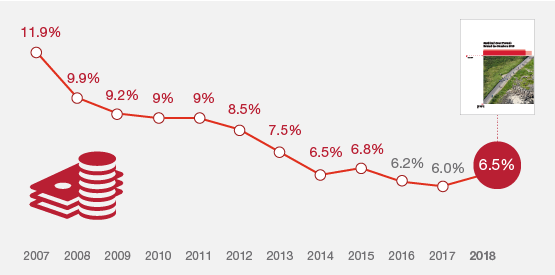

Health care costs will trend upward by 6.5% in 2018 according to the forecast, Medical Cost Trends: Behind the Numbers 2018, from PwC’s Health Research Institute.

Health care costs will trend upward by 6.5% in 2018 according to the forecast, Medical Cost Trends: Behind the Numbers 2018, from PwC’s Health Research Institute.

The expected increase of 6.5% is a half-percentage point up from the 2017 rate of 6.0%, which is 8% higher than last year’s rate matching that of 2014.

PwC’s Health Research Institute has tracked medical cost trends since 2007, as the line chart illustrates, when trend was nearly double at nearly 12%. The research consider medical prices, health care services and goods utilization, and a PwC employer benefit cost index for the U.S.

The key points of the forecast are that:

Employers’ medic al costs have settled into a “new normal” in the words of PwC, rising at single-digits below 6% over the past several years.

al costs have settled into a “new normal” in the words of PwC, rising at single-digits below 6% over the past several years.

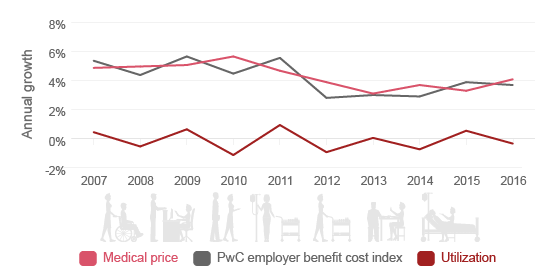

Medical prices are a greater driver of overall healthcare costs compared with utilization (use) of medical services, shown in the second chart

Pharmacy and outpatient costs will consume more of employers’ health spending in 2018 than in 2008. Pharmacy will grow to 18% of employer health spending in 2018, up by 20% since 2008. Outpatient costs will comprise 19% of health spending in 2018, increasing by 18% over the past ten years.

Inpatient costs will remain a flat share of spending at 30% since 2008, and spending on physicians will drop from 35% of share to 29% — a fall of 16%.

The opportunity for payors to lower costs based on branded prescription drugs coming off-patent will erode given fewer medicines moving to cost-saving generics in 2017. PwC points out that it takes as long as 24 months for the market to benefit from a fall in a drug’s price once going off-patent.

Health Populi’s Hot Points: The cost growth of prescription drugs as a component of total healthcare spending takes center-stage in PwC’s 2018 trend projections. Two important studies out this week speak to the public perceptions on branded pharmaceutical costs, as well as a global perspective on the role of medicines in rich countries’ primary care systems.

9 in 10 U.S. consumers are concerned (somewhat or very) about the high cost of prescription drugs, according to a survey from CVS published this week. The poll was conducted among 2,195 registered U.S. voters in April 2017. While costs are seen as too high, one in two consumers also believes that there aren’t enough drugs on the market to treat the diseases they face. Most Americans support faster market entry of lower-cost drugs (e.g., generics) to substitute for more expensive brands, in favor of speeding up FDA approvals for biosimilars.

The second point is that in developed countries where health care universally covered, prescription drug spending is lower based on the encouragement of lower-cost alternative medicines and treatments. The result is lower overall pharmaceutical spending, according to a new study sponsored by The Commonwealth Fund published today. The research looked at 10 high-income countries’ spending on prescription drugs used in primary care in six common drug categories: hypertension, pain, cholesterol, non-insulin diabetes treatment, depression, and GI disorders (e.g., ulcer and heartburn). The nations with single-payer healthcare were more successful at maintaining lower costs. The key approach is that these countries leveraged greater purchasing power in negotiating drug prices with manufacturers, thus driving lower prices paid.

The second point is that in developed countries where health care universally covered, prescription drug spending is lower based on the encouragement of lower-cost alternative medicines and treatments. The result is lower overall pharmaceutical spending, according to a new study sponsored by The Commonwealth Fund published today. The research looked at 10 high-income countries’ spending on prescription drugs used in primary care in six common drug categories: hypertension, pain, cholesterol, non-insulin diabetes treatment, depression, and GI disorders (e.g., ulcer and heartburn). The nations with single-payer healthcare were more successful at maintaining lower costs. The key approach is that these countries leveraged greater purchasing power in negotiating drug prices with manufacturers, thus driving lower prices paid.

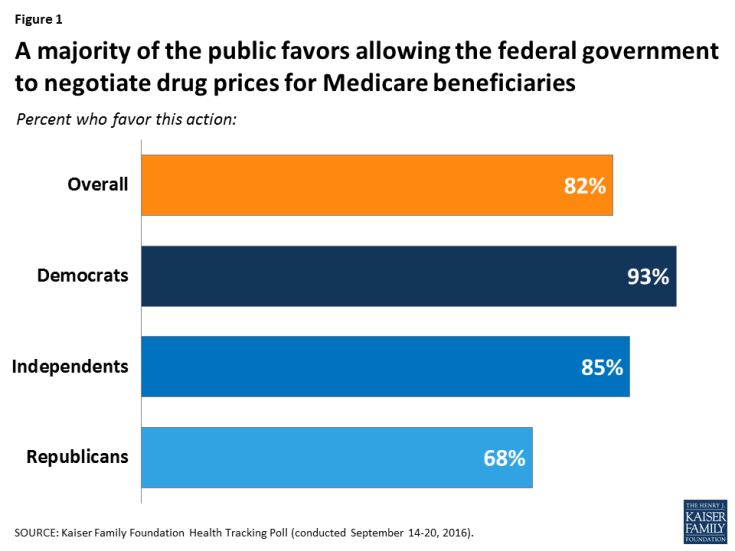

In the Kaiser Health Tracking Poll conducted last September 2016, 4 in 5 consumers support allowing the U.S. Federal government to negotiate prices for prescription drugs for Medicare. See the third chart: Federal negotiation for drug prices gets positive nods from Democrats (93%), Independents (85%) and Republicans (68%) alike. This is one of the few areas that receives tri-partisan support in America in 2017.

This is not a new wake-up call for the pharma industry, which has instituted a public marketing campaign to “Go Boldly” and communicate the sector’s commitment to new-new drug development. The industry should remember American health policy history, which PwC notes in the report: political and public scrutiny of pharma companies put downward pressure on the growth of drug costs in the 1990s under the President Clinton years, discussed here in a 1993 New York Times analysis. Read it and learn.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...