People define their personal health and well-being broadly, well beyond physical health. Mental wellness, physical appearance, social connections, and financial wellness all add into our self-health definitions.

Mind Over Money is a consumer study conducted by Frost Bank, working with FleischmanHillard, connecting the dots between optimism and financial health.

Mind Over Money is a consumer study conducted by Frost Bank, working with FleischmanHillard, connecting the dots between optimism and financial health.

The top-line of the study is that people who are optimists have roughly two-thirds fewer days of financial stress per year than pessimists. Put another way, pessimists stress about finances 62% of the year, shown in the first chart from the study.

This translates into 62% of optimists having better financial health, seven times greater than pessimists at 9%.

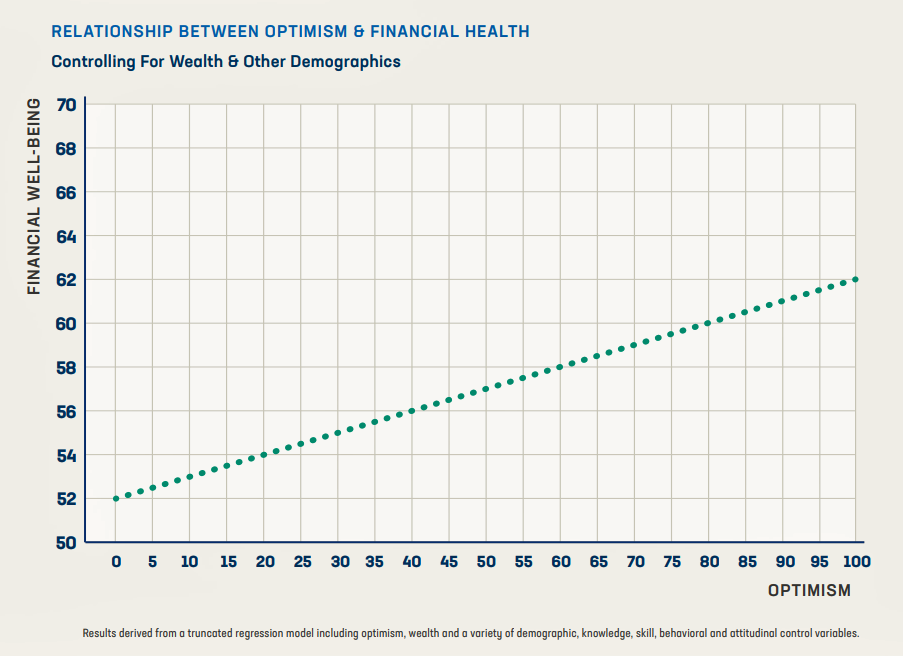

In a regression analysis, the study showed a significant relationship between optimism and

better financial health: a 1-point increase in optimism was associated with a 0.1-point increase in financial well-being. Optimism was associated with an increase in financial well-being of up to 10 points. This straight-line relationship is illustrated in the second graph showing that greater optimism, controlling for wealth and other demographics, is related to greater financial well-being.

The study identified several other data points that paint the financially unwell profile of Americans:

The study identified several other data points that paint the financially unwell profile of Americans:

- Six in ten people say finances control their lives at least sometimes

- On average, Americans have five months of financial stress annually

- Nearly 9 in 10 Americans have experience at least one financial setback.

The survey polled 2,002 U.S. adults 18 and over in September 2018 in English and Spanish.

Health Populi’s Hot Points: “By believing that life’s challenges are temporary rather than permanent, people can feel inspired to take meaningful steps to improvement,” Michelle Gielan, a psychologist with whom Frost collaborated for the study, asserts in the report. Optimism can be a catalyst for better physical and emotional health, Michelle adds, noting that Americans want more optimism in their lives.

Let me call out the front half of the first sentence here:

“By believing that life’s challenges are temporary rather than permanent…”

Millions of Americans feel health in-secure, both those with insurance who perceive they are under-insured and cannot afford their premiums or co-payments, and those who are uninsured.

That perception of healthcare insecurity has a negative impact on financial wellness and health status.

I discuss this phenomenon in my new book, HealthConsuming: From Health Consumer to Health Citizen. In Chapter 2, titled “The Patient Is the Payor,” you’ll read the introductory quote from a Moody’s analyst observing that, “Today’s high deductibles are tomorrow’s bad debt.”

This week, Health Affairs published an essay on The Challenges of High-Deductible Plans For Chronically Ill People. The authors note that, “There is a significant number of Americans who cannot simply elect to limit their use of health services or can do so only by risking severe consequences. For the 60 percent of Americans living with at least one chronic condition, high deductibles present precarious financial conditions that recur every January 1. As the National Center for Health Statistics has reported, people with HDHPs are far more likely than those with traditional health plans to forgo or delay medical care or to be in a household that is having difficulty paying medical bills.” The piece presents scenarios for patients dealing with cancer, auto-immune disease, and epilepsy.

For people enrolled in high deductible health plans dealing with chronic conditions, one-half felt financial stress due to health care costs versus 21% of people enrolled in conventional health plans.

High deductible health plan designs continue to grow and mainstream in both commercially-insured populations for people receiving employer-sponsored plans, as well as for folks enrolling in public sector and marketplace plans. In thinking through health care reform futures and how people live daily lives, in health and illness, we should be mindful of bundling in financial wellness into our visions for making healthcare better in America.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...