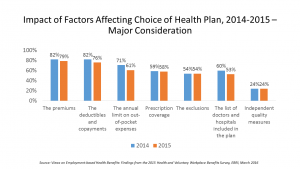

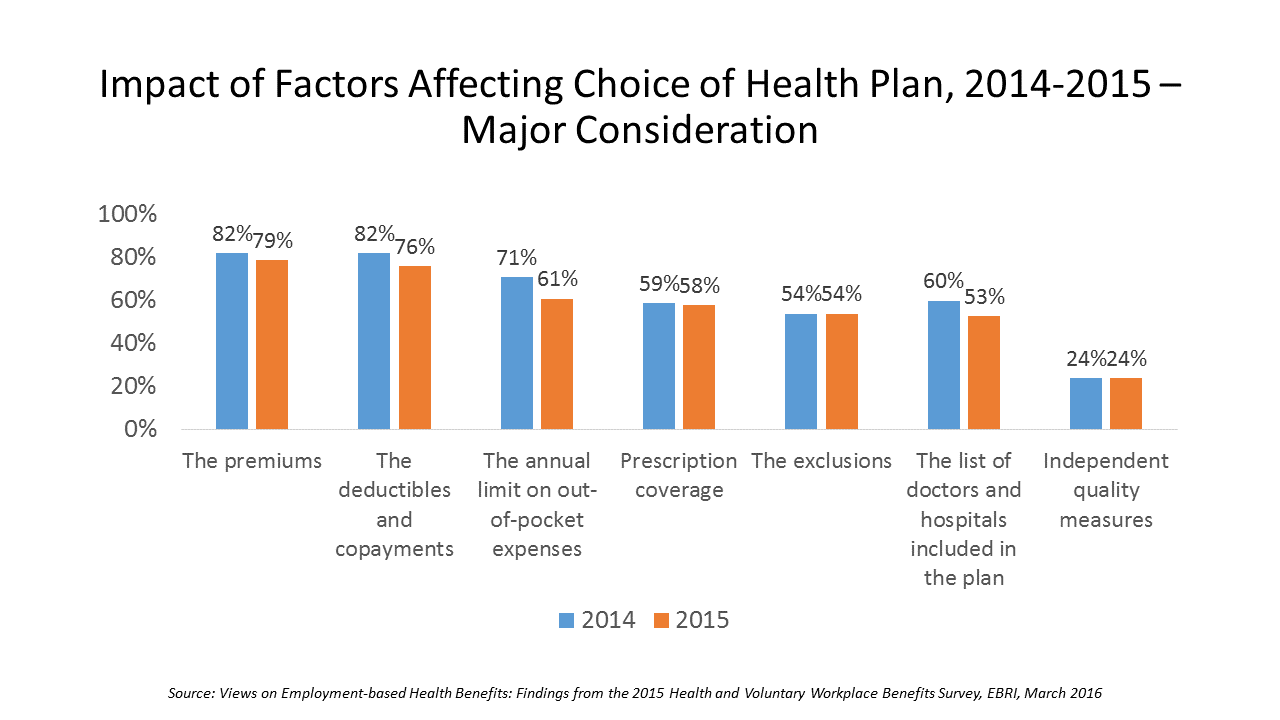

Consumers are extremely price-sensitive when it comes to shopping for health insurance. The cost of health insurance premiums, deductibles and copays, prescription drug coverage and out-of-pocket expenses rank higher in the minds of health insurance shoppers than the list of doctors and hospitals included in a health plan for health consumers in 2015.

Consumers are extremely price-sensitive when it comes to shopping for health insurance. The cost of health insurance premiums, deductibles and copays, prescription drug coverage and out-of-pocket expenses rank higher in the minds of health insurance shoppers than the list of doctors and hospitals included in a health plan for health consumers in 2015.

The Employee Benefit Research Institute (EBRI) surveyed 1,500 workers in the U.S. ages 21-64 for their views on workers’ satisfaction with health care in America. The results of this study are compiled in EBRI’s March 2016 issue of Notes, Views on Employment-based Health Benefits: Findings from the 2015 Health and Voluntary Workplace Benefits Survey.

There is a sign of a new trend among some consumers who aren’t as satisfied with their current wages vis-a-vis their benefits. 74% of workers were satisfied with their health benefits in 2012, compared with 66% in 2015. In the same period, 10% of consumers preferred fewer health benefits and higher wages in 2012, compared to 20% (double) in 2015.

Consumers are still largely confident in the benefit choices their employers make for them, with 50% saying they’d continue with current coverage through employers even if it was taxable. In 2013 45% of workers preferred to choose their own health insurance, cost-shared with employers; in 2015, that proportion fell to 39%, with 44% of insured workers looking for employers to continue to choose and pay for health insurance the way they do now.

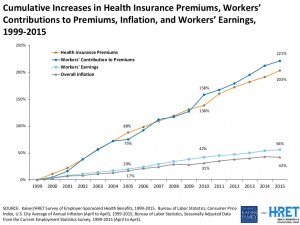

Health Populi’s Hot Points: The issue of U.S. workers’ wages remaining relatively flat for the past decade and longer is part of the U.S. Presidential policy landscape. Clearly consumers who work and receive health benefits at the workplace over this time period intimately understand this household economic fact, with the cost of health care far outpacing wage growth as shown in the line chart.

Health Populi’s Hot Points: The issue of U.S. workers’ wages remaining relatively flat for the past decade and longer is part of the U.S. Presidential policy landscape. Clearly consumers who work and receive health benefits at the workplace over this time period intimately understand this household economic fact, with the cost of health care far outpacing wage growth as shown in the line chart.

But the working health-insured also question their ability to pick health plans for themselves, lacking confidence in using so-called objective rating systems to help them choose insurance. Look at the first bar chart from the EBRI study: note that all the way to the right, “independent quality measures” describing health plans rank low on consumers’ factors in choosing health insurance.

Working people still highly value receiving health benefits at work and the support services that bolster their health consumer abilities. But clearly, workers are ready to see more money in their pay checks after years of trading off wage increases for health benefits.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.