Millions of mainstream, Main Street Americans entered 2020 feeling income inequality and financial insecurity in the U.S. The coronavirus pandemic is exacerbating financial stress in America, hitting women especially hard, based on PwC’s 9th annual Employee Financial Wellness Survey COVID-19 Update.

For this report, PwC polled 1,683 full-time employed adults between 18 and 75 years of age in January 2020.

For this report, PwC polled 1,683 full-time employed adults between 18 and 75 years of age in January 2020.

While the survey was conducted just as the pandemic began to emerge in the U.S., PwC believes, “the areas of concern back in January will only be more pronounced today,” reflecting, “the realities of the changing employee circumstances we are observing.”

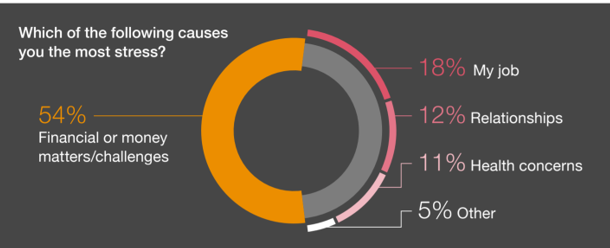

That primary changing employee circumstance involves finance and money, which PwC found to be the top stressor cited by a majority of U.S. workers, the first chart illustrates. Keep in mind these statistics were drawn from a sample of employed/working Americans.

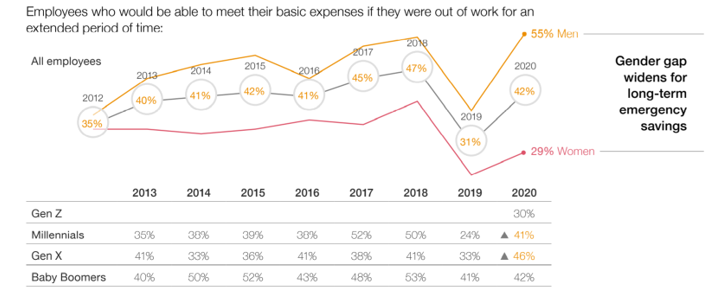

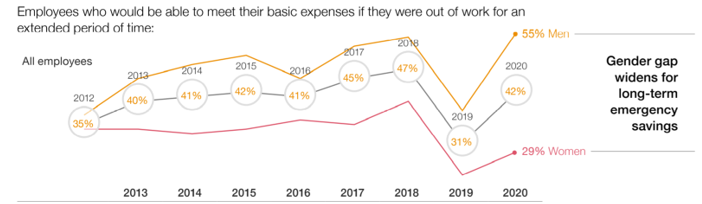

In January 2020, 4 in 10 U.S. workers said they’d be able to meet basic expenses if they lost their job for an extended period of time: under that 4 in 10 were 55% of men, but only 29% of women who could fund basic needs if they lost their job.

In January 2020, 4 in 10 U.S. workers said they’d be able to meet basic expenses if they lost their job for an extended period of time: under that 4 in 10 were 55% of men, but only 29% of women who could fund basic needs if they lost their job.

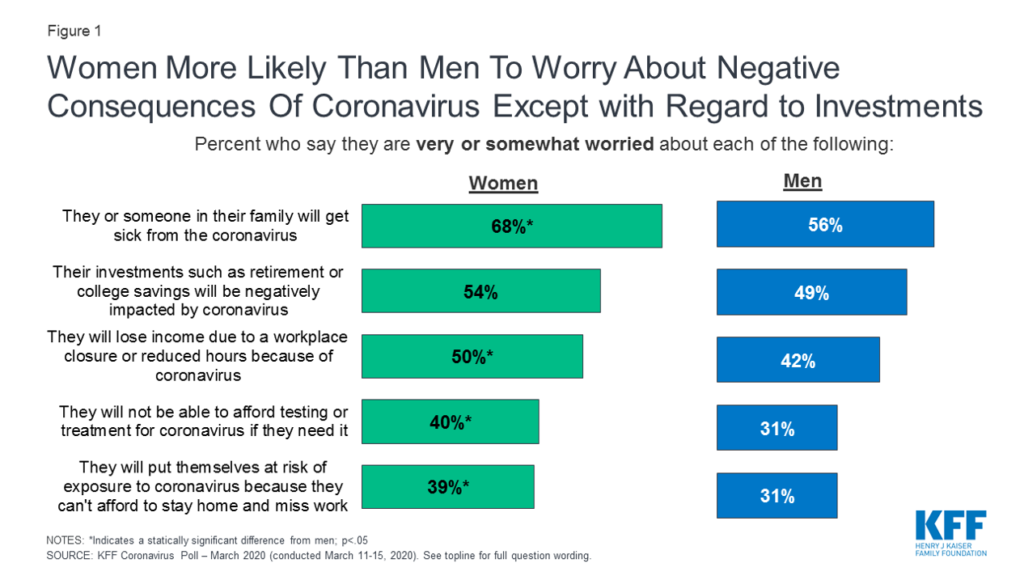

The gender gap widens for long-term emergency savings, PwC points out on the second slide, which clearly shows the financial chasm between men and women. Kaiser Family Foundation identified the COVID-19 financial gender gap in their March 2020 poll, shown in the bar chart below: larger proportions of women compared with men are worried about the negative financial consequences of the coronavirus such as losing investment value, losing income, and not being able to afford testing or treatment for the virus.

There are also gaps by generation, the lower half of the chart shows, with the youngest workers in Gen Z least able to fund basic expenses were they to lose their job.

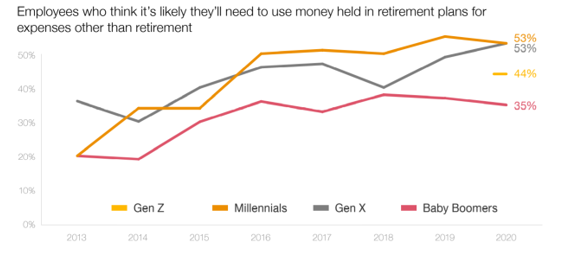

As a result, millions of working people who have saved money in retirement plans (e.g., 401(k) programs) would likely draw money out of those funds to pay for current expenses. The likelihood of taking money early out of retirement savings to pay for current expenses varies by age:

As a result, millions of working people who have saved money in retirement plans (e.g., 401(k) programs) would likely draw money out of those funds to pay for current expenses. The likelihood of taking money early out of retirement savings to pay for current expenses varies by age:

- 53% of Gen Z, the youngest cohort,

- 44% of Millennials,

- 53% of Gen X, and

- 35% of Baby Boomers.

The reasons people would make early withdrawals from their retirement funds include dealing with an unexpected expense (for at least one-half of workers across all generations); and, paying medical bills, for roughly one-in-five workers cross age, among other financial obligations.

The report goes into detail on the challenge of student loan financing, especially burdensome for younger workers:

The report goes into detail on the challenge of student loan financing, especially burdensome for younger workers:

- Among 21% of Gen Z workers with student loans, 66% said they were having an impact on the worker’s ability to meet other financial goals

- For the 40% of Millennials with student loans, 71% said they were having an impact on the worker’s ability to meet other financial goals

- Among 30% of Gen X workers, 75% said the loans were having an impact on their ability to meet other financial goals, and,

- For the 11% of Baby Boomers with student loans, 63% said the loans had an impact on their ability to meet other financial goals.

The CARES Act, passed by Congress in April 2020, had provisions for people taking early withdrawals from retirement funds and to deal with student loan debt during the pandemic. Nonetheless, PwC notes that there is confusion about some of the legislative provisions, as well as the negative financial impact over the long-run of taking savings meant for future consumption in retirement to pay for current expenses, “missing out on the potential for future recovery and growth.”

Health Populi’s Hot Points: As the pandemic continues to exact tragic physical losses of close to 100,000 deaths in America as of 26th May 2020, the softening fiscal scenario in the U.S. looks like a “She-Cession,” impacting women’s financial health more than men’s in the U .S. as the Kaiser Family Foundation March 2020 poll found.

.S. as the Kaiser Family Foundation March 2020 poll found.

This marks a Mars vs. Venus difference from the 2008 Recession, which more negatively impacted men’s jobs and finances than women’s in relative terms. In the current coronavirus pandemic, job losses have hit women harder than men based on the propensity of women to hold jobs that can’t be done via telecommuting, largely in the service sector: hospitality, food service and restaurants, and…in health care.

Ironically, one of the fast-growing job categories during the long growth period of the American economy has been health care. That is, until COVID-19 hit the service economy hard in the first quarter of 2020.

This weekend, The Guardian published an analysis on the pandemic’s jobs impact in the U.S. titled, “‘Pink-collar recession’: how the Covid-19 crisis could set back a generation of women.”

Pink Collar Workers was the title of 1977 book by Louise Kapp Howe on the growing number of women in the labor force. The book was a finalist in the National Book Awards in 1978 for “Contemporary Thought.”

25 years before Howe wrote Pink Collar Workers, C. Wright Mills published White Collar, and then Shostak and Gomberg penned Blue-Collar World. Howe tracked the growth of women working as beauticians, nurses, telephone operators, secretaries, waitresses, and domestic workers, looking further into the early days of women in the male-dominated side of the labor market.

COVID-19 has uncovered many aspects of disparities in American life and, in this case, livelihoods: that the economic gains women have made in the past four decades since Howe looked into pink collar jobs show cracks. For years, we’ve been well aware of cracks looking up at the glass ceiling. The pandemic now shows women are falling through financial cracks in the floor.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...