Consider the key drivers of supply and demand in health care, globally, right now:

- On the medical delivery supply side, the shortage of staff is a limiting factor to continuing to deliver care based on the usual work-flows and payment models.

- On the demand side, patients are taking on more demanding roles as consumers with high expectations for service, convenience, and safe care delivered closer to home — or at home.

This dynamic informs The Future Health Index 2023 report from Philips, launched this week at HIMSS 2023.

This is the eighth annual global FHI report, with detailed country-specific analyses to follow for the U.S. along with Australia, Brazil, China, Germany, India, Italy, Japan, the Netherlands, Poland, Saudi Arabia, Singapore, and South Africa.

Here’s what I wrote about the 2020 FHI, research conducted in the thick of the COVID-19 pandemic. That was in the midst of the fast-pivot toward virtual care and telehealth on-ramps welcomed by both clinicians and patients.

Two years later, Philips finds that younger physicians are most bullish on care, everywhere: as Shez Partovi, Philips’ Chief Innovation and Strategy Officer asserts in the 2023’s FHI report introduction, “When I think of the future of healthcare delivery, I think of ‘your care, your way.'”

The FHI 2023 research revealed three major themes:

- To address clinician shortages and burnout, and solve financial pressures, investments in AI will ratchet up to enhance clinical decision support and productive workflows.

- To further benefit institutions’ fiscal health, care will move closer to patients — at home, in the community to lower-cost settings, and via hybrid channels of telehealth and virtual care outside of the hospital. This responds to both clinicians’ and healthcare managers’ needs for financial management as well as to consumers’ growing demand for convenience and accessible care.

- Continuing to improve healthcare delivery, finances, and outcomes, clinical care must collaborate and partner with others in the larger health/care ecosystem. In much of the world, ESG — attending to environmental, social, and governance objectives — will be baked into some of these decisions with respect to partners and programs.

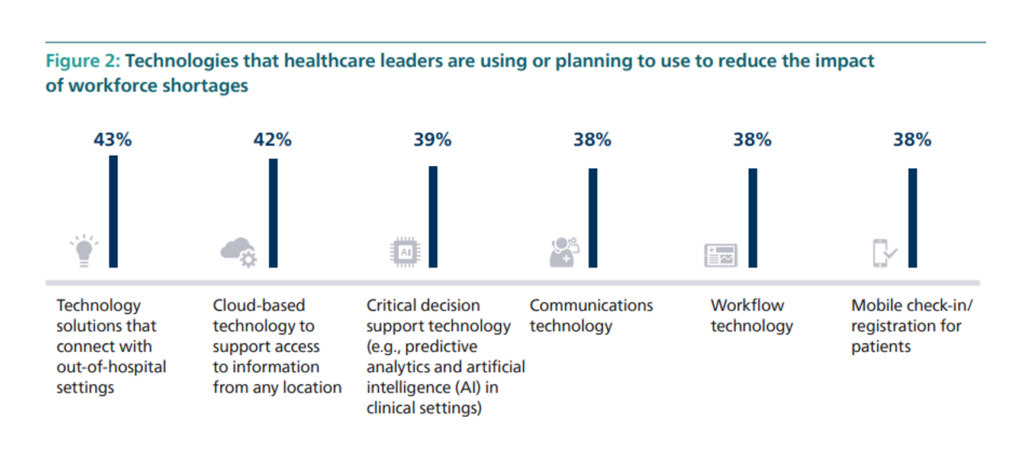

The second chart illustrates areas where healthcare leaders are already or plan to allocate resources to address workforce challenges.

Roughly 2 in 5 healthcare leaders look to technology to connect with out-of-hospital settings, cloud-based tech to support access to information “everywhere,” decision support tech (such as AI in clinical settings), communications, workflow applications, and patient-facing mobile check-in and registration.

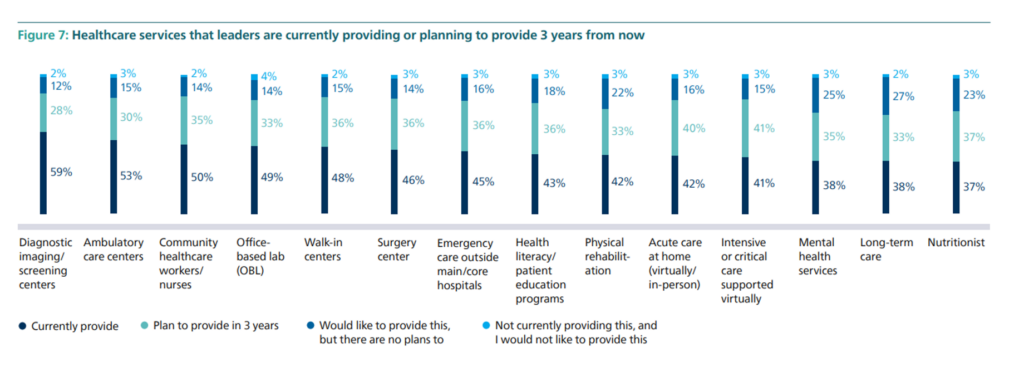

To meet patient-consumers where they live, work, play, pray, learn and shop, healthcare leaders have plans to expand a range of services outside of the hospital’s walls, shown in the third bar chart by category. Most commonly provided today are diagnostic imaging centers, ambulatory care centers, community healthcare workers, labs, and walk-in centers. We can expect increasing investments in surgery centers, emergency care outside of the traditional ER, patient education focused on health literacy, acute care at home (the hospital-at-home migration, continuing), more virtual critical care and e-ICUs, mental health, and nutrition.

Health Populi’s Hot Points: If we are good strategic planners, we’ll consider how trends will morph over time especially related to differences across generations – of both clinicians and consumers.

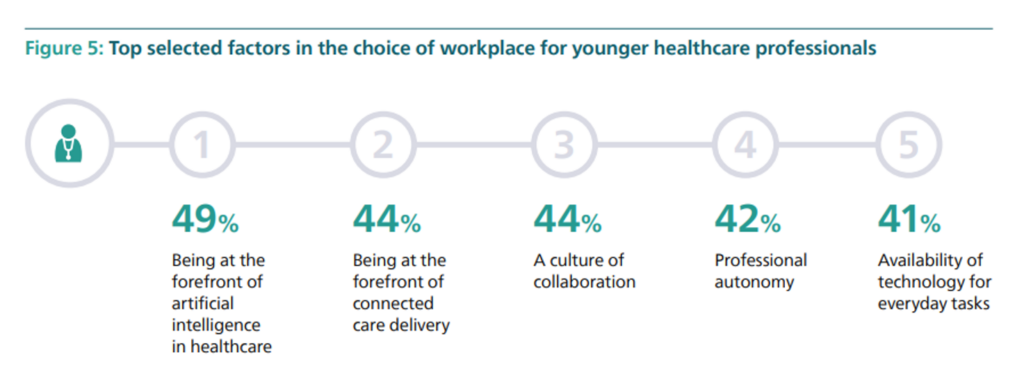

This last chart taken from the 2023 FHI identifies top factors in the choice of workplace for younger healthcare professionals — led by being and working at the forefront of AI in health care and connected care delivery, along with working in a culture of collaboration while maintaining autonomy and being freed-up to operate at the top of one’s license where technology can perform routine tasks.

Similarly, younger consumers — namely Millennials, Gen Z and Gen X members — are more likely to seek primary care and services in new and novel formats beyond the traditional medical home. Recent research from Wolters Kluwer explored this phenomenon, learning that these younger health care consumers seek convenience but also lower costs for medications and services.

Albertsons, the grocery chain working on its merger with Kroger, recently launched a digital health loyalty service which integrates with Apple, Fitbit and Google platforms, called Sincerely Health. The company explained, “As a grocery and pharmacy retailer committed to the health and wellness of our communities, we are empowering customers to have a connected and personalized view of their health across food, nutrition, activity, mental well-being and pharmacy services, enabling them to make more informed choices.”

This is one milepost event signaling the kind of pivot younger patients-as-consumers are expecting for their personal health engagement.

For a growing cohort of health consumers, their medical home will be, simply put….their home, as they define it. And a growing cohort of young clinicians appear keen to be part of this new life- and work-flow.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...