Two-thirds of U.S. consumers say they can’t afford to pay their medical bills on-time, based on the 2023 Consumer Survey from Access One, a financial services company focused on healthcare payments.

The report’s title page asks the question, “What options do consumers really want for paying healthcare expenses?”

The survey report responds to that question, finding out that nearly one-half of patients have taken some kind of action to reduce their medical expenses. Furthermore, one-third of consumers are not confident they could pay a medical bill of $500 or more.

Access One fielded the study in early October 2023 among 1,016 U.S. adults.

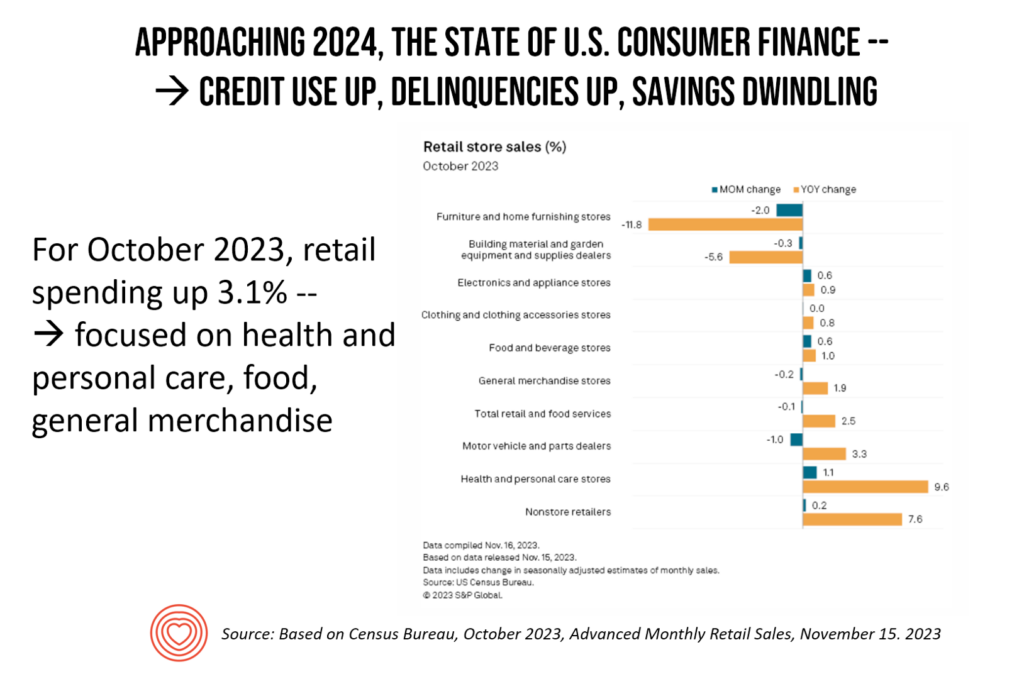

Let’s set the current context for these findings — set out in a summary here on the state of U.S. consumer finance based on the Census Bureau’s monthly analysis of retail sales for October 2023 published in mid-November.

Note that U.S. consumers’ use of credit has grown post-pandemic, delinquencies on credit cards are up, and savings falling after having achieved some nice growth in the pandemic largely owed to pandemic payments from the Federal government.

Importantly, see the orange bars in the graph illustrating that spending on health and personal care grew the most year-on-year versus 2022.

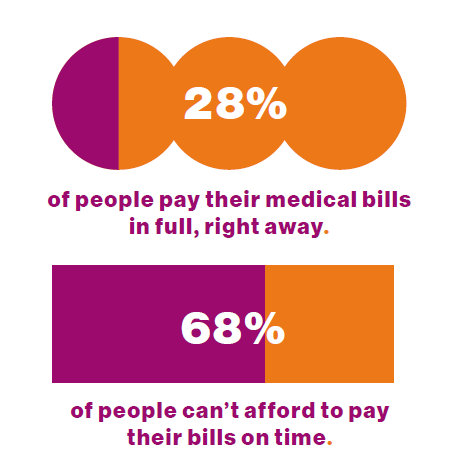

Now consider Access One’s top-line finding that 68% of people can’t afford to pay their bills on time, and only 28% pay their medical bills in full.

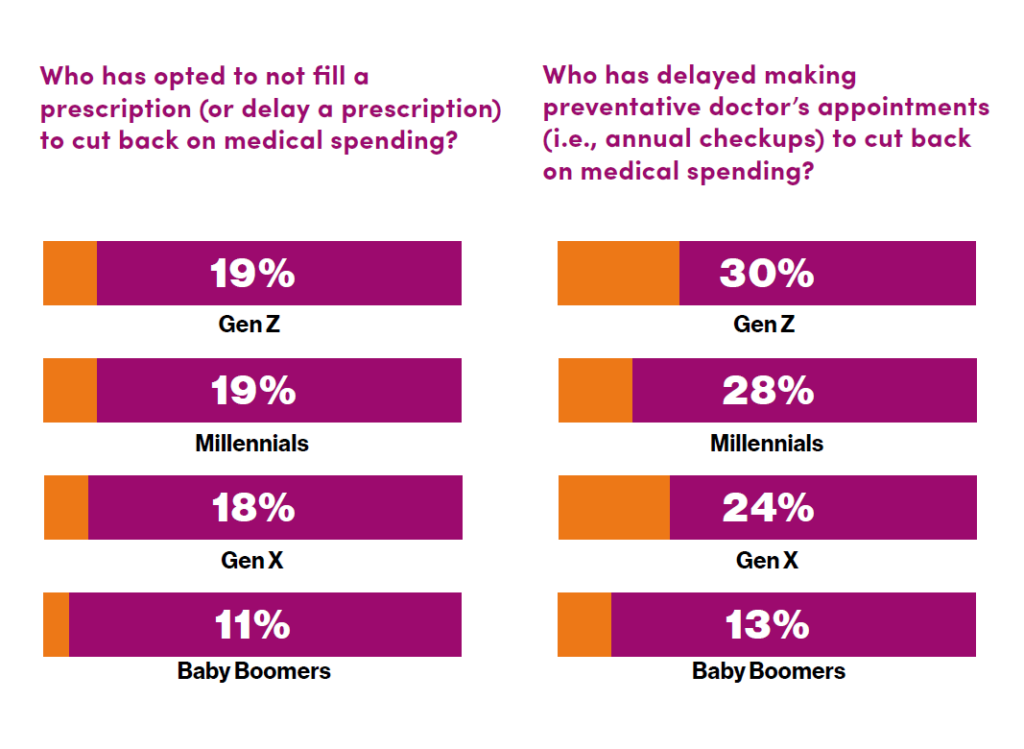

This dual chart from the study shows us that by generation, we can see some differences in patients delaying care for prevention — notably annual check ups — to cut back on spending. Those most likely to postpone preventive visits due to medical costs are Gen Z and Millennial consumers, following by one-fourth of patients in the Gen X cohort. Baby Boomers would be least likely to postpone a visit for preventive care.

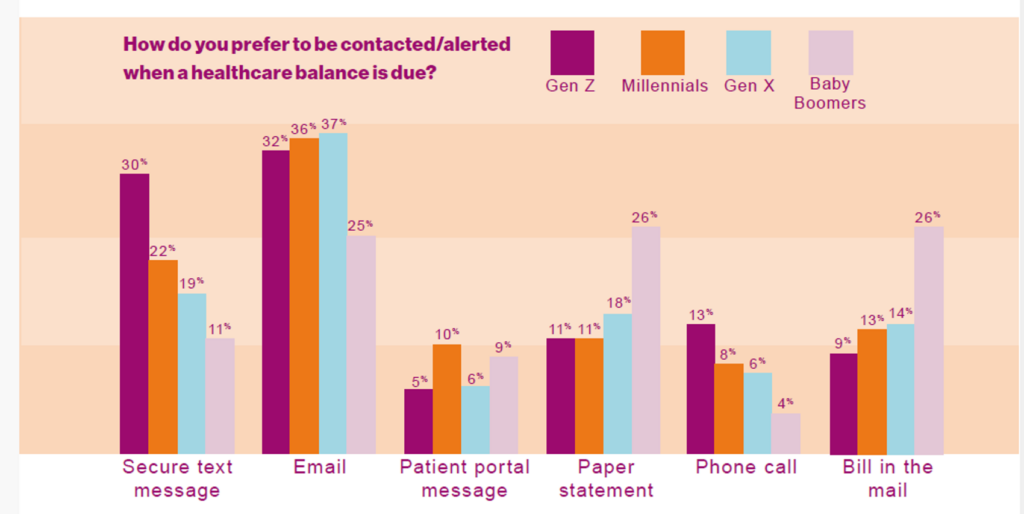

Further fleshing out he answer to the report’s title-page question, this chart on “how” consumers would prefer to be contacted when a healthcare bill is due sheds important and informational light on consumers’ growing demand for omnichannel communication and options.

Note for example how Boomers are most likely to point to a bill in the mail or paper statement, with equal proportions of older people citing email.

For the youngest cohorts, it’s secure text messaging and email preferred for healthcare bill communications.

Health Populi’s Hot Points: Omnichannel is the platform approach consumers are growing muscles to use in other aspects of daily living — retail, financial services, hospitality, and to be sure, health care services and payment.

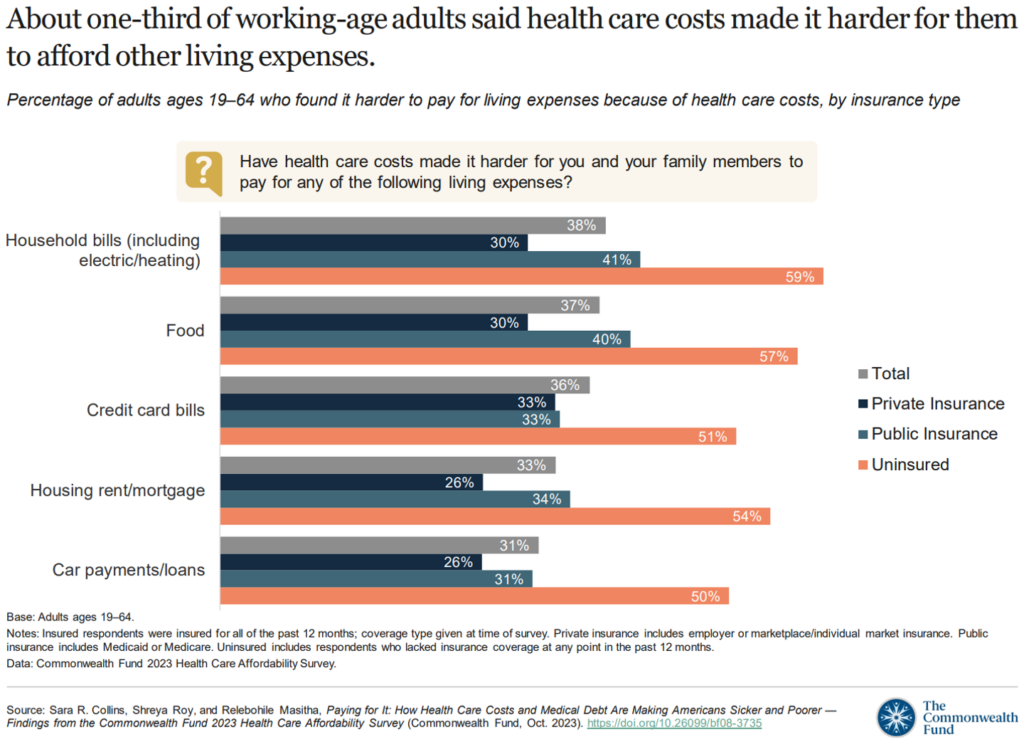

The growing feeling of “retail” in health care is being acutely felt by U.S. patients-as-consumers, this bar chart from The Commonwealth Fund’s latest consumer survey into health care affordability for 2023. The Fund summarized the findings in the essay on their website titled Paying for It: How Health Care Costs and Medical Debt Are Making Americans Sicker and Poorer from The Commonwealth Fund.

Even commercially insured patients feel health care cost pressures crowding out other household spending — for food, credit card bills, housing and auto payments.

Keep this in mind for your 2024 business planning across all aspects of health care that grow increasingly consumer-facing.

Thank you,

Thank you,  As a proud Big Ten alum, I'm thrilled to be invited to

As a proud Big Ten alum, I'm thrilled to be invited to  I was invited to be a Judge for the upcoming CES 2025 Innovation Awards in the category of digital health and connected fitness. So grateful to be part of this annual effort to identify the best in consumer-facing health solutions for self-care, condition management, and family well-being. Thank you, CTA!

I was invited to be a Judge for the upcoming CES 2025 Innovation Awards in the category of digital health and connected fitness. So grateful to be part of this annual effort to identify the best in consumer-facing health solutions for self-care, condition management, and family well-being. Thank you, CTA!