Americans are overwhelmingly keen to use food for their health, and overwhelmed by the amount of nutrition information they face to make good shopping and eating decisions.

Americans are overwhelmingly keen to use food for their health, and overwhelmed by the amount of nutrition information they face to make good shopping and eating decisions.

Welcome to “food confusion,” a phenomenon gleaned from the 12th Annual Food and Health Survey conducted by the International Food Information Council Foundation (IFIC).

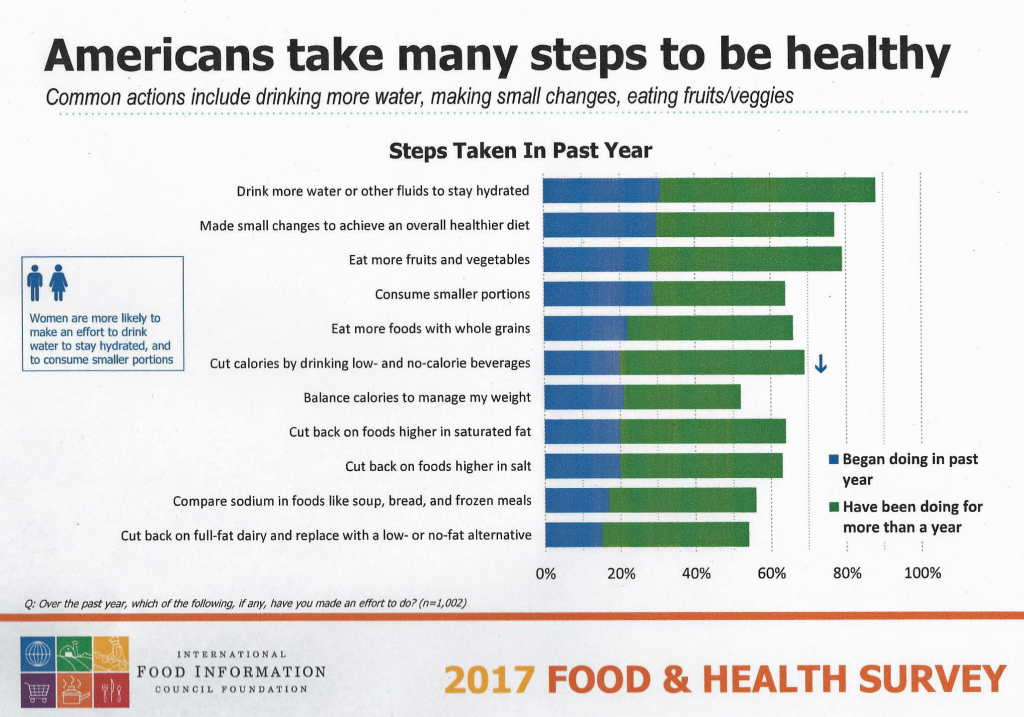

This 12th annual survey from IFIC finds that most Americans take many steps to be healthy. In the past year, the most popular health-steps include drinking more for hydration, making small changes to achieve a healthier diet, consuming smaller portions, eating more fruits and vegetables, and eating more whole grains.

Among people taking action(s) to be healthy, the key motivators for making healthy choices are to lose weight (with preventing weight gain another big motivation), to protect long-term health and prevent future medical conditions, and, to feel better and have energy. One fast-growing motivation is to improve health to have more independence in life.

The weight loss motivation decreases with age, with 40% of consumers 35-49 seeking health through weight loss, dropping to 25% of those over 50 seeking weight loss for health. On the other hand, the motivation to eat right for cardiovascular health increases with age: only 10% of people under 50 are keen to eat right for heart-health, reaching 30% of people over 50.

So the spirit is willing to be healthy, and a plurality of Americans undertake what they see as positive steps to make the health journey through food. But there’s evidence of food confusion and lack of consistent understanding about nutrition and what makes up “healthy” food.

So the spirit is willing to be healthy, and a plurality of Americans undertake what they see as positive steps to make the health journey through food. But there’s evidence of food confusion and lack of consistent understanding about nutrition and what makes up “healthy” food.

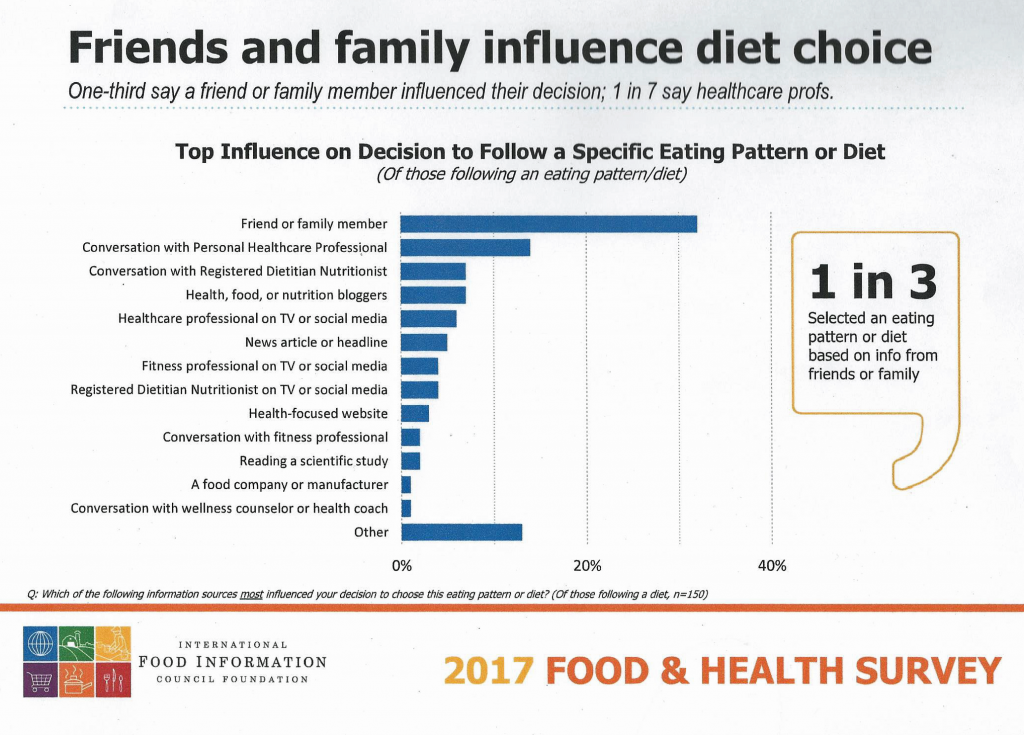

Americans turn to family and friends first to help guide their food choices, even though the most trusted sources of information on the best foods to eat are registered dietitians and nutritionists, personal healthcare professionals, wellness counselors and health coaches. The second chart illustrates that “friends and family influence diet choice” above influencers who have professional nutrition-cred.

Thus, there’s a disconnect between trust and reliance on family and social sources which may be leading to the glut of conflicting nutrition information that confuse consumers in the healthy eating marketplace.

Many Americans rely on food information sources they really don’t trust, IFIC learned, like a health professional or fitness personality popular in social media, or a food company that may be hyping an unproven health benefit.

The IFIC team calls this “dietary disconnect.” While most Americans seek food-for-health benefits, few can identify specific foods or nutrients that boost desired benefits: for example, while weight management is key for food-health seeking, 60% of American adults could not name a food or nutrient that’s good for losing or maintaining weight. Similarly, cardiovascular health is important to many, yet only 49% of folks could name a food or nutrient that’s heart-health boosting.

There are also so-called health halos around certain food products. Consider “low fat” foods, which many people believe to be “low calorie.” This is but one such health halo effect, challenging nutritionists and consumers alike. Good PR (on the part of food companies) can mislead shoppers, as this study conducted over a decade ago found among a community of obese people who faithfully shopped for and consumed low-fat food products,

A fascinating part of this study looked at the consumer’s lens on “processed” food, through the example of carrot-based product choices. Most consumers ranked store-bought carrot cake, boxed carrot soup, and store-bought carrot baby food as processed, compared with other carrot-choices like canned carrots, carrot juice, and homemade carrot cake. Double the number of people viewed bagged baby carrots as processed compared with a bag of organic baby carrots — whereas these two products have identical nutrition profiles, IFIC observed.

The survey was conducted among 1,002 U.S. adults 18 to 80 years of age in March 2017.

Health Populi’s Hot Points: Most consumers currently buy food in supermarkets, but other food shopping formats are growing due to more peoples’ search for convenience, time-saving, and on-the-go eating. So look at the expanding role of superstores/Big Box stores, warehouse clubs, farmers’ markets, natural foods stores, convenience stores, and pharmacies to complicate the retail food landscape.

Health Populi’s Hot Points: Most consumers currently buy food in supermarkets, but other food shopping formats are growing due to more peoples’ search for convenience, time-saving, and on-the-go eating. So look at the expanding role of superstores/Big Box stores, warehouse clubs, farmers’ markets, natural foods stores, convenience stores, and pharmacies to complicate the retail food landscape.

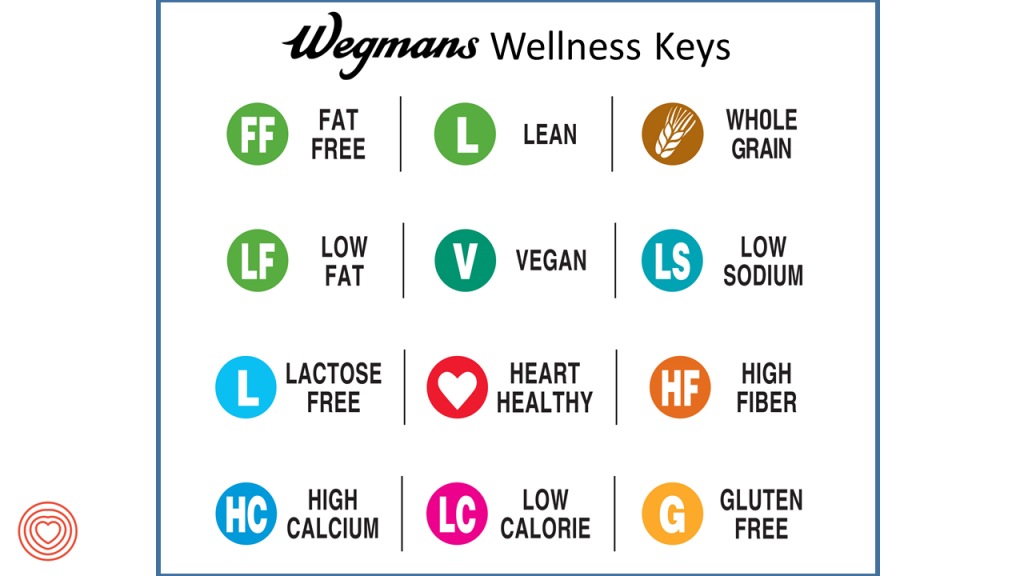

Wegmans is one of the grocers I watch as an example of a food-health destination marketing itself as a partner, “helping you live a healthier, better life through food.” To bolster shoppers’ food-nutrition literacy, the company labels foods through a straightforward “dot” system, known as Wellness Keys. Wegmans pharmacy has been ranked as highest in customer satisfaction by J.D. Power. The pharmacy’s app also connects consumers with the Doctor on Demand telehealth service to the company’s panel of Board Certified physicians, and offers higi kiosks which help shoppers in the store measure and track blood pressure, weight, and BMI. Wegmans also promotes healthy eating through its tagline “eat well, live well,” and recently committed to post calorie counts in its grocerant areas even as President Trump’s FDA is rolling back regulations on calorie labeling in public eating establishments.

Another gro cery chain, Hy-Vee, has long offered health programs through its pharmacy and recently launched Hy-Vee Fitness, “where food and fitness collide.” “Would you like yoga with your yogurt? Push-ups with your pork chops? How about chicken with your chin-ups?” a news article announcing the launch of the Hy-Vee Fitness Center in White Bear Lake, Minnesota, asked. This is the grocer’s second fitness center, with plans to add more as the concept gets proven out. The mission of the program is healthy eating coupled with healthy living. Benefits of joining the club include dietitian services and personal training consultations, among other services. The concept also speaks to financial wellness as new members of the club receive a $10 Hy-Vee store coupon and 10% off Hy-Vee HealthMarket products. Hy-Vee’s CEO noted that the store’s designs are evolving as they study how people shop.

cery chain, Hy-Vee, has long offered health programs through its pharmacy and recently launched Hy-Vee Fitness, “where food and fitness collide.” “Would you like yoga with your yogurt? Push-ups with your pork chops? How about chicken with your chin-ups?” a news article announcing the launch of the Hy-Vee Fitness Center in White Bear Lake, Minnesota, asked. This is the grocer’s second fitness center, with plans to add more as the concept gets proven out. The mission of the program is healthy eating coupled with healthy living. Benefits of joining the club include dietitian services and personal training consultations, among other services. The concept also speaks to financial wellness as new members of the club receive a $10 Hy-Vee store coupon and 10% off Hy-Vee HealthMarket products. Hy-Vee’s CEO noted that the store’s designs are evolving as they study how people shop.

Pay attention, too, to CVS/health, which recently announced the pharmacy chain would reduce its candy footprint and unhealthy snacks in its supply chain. CVS/pharmacy re-branded as CVS/health when the company dropped tobacco. I view this move to walk in the tobacco-free footsteps toward supporting healthy customers.

Some major movers in the candy industry just pledged to cut calories in their products, responding to consumers’ demand for lower sugar content in food — a trend which the IFIC survey identified. Hershey, Lindt, Mars, Nestle, and Wrigley have all committed to transparently stating calories on 90% of their best-selling products, as part of the initiative with the Partnership for a Healthier America. These companies also promised that at least 50% of their individually-wrapped products sold in the U.S. would have a maximum of 200 calories by 2022.

Health is where we live, work, play, pray and shop…with food-as-medicine going mainstream and playing into each of these touch-points of daily living. The more retail health destinations can boost consumers’ nutrition and health literacy, the greater impact these stores can make on their shoppers’, and communities’, health and economic well-being.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...