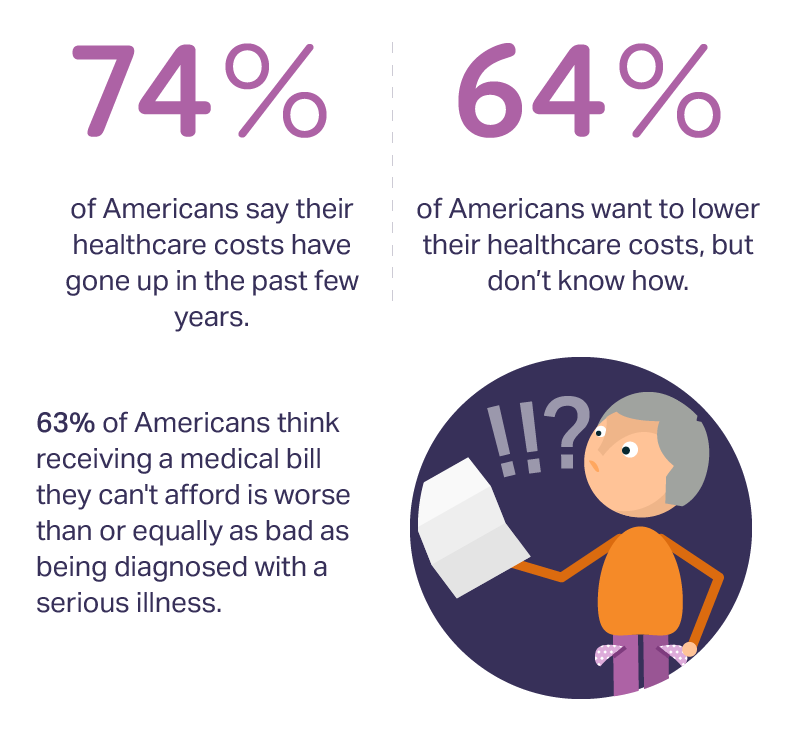

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that.

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that.

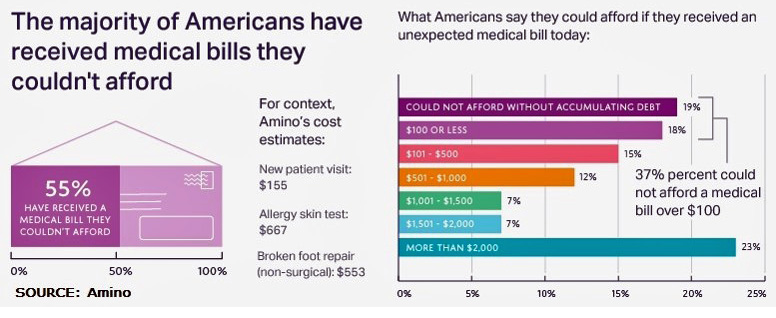

A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill.

This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree.

While medical debt challenges in the U.S. aren’t a new news story, one finding was surprising in this study: that the same proportion of Americans (53%) say being diagnosed with a serious illness is just as bad as receiving a large medical bill they can’t afford.

People who perceive an illness diagnosis is just as terrible as receiving a big medical bill tend to be older adults (55+), lower income earners, the unemployed, and people who live in the Southern U.S.

To avoid bearing expensive medical bills, health consumers believe the most useful strategies would be to have good health insurance, practice preventive care, and avoid going to the doctor’s office. People most likely to avoid going to the doctor to avoid a medical bill do not have health insurance (56% of the uninsured, vs. 14% of people who receive health insurance through the workplace).

Only 7% of health consumers say that researching doctors, facilities or costs ahead of time would help stem high medical costs. One-half of people with health insurance say their plan doesn’t give them sufficient information about healthcare costs.

Budgeting for healthcare, compared with other household items like food, transportation, and entertainment, is not commonly embraced.

But people who have received an unexpected medical bill in the past are much more likely to budget for health and medical expenses on an ongoing basis.

Ipsos conducted the poll on behalf of Amino in February 2017 among 1,006 U.S. adults.

Health Populi’s Hot Points: The second chart illustrates the epidemic of medical bill toxicity: that most Americans (55%) have received bills they could not afford. Over one-third of people (37%) couldn’t afford a medical bill over $100. One in 5 people couldn’t afford a bill without accumulating debt.

Health Populi’s Hot Points: The second chart illustrates the epidemic of medical bill toxicity: that most Americans (55%) have received bills they could not afford. Over one-third of people (37%) couldn’t afford a medical bill over $100. One in 5 people couldn’t afford a bill without accumulating debt.

Consider the cost of a new patient visit to a doctor, which Amino’s data estimates at $155. That one-third of people couldn’t afford spending over $100 without taking on debt for this doctor’s visit.

See Amino’s estimate for a broken foot repair, non-surgical – that would cost just over $550, on average. Looking at the right side of the charge, just one-half of people could afford to pay that bill.

“Financial toxicity” was originally coined by clinicians at the Memorial Sloan Kettering Cancer Center, which I discussed last year here in Health Populi. Dr. Leonard Saltz and colleagues recognized a growing side-effect endured by patients dealing with cancer: the high costs of therapies and hospital bills, which they termed as financial toxicity that could also accompany a chemotherapy’s toxic side effects (like nausea, wasting syndrome, and other clinical responses to strong medicines killing off cancer cells).

Americans’ relatively low savings rates, coupled with dependency on credit cards for daily living expense spending, pushes health care saving to the bottom of the household budgeting barrel. The eventual mounting of medical debt can be an on-ramp to personal bankruptcy, where health care costs play a primary role in Americans’ financial unwellness.

As Margot Sanger-Katz wrote last year in the New York Times, even the insured can face “crushing” medical debt. Her prescription: “Here is the surest way to enjoy the peace of mind that comes with having health insurance: Don’t get sick.”

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...