Virtually every closed-door meeting I have had in the U.S. with a client group in the past several months has had a line item on the agenda to brainstorm the impact and opportunity of care-at-home, hospital-to-home, or Care Everywhere. This has happened across many stakeholders in the evolving health/care ecosystem of suppliers, including hospital systems, health plans, grocery chains, retail pharmacy, consumer technology, digital health and tech-enabled providers, pharma and medical supply companies.

On October 10, Dr. Robert Pearl, former CEO of The Permanente Medical Group, published a provocative post on Forbes noting that Amazon, CVS, Walmart Are Playing Healthcare’s Long Game.

This snippet from Dr. Pearl’s essay will give you a sense of his view on the retailers’ “long game” plans; he begins by discussed CVS Health’s announced acquisition of Signify Health:

“Though I have no insider information about these three retailers, I believe they’re all on similar, strategic paths in their quest for total healthcare domination. To CVS, the Signify purchase isn’t a wager on home health. It’s a missing piece—an investment in becoming a dominant player across the entire $4.1 trillion healthcare industry. In that context, $8 billion is a small price to pay,” Dr. Pearl calculated.

The through-line for all of us who work in the broader health care ecosystem is that care is shifting “everywhere,” from home to work to wherever we “are” or where we want that care to be delivered.

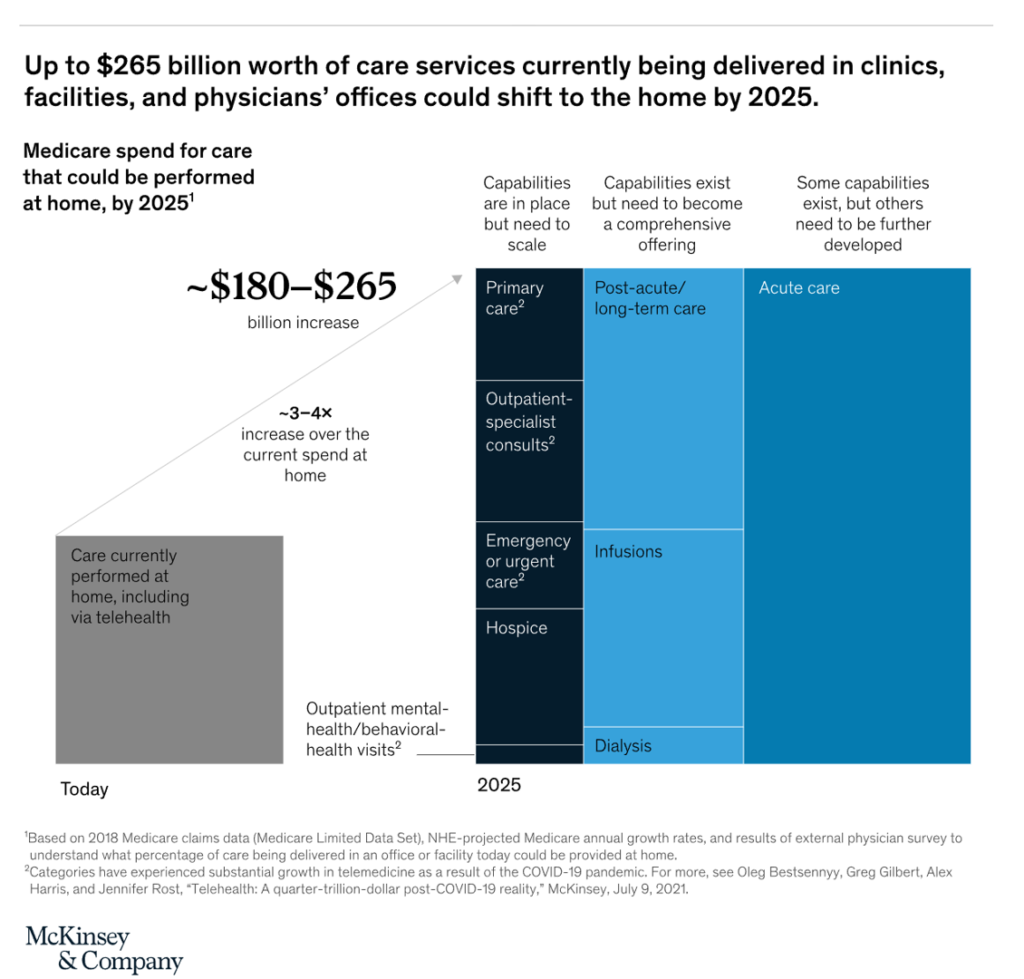

And it’s crucial for incumbent health care suppliers — hospitals, pharma, devices and supplies, and health plans — to assess, learn, strategize and execute on the potential shift of $265 billion of care services that McKinsey expects to migrate to the home by 2025.

2025? Why, that’s just some months away from “now.”

McKinsey is talking about Medicare’s spending that could be shifted home in just two+ years, ranging from $180 to a quarter of a trillion dollars. The services address primary care, outpatient specialty consults, emergency or urgent care, hospital, and outpatient mental and behavioral health — capabilities already in place that need to scale.

In addition, post-acute and long-term care, infusions, and dialysis exist but require a more complete offering to scale to the home.

Finally, what turbocharged during COVID-19 and hospitals’ inability to accommodate all the demand for inpatient beds in the height of the pandemic, a growing hospital-to-home migration of acute care where patients were well enough to recover at home — safety away from nosocomial infection risks, fall risks, and disorientation from being in an institutional setting.

What factors must underpin this Holy Grail of care at home, or “anywhere?”

Here are a few current examples of enabling pillars to support people in their self-care for chronic conditions, well-being, and acute care outside of the hospital.

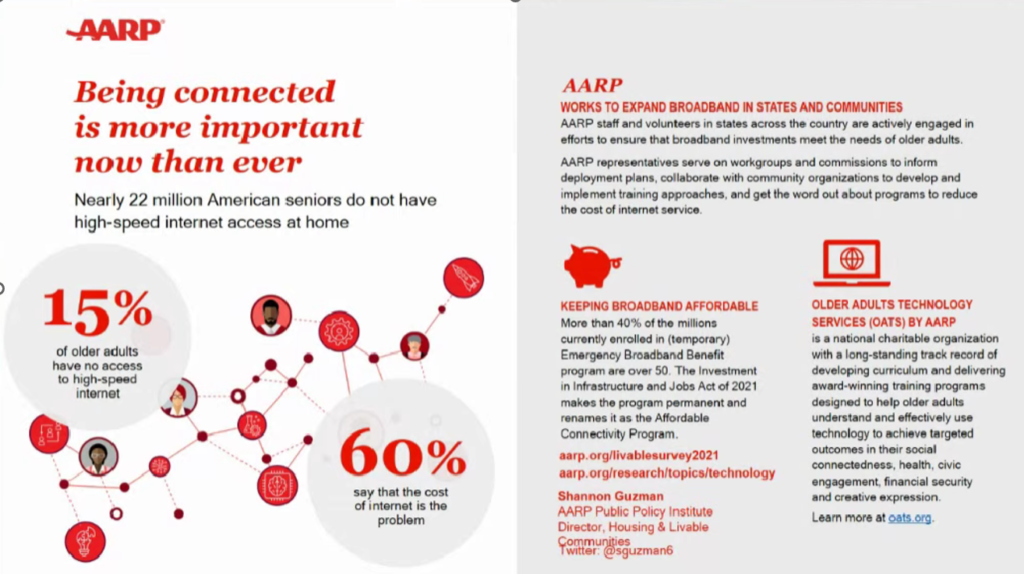

Start with connectivity to the home and elsewhere by phone. Last week, Shannon Guzman who is AARP’s Director of Housing and Livable Communities spoke in detail at the Parks Associates Connected Health Summit about the fact that “being connected is more important now than ever,” an ethos shared by millions of older people. Shannon called out that nearly 22 million American seniors do not have high-speed internet access at home. She discussed some programs currently working to expand broadband to the N of 1, but much work remains to be done on this.

Connectivity is a determinant of health, we knew pre-pandemic; this SDoH factor just accelerated to a mainstream fact which is much more embraced by health care stakeholder players.

Having a health plan and being health-insured does not mean you and your family members have access to sufficient and/or nutritious food. This announcement from Kroger and Priority Health plans to remedy, literally, that challenge with Kroger-branded whole health benefits that embed nutrition benefits. The company discussed this program at the recent White House Conference on Hunger, Nutrition and Health, which I detailed here in Health Populi to update the growing food-as-medicine trend. The program will be offered in eight counties in Southeast Michigan as of January 2023; we’ll be closely tracking these plans that could be replicated by other insurance companies and grocers committed to health and well-being throughout the U.S.

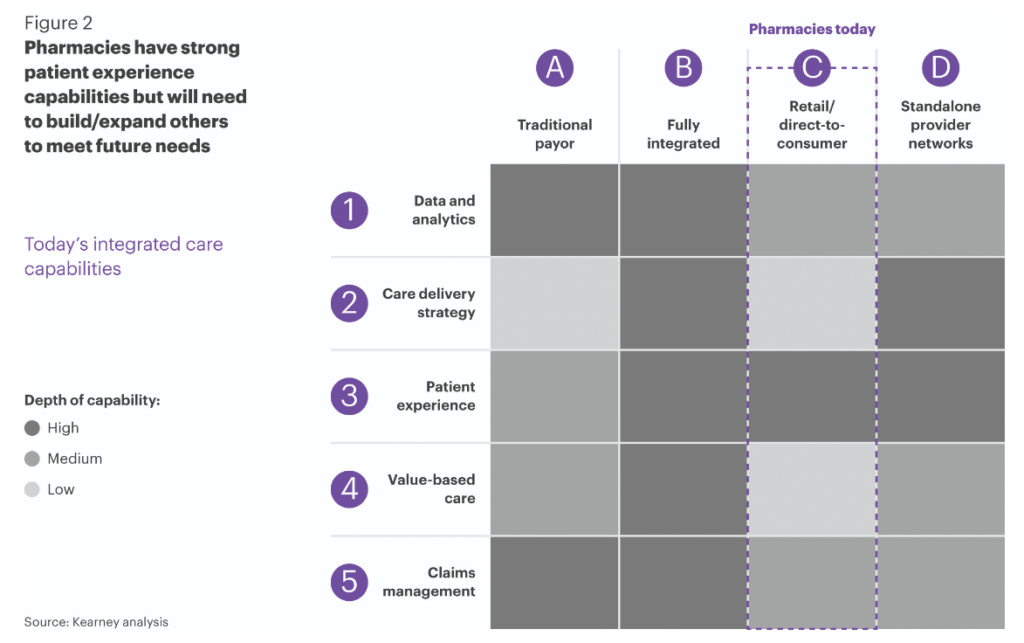

Health Populi’s Hot Points: Getting care home and “anywhere,” we must ensure that integrated care “isn’t lost in the shuffle,” a recent Chain Drug Review column explained. The authors of the essay are part of Kearney’s Health Practice team.

In preparing for more integrated care delivery, they developed this matrix focusing on retail pharmacies’ strong patient experience capabilities — but need to develop other capabilities such as care delivery and value-based care, which fully integrated systems like Intermountain Health and Kaiser Permanente are models of, Traditional payors/health plans may have strong data and analytics along with claims management chops, but again, care delivery and PtX? Not so much.

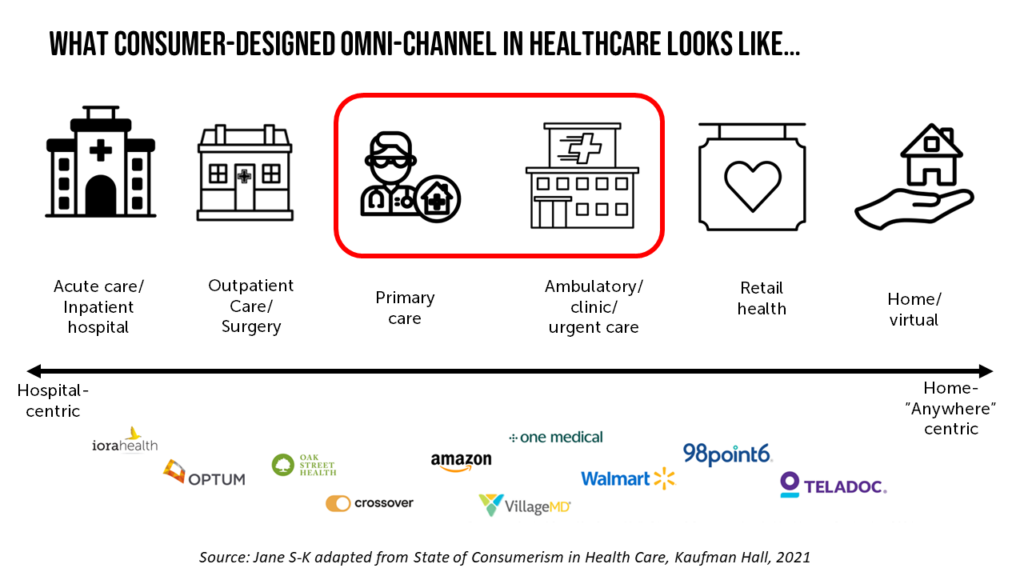

Integrating care “anywhere” will also require a multi-channel, omni-channel approach for communications and delivery alike. This flow chart from Phreesia’s work on Healthcare’s Digital Transformation is a good example of integrated care “media and messages” across time, channels, and patient touchpoints in their care journeys.

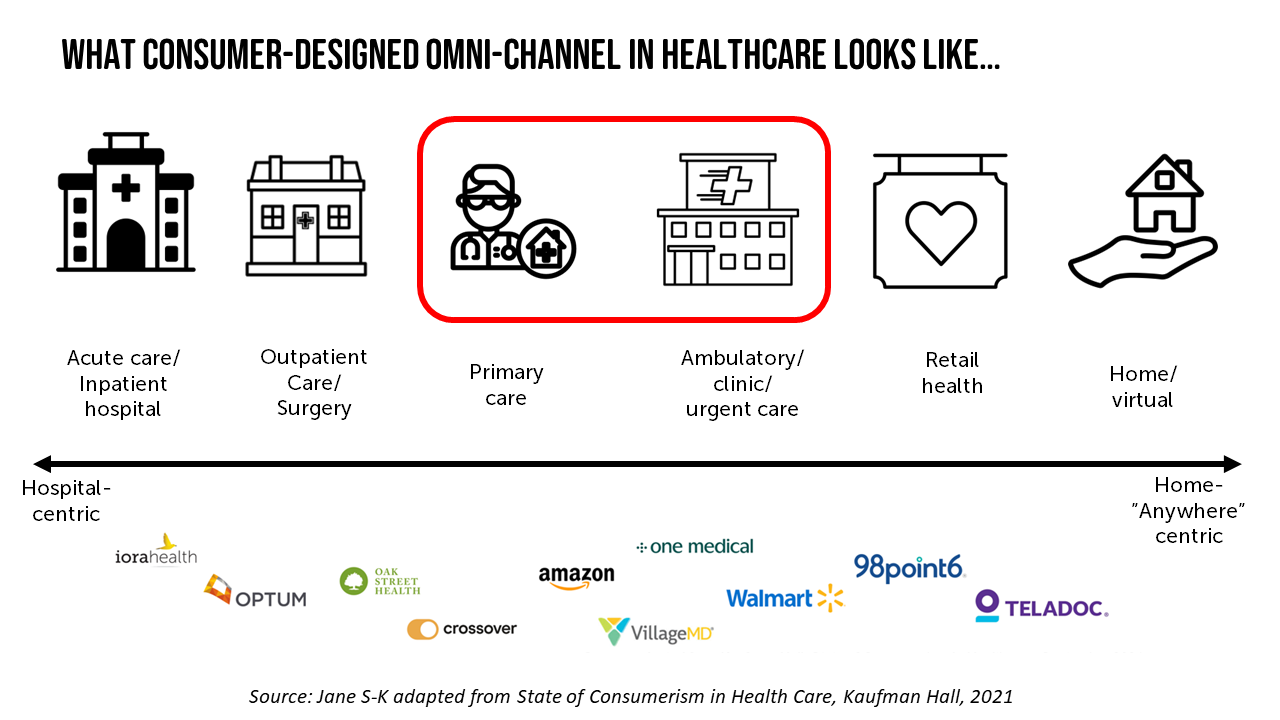

I’ll conclude by sharing a chart I developed for a recent client meeting which spoke to the convergence of the mature health care system players with the newer entrants – whether Big Retail, Big Tech, Big Food/Grocery, or other digital or social driver provider. There’s a convergence and blur in the center here, with primary care and ambulatory care getting the attention they merit as lower-cost and more appropriate sites of care. This is where we “are” right now: I spent a week in late July writing in this channel about “the retail health battle royale” which has so much focus on primary care, revisited.

The momentum for the Blur is high velocity. Along with offering counsel and support and ideation in meetings, I’m also adding in one last piece of simple advice: “don’t blink.”

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...