National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items.

The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded Coverage and Improving Economy, written by a team from CMS.

The backstory of health spending growth for the next decade begins with what’s happened since the 2008 Recession: a slowdown in medical spending due to lagging economic growth, coupled with the advent of the Patent Cliff and expansion of generic drugs available for low retail prices at the pharmacy and increasing cost-sharing requirements for privately-insured people via high-deductible health plans and risk-shifting to workers by employers covering health insurance.

The backstory of health spending growth for the next decade begins with what’s happened since the 2008 Recession: a slowdown in medical spending due to lagging economic growth, coupled with the advent of the Patent Cliff and expansion of generic drugs available for low retail prices at the pharmacy and increasing cost-sharing requirements for privately-insured people via high-deductible health plans and risk-shifting to workers by employers covering health insurance.

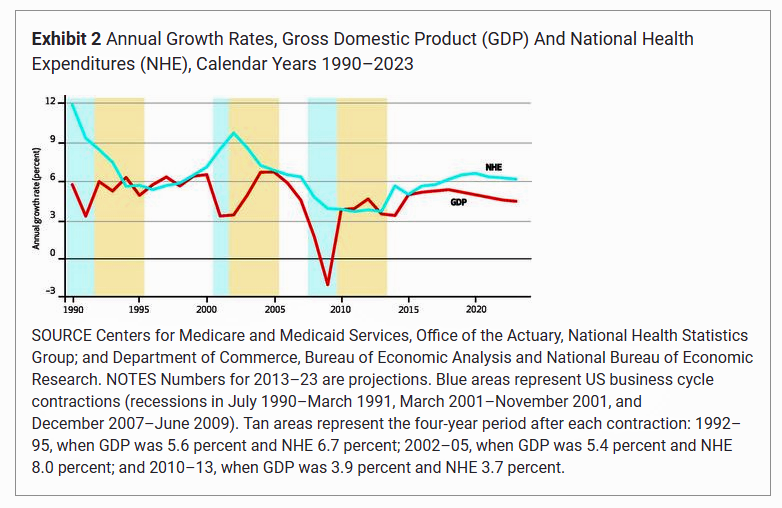

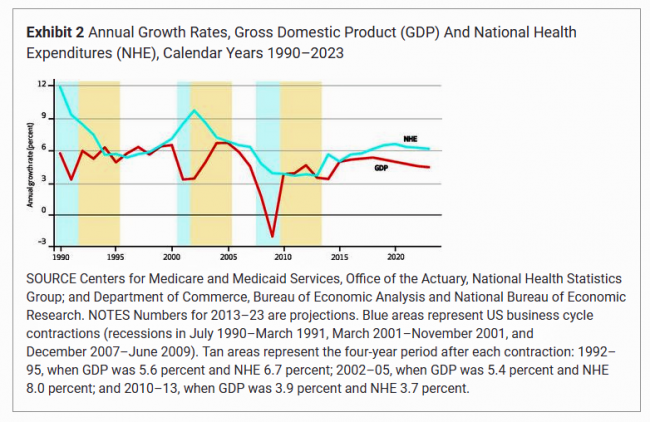

The chart illustrates that while costs may be growing more slowly than historic medical spending growth, the rate is still greater than the general economic growth projections. Looking forward, costs are expected to increase faster due to the relatively high costs of specialty drugs; the CMS team calls out “expensive new hepatitis C treatments [are] expected to contribute to an acceleration of drug spending growth in 2014,” for example.

CMS expects that cost growth in private health insurance premiums will accelerate to 6% in 2014 up from 3.1% in 2013, as more people enroll in insurance plans and rev up utilization of services. Costs will continue to increase in the years up to 2023 with expected economic growth leading to increases in private insurance enrollment (as business conditions improve) and rising demand for health goods and services.

“The projected growth would have been higher,” CMS writes, “but it is dampened slightly by other factors….some large employers of low-wage workers are expected to stop offering health insurance, resulting in employees’ moving the Marketplace plans or Medicaid or becoming uninsured.” In addition, CMS projects higher deductibles for insured people will offset cost-growth.

Health Populi’s Hot Points: The new patient engagement is health financial engagement. CMS asserts that one of the factors slowing down health care cost growth is the rise of high-deductible health plans and the risk-shift to consumers having more financial skin-in-the-healthcare-game. At the same time, the Health Affairs forecast notes that “consumers are expected to have contineud to limit their use of health care services.”

Furthermore, the authors add, “The impacts of reform on the behavior of consumers, insurers, employers, and providers will continue to unfold throughout the projection period and beyond.”

Consumer health spending behavior is increasingly including line items not covered in the official definition of CMS as listed in the first paragraph of this post. People are going HealthDIY in managing health through food, retail health channels, caregiving that’s not explicitly recognized in health spending accounts (although makes up a large and growing piece of the health “grey” market value), and other home-based strategies — largely done to stay ‘out’ of the health care system. In this way, people are mitigating risks — financial, clinical (think: hospital-borne infections and medical errors), and even social in terms of potential stigma (for, say, depression, sexually transmitted disease, or other real-life issues that people don’t want recorded in a digital health record).

In this context, way more than $1 in $5 is spent on health in America. As consumers get increasingly health engaged, expect people to opt-out and project-manage health both within and outside the health system for personal risk management in all respects.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.