On the face of the raw data, tbe good news from the U.S. Bureau of Labor Statistics on the nation’s employment picture was an additional 120,000 jobs in November. This drove the unemployment rate down to 8.6%. Underneath that number, though, remains what is still a shaky economy for both workers and those seeking full employment to match what they might have lost as a result of their layoffs.

On the face of the raw data, tbe good news from the U.S. Bureau of Labor Statistics on the nation’s employment picture was an additional 120,000 jobs in November. This drove the unemployment rate down to 8.6%. Underneath that number, though, remains what is still a shaky economy for both workers and those seeking full employment to match what they might have lost as a result of their layoffs.

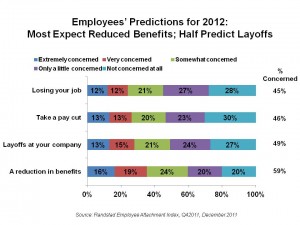

First and foremost, most people who are fortunate to still have their jobs see 2012 as a year where the benefits they receive through their employers will fall, according to the Randstad Employee Attachment Index, Q42011.

The Index is based on survey research among 3,022 adults aged 18 and over who are currently employed full-time from Ipsos’s U.S. online panel. The poll was conducted in October 2011.

Older workers are particularly concerned: over half of workers age 50 and over believe it would take over a year to secure a new job. The most optimistic workers are young people, aged 18-34.

24% of highly engaged workers say they will likely look for a new job in the next six months, 30% would seriously consider another job, and one-third would accept another job in the next six months.

On the positive front, 78% of employees feel inspired to do their best on the job, 76% say they’re proud to work for their current company, and 64% feel their efforts are recognized and valued.

However, over one-third of workers do not trust their leadership to make good decisions, and 36% don’t believe their companies share their values.

To balance the optimism and pessimism they feel about job security and potential layoffs, vs. their positive feelings at the workplace, 40% of workers say they’re cutting back on expenses due to fear of job loss, and 34% are trying to save more money.

Health Populi’s Hot Points: Workers would be well-advised to save their money, maxing out both their 401(K) plans as well as conserving funds for future health care needs. That’s because, once you lose your job in America, unemployment often leads to uninsurance. The cost of paying for health insurance under COBRA coverage can exceed the average monthly unemployment check.

Today’s worker expects job-based benefits to erode in 2012. Prime among these benefits is health care. Employers who have been providing health insurance to workers have been allocating a greater share of out-of-pocket costs to employees over the past several years. 2012 will continue that trend.

The challenge for employers and the health plans with whom they contract is how to artfully craft health plan designs that encourage workers to behave in healthy ways that yield wellness and optimal outcomes. This is the important Nudge, and it’s still overlooked by too many employers who may “speak” wellness in the form of health risk appraisals and gym club membership discounts. But the more strategic nudge is in creating a total culture of wellness and health, that links medical benefits to lifestyle and incentives. This isn’t about increasing co-pays: it’s about reducing them, sometimes to $0 at the point of purchase at the pharmacy, for employees who need to manage chronic conditions that spur medical trend and increasing costs – think diabetes, COPD, asthma, depression.

Another useful nudge will be to provide financial counseling through the HR department that can help employees better manage their take-home pay and investments. Financial health is integral to whole health.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.