Consumers face increasing health insurance deductibles in 2016, faster-growing than earnings and well above general price inflation, featured in the Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2016.

This report, updated annually, is the go-to source on the availability of, cost for, and trends in U.S. employer-based health plans.

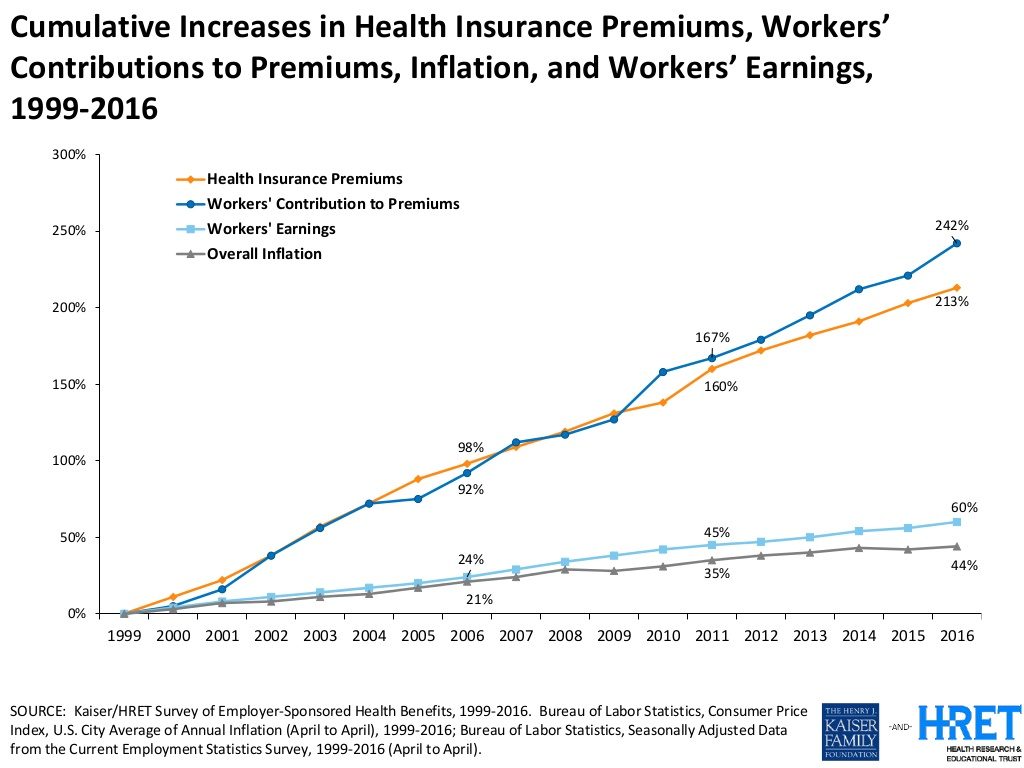

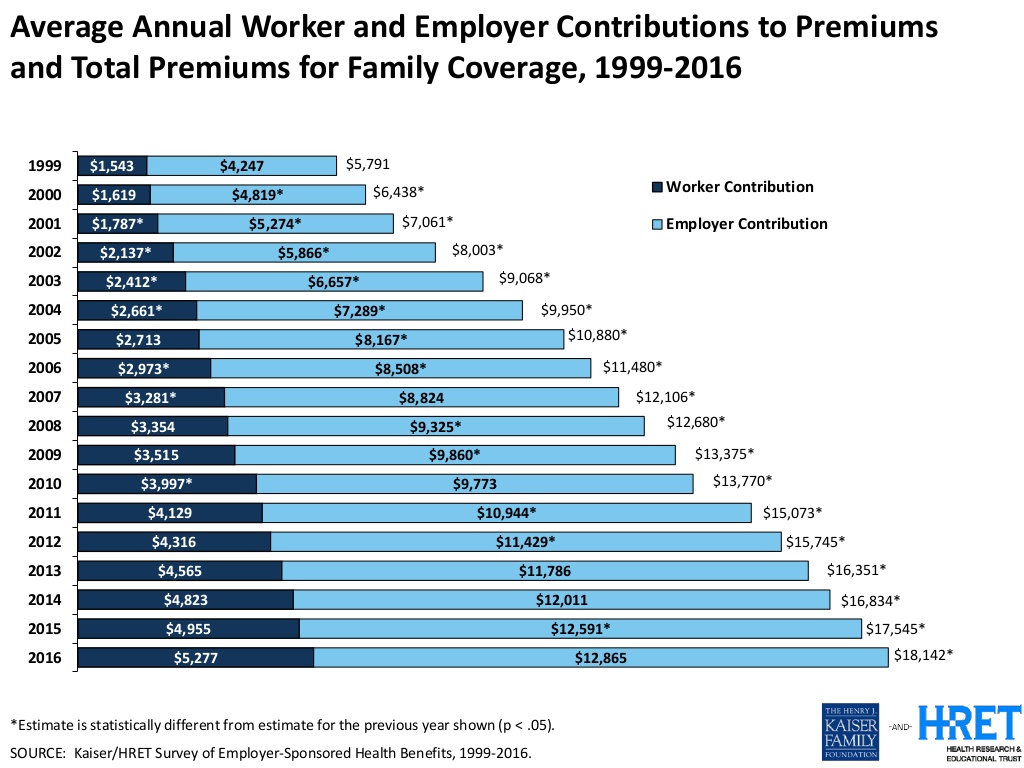

The average annual health insurance premium in 2016 reached $18,142, the survey found, about $600 more than in 2015. Over the past ten years since 2006, workers’ contributions to health insurance premiums increased 78%; employers’ contributions grew 58% over the decade.

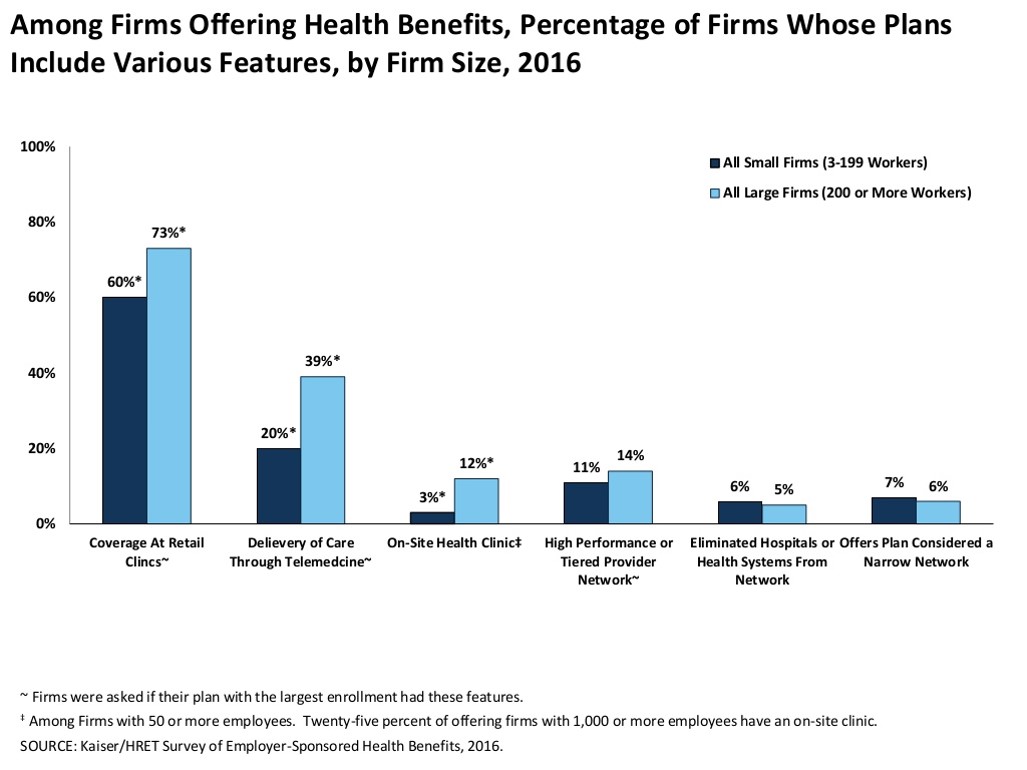

To help stem costs, employers are adopting new services to complement (more expensive) inpatient and physician in-office care. In particular, coverage at retail clinics is the most popular new-new thing among U.S. employers, for 73% of large firms and 60% of small firms. Telemedicine coverage is growing as a cost-saving tool, among 39% of large companies and 20% of small. Offering on-site health clinics (a more mature strategy) and identifying high-performing provider networks are also emerging for company cost-containment.

Health Populi’s Hot Points: There was good macroeconomic news this week, as we learned that Americans’ incomes rose an astonishing 5.2% last year, according to the latest report from the U.S. Census. Wage increases were more pronounced in urban metropolitan areas, while incomes for people living in smaller rural communities stayed flat, and in certain cases (especially among some African-Americans) slightly fell.

The U.S. has many health disparities — between men and women, whites vs. African-Americans and Hispanics, and urban compared with rural town dwellers. There’s another disparity to call out in America: the states where Medicaid expansion hasn’t happened are also those with relatively worse records on the social determinants of health (like healthy food access and lower incomes), basic health statistics like obesity levels, and overall poorer health system performance.

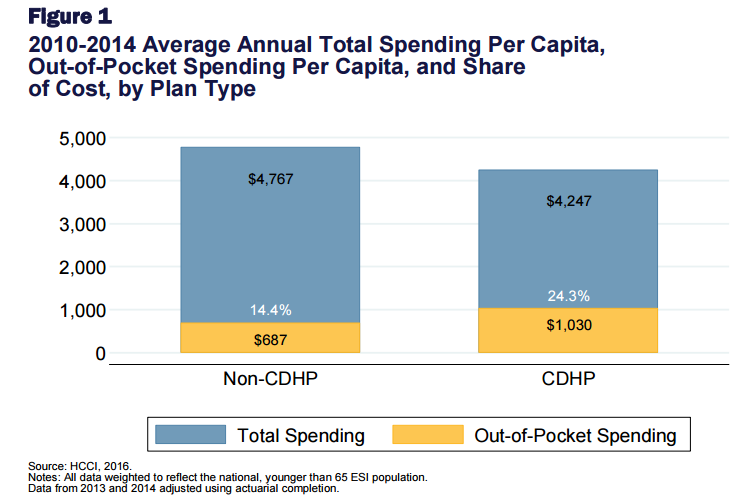

Members of consumer-directed health plans (generally high-deductible plans coupled with health savings accounts) have been found to use fewer healthcare services, but pay 1.5 time more higher out-of-pocket costs compared with insured people in other types of plans like PPOs. This finding was revealed this week in a report from the Health Care Cost Institute (HCCI).

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...