![]()

1 in 3 consumers track health or fitness via an app, wearable technology, or smartwatch, according to GfK’s global survey on Health and fitness tracking published in September 2016. The key reasons people monitor health or fitness are to maintain or improve physical condition/fitness (for 55%) and to motivate oneself to exercise (for 50%), across the 16 countries GfK surveyed.

Improving energy level, feeling motivated to eat and drink more healthfully, improving sleep, making tracking part of a daily routine, losing weight, and being more productive were cited as reasons to health-track by at least one-fourth of health citizens globally.

![]()

Underneath the global 1-in-3 stat are national comparisons, ranging from a high of 45% of people in China who are tracking health or fitness, to a low of 10% in The Netherlands. In the U.S., GfK gauged that 29% of Americans track health via some form of technology, roughly the same percentage of health citizens as in Brazil and Germany (29% and 28%, respectively). Health and fitness tracking rates by country polled by GfK are shown in the second image.

In the U.S., 29% of people currently health-track and 16% say they have in the past, but aren’t doing so at present. 27% of women in the U.S., and 32% of men, track health or fitness via technology.

The most prevalent age cohort doing digital health tracking is among Americans age 30-39 years of age, 46% of whom monitor health via tech. 44% of Americans 20-29 years old track, and 25% of people 40-49 do so. In the U.S., 17% of people 50-59 and 60 years of age and over track health via digital means, GfK found.

GfK’s global lead for wearables research, Jan Wassmann, concluded that, “health and fitness monitoring (has attracted) much wider groups than just the obvious young sports players.”

Health Populi’s Hot Points: GfK is right to point out that health and fitness monitoring, and interest in the use of digital health tools, is reaching well beyond the young and buff. Recent research has shown that people in every age cohort, from the oldest to the youngest, are interested in the convenience, access, and empowerment that digital health tools can offer — although the types of tools consumers favor vary by segment, and it’s not always as simple as analyzing gender and age.

Health Populi’s Hot Points: GfK is right to point out that health and fitness monitoring, and interest in the use of digital health tools, is reaching well beyond the young and buff. Recent research has shown that people in every age cohort, from the oldest to the youngest, are interested in the convenience, access, and empowerment that digital health tools can offer — although the types of tools consumers favor vary by segment, and it’s not always as simple as analyzing gender and age.

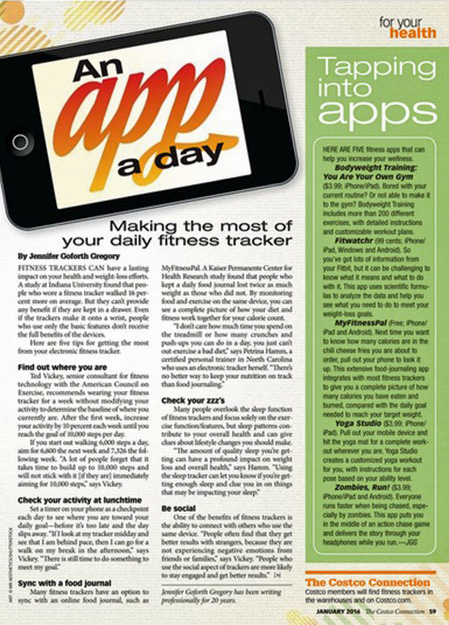

This ad, published in Costco’s publication The Costco Connection in January 2016, talks to the retailer’s mainstream consumers about “making the most of your daily fitness tracker,” and “tapping into apps.” Health and fitness tracking is now mainstream. As we enter the 2016 holiday season, expect Black Friday and Cyber Monday specials from the likes of Fitbit, Fossil, Garmin, Withings and other competitors in the space to channel well-priced digital health devices for gifting to loved ones…who will be shopping at Costco, Best Buy, Dick’s Sporting Goods, Target, Walmart, and other less traditional retailers who will ride the health-wearables wave. The 2017 CES in Las Vegas will meet just days after the trackers are unwrapped and synced, unveiling even more shiny new digital health techs embedded with more sensors and capabilities like heart function and better sleep.

These devices are a means to an end, which is to get to a more mindful place when it comes to personal health and wellness. As with most S-curves for technology adoption and diffusion, it’s tended to be the young or the tech-savvy who are early adopters; for consumer health-tech, the analog is the fittest and the strongest. But for digital health tech in late 2016, we can expect older, more female, and less athletic folks to take up new digital health tech with an eye toward New Year’s health improvement on 1 January 2017.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...