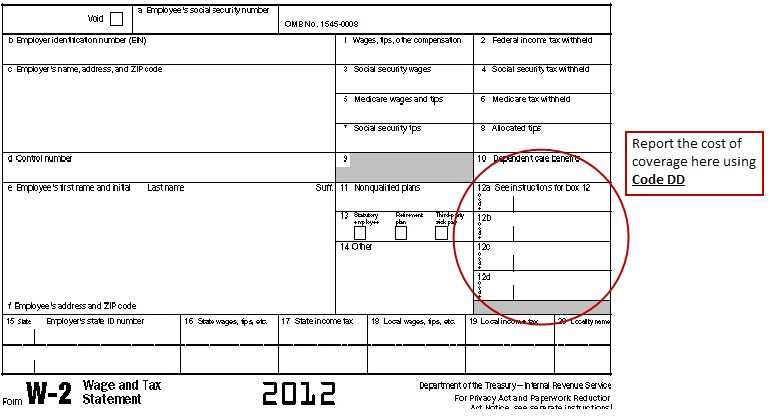

If you receive health insurance benefits from your employer, you’ll see a new line item on your W-2, courtesy of the Internal Revenue Service: the cost of employer-sponsored group health plan coverage.

If you receive health insurance benefits from your employer, you’ll see a new line item on your W-2, courtesy of the Internal Revenue Service: the cost of employer-sponsored group health plan coverage.

This new piece of data, shown in Box 12, DD information, comes as part of health reform, The Affordable Care Act, which requires employers with over 250 workers to show how much they spend on employer-sponsored health benefits in total. This is the employer’s premium cost, and does not include the covered worker’s out-of-pocket spending (e.g., copays, coinsurance and deductibles). It is being furnished on W-2’s “for informational purposes only,” according to Kaiser Family Foundation based on the IRS guidance.

Health Populi’s Hot Points:

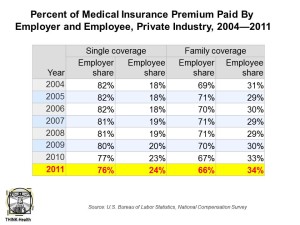

This information, in aggregate, will give the IRS and, thus, the Federal government, a macro insight into the total value of health benefits that could, eventually, be taxed. Some of the most prominent tax accountants have stated that this is the biggest tax break in the nation, and could be under threat of erosion as the U.S. gets more sober in its approach to fiscal austerity, European-style, in dealing with the Fiscal Cliff and the long-term deficit driver which is U.S. health financing.To put this into the consumer-worker’s personal finance perspective, the chart shows the premium responsibility shared by employer and employee in the private sector. In 2011, workers covered by health on the job paid 34% on average for family coverage. The employee premium share can range as high as 40% based on data from the 2012 Milliman Medical Index.

Workers viewing the W-2 Box 12 may be experiencing health cost sticker shock now that they can view, in black and white, what health care costs over and above their out-of-pocket expenses. U.S. health citizens are about to experience even more price and cost transparency in the coming months. This will require stretching new health financial literacy muscles for people, who tend to want to avoid thinking about such sobering information.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.