There’s good news on the macro-health economics front: the growth rate in national health spending in the U.S. fell in 2011, according to an analysis published in Health Affairs January 2013 issue. Furthermore, this study found that consumers’ spending on health has fallen to 27.7% of health spending, down from 32% in 2000, based on three spending categories:

1. Insurance premiums through the workplace or self-paid

2. Out-of-pocket deductibles and co-pays

3. Medicare payroll taxes.

A key factor driving down health spending is the growth of generic drug substitution for more expensive Rx brands. Generics now comprise 80% of prescribed drug volume according to IMS Institute for Health Informatics. The current era of the Patent Cliff is good news for generics companies, but not for branded pharma firms.

This Health Affairs analysis notes that consumer-directed health care, especially in the formats of high-deductible health plans, will grow through the implementation of Health Insurances Exchanges (HiXs) in 2014 as the Affordable Care Act’s provisions play out.

Health Populi’s Hot Points: The conclusion drawn by this study is based on the three consumer spending elements cited in the study: insurance premium costs, out-of-pocket costs found in health care claims, and Medicare payroll taxes. But this is a limited view over what is a growing category for consumers’ household spending. This number doesn’t take into account other forms of health spending, from self-care categories like over-the-counter goods which have grown under medical savings accounts, vitamins/minerals/supplements, complementary and alternative medical care (such as chiropractic, acupuncture and homeopathy), and the largest fiscal hit of all — caregiving and long-term care. ]

Health Populi’s Hot Points: The conclusion drawn by this study is based on the three consumer spending elements cited in the study: insurance premium costs, out-of-pocket costs found in health care claims, and Medicare payroll taxes. But this is a limited view over what is a growing category for consumers’ household spending. This number doesn’t take into account other forms of health spending, from self-care categories like over-the-counter goods which have grown under medical savings accounts, vitamins/minerals/supplements, complementary and alternative medical care (such as chiropractic, acupuncture and homeopathy), and the largest fiscal hit of all — caregiving and long-term care. ]

Deloitte’s recent study into these “gray” categories of health spending shed light on the fact that consumers spend much more than the national health spending accounts account for.

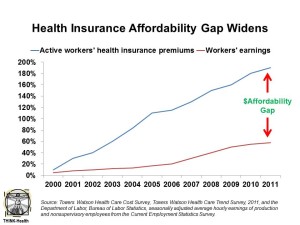

Furthermore, as the second chart illustrates, the “affordability gap” between workers’ wage increases (fairly flat for a decade) and the rise of health insurance premiums for active workers has dramatically grown. This illustrates the real fiscal hit on consumers the national health accounts don’t discuss. In the wake of the Great Recession of 2008, one-half of consumers has self-rationed health care due to cost. Postponing necessary health care, not filling prescription drugs, and avoiding recommended medical tests due to costs aren’t sound approaches to self-health care. They postpone needed care down the line, which can increase costs downstream.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...