The U.S. economy is largely built on consumer purchasing (the big “C” in the GDP* – see note, below Hot Points). Americans have universally embraced their role as consumers in virtually every aspect of life — learning to self-rely in making travel plans, stock trades, photo development, and purchasing big-dollar hard goods (like cars and washing machines). Consumers transact these activities thanks to usable tools and information that empower them to learn, compare, and execute smarter decisions. That is, in every aspect of life but in health care.

The U.S. economy is largely built on consumer purchasing (the big “C” in the GDP* – see note, below Hot Points). Americans have universally embraced their role as consumers in virtually every aspect of life — learning to self-rely in making travel plans, stock trades, photo development, and purchasing big-dollar hard goods (like cars and washing machines). Consumers transact these activities thanks to usable tools and information that empower them to learn, compare, and execute smarter decisions. That is, in every aspect of life but in health care.

While the banner of “consumerism” in health care has been flown for much of the past decade, it’s been heavy-lifting for those U.S. health citizens who’ve been covered by insurance plans – and even heavier for those without health insurance coverage. The US News magazine cover shown here is from 2004 – an image that clearly resonate 9 years later when we’re all still trying to be “a smart patient.”

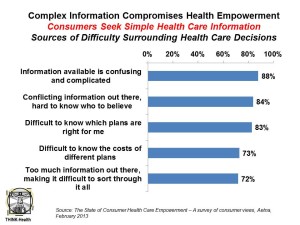

9 in 10 American adults still find health care information that’s available to be confusing and complicated, and 8 in 10 say they don’t know which information and sources to believe. 7 in 10 say it’s difficult to know the costs of different health plans, and 7 also say there’s too much information to sort through.

Aetna‘s survey of consumer views is summarized in their report, The State of Consumer Health Care Empowerment. In three words, this state can be summed up as, “Not So Empowered.” 41% of U.S. adults have either skipped/stopped taking prescribed medications or skipped/delayed a recommended medical procedure.

Aetna quantifies that only 14% of U.S. adults are truly empowered in health care based on their perceptions of making health care related choices including comparing costs of health procedures beforehand, tracking out-of-pocket costs, and using mobile phone apps to manage health and wellness.

At the lowest run of health empowerment, 41% of U.S. adults tend to be in fair or poor health, unemployed, with household incomes of less than $50,000, and unsurprisingly, the uninsured.

Aetna calculated an “empowerment gap” in several specific areas:

- Getting a second opinion: 73% do so when they want one, but only 40% find it easy to do, leaving a 33% empowerment gap;

- Comparing costs of health procedures: 53% do so, 22% find it easy to do, leaving a 31% gap;

- Getting an appointment with the doctor of your choice: 82% do so, 53% find it easy to, leaving a 29% gap;

- Finding a doctor that takes your insurance: 84% do so, 56% find it easy to do, and 28% don’t.

Aetna’s survey was conducted in July 2012 among 1,500 U.S. consumers 18 and over via a 20-minute phone survey (landline and cell phones).

Health Populi’s Hot Points: While the present state of health empowerment shows many gaps, consumers polled by Aetna say they’re keen to access tools that help them embrace their consumerism in health care. 71% of people told Aetna they’re interested in a website to help manage health care expenses, 65% would like a mobile phone app to provide reminders for doctors’ appointments and medication adherence assistance, and 52% would like a mobile phone app to help manage health expenses. Aetna offers digital tools through its iTriage platform.

The data chart tells the story about consumers who desire health empowerment but face complex information that’s inaccessible, opaque, potentially untrustworthy, and daunting to sort through. The tools people are looking for must do that sorting and triaging to personalize the information so people can make as good a decision about their health care plan, provider, procedure, or pill, as they do for their next washing machine.

The start-ups being funded in record dollar-numbers (see Rock Health’s 2012 report on the subject to get up to speed), the most successful of these ventures will be informed by what users want. Since 2004 and well before, the consumer’s been waiting in the exam room in her white gown to become a smarter health purchaser. With newly insured people entering the health insurance marketplace in a matter of months — that would be about three fiscal quarters remaining in 2013 — it will be hard to fill those empowerment gaps noted by Aetna in time.

*From your Econ 101 course, remember that GDP = C + I + G + (X-M), where C=consumer spending, I=investment, G=government spending, and (X-M) is the net trade surplus of deficit of exports less imports.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...