In the U.S., peoples’ expectations of their health care experience is melding with their best retail experience — and that’s taken a turn toward their digital and ecommerce life-flows.

In the U.S., peoples’ expectations of their health care experience is melding with their best retail experience — and that’s taken a turn toward their digital and ecommerce life-flows.

The American Customer Satisfaction Index Insurance and Health Care Study 2020-2021 published today, recognizing consumers’ value for the quality of health insurance companies’ mobile apps and reliability of those apps.

Those digital health expectations surpass peoples’ benchmarks for accessing primary care doctors and specialty care doctors and hospitals, based on ACSI’s survey conducted among 12,274 customers via email. The study was fielded between October 2020 and September 2021.

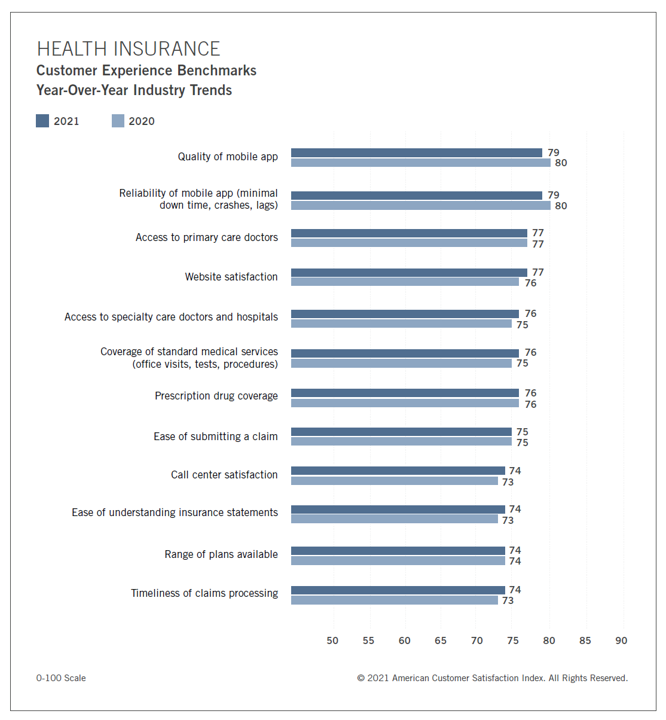

Year on year, few experience benchmarks significantly shifted between 2020 and 2021, the first bar chart shows.

Other key experience metrics for health insurance companies address the website, coverage of services, prescription drug coverage, ease of claims submission, experience with the call center, ease of understanding statements, range of available plans, and timeliness of claims processing.

The study also gauged consumers’ satisfaction with ambulatory care and hospitals, whose benchmarks barely shifted between 2020 and 2021:

- Inpatient care remained flat at an index of 70

- Outpatient care inched up from 73 to 74

- Emergency room experience stayed at an index of a (low) 66.

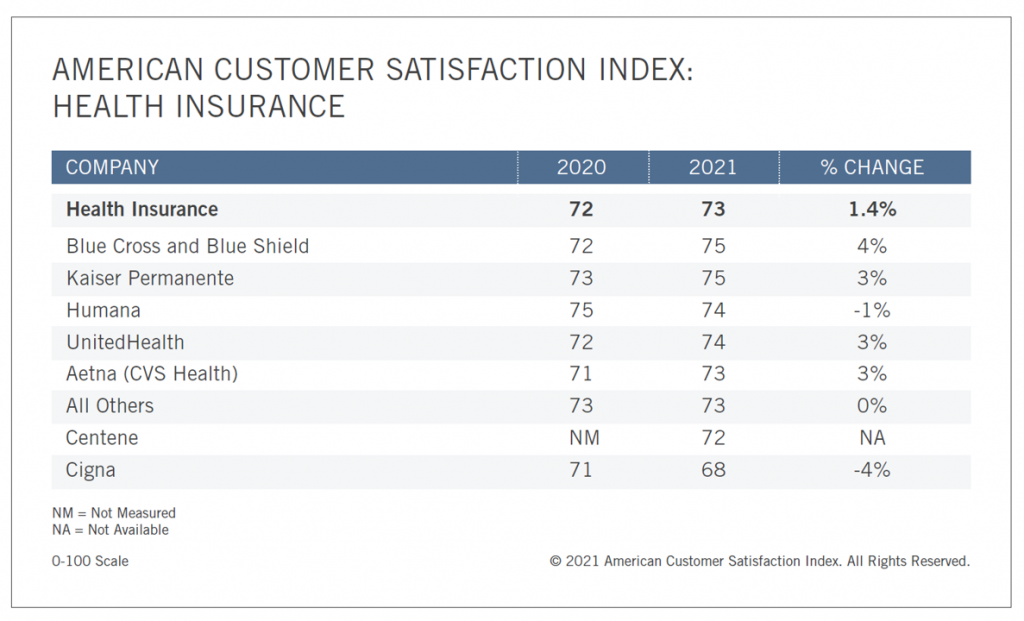

Health consumer satisfaction scores with health plans average out at 73 on the ACSI index in 2021, up slightly from 2020. This varied by health insurer, with the Blue Cross and Blue Shield brand (rising 4%) and Kaiser Permanente (rising 3%) tops at 75, followed by Humana and UnitedHealthcare a point lower at 74.

Health consumer satisfaction scores with health plans average out at 73 on the ACSI index in 2021, up slightly from 2020. This varied by health insurer, with the Blue Cross and Blue Shield brand (rising 4%) and Kaiser Permanente (rising 3%) tops at 75, followed by Humana and UnitedHealthcare a point lower at 74.

Cigna fell the most in this health plan field, dropping from the index of 71 in 2020 to 68 in 2021.

All other plans landed at 73.

The ACSI study covering health care annually includes property & casualty insurance as well as life insurance companies. For comparison,

- P&C insurance companies average a satisfaction index at 78, led by GEICO and State Farm at 79 in 2021

- Life insurance companies garnered a satisfaction index overall at 78, with Allstate and State Farm at 79.

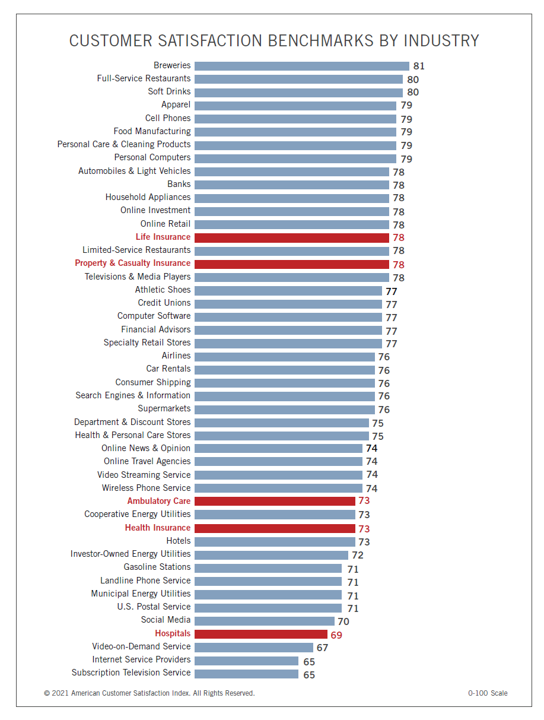

Health Populi’s Hot Points: Consumers’ health care experiences rank relatively lower than peoples’ satisfaction with grocery stores, full-service restaurants, soft drink brands, mobile phones and personal and home cleaning care, ACSI found. This last table organizes that data by consumer-facing industry for 2021.

Health Populi’s Hot Points: Consumers’ health care experiences rank relatively lower than peoples’ satisfaction with grocery stores, full-service restaurants, soft drink brands, mobile phones and personal and home cleaning care, ACSI found. This last table organizes that data by consumer-facing industry for 2021.

Health insurance experience ranks in line with hotels and just above gas stations, landline phone services, and the US Postal Service. Hospitals sit between social media and video-on-demand services, just above internet service providers and subscription TV at the bottom of consumers’ industry sector experiences.

One of the most interesting career news items in our field I recognized this month was Dr Adrienne Boissy’s announcement that she was leaving her long-time leadership role at Cleveland Clinic as Chief Experience Officer, to take a Chief Medical Officer position with Qualtrics, the consumer experience company.

Qualtrics’ press release discussing Dr. Boissy’s appointment would “help industries, including healthcare institutions, deliver exceptional experiences for patients, customers and employees.”

Aside from the fact that I’m very excited for Dr. Boissy on a personal level for career development and a fascinating new chapter, I’m energized and hopeful that this is a milestone for the health care industry recognizing the importance of experience design for patients, caregivers, and staff (with burnout at a high).

Design-thinking in health care has several important lenses:

- In the U.S., the financial experience in health care is front-of-mind for health care consumers

- The clinical experience is central — note Philips new Pediatric Coaching experience for children undergoing imaging encounters

- The administrative work-flows for patients are also big influences on the experience, recognizing the importance of the mobile app for health plans in the ACSI survey findings

- Finally, privacy-by-design and health data access has emerged as a growing patient and caregiver demand.

As experienced experience leaders like Dr. Boissy scale their expertise across the health care ecosystem, we could see hospitals and health plans move up the consumer satisfaction index to rival the likes of our favorite grocers and banks. As patients continue to morph into health consumers paying more out-of-pocket facing greater financial risk and administrative flows via digital on-ramps, their medical lives are blurring into an evolving retail health ecosystem.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...