Consumers have grown accustomed to Amazon, and increasingly to the just-in-time convenience of Amazon Prime. Today, workers who sign onto employee benefit portals are looking for Amazon-style convenience, access, and streamlined experiences, found in the Aflac Workforces Report 2016.

Aflac polled 1,900 U.S. adults employed full or part time in June and July 2016 to gauge consumers’ views on benefit selections through the workplace.

Consumers have an overall angst and ennui about health benefits sign-ups:

- 72% of employees say reading about benefits is long, complicated, or stressful

- 48% of people would rather do something unpleasant like talking to their ex or walking across hot coals instead of completing their annual benefits enrollment process

- 36% of consumers say the benefits enrollment process makes them feel frustrated, anxious, or confused.

Because of their lack of engagement in this process, 80% of these consumers spent less than an hour researching options, and 57% of people spent less than 30 minutes. Thus, 93% of employees typically choose the same benefits year after year, Aflac found.

And that can be expensive, as more companies are offering newly-designed health plans that can save people money if they carefully assess their own and their families’ needs for the next year.

Millions of workers do not understand details of their plans, such as:

- Coinsurance, 32% of whom do not understand

- Prescription drug coverage, 41% don’t understand

- Annual deductible, 48% don’t understand

- Provider participation, 48% don’t understand

- Monthly premium, 33% don’t understand.

Aflac also learned that most employees value subject matter experts for benefits service.

Health Populi’s Hot Points: Ironic, isn’t it, that we’re talking about “benefits” here. But people don’t feel like valued consumers when it comes to getting on the on-ramp to selecting their so-called “benefits” which are a crucial component of their personal financial wellness and their employers’ value proposition to stay engaged and present at work and with the firm.

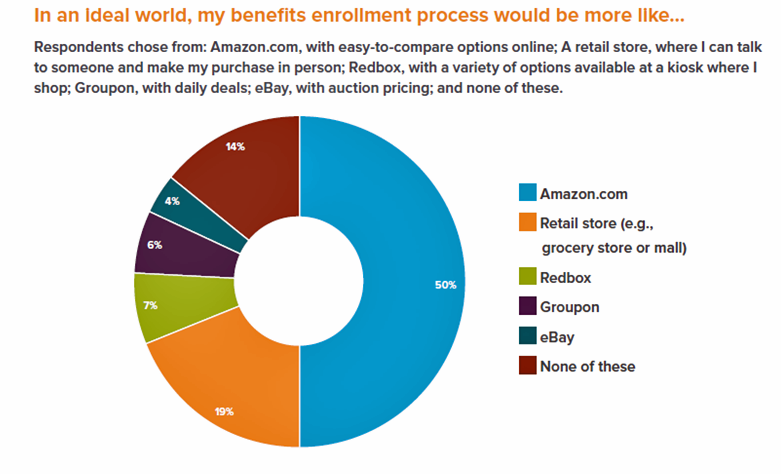

In a perfect world (under the employer-sponsored health system that’s unique to the U.S.), workers would have full understanding of their benefits options and be fully engaged in their health and health care. Without a perfect world, user-centered design and behavioral economics play key roles in helping people understand their benefits options and how they fit into personal lives and values. Amazon and retail stores together are attractive models for two-thirds of employed consumers, shown in the chart.

In fact, employees across all generations value the availability of interactive tools to help with customized recommendations for benefits — coupled with the opportunity to speak with knowledgeable experts for benefits advice.

In fact, employees across all generations value the availability of interactive tools to help with customized recommendations for benefits — coupled with the opportunity to speak with knowledgeable experts for benefits advice.

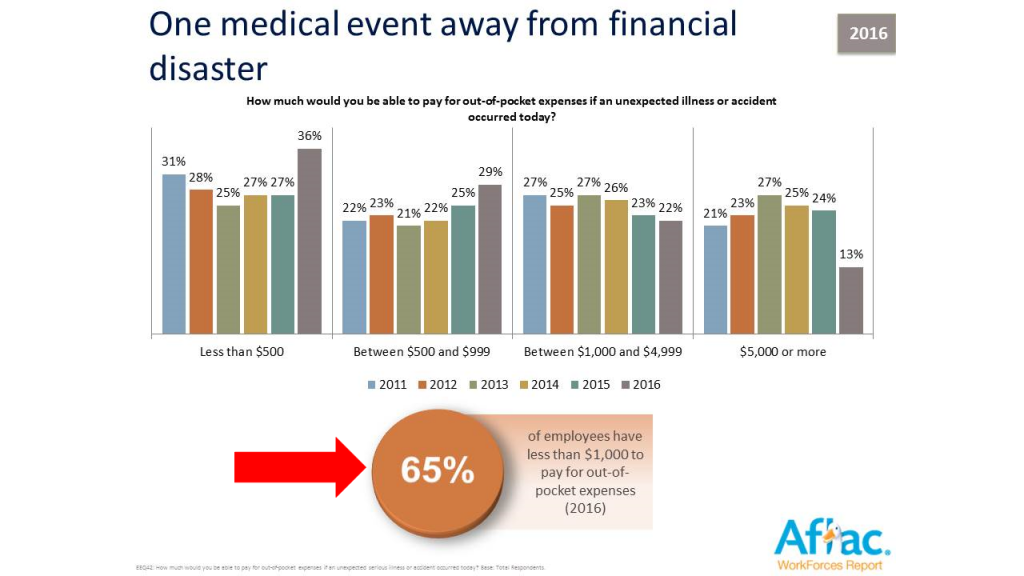

The reality facing two-thirds of consumers is that they’re $1,000 away from financial disaster in the event of an unexpected illness or accident, shown in the second graph from the Aflac report.

36% of workers would have less than $500 available to pay for a medical event, and 29% between $500 to $999.

In the experience of a worker getting health benefits through an employer, that health benefit is part of a larger financial wellness mindset. Cost-shifting to employees without bolstering benefit education, personalized benefits selection, and streamlined benefits management is worsening workers’ stress and workplace engagement.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...