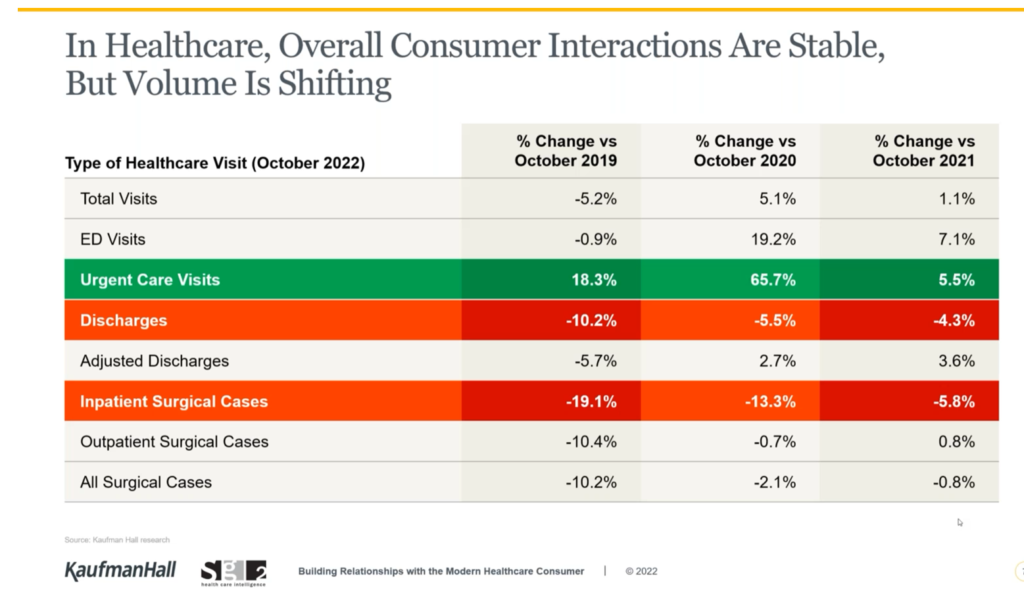

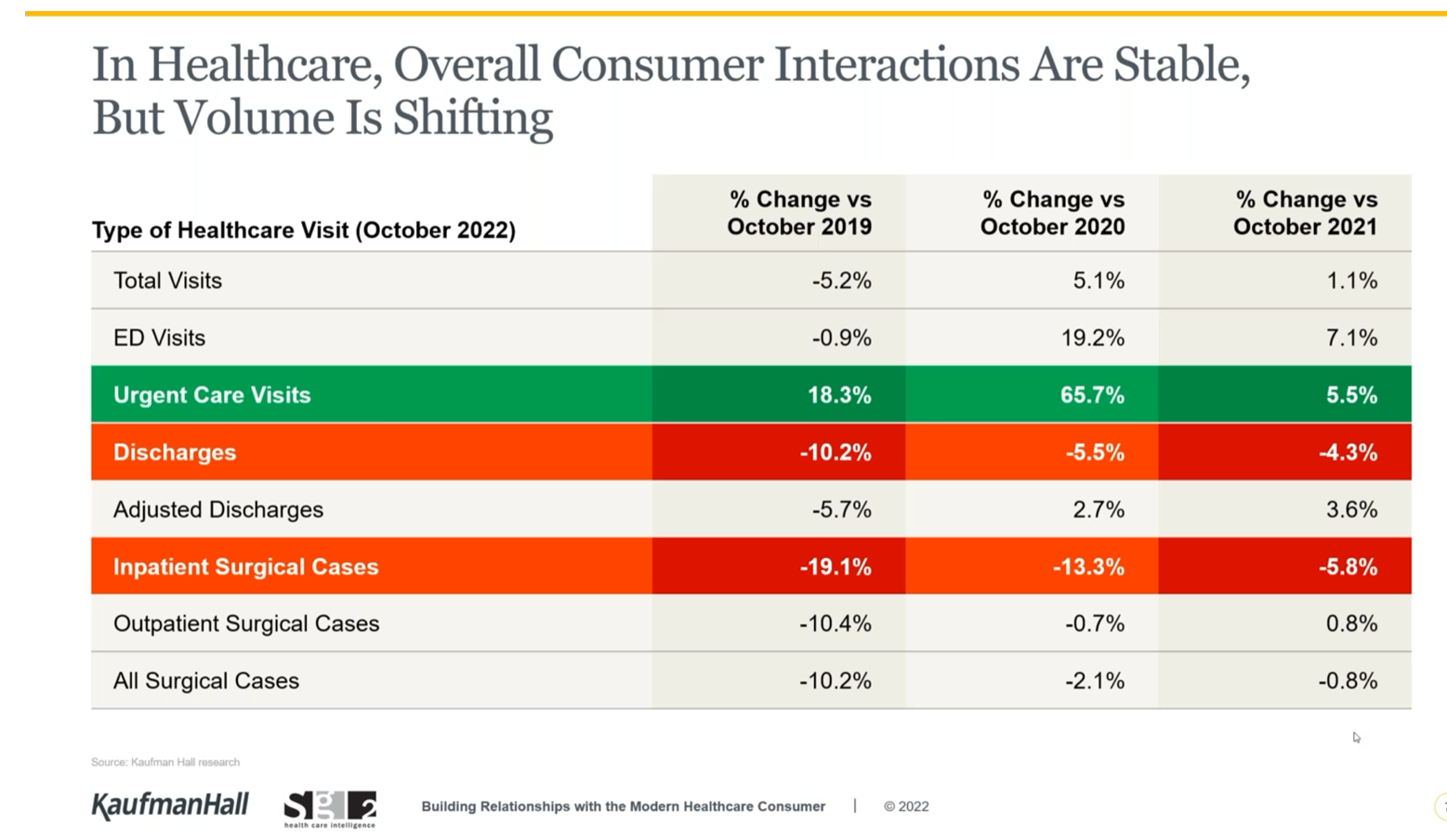

While overall U.S. consumers’ utilization of health care has been pretty stable, the type of visit encounters is shifting away from hospital inpatient cases to ambulatory care, urgent and retail health care sites, data from Kaufman Hall and Sg2 tell us.

The companies shared insights in a session on Building Relationships with the Modern Healthcare Consumer last week, warning that hospitals are facing economic challenges with implications on how they should engage and interact with patients in the coming months and years.

Wearing a consumer-centric lens, Dan Clarin of Kaufman Hall and Charlotte Brown-Zalewa of Sg2 tracked the patient-journey from lower-acuity virtual health and primary care through to imaging, specialty care, hospital outpatient and high-acuity large hospital inpatient services. The fastest growth over the next 3 years will be seen for the virtual health channel (or “front door”) at 17%.

But even at 6% growth for specialty care and hospital inpatient services, acute care providers must “accommodate current patients and bring in the new ones who want to come in,” the consultants recommended.

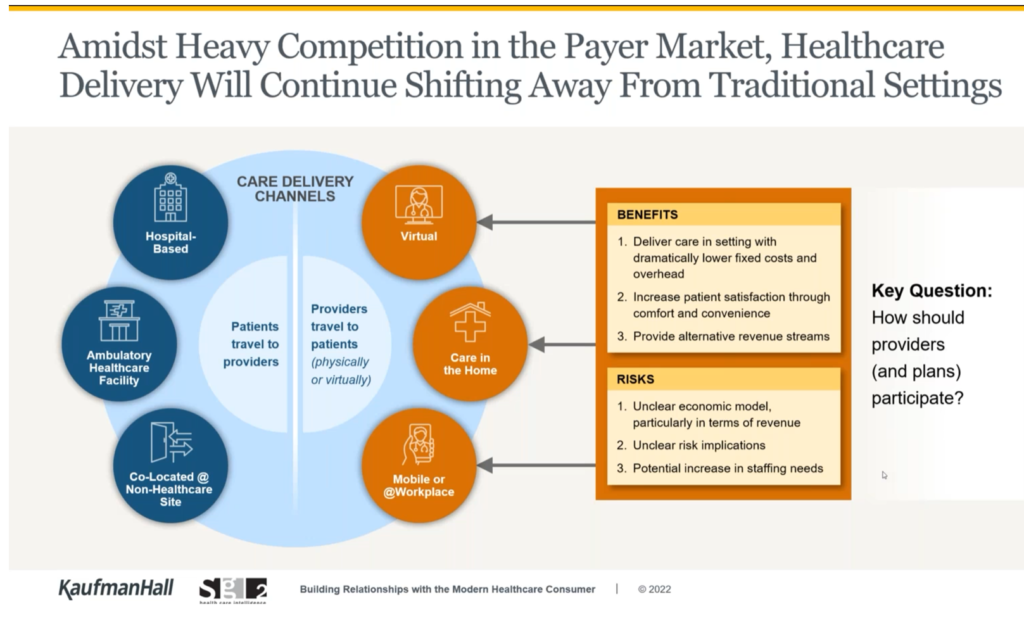

While the economic models are currently unclear — there is no one roadmap for success in the growth of health care omnichannel delivery — services will continue to shift away from traditional settings, illustrated in the second drawing of care delivery channels. On the left side of the channels circle, we see hospital-based, ambulatory, and co-located care at non-healthcare sites where “patients travel to providers.”

On the right side, “providers travel to patients” whether physically or virtually — via telehealth, care in and to the home, via mobile clinicians and vehicles or delivered at the workplace.

What’s clear from this is that “we cannot build it all on our own,” the researchers advised.

Health Populi’s Hot Points: For a couple of decades, our field has talked about “consumer-driven health care,” which in its first iteration was based on shifting more financial “skin in the game,” a financial risk-shift of front-end health care costs to the health plan member in the form of a deductible.

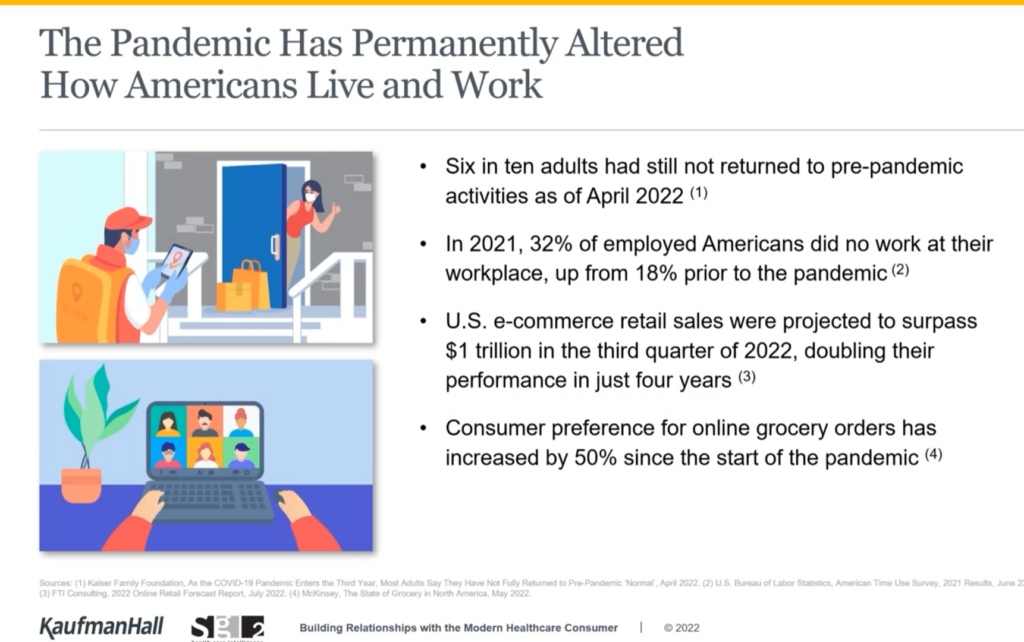

Welcome to a new phase of consumer-driven care, whereby patients-as-consumers are voting with their feet and medical savings or cash in the wallet in favor of a better experience at lower cost. As Dan and Rebecca rightly observed, the pandemic has permanently altered how people live and work, illustrated by the third graphic from their discussion.

Home is indeed where the health is for more patients behaving as health consumers as their personal health and home economics converge in this era of inflation and financial uncertainty. This last graphic comes out of my book Health Citizenship: how a virus opened up hearts and minds, where I tracked the changing patient morphing to health consumer and, eventually for many, health citizens.

The shift to lower cost, more convenient, better designed and friction-less (or less friction-inducing!) sites for care are in demand.

Here, I’m using the word “demand” in the economist’s definition: that is not just sheer “need” but “demand” in terms of a consumer’s willingness-to-pay for a service. When the patient faces a copayment or deductible obligation to meet, that’s real money to a consumer.

So the consumer-facing price as a cost of care becomes akin to a retail spend in that person’s household/family budget.

Thus, issues of ecommerce, grocery shopping, house and energy payments all blur at the kitchen table….and the home as a hub for health.

I’ll be covering #CES23, the Consumer Electronics Show, in early January wearing this lens. Stay tuned to the Health Populi blog, my tweets @HealthyThinker, and my LinkedIn page @Jane Sarasohn-Kahn for more on the Home-Health-Hub and consumer technology innovations we’ll see at the big Las Vegas Convention Center.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...