People love being health-insured, but their negative experiences with health plans create serious burdens on patients-as-consumers. And those burdens impact even more people who are unwell than healthier folks.

The 2023 Kaiser Family Foundation Survey of Consumer Experiences with Health Insurance updates our understanding of and empathy for insured peoples’ Patient Administrative Burdens (PAB). For this study, KFF polled 3,605 U.S. adults 18 and over in February and March 2023 who had health insurance across different plan types.

Over the past several years, I’ve come to appreciate the concept of PAB by listening to and learning from colleagues Dr, Grace Cordovano, Anna McCollister, Susannah Fox, and Dr. Adrienne Boissy among others who, on a daily basis, work with patients dealing with the kinds of challenges the KFF study reveals.

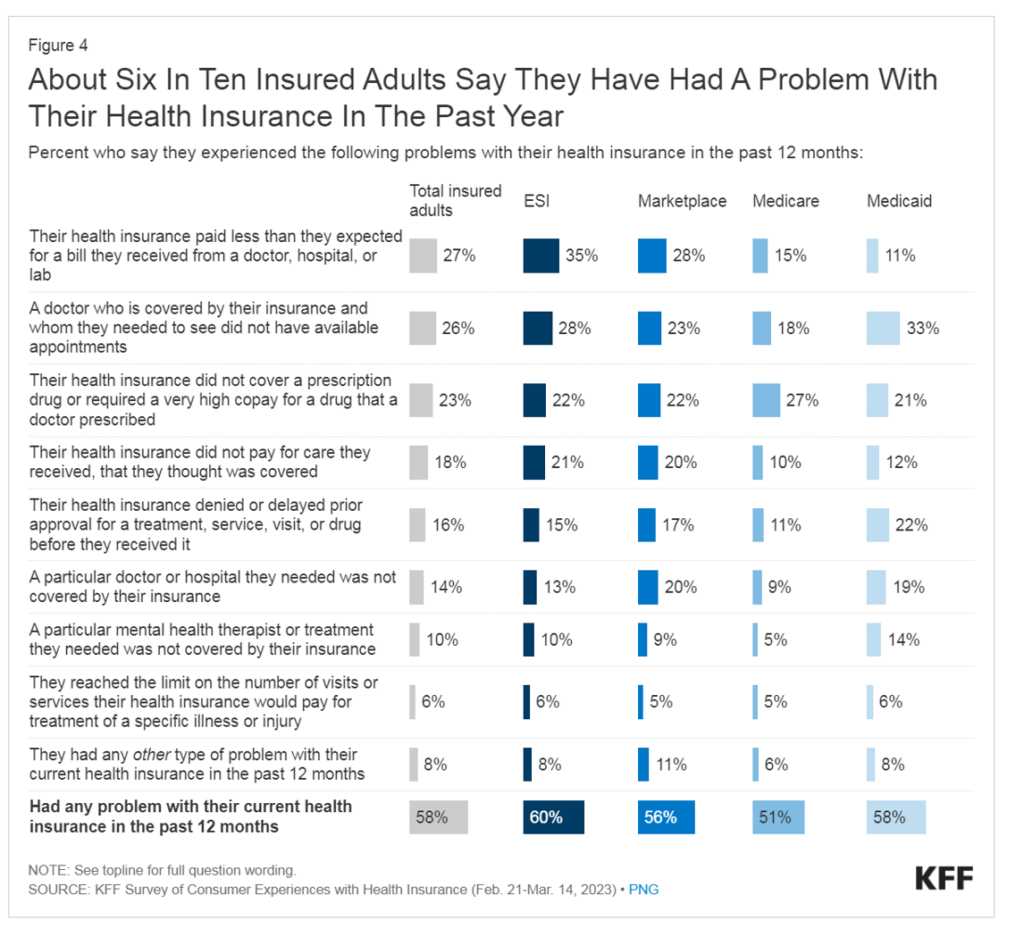

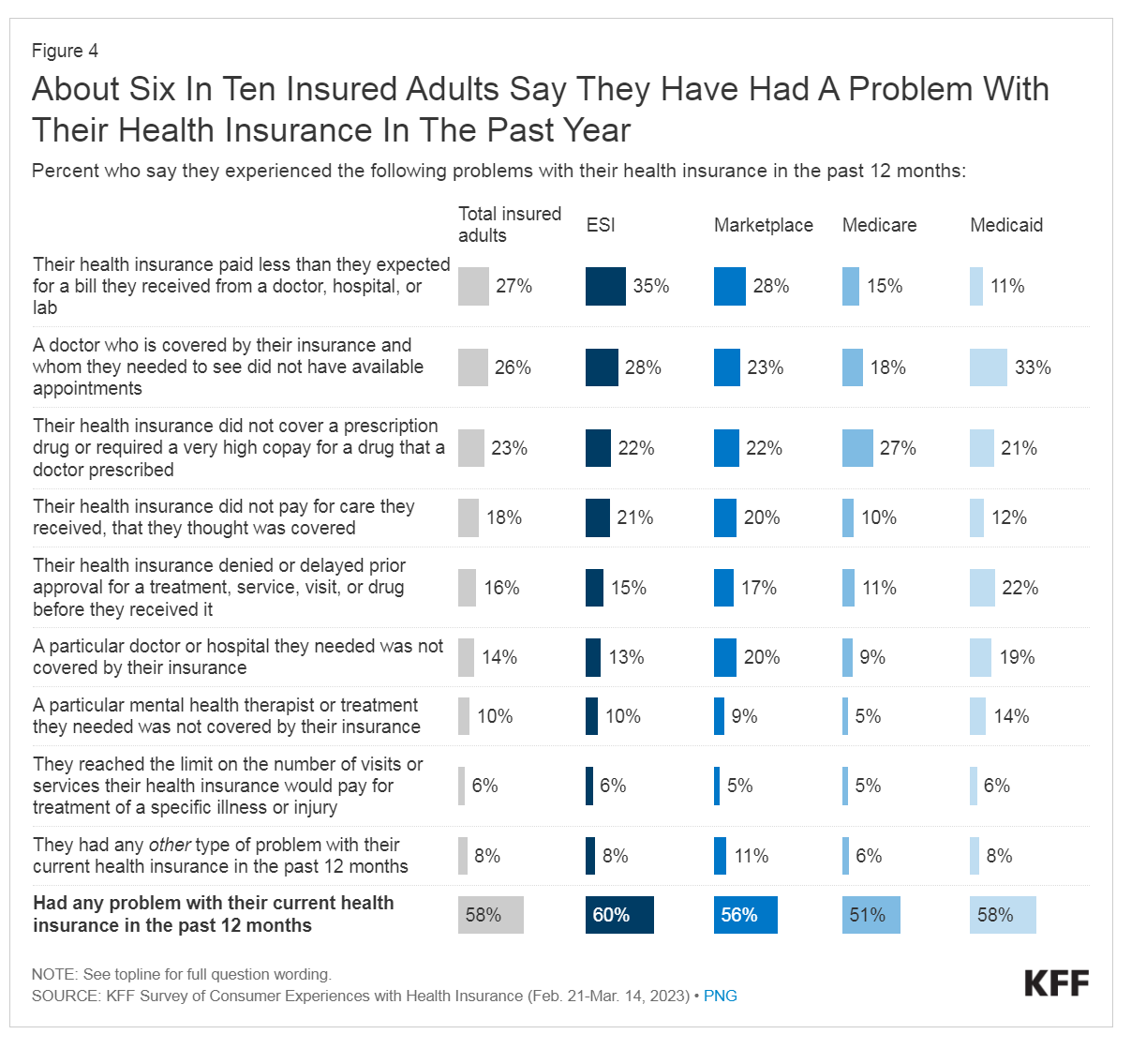

Start here. Three in five people with health insurance have had a problem with their plan in the past year. Most commonly, these challenges were that,

- The health plan paid the member less than expected for a bill from a doctor, hospital or lab (27% across all plan types)

- A doctor who was covered by the insurance plan (that is, in-network) was not available for an appointment (26%)

- The health plan did not cover a prescription drug or required a “very high” copayment for a drug their doctor prescribed (23%)

- The health plan did not pay for care received that the patient thought was covered by the insurance benefit (18%); and,

- The health plan denied or delayed prior approval for a treatment, service, visit or prescription drug before they received it (18%), known as prior authorization.

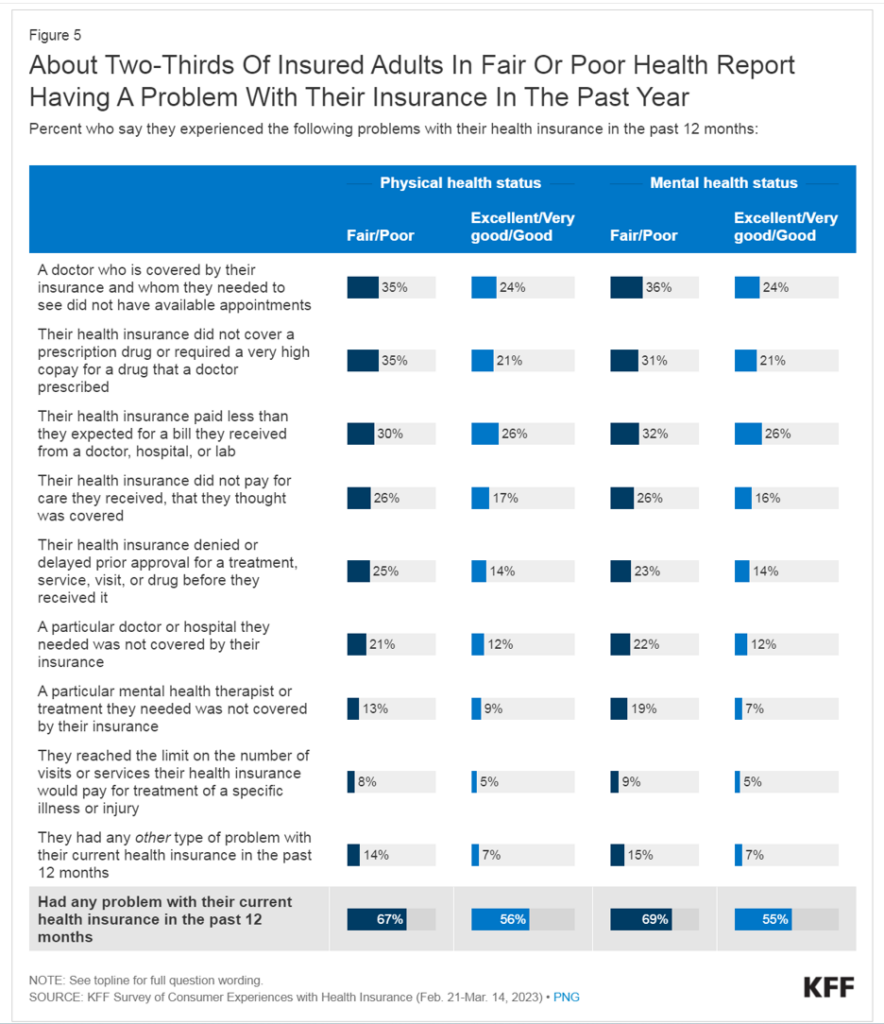

Here are the data on administrative burdens impact more people who are sicker than those who are in better health.

Two in three people in fair or poor health had a problem with their health insurance in the past year, led by lack of available appointments (for 35% of these patients), lack of prescription drug coverage or access (for 35%), lower payments for a medical bill (among 30%), lack of payment for services the patient thought was covered (for 26%), and 25% of people being denied or getting delayed in approval for required services.

Note that 21% of these sicker patients needed a particular doctor or hospital not covered by their insurance — that is, out-of-network.

The table breaks out these data points for the well versus the un-well, making the point that PAB is more likely greater among people dealing with chronic and acute conditions.

In addition to the points I explore here on patient administrative burden, please check out the KFF survey for more insights into peoples’ access to mental health benefits and other experiences with health plans.

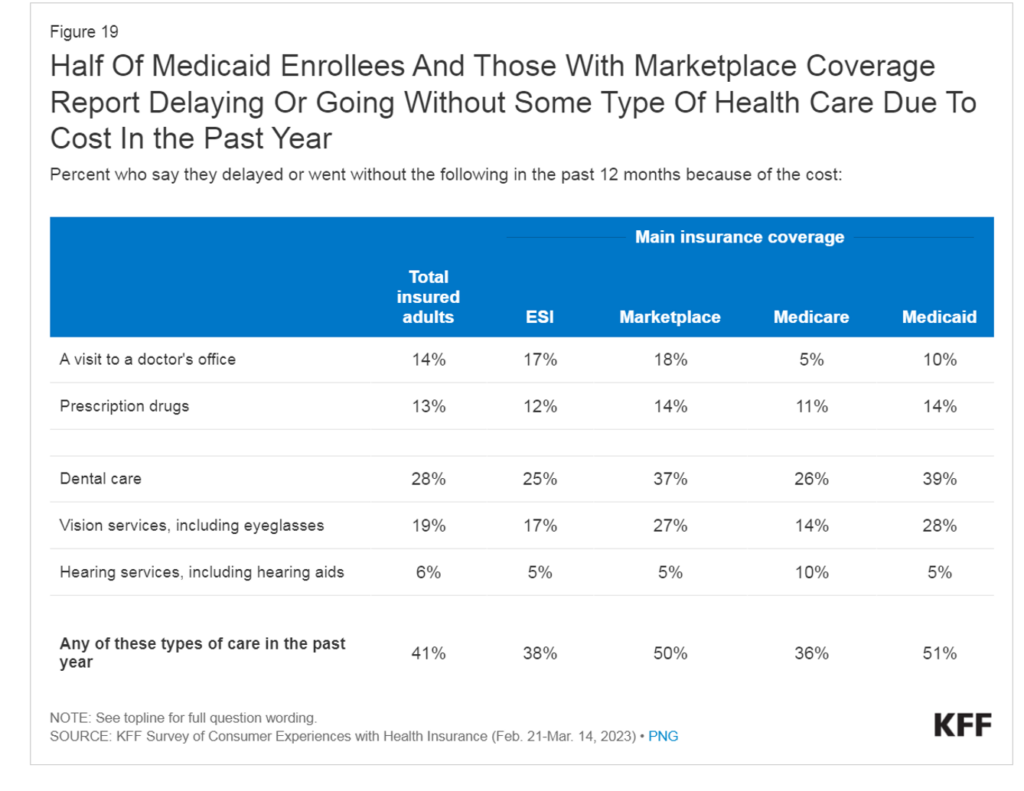

Health Populi’s Hot Points: These administrative and financial burdens cause many health-insured people to delay or forego health care visits, filling prescription drugs, and other services. Two in five insured adults, over all, went without some aspect of health care due to cost in the past year.

This “choice” to self-ration health care due to among health-insured Americans varies by health insurance plan type — notably, foregoing care is more likely the act of someone enrolled in a marketplace plan (50%) or Medicaid (51%).

Note that one-third of people enrolled in Medicare or employer-sponsored insurance (ESI) self-rationed care due to cost in the past year.

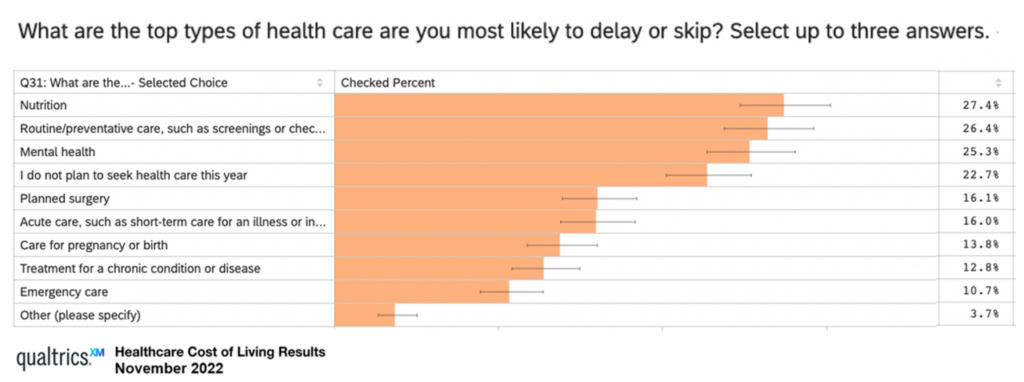

The top reason people in the U.S. are now delaying care is due to cost, not concerns about exposure to COVID-19 which created the phenomenon of “medical distancing” between 2020 and 2022, resulting in some patients avoiding preventive screenings and necessary care in face-to-face medical settings.

“If people can’t afford to access care in the first place, then not only are they having a poor experience, but we will never fully realize the health outcomes in our communities that we aspire to,” Dr. Boissy, Qualtrics Chief Medical Officer, explained in the context of a study her company did among health consumers avoiding care due to cost.

“While encouraging that people feel more comfortable seeking the care they need, the cost barrier to care during these tenuous economic times is worrisome. It reinforces the need to hear from our communities and provide access in the channels that work for the populations that need us the most. This research further emphasizes the need to constantly listen with intention and to design solutions with our patients.”

The Qualtrics Study explored the views of over 1,000 U.S. patients 18 and over in August and September 2022, which learned that the high cost of health care services (46%) and higher costs of living overall (43%) contributed to peoples’ healthcare avoidance in America. For more details on this important study, you can check out my post here in Health Populi from November 2022.

The financial experience is embedded in the overall patient experience in health care….watch this space as new and newer-entrants continue to develop digital and brick-and-mortar front doors designed to delight and serve patients as health consumers. There’s a big volume opportunity for those who design to serve under-served patients — those dealing with chronic conditions and high patient administrative burdens.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...