On April 11, 2023, three of the largest U.S. consumer credit rating companies — Equifax, Experian and TransUnion — planned to remove medical bill collections that were under $500 from consumers’ credit reports. The Consumer Financial Protection Bureau (CFPB) calculated that these medical bill “erasures” under $500 impacted nearly 23 million consumers and eliminated medical collections totally for 15.6 million people in the U.S. according to CFPB’s recently-published Data Point report.

For some context, it’s useful to know that the CFPB was created as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act passed by Congress and signed by President Obama in July 2010 in the wake of the 2008-9 financial crisis in the U.S. From the start, CFPB has been monitoring medical debt along with other forms of household debt — student loans, mortgages, credit cards, and so on.

Commenting on the Data Point report’s update on medical debt, Eva Stahl, VP of public policy at RIP Medical Debt, told Yahoo Finance, “In moments of distress and uncertainty, people want to resolve medical bills swiftly and may sign up for medical credit cards that offer lower interest rates or deferred interest opportunities.”

She noted that general purpose credit card interest, the so-called average annual percentage rate (APR) was 23.84%, but for medical credit cards, a higher rate of about 27%.

In the Commonwealth Fund’s State of the U.S. Health Insurance Industry report for 2022, we realize that health care spending has joined other household expenses as key family budget line items, with as much as $1 in $5 of mainstream Americans’ budgets going to medical services and products along with vitamins, minerals and supplements, gym memberships, and other out-of-pocket spending on personal and family well-being.

As Sara Collins who co-wrote the Commonwealth Fund report coined, “These [medical credit] cards are a symptom of the serious growing affordability problems people are encountering who have health plans that don’t provide them with the cost protection they need to access timely care.”

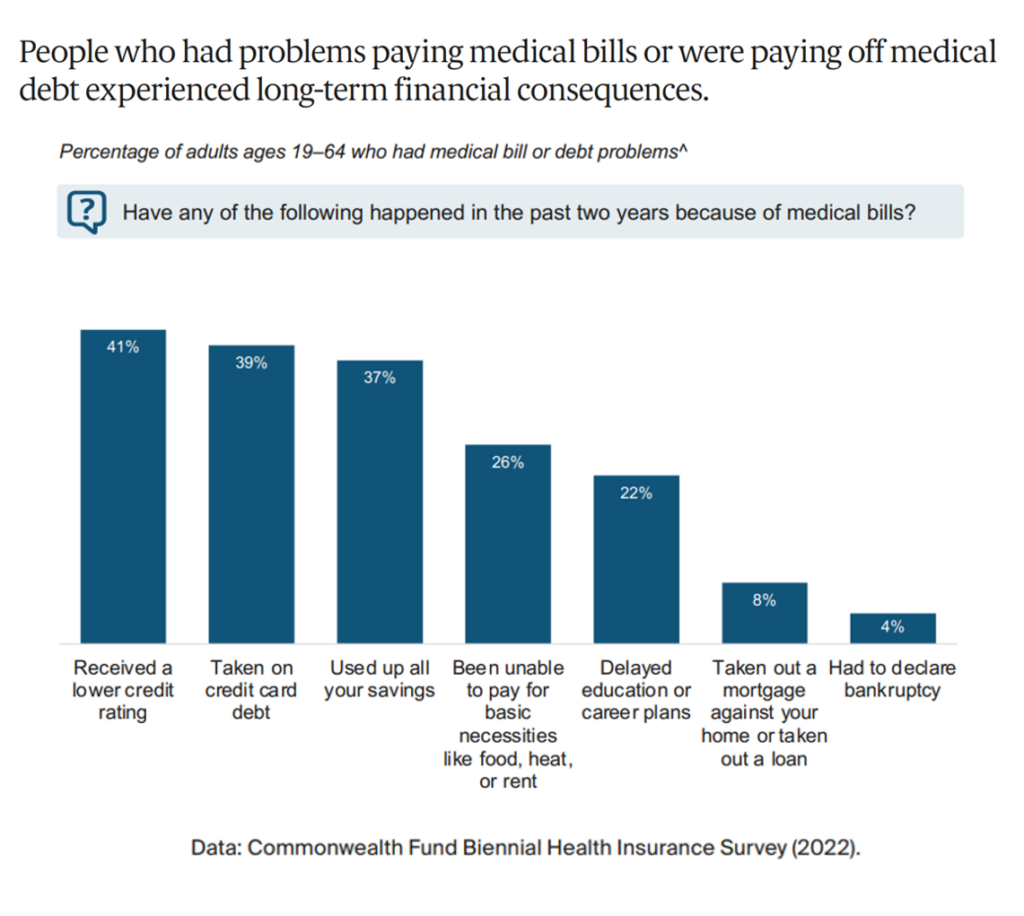

The Commonwealth Fund data in the bar chart tells us that many patients in the U.S. have had fiscal challenges related to medical bills: negatively impacting their credit rating, adding to credit card debt, forcing the use of savings, and crowding out other spending on basic needs such as food, heat, or rent.

Those out-of-pocket costs and financial stress feels a lot like “retail” to the U.S. health consumer, now a significant stakeholder-payer for healthcare in America. As such, people expect retail-style experiences from health care touchpoints, from the doctor’s office and hospital to the pharmacy, fitness site, and grocery store evolving as a health destination.

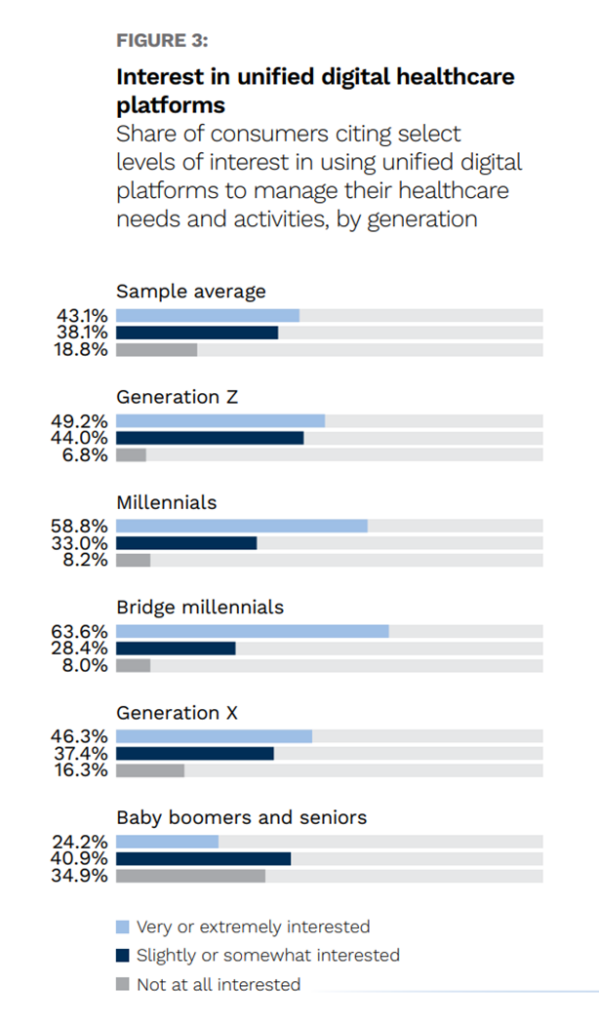

Health Populi’s Hot Points: The last chart shown here comes from a new study from PYMNTS and Lynx on what patients want from digital healthcare platforms — with special focus on older patients.

Note that 3 in 4 Boomers and Seniors have used, and were satisfied with, paying for healthcare products or services online. And, over one-half of patients have also sought information about medical bills.

The CFPB and PYMNTS/Lynx give us further evidence that the patient is the payor for health care — and those levying a price on services and products to those patients best embed enchanting design that speaks to both peoples’ values and sense of value.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...