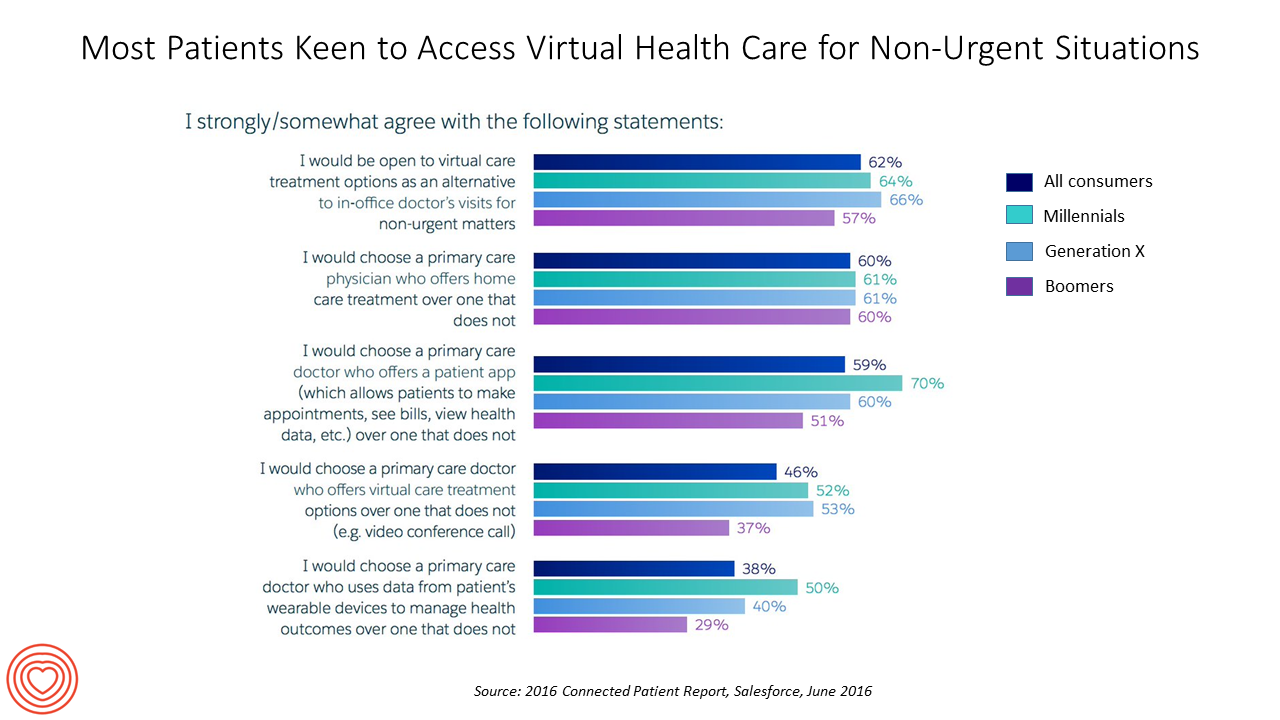

About two-thirds of health consumers would be open to virtual health care options for non-urgent situations, according to the 2016 Connected Patient Report from Salesforce Research.

About two-thirds of health consumers would be open to virtual health care options for non-urgent situations, according to the 2016 Connected Patient Report from Salesforce Research.

Salesforce conducted the survey with the Harris Poll online among 2,025 U.S. adults in June 2016. 1,736 of these health consumers had health insurance and a primary care physician.

Among the many findings in the report, Salesforce found that:

In terms of communications and relationship…

- The vast majority of consumers with primary care physicians are very satisfied with them (91% of people with PCPs)

- However, one-third of people with a PCP believe their physicians would not recognize them “walking down the street”

- 3 in 4 consumers make appointments with their physicians via telephone (across all generational cohorts)

- 9% of consumers use a health portal to make appointments, led by Millennials at 13%

- Looking at personal health data (for medical records and lab results, for example) happens most frequently in-person, among 36% of health consumers, and via portal, by 29% of consumers (equal across generations)

- Checking insurance coverage happens most frequently via phone and in-person

- When it comes to keeping track of health records, two-thirds of consumers rely on the doctor, and 29% keep records in a paper medium (e.g., folder, shoebox, lockbox, drawer, or other home-based storage)

- 62% of health-insured patients rely on their doctors to manage their data, while 29% — including 35% of Baby Boomers (ages 55+) — keep their records in a home-based physical storage location like a folder or shoebox.

Regarding telemedicine and home health…

- Two-thirds of PCPs provide consumers at least one virtual care service

- 28% provide email access

- 10% provide communication through a mobile health app

- Two-thirds of consumers are open to virtual care treatment options as an alternative to in-office visits for non-urgent situations

- 60% of consumers say they would choose a PCP who offers home care treatment over one that doesn’t; 60% would also choose a doctor that offers an app or online service or portal to make appointments, see bills, view data, and other health information tasks versus a physician who did not offer such services

- The key reasons consumers would be keen to access virtual care are convenience (among 74% of people), scheduling ease (52%), managing risks from being exposed to sick patients (33%), privacy (for 27%), and not liking to go to the doctor’s office (among 26% of consumers).

For wearable health technology…

- About 1 in 4 consumers owned a wearable tracking device: 39% of Millennials did, compared with 26% of Gen X consumers and 20% of Boomers

- Among people who owned wearable technology, 78% of consumers would want their doctors to have access to their health data generated by the device, and 62% of people would choose a PCP who would use data from the device to help manage health outcomes versus a doctor who would not. There wasn’t a huge difference in the proportion of Millennials (83%) who liked this idea compared with Boomers (74%)

- In the last 12 months, 55% of consumers owning a wearable tracking device said they wore it daily

- 90% of consumers who used at least one fitness app said they’d like their healthcare, nutrition and/or fitness apps to be able to integrate and share data together

- 50% of consumers said they would be likely to use a wearable health tracking device given to them by their health provider to support managing their health for access to all their health data provided by the device

- Similarly, 53% of consumers said they’d likely use a wearable health tracking device given to them by their insurance company in exchange for potentially better insurance rates based on data provided by the device.

This look into consumers’ collective interest in connecting with health providers shows some real differences from recent polls that found larger gaps between younger and older consumers. There are fewer pronounced disparities between Millennials and Boomers in this survey compared with others covered here in Health Populi in the past few years.

Health Populi’s Hot Points: Salesforce launched its Health Cloud last year, promoting “Patient relationships, not records” in its tagline, because, as Salesforce says, “Patients no longer have patience.”

Health Populi’s Hot Points: Salesforce launched its Health Cloud last year, promoting “Patient relationships, not records” in its tagline, because, as Salesforce says, “Patients no longer have patience.”

I say “Amen” to that, and perhaps one reason is because all patients are dealing with greater out-of-pocket costs, insurance hassles, and information gaps (and gaffes) in U.S. healthcare. More skin in the game of health care is translating into less patience and higher expectations for customer service, which is one of Salesforce’s callouts and a strong rationale for the Health Cloud.

As the patient continues to morph into the payor for healthcare, they demand (in the economic sense) the kinds of information, tools, and services required to manage their financial risk, as well as clinical support for self-care in-between hands-on care with their clinicians. While the clinicians are beloved, as shown in the Salesforce survey, people (who don’t view themselves as patients 24/7) seek virtual care alternatives in real life. Salesforce’s Health Cloud, which leverages important wonky information integration features like FHIR standards and HL7 interfaces, can (potentially) bring a streamlined experience to patients and their physicians. As I asserted in a post last week on the potential for platforms in health/care, this is what health consumers seek. Salesforce looks to be part of that scenario.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.