Getting health insurance at work means also having prescription drug coverage; 99% of covered workers’ companies cover drugs, based on the 2017 Employer Health Benefits Survey released by the Kaiser Family Foundation (KFF).

Getting health insurance at work means also having prescription drug coverage; 99% of covered workers’ companies cover drugs, based on the 2017 Employer Health Benefits Survey released by the Kaiser Family Foundation (KFF).

I covered the top-line of this important annual report in yesterday’s Health Populi post, which found that the health insurance premium for a family of four covered in the workplace has reached $18,764 — approaching the price of a new 2017 small car according to the Kelley Blue Book.

The complexities of prescription drug plans have proliferated, since KFF began monitoring the drug portion of health benefits at the workplace.

As the first chart illustrates, virtually all workers covered by workplace health plans cover medicines, including specialty drugs. Slightly fewer smaller companies (91%), with 200 to 999 workers, provide drug coverage.

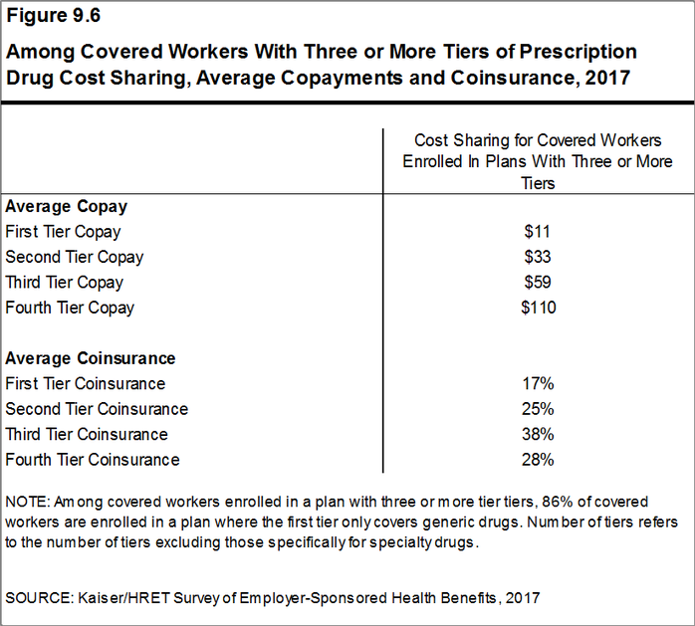

83% of covered workers’ plans have three or more tiers for consumers’ cost-sharing. Co-payments are the most common form of cost sharing in the first three tiers, shown in the second chart. Coinsurance is the second type of cost-sharing for Rx drugs.

Tier 1 of prescription medicines generally covers generic drugs, for which there are the lowest co-payments: on average, $11 per prescription. Tier 2 covers so-called preferred drugs, those on a formulary which are often brand-name drugs without generic substitutes or older drugs still on-patent with a proven track record. The average price of second-tier drugs was $33. The average co-payments for third-tier drugs was $59, covering drugs excluded from formularies; these tend to be branded drugs with generic substitutes. Fourth-tier drug co-pays reached $110 in 2017; this category can apply to lifestyle drugs (for, say, dermatology or erectile dysfunction), or biologics. Finally, specialty drugs are cost-sharing quite differently, discussed below. Specialty drugs are the new high-cost drugs to treat arthritis, blood disorders, cancer, and other conditions where the treatment may need special handling or infusion at the doctor’s office. For more on this growing category of therapies and their impact on U.S. health consumers, see my recent post on the rise and rise of specialty drug costs here in Health Populi.

Virtually all covered workers at large companies have specialty drug coverage. (KFF covered this issue for the first time in this year’s study, and did not research specialty drug coverage at smaller companies). Among people with specialty drug coverage, nearly one-half are in a plan with at least one cost-sharing tier to deal with specialty drugs. 45% have a co-payment for specialty drugs (on average, $101 per prescription), and 46% have coinsurance (on average, 27% of the cost).

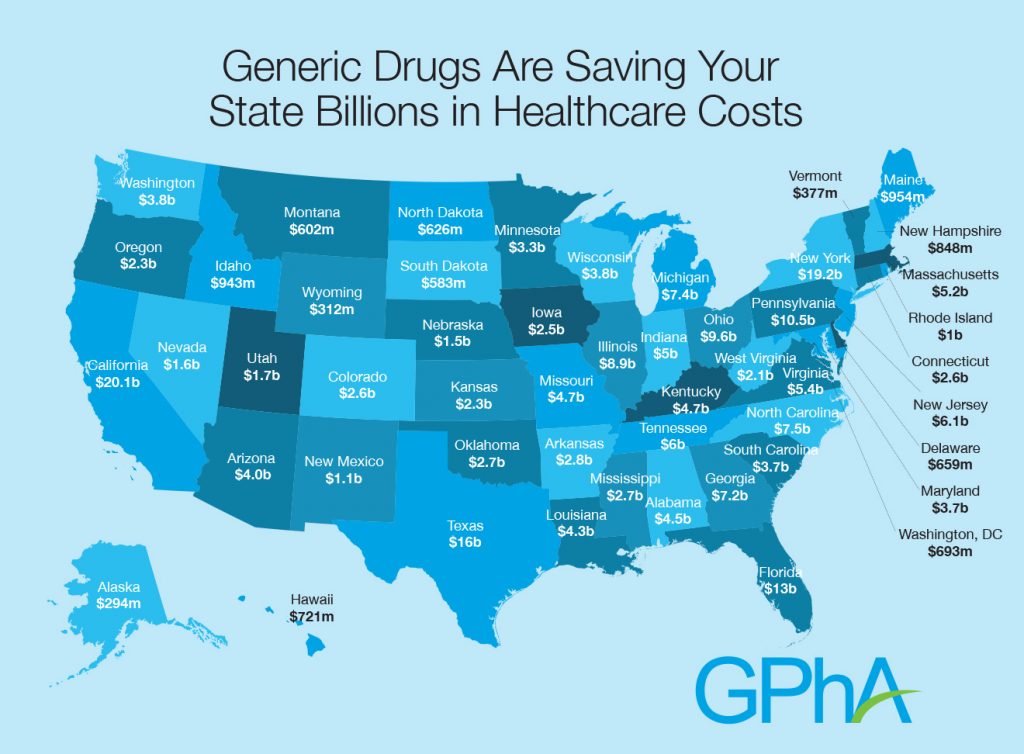

Health Populi’s Hot Points: Prescription drug spending is the most transparent consumer-facing health care cost aside from the health plan premium. Generic Rxs, accounting for 89% of prescriptions filled in 2016 (3.9 billion prescriptions), have become a beloved component of the consumer-facing health supply side. Generic drugs, covered on Tier 1, save consumers and states money, illustrated by the map. In 2016, generics saved Medicare $1,883 per enrollee, and $512 per Medicaid enrollee.

Health Populi’s Hot Points: Prescription drug spending is the most transparent consumer-facing health care cost aside from the health plan premium. Generic Rxs, accounting for 89% of prescriptions filled in 2016 (3.9 billion prescriptions), have become a beloved component of the consumer-facing health supply side. Generic drugs, covered on Tier 1, save consumers and states money, illustrated by the map. In 2016, generics saved Medicare $1,883 per enrollee, and $512 per Medicaid enrollee.

But consumers’ collective love for the pharmacy is now threatened, J.D. Power learned, as more patient-consumers face higher-cost drugs in the retail setting as I discussed here in Health Populi.

Research published this month in JAMA Internal Medicine details Strategies That Delay Market Entry of Generic Drugs, research sponsored by The Commonwealth Fund. The issue is that, “Manufacturers of brand-name drugs use many strategies to extend the market exclusivity of their products…By delaying the entry of generic products into the marketplace, such tactics can keep prices high and limit the affordability of drugs to patients and payers,” the researchers assert. Some of these tactics include extending market exclusivity on the initial patent by applying for new patents on “secondary aspects” of drugs (like coating or how the treatment is administered); offering compensation to generic companies to stall generic drug entry to the market; restricting generic companies’ distribution for drugs, such as preventing sampling; and, various petitions to the FDA (a boondoggle for lawyers),

Allergan gets the Health Populi Chutzpah Award for Generic-Stall Tactic this month. Allergan transferred ownership of the patent for Restasis to the Saint Regis Mohawk Tribe, to whom Allergan will pay $15 million every year. Restasis, a drug that treats the condition of dry eye, is Allergan’s second-biggest selling drug generating $393.1 million in the fourth quarter of 2016, up 13%.

Prescription drug pricing is a legislative issue that Democrats, Independents, and Republicans converge on in a tri-partisan way, compared with dealing with the ACA. The President and Congress had an opportunity at the start of 2017 to address this healthcare policy convergence. Even Donald Trump said, in his TIME magazine interview, that he would seek to deal with prescription drug pricing once assuming the presidency.

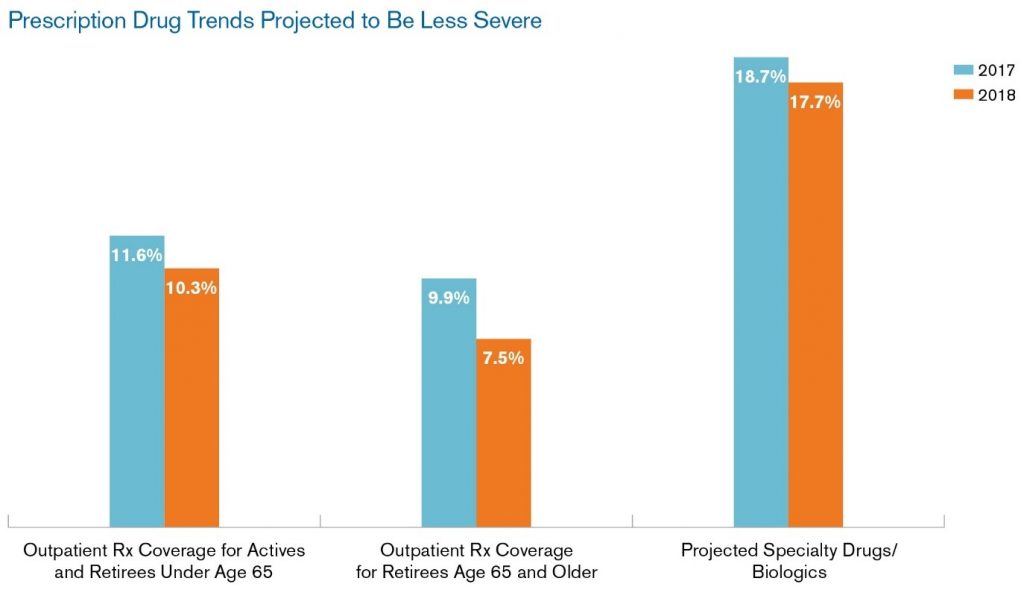

Specialty drug costs will rise nearly 18% in 2018, according to the Segal Company’s annual health plan survey, shown in the bar chart. With such a forecast, employees covered by prescription drug plans can expect to face growing complexity and shared costs in 2018 and beyond if regulatory and legislative forces don’t directly address this dynamic.

Specialty drug costs will rise nearly 18% in 2018, according to the Segal Company’s annual health plan survey, shown in the bar chart. With such a forecast, employees covered by prescription drug plans can expect to face growing complexity and shared costs in 2018 and beyond if regulatory and legislative forces don’t directly address this dynamic.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...