A family in Orange County, California, paid a brother’s 1982 hospital bill by selling 50 pieces of their newly-deceased mother’s jewelry. “It’s what she wanted,” the surviving son told a reporter from The Orange County Register.

The cache of jewelry fetched enough to pay the $10,000 bill.

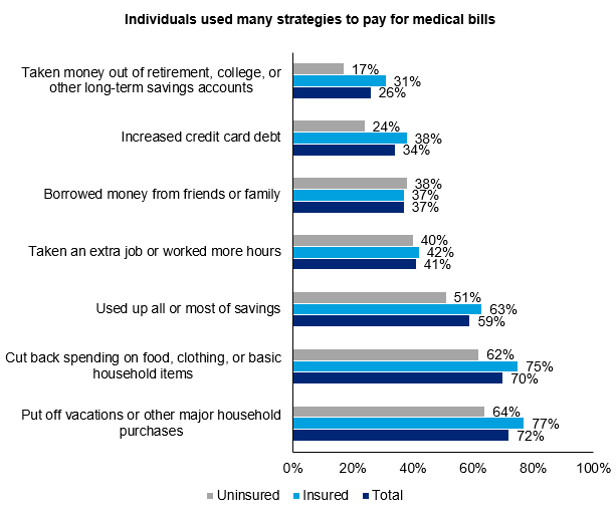

Patients in the U.S. cobble together various strategies to pay for healthcare, as the first chart drawn from a Kaiser Family Foundation report on medical debt attests. As health care consumers, people cut back on household spending like vacations and household goods. Two-thirds of insured patients use up all or most of their savings to pay for health care. Long-term savings are also mined for current health care costs: one-third of people with health insurance have taken money out of retirement, college, and other long-term savings accounts to pay for health care ‘today.’

More people in the U.S. are dealing with health care costs that represent a kind of financial toxicity of being an American patient. Elizabeth Rosenthal’s new book, An American Sickness, discusses this scenario in great, painful detail.

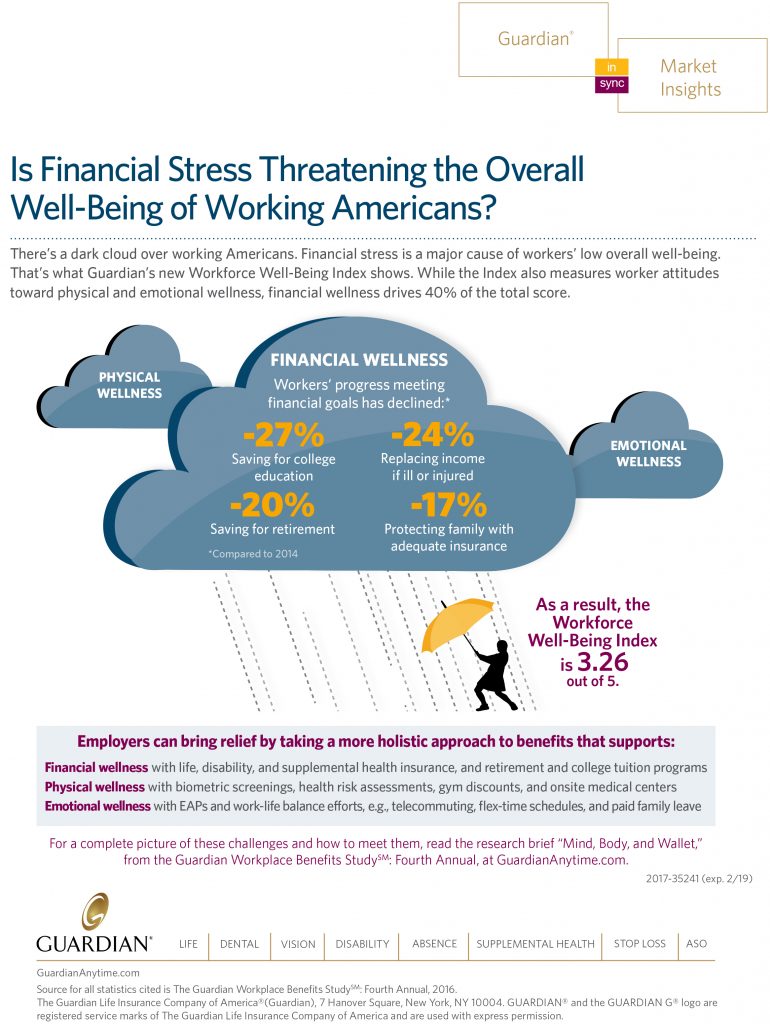

New research on how financial stress impacts the emotional and physical well-being of employees.

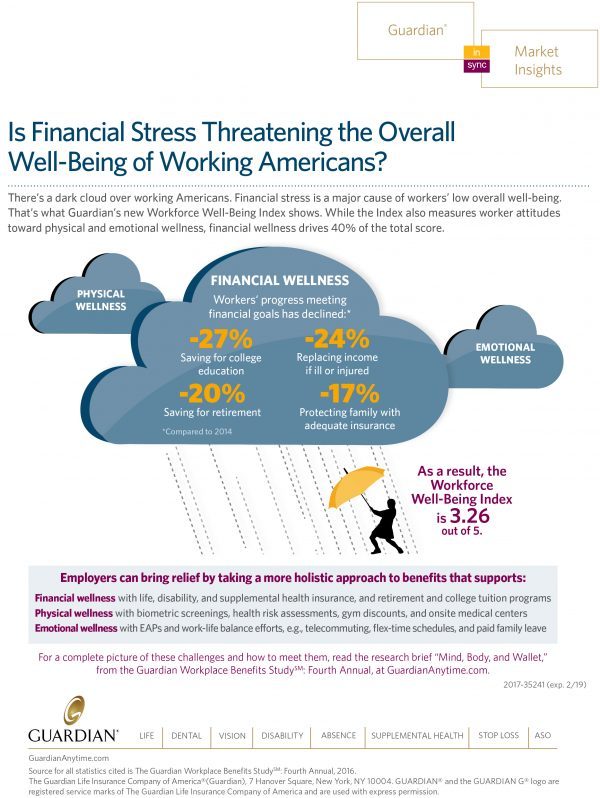

New research into financial stress is presented in the new aptly-titled report, Mind, Body, and Wallet: Financial Stress Impacts the Emotional and Physical Well-Being of Working Americans. This is the 4th annual Guardian Workplace Benefits Study, which tracks a Workforce Well-Being Index measuring consumers’ views on emotional, financial, and physical wellness. This round of research found that consumers’ concerns about financial security have the greatest impact on peoples’ feelings of overall well-being and have worsened over the past two years.

Guardian points out that traditionally, wellness has been most associated with physical health. However, in 2017, it’s the fiscal that’s taking a toll on the physical.

A key finding is that workers who rated financial self-assessment lower tended not to receive medical benefits through employers.

Furthermore, progress toward personal financial goals went negative in the past two years: the proportion of workers paying off household debt, obtaining adequate life insurance to protect one’s family, saving for retirement, replacing income if seriously ill, and saving for college all fell.

Only one-fourth of workers say they’re living a healthy lifestyle. 3 in 4 admit they’re not eating well or exercising. But living that healthy lifestyle is important to 75% of people.

That Guardian study was based on survey research among working Americans. Now consider how people thinking about retirement view financial health.

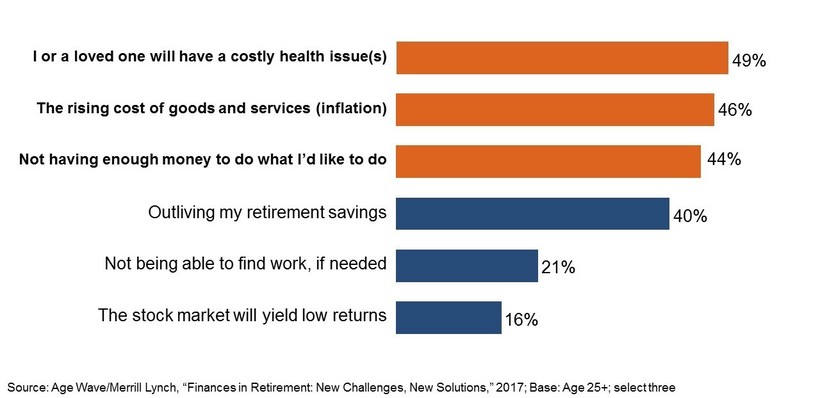

Health, overall, is one of seven pillars of life priorities in retirement, described in new research from Merrill Lynch and AgeWave, Finances in Retirement – New Challenges, New Solutions. The other six pillars are family, home, work, leisure, giving, and finances. Among the seven priorities, health is the biggest wildcard, the report asserts, “sending ripple effects across the other life priorities.” The report advises that two of the most important investments Americans can make in retirement are to (1) maintain good health, and (2) cover its uncertain costs.

The third graphic comes out of this report. Note that unexpected costs for health care rank at the top of the list of financial worries in retirement, above paying for everyday living expenses, and outliving retirement savings.

The most important key to achieving a happy retirement is good health, noted by 81% of retirees. In second place is financial security, reported by 58% of retirees. Retirees who said their health was excellent or very good were twice as likely as those whose health was fair or poor to be exercising, eating nutritiously, maintaining a healthy weight, and staying socially connected.

Retirees’ course corrections for “making health” are to make healthier choices now to save money later (among 91% of retirees), using more generic medications and health supplies (91%), re-evaluating health insurance plans (83%), increasing the use of free or low-cost community health programs (77%), and buying insurance for out-of-pocket expenses in retirement (74%). Note that 58% of retirees said they might spend down assets to be eligible for Medicaid.

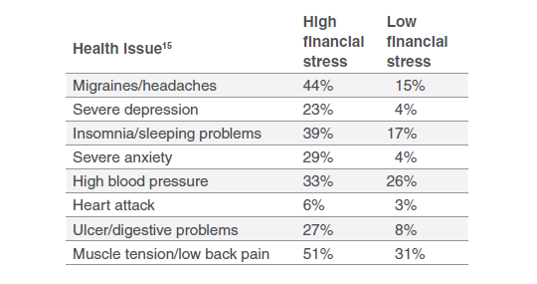

Health Populi’s Hot Points: The evidence is clear that Americans dealing with health care costs are financially stressed. Financial stress has direct health impacts, as shown in the last table with data from a landmark 2008 poll conducted by the Associated Press and AOL. Note the preponderance of behavioral health issues – depression and anxiety, along with pain, sleeping issues, and gut problems.

The opioid epidemic is one of several outcomes due to financial stress. This relationship was soberly outlined in Princeton’s Anne Case’s study on “deaths of despair,” discussed here in Health Populi earlier this year.

Dealing with the social determinant of health that is financial un-wellness is a multi-factor challenge. Taking a person’s life cycle approach, bolstering financial health can start with pre-natal care for women, along with good nutrition for mom-to-be which carries on to baby. Early childhood education and access to safe and joyful daycare is an investment that yields a strong ROI, especially for little boys, as detailed last week in this New York Times article. Good jobs for moms and dads, and good schools for the growing child further contribute to future financial wellness. Along the way, clean water, safe streets, healthy housing, and health care feed a person’s health.

Check out this new graphic from my friends at Involution Studios on the Determinants of Health to get a sense of the many factors that Make Health, of which financial wellness is such a large component.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...