“Health is the cornerstone to our core needs, thereby the cornerstone to trust.”

So wrote Kirsty Graham, Global Leader of Sectors and Global Chair of Health at Edelman, in an essay explaining the 2022 Edelman Trust Barometer.

If it’s January, it must be time for the World Economic Forum in Davos, the annual setting for Edelman’s launch of the company’s Trust Barometer. While WEF is mostly virtual this year due to the pandemic, Edelman has released the survey of global citizens’ views on trust in institutions right on-time and in full and sobering detail.

If it’s January, it must be time for the World Economic Forum in Davos, the annual setting for Edelman’s launch of the company’s Trust Barometer. While WEF is mostly virtual this year due to the pandemic, Edelman has released the survey of global citizens’ views on trust in institutions right on-time and in full and sobering detail.

I welcome and dig into the Edelman Trust Barometer every year, and put on my health/care lens when reviewing its findings. In this Health Populi blog, I’ll cover the global results and some of the granular health-related nuggets I can divine from this overall world-view. [Edelman usually releases a specific health industry deck some weeks after the initial Trust Barometer publication, which I will cover as soon as the data are available],

I welcome and dig into the Edelman Trust Barometer every year, and put on my health/care lens when reviewing its findings. In this Health Populi blog, I’ll cover the global results and some of the granular health-related nuggets I can divine from this overall world-view. [Edelman usually releases a specific health industry deck some weeks after the initial Trust Barometer publication, which I will cover as soon as the data are available],

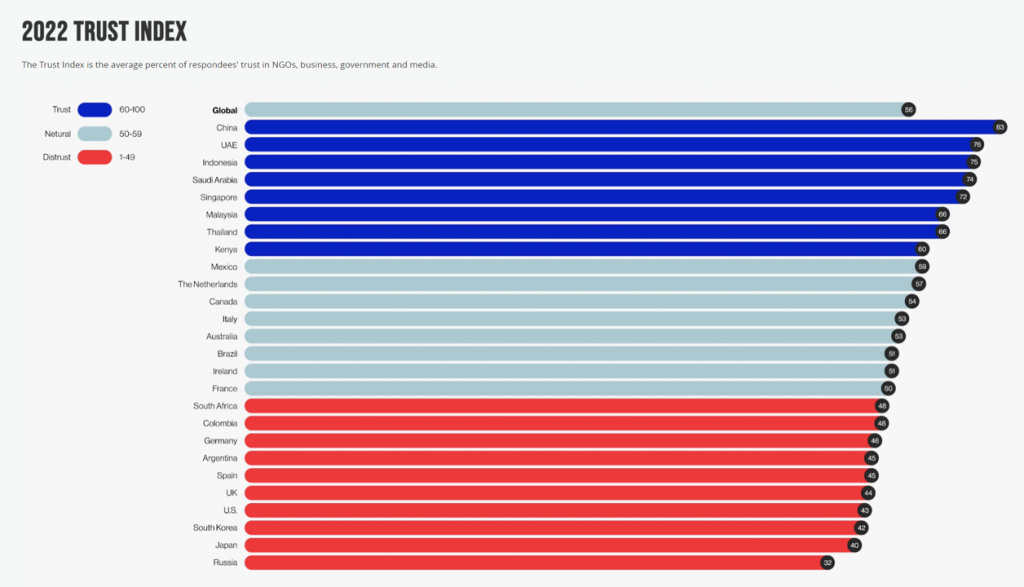

Overall, peoples’ trust across the world in NGOs, business, government, and media, has stayed relatively flat over 2021 levels, the bar chart illustrates at the top-line. Citizens’ trust levels grew in China, UAE, Indonesia, Saudi Arabia, and Singapore, among other countries.

But among Americans, trust fell to levels shared with other un-trusting residents of the U.K., South Korea, Japan, and Russia — bottom-most in this list at a low of 32 versus 43.

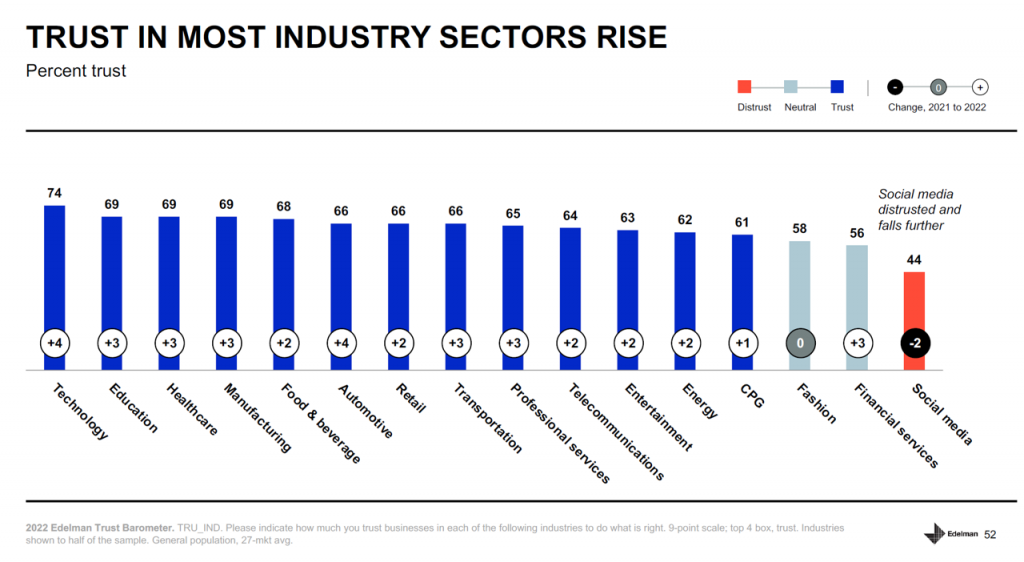

This year as last, business garners the greatest trust versus NGOs, government, and media. Trust increased in most industry sectors, most markedly in technology, education, healthcare, and manufacturing, shown in the bar chart. [This is a global statistic that I look forward to exploring for the U.S. and Europe later].

This year as last, business garners the greatest trust versus NGOs, government, and media. Trust increased in most industry sectors, most markedly in technology, education, healthcare, and manufacturing, shown in the bar chart. [This is a global statistic that I look forward to exploring for the U.S. and Europe later].

The only declining industry segment here was social media, falling over the year. It holds the distinction of being the sole distrusted industry over all sectors Edelman looked at, falling below fashion and financial services which in 2022 sit in “neutral” trust space.

Through the health citizens’ lens, its useful to call out technology, food & beverage, retail, among others that are increasingly part of a consumer’s health/care ecosystem for self-care at home.

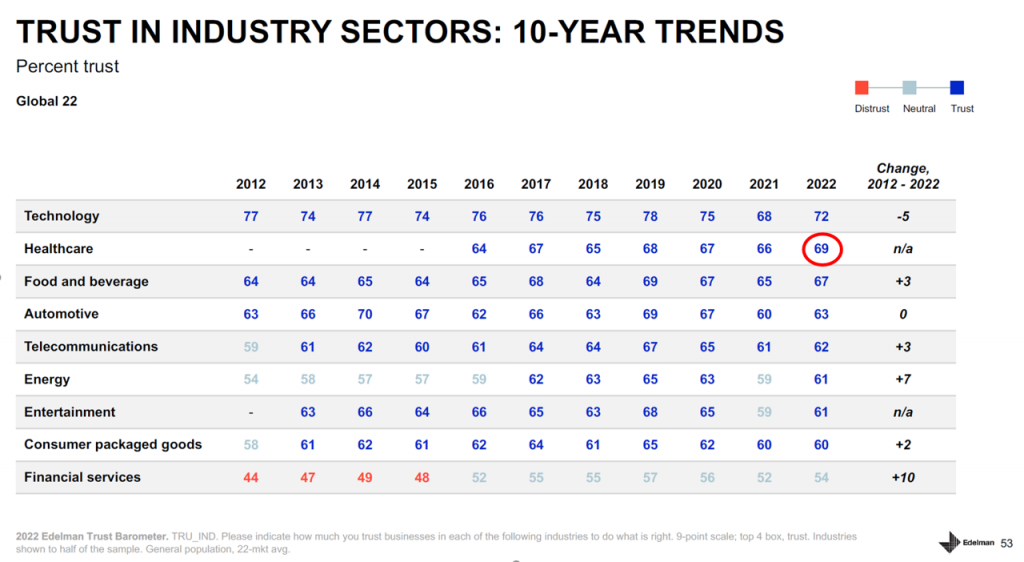

The trending of these industry segments over time is also important to understand, with the pandemic certainly shifting citizens’ perspectives of different business types.

The trending of these industry segments over time is also important to understand, with the pandemic certainly shifting citizens’ perspectives of different business types.

For healthcare, trust hit a 7-year high in the Trust index at 69, the highest level since 2016 and gaining 3 points over 2021. Tech gained 4 points in the index over 2021, and automotive increased by 3 in the Barometer since last year. [Cars have become a vehicle, literally, for liberating oneself from one’s working-and-living-at-home, allowing a person to escape to another town, vacation, or simply taking a drive with an open window and radio blasting tunes to help manage stress and get away from the home base].

Over the year, every business’s trust level rose or stayed flat, further demonstrating consumers trust equity with business versus the 3 other institutional segments studied.

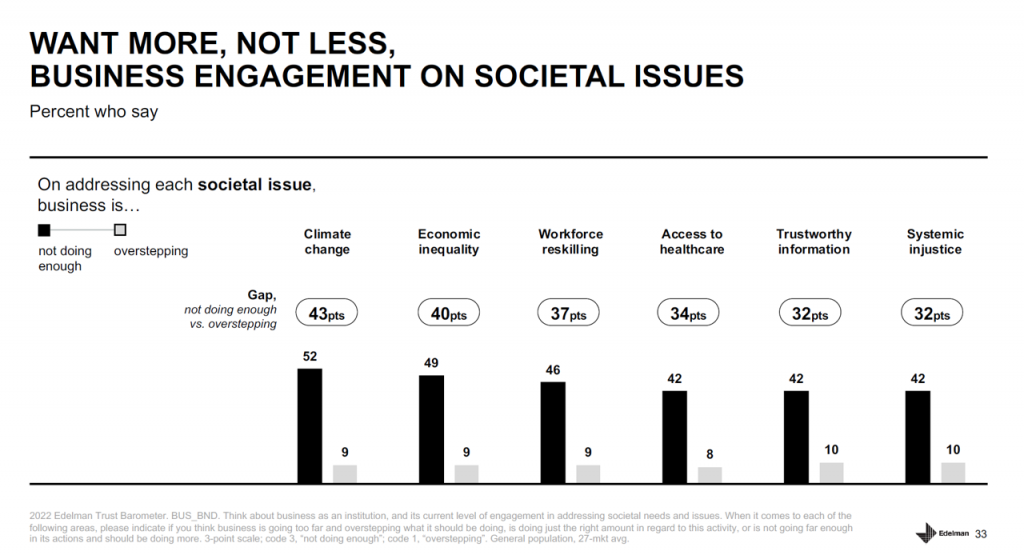

Given peoples’ lack of trust in NGOs, government, and media, citizens around the world are looking for business to engage more on societal issues such as climate change, income inequality, jobs, systemic injustice, and to be sure, access to healthcare.

Given peoples’ lack of trust in NGOs, government, and media, citizens around the world are looking for business to engage more on societal issues such as climate change, income inequality, jobs, systemic injustice, and to be sure, access to healthcare.

There is a 34 point different in people believing the private sector should be doing more to help address access to health care, with only 8 percent of people saying industry is “overstepping” compared with 42% of consumers believing business is “not doing enough” to expand access to healthcare.

The 2022 Edelman Trust Barometer was fielded in November 2021 among over 36,000 respondents in 27 countries. Some 1,150 U.S. adults were included in the study, now in its 22nd year.

Health Populi’s Hot Points: It’s clear that globally, health citizens seek greater private sector involvement in health care to help address access.

Health Populi’s Hot Points: It’s clear that globally, health citizens seek greater private sector involvement in health care to help address access.

We’ve seen the growing brand-equity for vaccine “brands” during the pandemic — in particular, for Pfizer, Moderna, and AstraZeneca, found in consumer research conducted since the emergence of COVID-19 around the world.

Thus it’s important to look at the 2022 Edelman Trust Barometer data point on trusted societal leaders — noting that scientists and employers garnered the most trust compared with other types of leaders.

At the same time, trust in the World Health Organization and national health authorities ranked fairly low among U.S. citizens compared with people living in most other countries. In the U.S. trust in the WHO fell by 5 points versus 2021 levels, and trust in national health authorities dropped 4 points versus 2021.

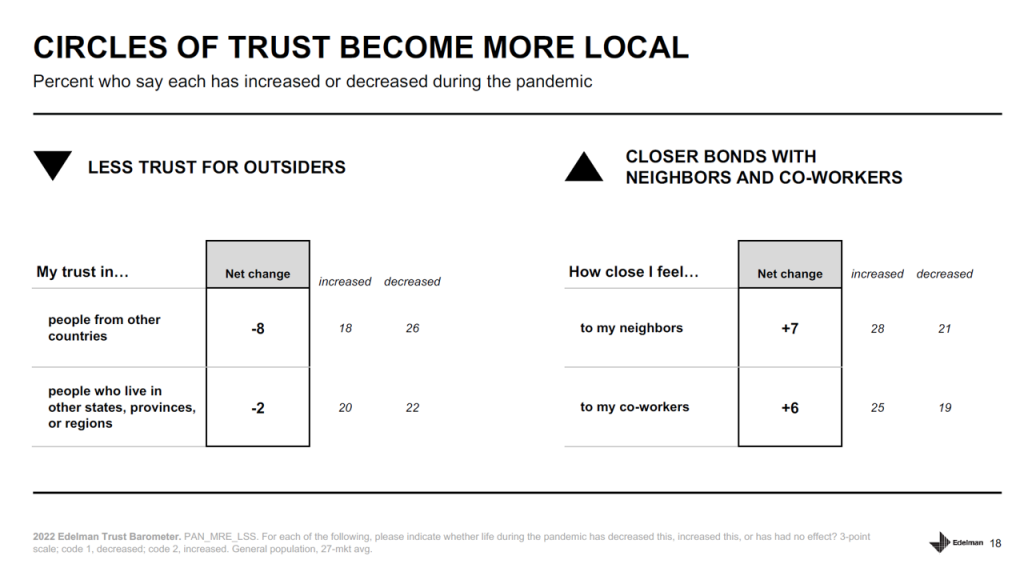

I’ll leave you with one last thought for health/care based on the data we have from Edelman’s 2022 Trust Barometer. The last chart shown here, from the study, notes that “circles of trust become more local.”

I’ll leave you with one last thought for health/care based on the data we have from Edelman’s 2022 Trust Barometer. The last chart shown here, from the study, notes that “circles of trust become more local.”

The health/care opportunity here is that health citizens trust “my neighbors” and “my co-workers,” as well as “My CEO,” that is, the leader of the organization for/with whom I work.

This more localized, close-to-home circle of trust can extend to the local hospital and health system, health plan, and retail health channel. For the latter, grocery stores (especially those with co-located pharmacies and health programs) and neighborhood pharmacies and retailers (e.g., Walmart) became essential, highly-valued health destinations.

We are in the midst of living through the emergence of CVS Health’s primary care strategy, Walgreens’ expansion of VillageMD clinics, Walmart’s health center refinements, and proliferating new models for primary care (for both commercial and public-health plan members). The 2022 Edelman Trust Barometer Data should bolster these retail health and primary care organizations’ confidence in health care plans that move care closer and closer to peoples’ homes and communities to engender that local “circle of trust.”

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...