Two in three U.S. consumers skipped or delayed getting in-person medical care in 2020.

One in 2 people had a telehealth visit int he last year. Most would use virtual care again.

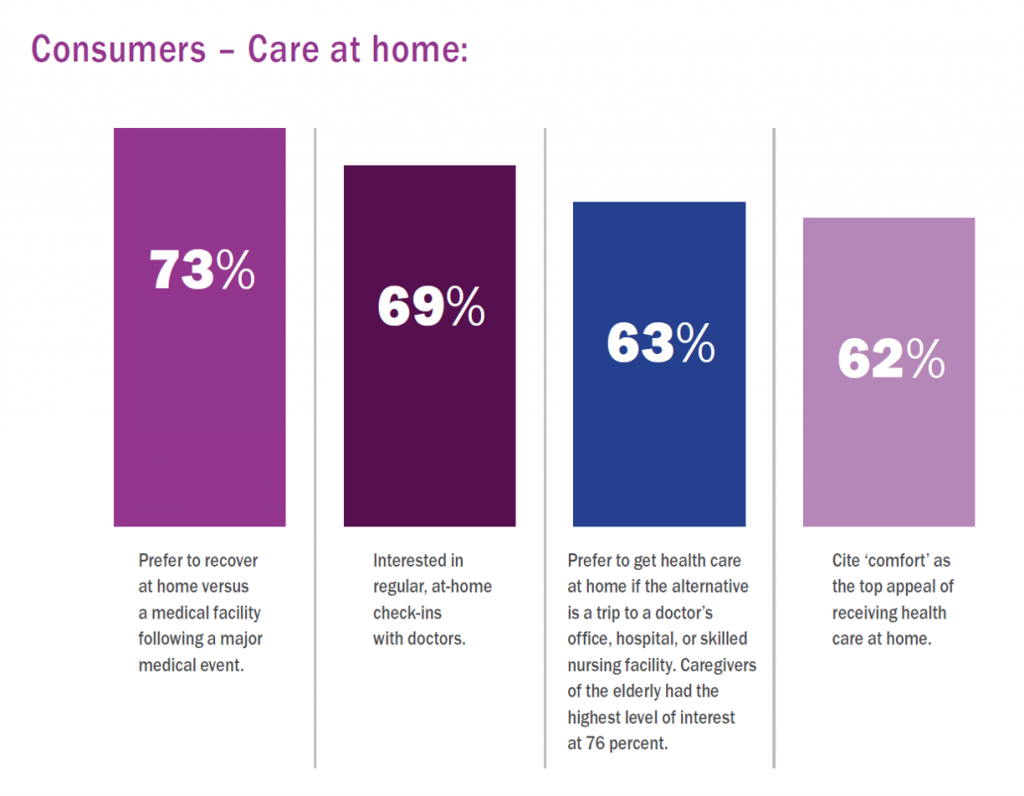

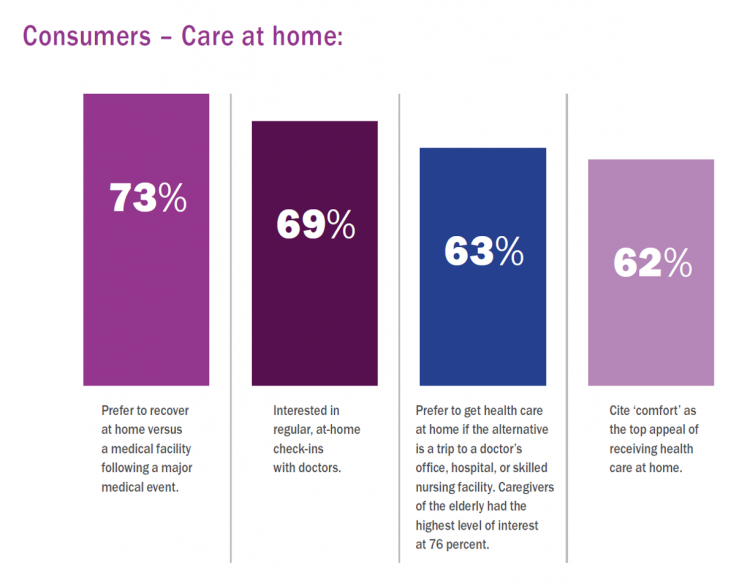

The coronavirus pandemic has mind-shifted how patients envision a health care visit. Today, most consumers prefer the idea of getting health care at home compared with going to a doctor’s office. Most Americans also like the idea of recovering at home instead of at a medical facility after a major medical event, according to the report, Health-at-Home 2020: The New Standard of Care Delivery from CareCentrix.

COVID-19 has re-shaped consumers as patients, inspiring most people to re-imagine health care at home as their new personal standard of care delivery, per the report’s apt-chosen title. “Comfort” was the top reason people valued the concept of health care received/delivered at home.

Between late September and early October 2020, CareCentrix fielded an online survey of 1,000 U.S. adults 18 and over, and of 76 health plan executives, gauging interest in healthcare at home. The results of those studies are presented in the Health-at-Home 2020 report.

Between late September and early October 2020, CareCentrix fielded an online survey of 1,000 U.S. adults 18 and over, and of 76 health plan executives, gauging interest in healthcare at home. The results of those studies are presented in the Health-at-Home 2020 report.

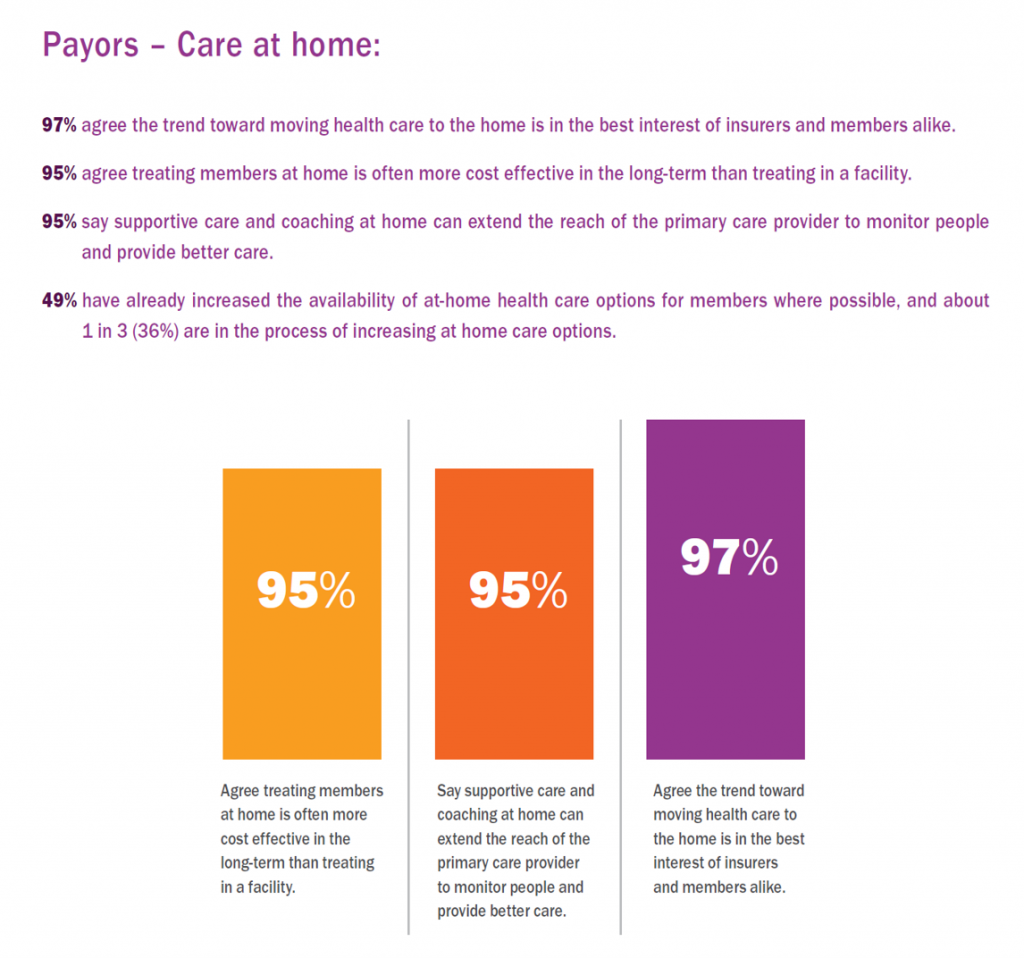

Consumers and payors (health plans, insurers, employers sponsoring health insurance coverage) are aligned in believing that moving care “home” is better for both parties.

While most health care providers are open to more care delivered in patients’ homes, doctors and hospitals face barriers to fully committing to the home-as-health-hub for their patients.

Key barriers for providers include insufficient regulatory support (such as licensing cross-state as well as Federal regulations), fragmented processes and information systems, and reimbursement challenges, among other obstacles to going virtual care-first.

The COVID-19 pandemic motivated clinicians to adopt telehealth and virtual care platforms as both providers and patients sought to limit exposure to the coronavirus in face-to-face visits to doctors’ offices and hospitals outpatient clinics.

One indication that doctors fast-adopted virtual care in the pandemic is that the number of doctors reporting “telemedicine” as a skill nearly doubled between 2019 and 2020, a growth rate of 38% compared with 20% between the three years of 2015 and 2018, Doximity found in its 2020 state of telemedicine report.

One indication that doctors fast-adopted virtual care in the pandemic is that the number of doctors reporting “telemedicine” as a skill nearly doubled between 2019 and 2020, a growth rate of 38% compared with 20% between the three years of 2015 and 2018, Doximity found in its 2020 state of telemedicine report.

Nearly 100% of health plan executives believe more health care delivered at home is better for both their insurance plans and their members alike. Nine in ten plan executives also agree that the health risks of members going to health care facilities.

One-half of health plans have already increased the availability of home-delivered care options for their members, and one-third of insurers are in the process of increasing home care options.

Health plans are also firmly focused on how to lower the costs of care while maintaining quality and bolstering health outcomes. Four in five plan executives told CareCentrix that the ability to lower overall costs by shifting to value-based provider contracts underpins the shift of care to the home. That means changing the payment model to providers to incentivize them to leverage technologies that can support patients’ care in the comfort, safety, and convenience of their homes.

The vast majority of health insurers are viewing advancements in telehealth and remote health monitoring to shift care to peoples’ homes when clinically appropriate.

Health Populi’s Hot Points: COVID-19 has inspired, in many cases “forced,” consumers to undergo a kind of digital transformation – working, schooling, praying, cooking, exercising, and shopping from home. Broadband connectivity and a piece of hardware to connect – a smartphone, computer, or tablet – could enable this for people with an Internet connection.

Health Populi’s Hot Points: COVID-19 has inspired, in many cases “forced,” consumers to undergo a kind of digital transformation – working, schooling, praying, cooking, exercising, and shopping from home. Broadband connectivity and a piece of hardware to connect – a smartphone, computer, or tablet – could enable this for people with an Internet connection.

The promise of healthcare-at-home goes beyond the prototypical visit of a patient and doctor via a real-time virtual face-to-face consultation. CareCentrix notes the opportunities to expand the care continuum to the home, including:

- Expanding preventive care and shifting more aging care and services to the home

- Providing routine care at home for younger health care consumers

- Caring for the caregiver — an already-huge and growing burden

- Physical therapy rehab and personal training

- Mental health support — fast-growing during the pandemic with pent-up demand even before the public health crisis, and,

- Social supports — delivery of healthy food and access to transportation, among them.

I would add the growing opportunity for moving hospital care to the home, accelerated during the pandemic. See my take on this movement in the Medecision Liberation blog.

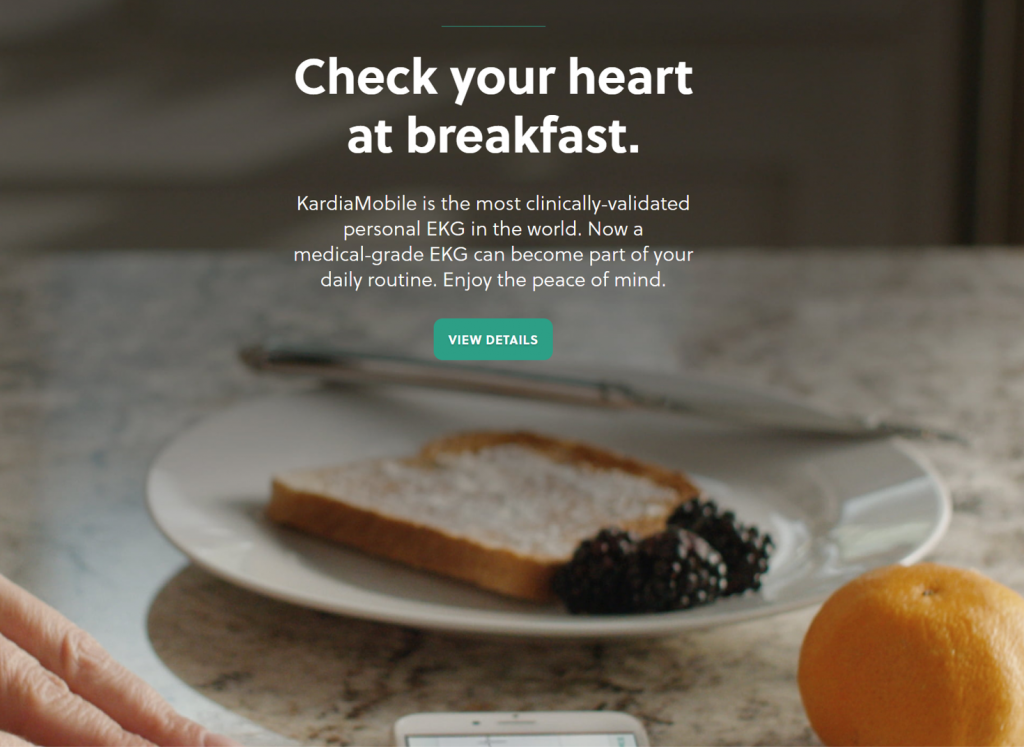

To that point, one example of the growing portfolio of consumer-facing medical devices for use at home is AliveCor’s KardiaMobile which enables clinical quality ECG tracking from the home. AliveCor closed a $65 million round of financing earlier this month to help the company expand telehealth and condition management services. [I note in this holiday season more DTC advertising on TV and streaming radio promoting the device to both patients and caregiving loved ones who could gift it at a discount of $84 via Amazon or the company website].

To that point, one example of the growing portfolio of consumer-facing medical devices for use at home is AliveCor’s KardiaMobile which enables clinical quality ECG tracking from the home. AliveCor closed a $65 million round of financing earlier this month to help the company expand telehealth and condition management services. [I note in this holiday season more DTC advertising on TV and streaming radio promoting the device to both patients and caregiving loved ones who could gift it at a discount of $84 via Amazon or the company website].

It was clear before the pandemic that people as health consumers have been seeking more accessible, convenient, culturally comfortable health care options that brought both value and fit with personal values. COVID-19 has accelerated peoples’ search for health care at home or closer-to-home in their local communities.

This post ties to one I wrote yesterday on how consumers are seeking health and wellness embedded in their physical homes, whether purchased or rented. That’s the demand side from the patient’s standpoint. We must be mindful that there are obstacles for consumers that create a gap between “want” or “need” and ability to move their care to their home: especially, access to broadband connectivity, care providers and payors that may not offer or pay for home-delivered care. These and other barriers must be acknowledged and addressed to deliver care to the N of 1 person/patient/caregiver.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...