Transparency, data-based pharmacy decisions, incentivizing patient behavior, and outcomes-based payments will reshape the environment for marketing pharmaceutical drugs in and beyond 2012. Two reports published this week, from Express Scripts–Medco and PwC, explain these forces, which will severely challenge Pharma’s mood of market ennui.

Transparency, data-based pharmacy decisions, incentivizing patient behavior, and outcomes-based payments will reshape the environment for marketing pharmaceutical drugs in and beyond 2012. Two reports published this week, from Express Scripts–Medco and PwC, explain these forces, which will severely challenge Pharma’s mood of market ennui.

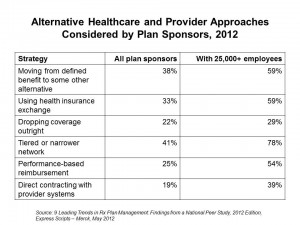

Express-Scripts Medco’s report on 9 Leading Trends in Rx Plan Management presents findings from a survey of 318 pharmacy benefit decision makers in public and private sector organizations. About one-half of the respondents represented smaller organizations with fewer than 5,000 employees; about 20% represented jumbo companies with over 25,000 workers. The survey was conducted in the fourth quarter of 2011.

The 9 trends shaking up the pharma landscape are:

- Balancing

cost with case, investing in members’ making better health decisions

cost with case, investing in members’ making better health decisions - Using online and mobile tools and apps, revisiting “new media.” 84% of plan sponsors plan to use online and mobile apps to help members make more cost-effective health decisions.

- Assessing health reform’s impact on the business and future coverage options: 38% of sponsors plan to move away from defined benefit, and 33% plan to use a health insurance exchange

- Reassessing retiree Rx benefits

- Looking at how consumer-directed health plans can encourage member self-reliance: the largest employers who are self-insured are attracted to CDHPs

- Continuing to grow mail order

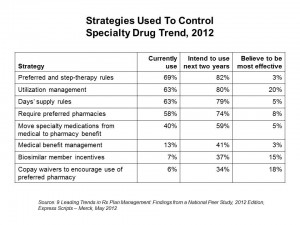

- Mitigating specialty drugs’ high costs, as illustrated in the second chart. Preferred and step-therapy rules will dominate this strategy, coupled with utilization management, days’ supply rules, and requiring preferred pharmacies

- Addressing how coupons drive demand for branded Rx, threatening generic utilization and increasing costs: 65% of plan sponsors believe coupons used by members to get lower prices on branded drugs increase the plan’s costs

- Embracing data-driven pharmacy care.

Unleashing value: the changing payment landscape for the US pharmaceutical industry from PwC‘s Health Research Institute. PwC identifies five forces “dramatically” changing pharma’s revenue model:

Unleashing value: the changing payment landscape for the US pharmaceutical industry from PwC‘s Health Research Institute. PwC identifies five forces “dramatically” changing pharma’s revenue model:

- The growth of biologics (specialty drugs) that will drive up the cost of care and challenge concepts of value in health care

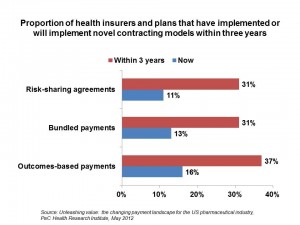

- Payors moving away from volume-based payment models toward outcomes-based payment, as the chart illustrates

- Providers and payors demanding more data about drug efficacy

- A concerted effort to improve adherence to therapies, recognizing that patients who don’t take meds properly cause plans to “lose money”

- Increased transparency of health information to empower payments to make better decisions about therapeutics.

Thank you,

Thank you,  As a proud Big Ten alum, I'm thrilled to be invited to

As a proud Big Ten alum, I'm thrilled to be invited to  I was invited to be a Judge for the upcoming CES 2025 Innovation Awards in the category of digital health and connected fitness. So grateful to be part of this annual effort to identify the best in consumer-facing health solutions for self-care, condition management, and family well-being. Thank you, CTA!

I was invited to be a Judge for the upcoming CES 2025 Innovation Awards in the category of digital health and connected fitness. So grateful to be part of this annual effort to identify the best in consumer-facing health solutions for self-care, condition management, and family well-being. Thank you, CTA!