The challenging financial climate at the start of 2023 is impacting how people, globally, are perceiving, managing, and spending money on health and well-being, based on the latest (Wave 21) Global Consumer Barometer survey conducted by Toluna, a sister company of Harris Interactive.

Globally, one-third of health citizens the world over are confronting greater stress levels due to the higher cost of living in their daily lives.

One in two people say that rising cost of living is negatively impacting their health and well-being.

On the positive side, one in three people believe they will be more satisfied with their personal health and well-being by the end of the year — and as health consumers, expect to spend more money on healthcare, vitamins and supplements, and personal care and hygiene.

I asked Lucia Juliano, who discussed the global findings in a webinar in February, if she could share U.S.-specific data with me for the Health Populi blog and my upcoming talks about health consumers at SXSW and the Virgin Pulse Summit happening in the next month.

Lucia with her team including Esther Ward, and Ian Smith generously put together a special data cut for us to consider, key points of which I share with you here in this Health Populi post.

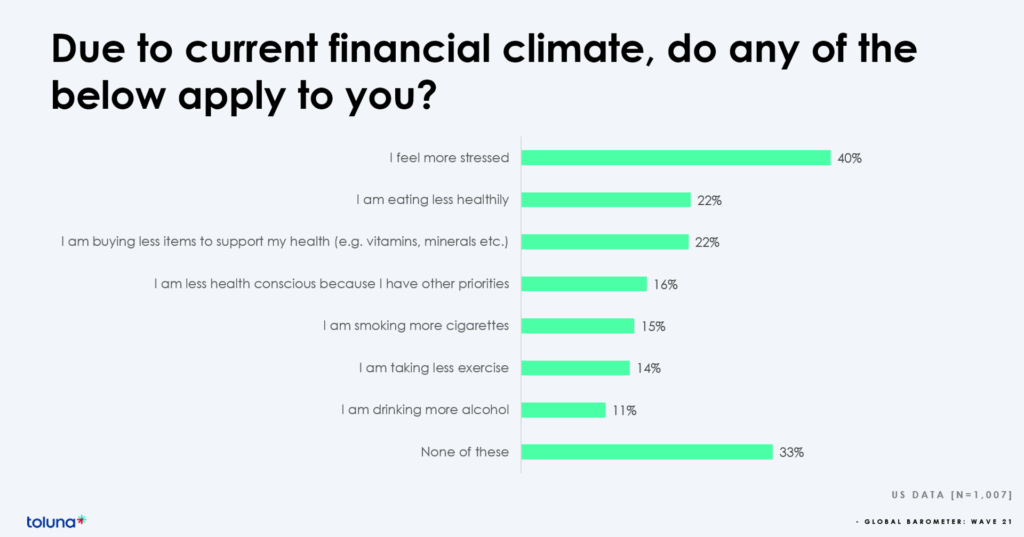

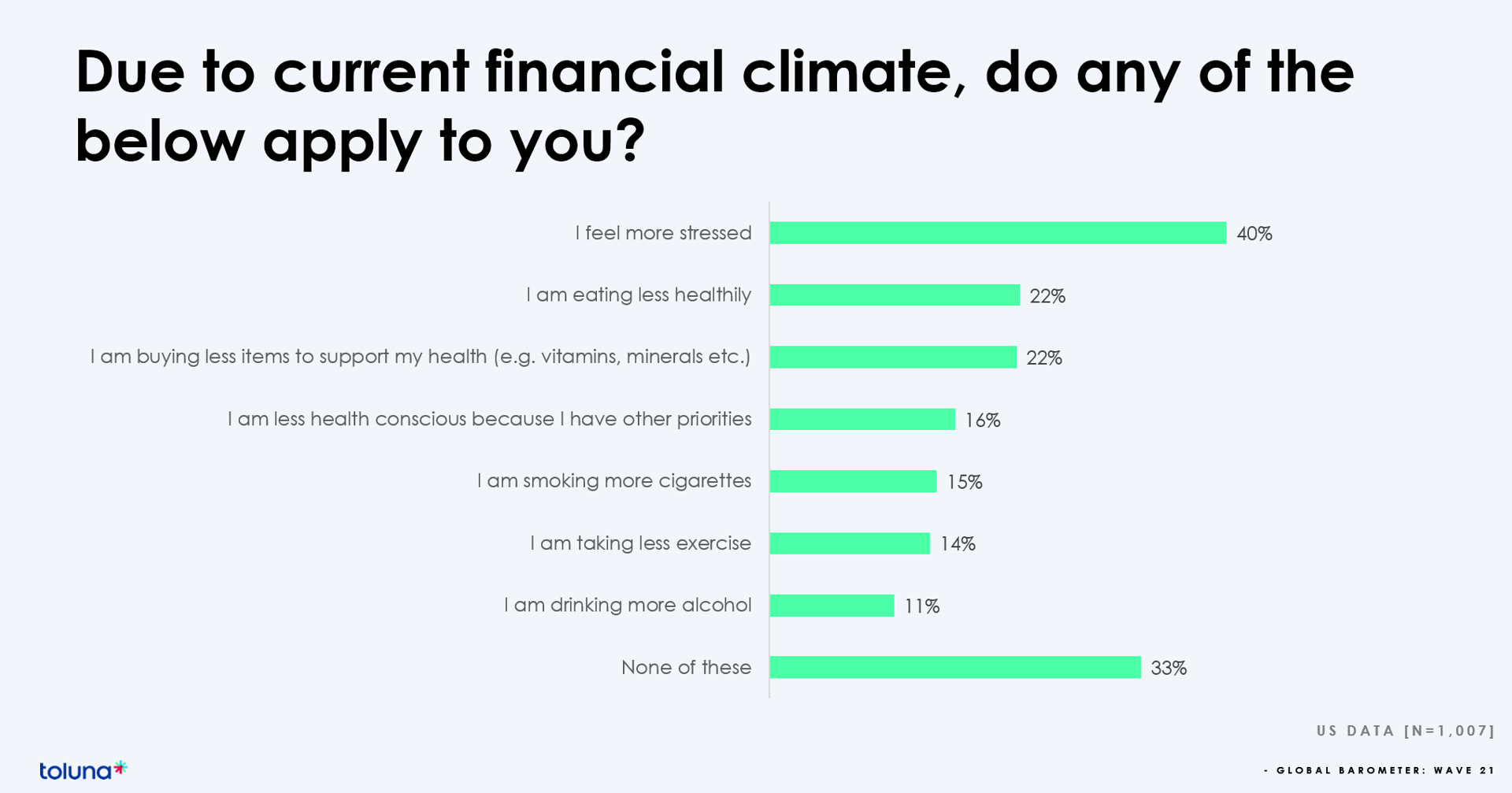

The green-bar chart shows us the U.S. data responding to the question of how the financial climate is re-shaping Americans’ health across physical and behavioral aspects.

Stress is the most common impact shared by U.S. health consumers, followed by eating less healthfully and buying less health-supportive products such as vitamins and supplements.

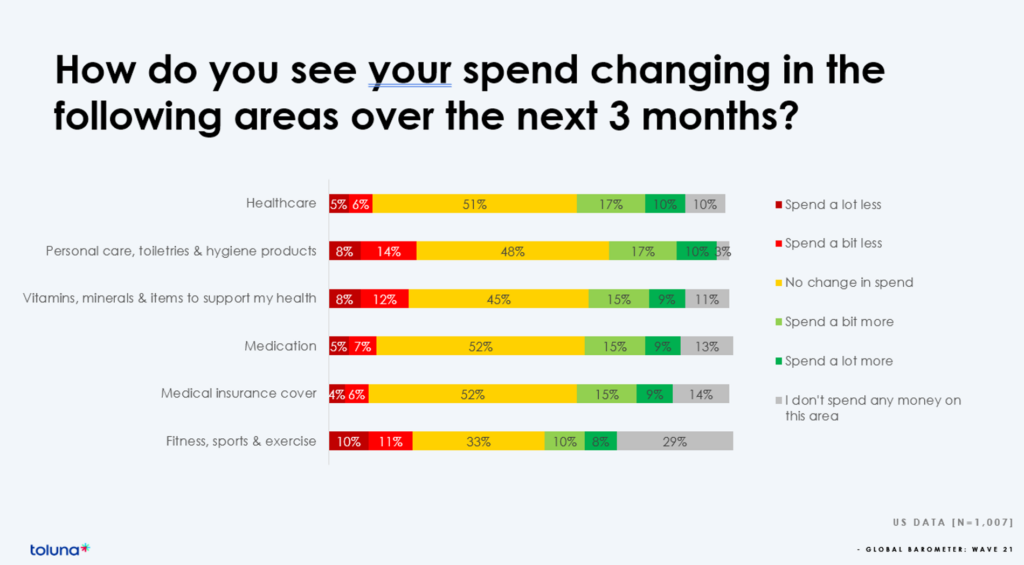

Looking forward to the next few months, 27% of U.S. consumers expect to spend more on health care as well as personal care and hygiene, 24% of folks more on vitamins and minerals to support health as well as 24% on medications and health insurance coverage.

Roughly one-half of U.S. consumers will spend about the same on personal care and hygiene, VMS, meds, and health plans.

Several other granular points to note about U.S. consumers in light of the current fiscal challenges households face:

- 1 in 2 Americans say the rising cost of living is impacting their health and wellbeing

- 21% expect to spend more on fitness, sports and exercise

- 25% expect to spend more on vitamins, minerals and other items to support personal health

- 25% expect to spend more on health care services

- 23% expect to spend more on medications

- 24% expect to spend more on personal care, toiletries and hygiene products

- 22% expect to spend more on health insurance, and,

- 30% of U.S. health citizens are looking for more cost-effective solutions for health, wellness and fitness.

The Barometer’s findings bolster our ongoing appreciation for consumers linking their financial fiscal lives and livelihoods to their physical lives and well-being, continuing to morph people into health consumers.

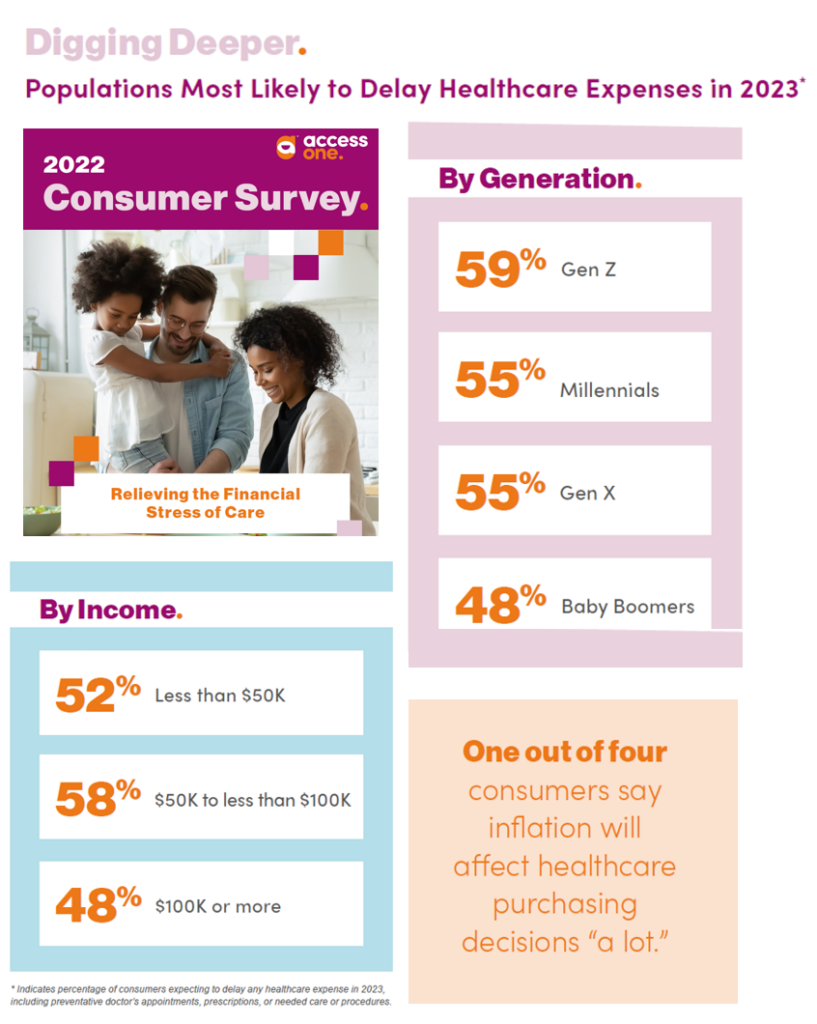

Health Populi’s Hot Points: “In 2023, inflation will influence most consumers’ purchasing decisions — and purchases of food, fuel utilities, healthcare services, and more will undergo greater scrutiny,” the 2022 Consumer Survey from Access One observed.

Note that at least one-half of consumers across generations, from Gen Z to Boomers, were likely to delay healthcare expenses in 2023.

Furthermore, across incomes, it’s 1 in 2 people expecting to delay healthcare expenses in 2023, ranging from 48% of people earning $100,000 or more a year to 58% of folks earning between $50K and $100K annually.

In the U.S., and the larger world, health citizens are all health care consumers now.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...