Nearly 1 in 2 people own at least one wearable device, up from 21% in 2014; one-third of people own more than one such device that tracks some aspect of everyday life, according to PwC’s latest research on the topic, The Wearable Life 2.0 – Connected living in a wearable world, from PwC.

Wearable technology in this report is defined as accessories and clothing incorporating computer and advanced electronic technologies, such as fitness trackers, smart glasses (e.g., Google Glass), smartwatches, and smart clothing.

Specifically,

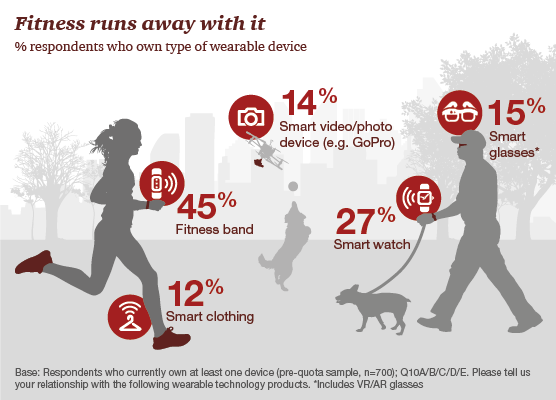

- 45% of people own a fitness band, such as a Fitbit, the most popular device in this category and overall the most popular wearable segment among all consumers across gender, age, and socioeconomic status

- 27% own a smartwatch (more adopted by people 35-49 years of age)

- 15% own smart glasses, including VR/AR glasses (virtual reality or augmented reality)

- 14% have a photo device or smart video, such as GoPro

- 12% wear smart clothing, sensor-embedded textiles, on their body.

What’s motivating people to buy and use wearable tech is, first and foremost, health, PwC found. Wearable tech helps us exercise smarter, agreed 82% of consumers using the technology, helps parents keep kids safe (73%), improves personal accountability (69%), and makes us more efficient at home and work (65% and 63%, respectively).

The most important motivators people look to use wearables include:

- Monetary rewards, for 54% of consumers

- Gaming features to compete and socialize with others, 45%

- Providing information not otherwise available, 45%

- Allowing a consumer to cut back on spending, 44%

- Apps and features that reward loyalty points, 43%

- A fashion statement: “looks good,” an important part of my wardrobe, 36%.

A growing market for wearable tech is among companies sponsoring wellness programs: Gartner estimates that 2 million employees will be required to wear health tracking devices as a condition of employment in 2018. And consumers seem largely amenable to this requirement when the device is subsidized by their employer: two-thirds of consumers say, “My company should pay for my wearable,” especially among Millennials and men.

The most excitement and trust for wearables are found via the doctor’s office: 65% of consumers would be excited about the possibility of a wearable tech coming from the doctor, with 41% of people trusting this source. That’s the high watermark for excitement and trust, followed closely by hospitals, then health plans. Trust would be low with a device coming from a cellphone provider, entertainment company, teacher, travel agent, cable company, or car company.

PwC surveyed 1,000 online consumers in March 2016 for this research.

Health Populi’s Hot Points: The number one factor justifying a consumer’s purchase of a wearable is….price, price, and price. This is coupled with the secondary factor: the consumers’ uncertainty about their potential use of the wearable tech. Privacy is not a primary deterrent compared with price and perceived utility of the device.

This is the value equation for wearables: affordability and utility. Utility has to do with helping bolster personal health, along with helping “me” be productivity and providing me information that’s important to me.

Lowering health insurance premiums, earning loyalty points for dollars via pharmacies and retailers, drive value and ongoing use of wearable tech.

So does helping support weight loss, with fully 63% of consumers pointing to this health issue.

Value is in the eye of the beholder when it comes to consumers and wearable tech. But price — that is, the consumer’s out-of-pocket direct cost for the device — ranks first in that equation.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...