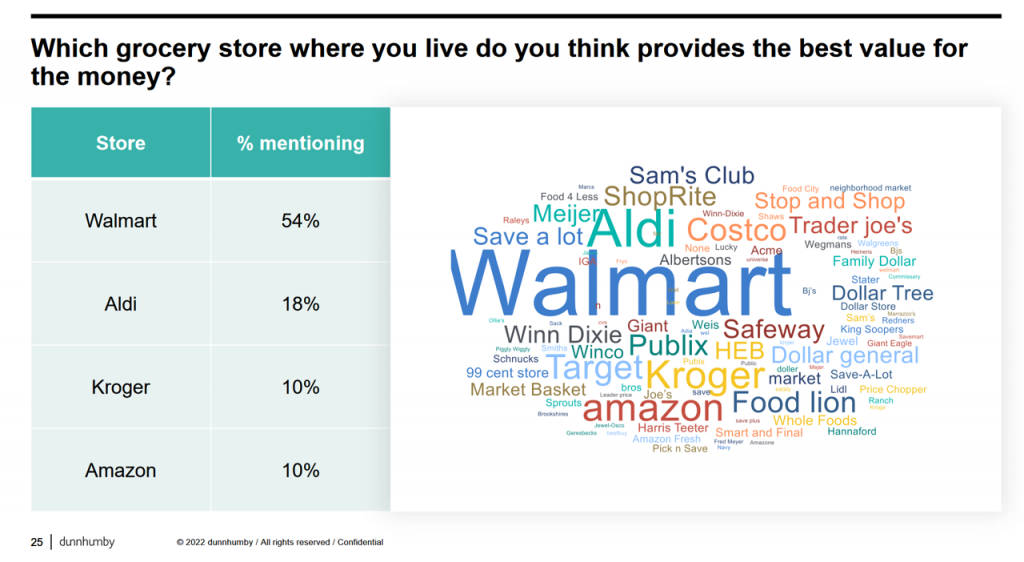

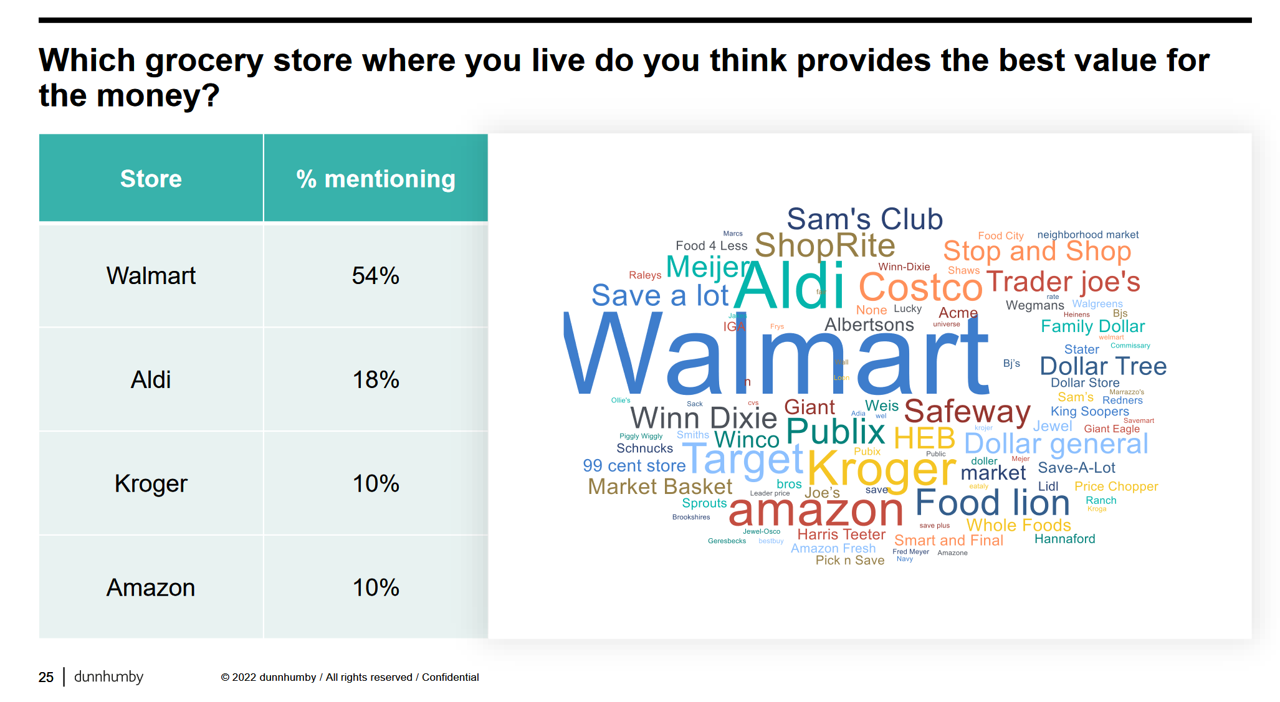

The wordle diagram here arrays U.S. consumers’ perception of grocery stores delivering value-for-money: Walmart emerges as the top value provider, among 54% of U.S. consumers, followed by Aldi, Kroger, Costco, Safeway, Sam’s Club, Trader Joe’s, Stop and Shop, Food Lion, and Dollar stores, among others.

The wordle diagram here arrays U.S. consumers’ perception of grocery stores delivering value-for-money: Walmart emerges as the top value provider, among 54% of U.S. consumers, followed by Aldi, Kroger, Costco, Safeway, Sam’s Club, Trader Joe’s, Stop and Shop, Food Lion, and Dollar stores, among others.

Amazon, too, emerges as a value-delivering grocer among 10% of consumers mentioning the ecommerce leader which has grown as a leading grocery channel during the pandemic.

I’ll pivot here to the fact that Walmart, Kroger, and other grocery and discount chains are also bolstering their healthcare and wellness footprints in the retail health ecosystem, delivering more than prescription drugs through the pharmacy.

Health Populi’s Hot Points: As regular readers of the Health Populi blog have frequently noted here, trust is a key enabler of consumers’ health engagement. And, in the past several years, health citizens’ trust in their governments has eroded relative to their faith in the private sector and employers.

Health Populi’s Hot Points: As regular readers of the Health Populi blog have frequently noted here, trust is a key enabler of consumers’ health engagement. And, in the past several years, health citizens’ trust in their governments has eroded relative to their faith in the private sector and employers.

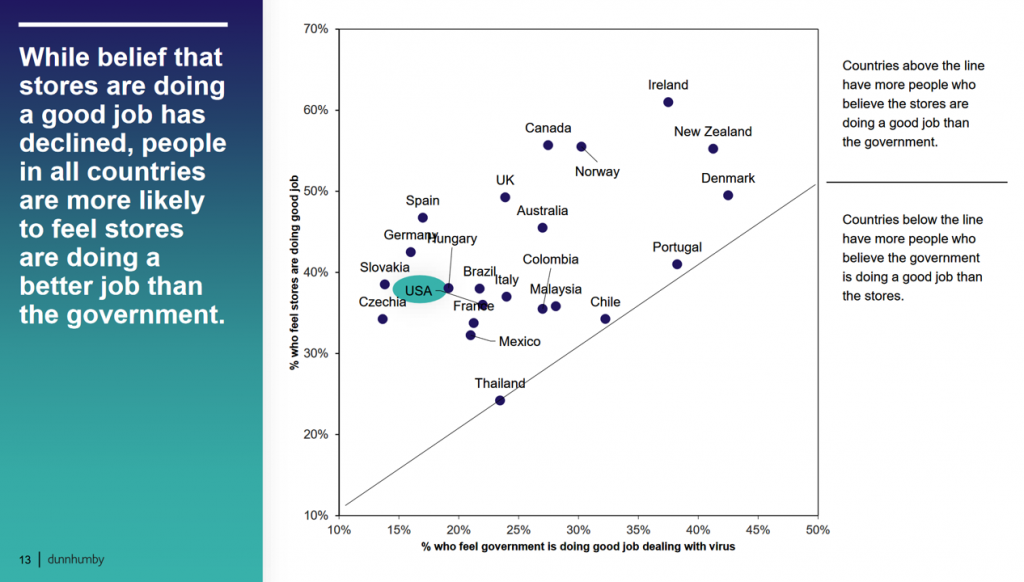

Dunnhumby’s research spoke to that in this chart arraying data for nations in their study comparing the percent of consumers feeling stores are doing a good job compared with their governments doing a good job dealing with the coronavirus.

Note that countries appearing above the line have more people who believe retail stores were doing a good job compared with their governments.

That is, virtually every country.

For the U.S., just over 20% of people felt the government was doing a good job with the public health crisis; about 35% felt that stores were doing a good job.

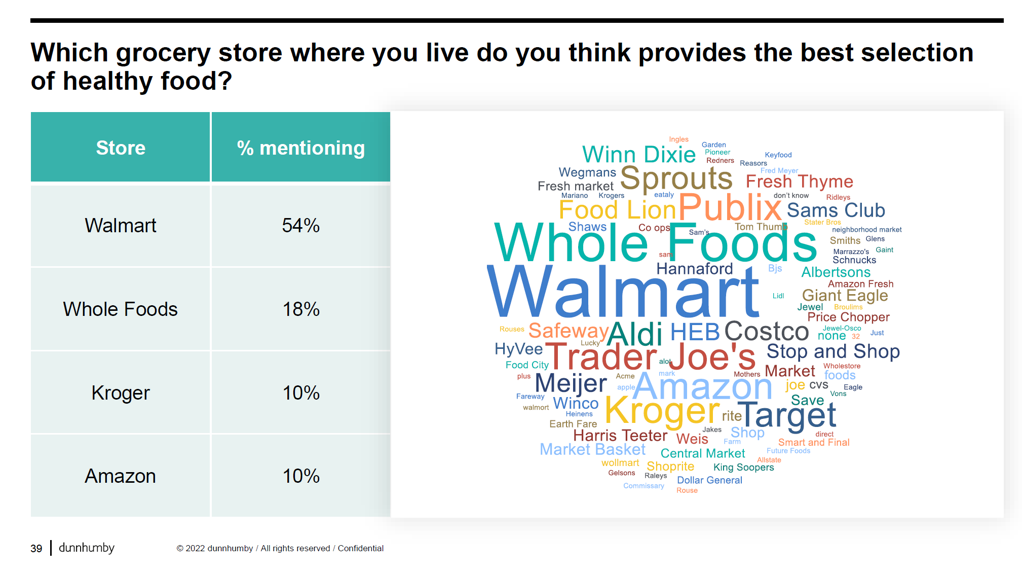

In the February 2022 dunnhumby Pulse Study, Keeping our finger on the pulse of shoppers, consumers identified the local grocery story providing the best selection of healthy food.

In the February 2022 dunnhumby Pulse Study, Keeping our finger on the pulse of shoppers, consumers identified the local grocery story providing the best selection of healthy food.

That turned out to be Walmart for over one-half of U.S. shoppers, followed by Whole Foods (18%), Kroger and Amazon (each with 10% mentions). Trader Joe’s also ranked well, along with Kroger, Target, Publix, Sprouts, and Aldi.

Watch Walmart and Kroger, and other retailers (including CVS Health and Walgreens, building up outpatient clinic and well-being offerings) for their responses to patients-as-payers’ stresses from inflation, supply chain, and medical spending as a component of overall household budgets.

Health care providers have begun to respond to consumers’ growing demand for more convenience in health care service delivery: this week, Walgreens announced its alliance with Blue Shield of California to collaborate on Health Corner services for the health plan’s members in Los Angeles and San Francisco. Expect more like this, with grocery store and Big Box alliances, as well.

Health care providers have begun to respond to consumers’ growing demand for more convenience in health care service delivery: this week, Walgreens announced its alliance with Blue Shield of California to collaborate on Health Corner services for the health plan’s members in Los Angeles and San Francisco. Expect more like this, with grocery store and Big Box alliances, as well.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...